From June 1 to June 16, Litecoin’s blockchain experienced significant activity, indicating strong bullish fundamentals.

The following analysis delves into the observed trends, highlighting the most noteworthy changes during this period.

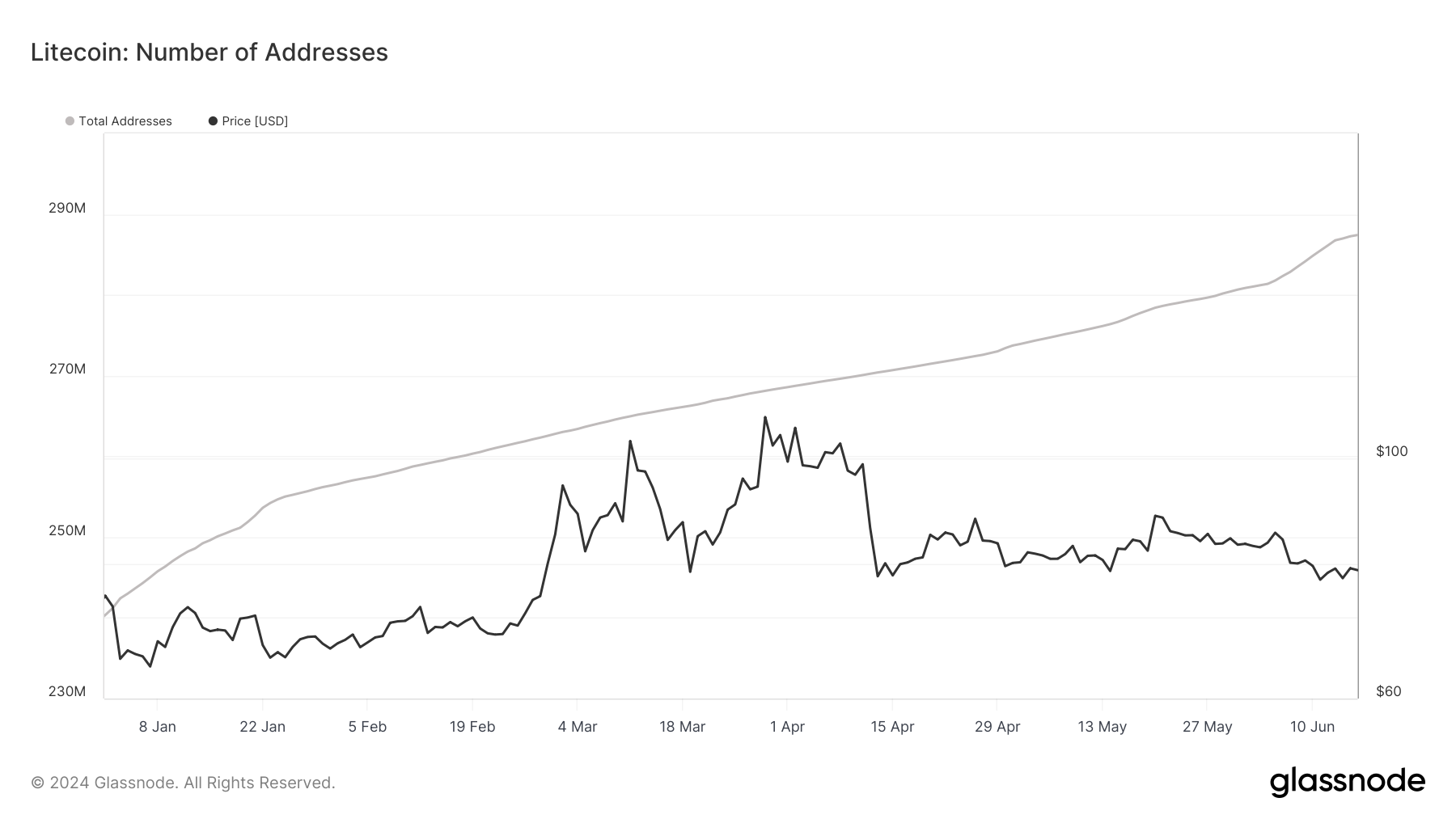

Litecoin Address Growth Analysis

The period from June 1 to June 16 witnessed important activity in the Litecoin blockchain, as indicated by the growth in the total number of addresses. Below is a detailed analysis of the observed trends, highlighting the most significant changes during this period.

This indicator refers to the cumulative number of unique addresses that have been created on the Litecoin blockchain.

The number of total addresses on the Litecoin blockchain consistently increased from 283.80 million on June 1 to 287.42 million by June 16. This represents a growth of approximately 1.28% over the 16-day period.

Read More: Litecoin: A Complete Guide to What it is And How it Works

Between June 3 and June 4, we saw a significant change in the number of addresses. On June 3, there were 284.43 million addresses, which jumped to 284.9 million by June 4. Marking an increase of 511,527 addresses. This day saw the largest single-day increase, indicating a substantial influx of new users or addresses, likely linked to specific events or heightened network activity.

Another notable change occurred between June 12 and June 13. The number of addresses increased from 286.11 million on June 12 to 286.7 million on June 13. An increase of 650,128 addresses. This represents the second-largest increase in the dataset, suggesting another period of heightened activity.

From June 15 to June 16, the number of addresses rose from 287.25 million to 287.41 million, an increase of 165,306 addresses. Although smaller than the previous spikes, this increase indicates sustained interest and growth in the network towards the end of the period.

The consistent increase in total addresses is a positive indicator of market sentiment. It suggests growing trust and interest in the Litecoin network. The steady growth of addresses is a crucial adoption metric, reflecting increased usage and engagement.

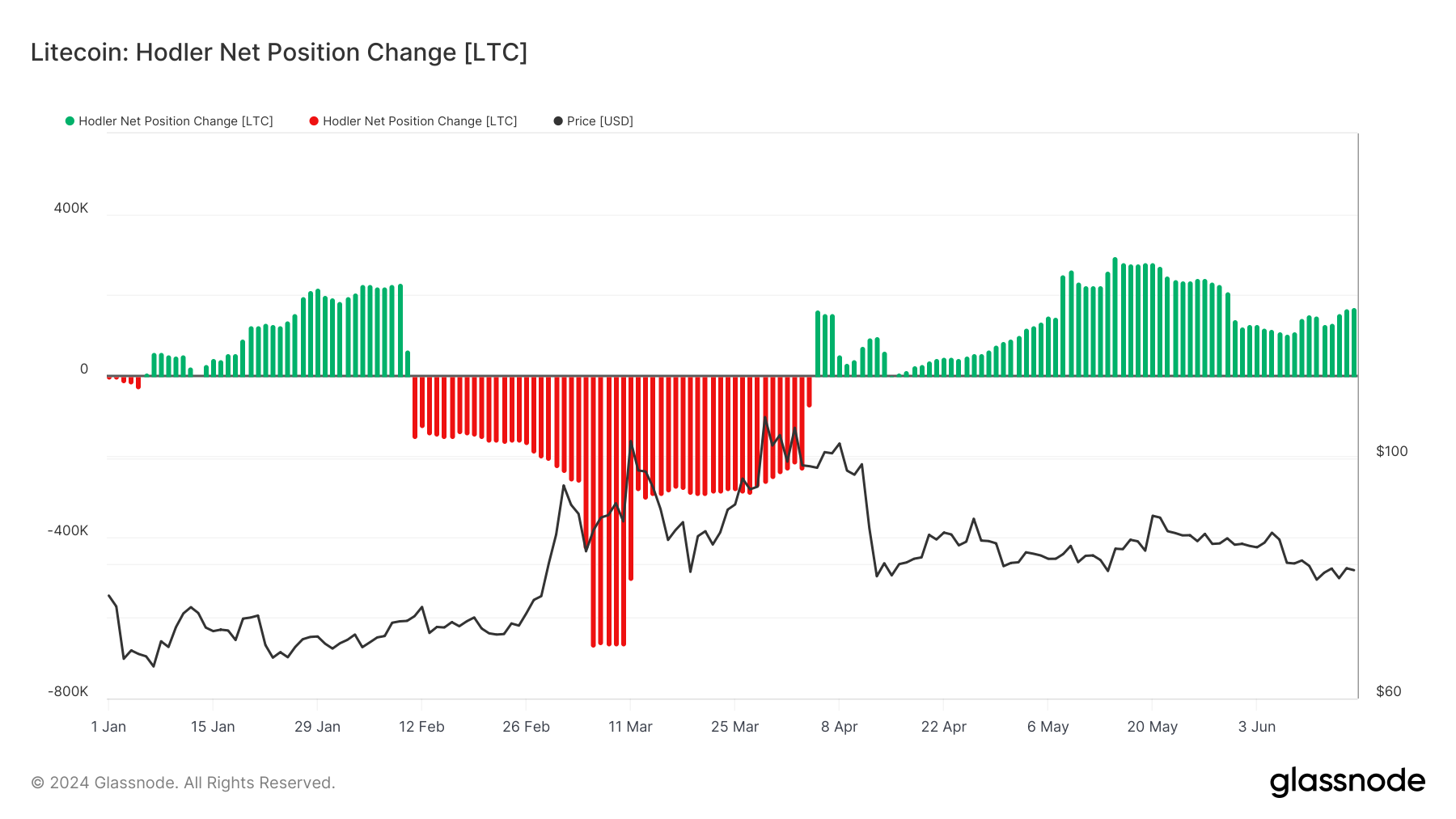

HODLers are accumulating again

The HODLer Net Position Change indicator measures the net movement of Litecoin holdings by long-term investors (HODLers). It provides insights into these investors’ behavior by tracking whether they are accumulating (buying) or distributing (selling) their Litecoin holdings. This metric excludes lost coins, focusing only on actual movements, making it a precise tool to understand the active holdings in the market.

- Positive Values: Indicate net accumulation by HODLers, suggesting bullish sentiment and confidence in the long term. value.

- Negative Values: Indicate net distribution by HODLers, suggesting bearish sentiment or profit-taking behavior.

The HODLer Net Position Change metric provides insight into the behavior of long-term Litecoin holders. Over the observed period from May 29, 2024, to June 16, 2024, the metric shows positive values, indicating net accumulation rather than selling. However, the daily net position changes fluctuate.

Read More: How To Buy Litecoin (LTC) and Everything You Need To Know

The metric remained positive throughout the period, which indicates that HODLers were generally accumulating Litecoin, reflecting a bullish sentiment among long-term investors.

From May 29 to June 7, the HODLer Net Position Change values decreased noticeably, dropping from 228,717.03 to 104,604.04. This decrease suggests a reduction in the accumulation rate or potential minor selling by HODLers during this period.

The fundamental outlook for LTC is looking bullish. The recent downtrend in Litecoin’s price, dropping from a local high of $85 on June 6 to $75. This is mainly due to Bitcoin’s price action and its impact on LTC and the broader crypto market. Litecoin has just broken through some major technical indicators, signaling that it might be a good time to buy, given the strong fundamentals.

Buying in the $71 – $75 range seems prudent, assuming the local low is around this area. If Bitcoin rebounds to $68,000, we could see Litecoin climbing back to $80.