Litecoin (LTC) price is trading under a key resistance level, and flipping the same into support could drive LTC to $90.

Investors are also playing their part in making this happen as they are opting to HODL their supply instead of selling for profits.

Litecoin Holders Aim at Gains

Litecoin’s price is noting recovery after a sharp decline in mid-April, and LTC holders are playing their part in supporting the recovery. They are doing this by keeping selling at a minimum, which is noted in their participation on the network.

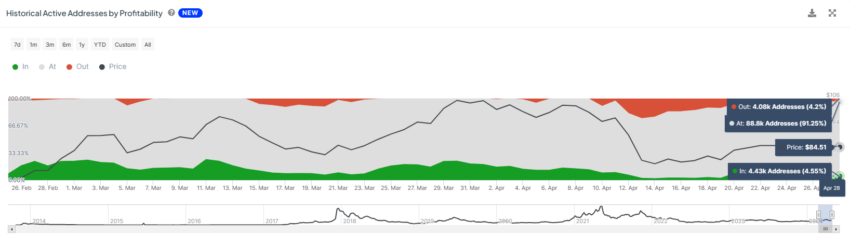

Upon distributing active addresses by profitability, it can be seen that less than 5% of all 97,000 addresses are in profit. About 91% of the active addresses are at the money, looking to secure gains.

This shows that LTC holders with a profitable supply are not too keen on selling, which in return could bolster potential recovery.

Read More: How To Buy Litecoin (LTC) and Everything You Need To Know

Also nearly 12.78 million LTC worth more than $1.6 billion, is on the verge of turning profitable. Observed on the Global In/Out of the Money (GIOM) indicator, this supply was bought between $81.51 and $87.50 and would note profits when Litecoin’s price manages to breach and close above the upper limit.

To make this happen, investors are likely to avoid selling their holdings as further profits would translate to the potential for an increase in price.

LTC Price Prediction: This Is the Key to Recovery

Litecoin’s price at the time of writing is trading at $83, under the 50% Fibonacci Retracement of $86. Flipping this level into support is important as it could potentially push LTC beyond $87. This would result in the aforementioned supply turning profitable.

Litecoin could benefit from this and initiate a rally should it breach the 61.8% Fib level at $93. This level is also known as the bull market support floor and prevents a drawdown during an uptrend. Flipping it into support bolstered by conviction among holders could bring LTC closer to $100.

Read More: Litecoin (LTC) Price Prediction 2024/2025/2030

However, if the breach fails and Litecoin’s price falls back down, it could note a correction to $79. This price is in confluence with the 31.8% Fib level. Falling through it would invalidate the bullish thesis, sending LTC to $71.

Trusted

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.