After delivering 38% gains in Q1, Chainlink (LINK) has consolidated its current rally with another 15% price surge in April. On-chain data reveals how crypto whales have been betting big on LINK in the past week. Can the bulls push for the $10 milestone?

Chainlink (LINK) is a decentralized oracle network that allows blockchain networks and smart contract platforms to integrate off-chain data into their products.

Compared to the 50% growth in the global crypto market cap, Chainlink delivered a relatively lower performance in Q1. However, recent on-chain developments suggest that the Chainlink team’s building efforts and partnerships secured in Q1 are now yielding results.

Crypto Whales Are Betting Big on Chainlink

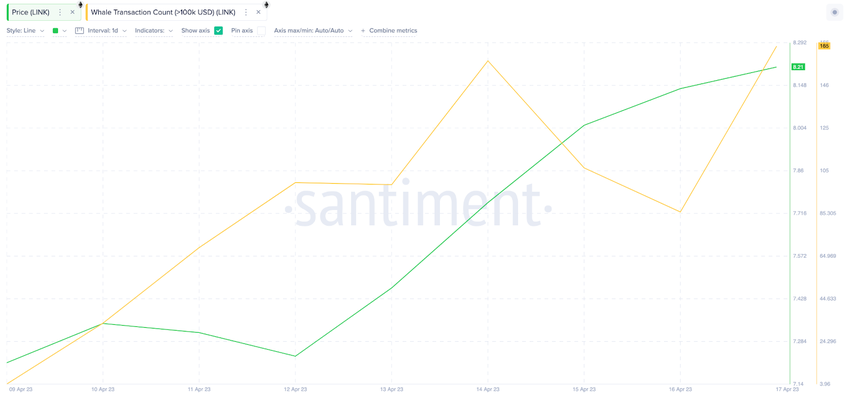

Crypto whales have intensified investing activity on the Chainlink network in the last 10 trading days. According to Santiment, there has been a 400% rise in the large transactions involving LINK in the past week.

The chart below shows how LINK Whale activity increased from 33 transactions on April 10 to 165 as of April 18.

Whale transaction count tracks the number of daily large cryptocurrency trades that are worth $100,000 or more. Large institutional investors are considered to be influential and knowledgeable about the market. Hence, such a spike in Whale transaction count can inspire a bullish sentiment among new entrants and other existing LINK investors.

Furthermore, the recent rise in the number of new users on the Chainlink network also validates the bullish narrative. According to data compiled by Glassnode, Chainlink network growth increased 57% from 475 new wallet addresses created on April 9 to 747 on April 16.

Network Growth measures the number of new users joining a blockchain network. When it increases during a price rally, it implies that the price increase is driven by strong fundamentals and increased demand rather than speculative traders. Furthermore, this increased demand could form a higher LINK price support level when a retracement occurs.

In summary, the coincidental upturn in whale activity and network growth means that LINK will likely sustain its price momentum for the time being.

LINK Price Prediction: Road to $10

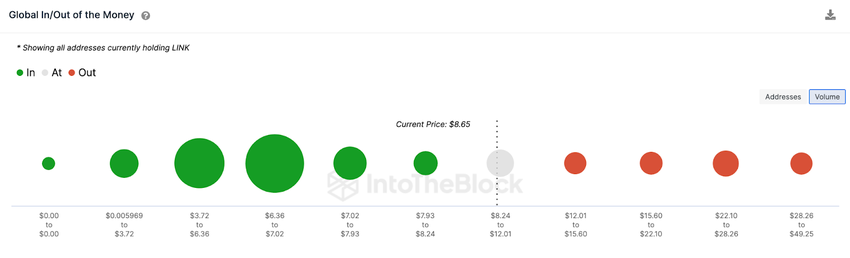

IntotheBlock’s Global In/Out of the Money data suggests that LINK could ride the current price rally toward a new one-year peak of $10.

The chart below shows that LINK could face minimal resistance until it breaks out of the $10 zone. But profit-taking from 44,000 addresses that bought 44 million LINK for an average price of $10.34 could prevent this.

If Chainlink can breach that resistance, the rally could gain enough momentum to reach $15. However, at that point, the 61,000 addresses that paid an average of $13.76 to acquire 18 million LINK could mount another roadblock.

Yet, the bears could steal a march on the bulls if Chainlink’s price loses its current support at $8. But, the 7,000 addresses that bought 25 million tokens here could look to prevent the drop.

Failure to hold that support level could decrease the LINK price to $6.75. Here, a more significant support of 68,000 addresses holding 427 million coins will likely shore up the price.