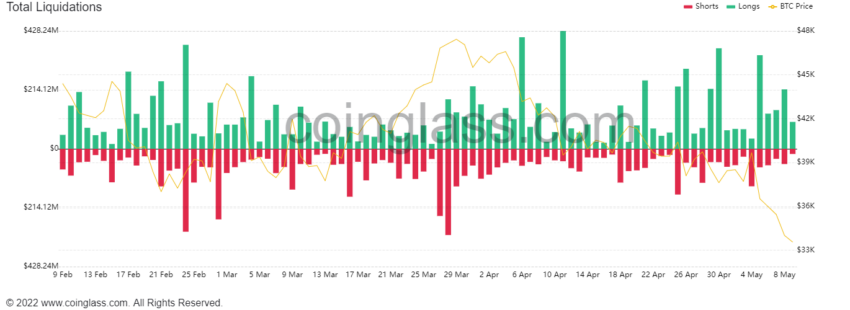

The crypto market has seen over $260 million liquidated in the past 24 hours as lows not seen since Nov are swept. Ethereum (RTH) accounted for most of the losses, followed by bitcoin (BTC).

Ethereum traders saw over 17,600 ETH liquidated, worth about $43 million. Bitcoin followed with $31 million liquidated, then LUNA with $2.77 million. The vast majority of these liquidations took place on OKex, FTX, and Binance. In total, more than 69,000 traders lost their positions.

Liquidations hit ETH traders

Ethereum traders lost the most, with over 17,600 ETH liquidated, worth about $43 million. Bitcoin followed with $31 million liquidated, then LUNA with $2.77 million. The vast majority of these liquidations took place on OKex, FTX, and Binance.

The market had been teetering back and forth in the past few days, and bitcoin was temporarily looking like it might cross $40,000 before plummeting to its current price.

Inflows into exchanges have also been climbing, with Glassnode pointing out that the BTC exchange inflow volume (7d MA) reached a three-month high of 1,755.021 BTC.

The total market cap of crypto dropped from $1.75 trillion to $1.62 trillion in the past day, with trading volume standing at roughly $102 billion. Bitcoin’s market cap is approximately $638 billion, down from $1 trillion at its peak last year.

It remains unclear whether there was a specific trigger for the sell-off, but all markets are in the midst of a downturn, and crypto has not been spared.

This lends credence to the idea that the crypto market is moving more in line with traditional markets. The S&P 500 and Big Tech firms have been more strongly correlated with crypto in the past 12 months. The correlation is a natural byproduct of the crypto market being more tightly woven with the rest of the global economy.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.