Chainlink (LINK) price has retraced 18% since reaching a new 2023 high of $8.60 on April 18. On-chain data shows that LINK has strong support around $7.00.

Chainlink has struggled to attract new users in recent weeks. Long-term holders have stopped selling ahead of the upcoming Spring 2023 hackathon. But will it be enough to attract new network participants and trigger a sustained bull rally?

Long-Term Holders Have Stopped Selling

Chainlink (LINK) price has been in a freefall since Apr. 18. But according to data from Santiment, long-term participants in the Chainlink ecosystem appear to have stopped selling.

Looking at the chart below, The Mean Coin Age of the native LINK token has increased considerably over the last two months. Since the last drop around Mar. 16, the Mean Coin Age has risen from 385.03 to 417.46 as of Apr. 25.

Mean coin age evaluates the average time all coins in circulation have been held since their last transaction. An increase in Mean Coin Age can be a bullish signal because it indicates that coins are being held longer.

This suggests that long-term network participants still have confidence in the LINK token’s long-term price prospects and utility despite the recent price downtrend.

Chainlink Investors Are Piling Up Orders

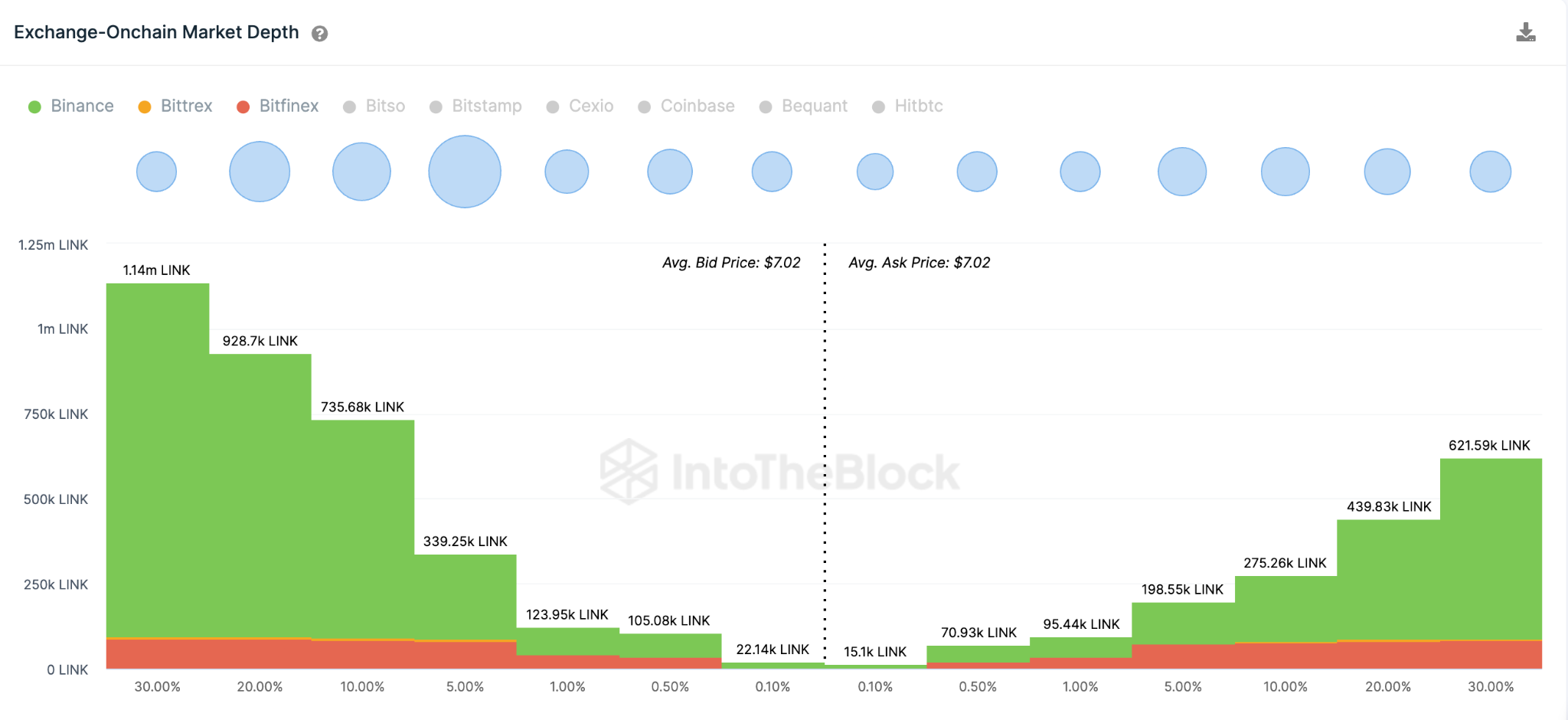

Similarly, increased demand for LINK relative to the current market supply is another signal of growing bullish momentum. IntoTheBlock’s Exchange-Market Depth chart shows that within the +/- 30% price range, the demand for LINK nearly doubles the number of tokens put up for sale.

The chart below shows investors have placed buy-orders for nearly 3.39 million LINK, while active sell-orders currently sit at 1.7 million tokens.

The Exchange On-Chain Market Depth chart presents investors’ aggregate number of buy and sell limit orders across various crypto exchanges.

When buy orders exceed sell orders, as observed above, it indicates an excess demand for the asset around the current prices. This means that LINK could experience some upswing in the coming days as buyers compete by bidding higher prices.

LINK Price Prediction: Bulls Can Hold $6.5 Support

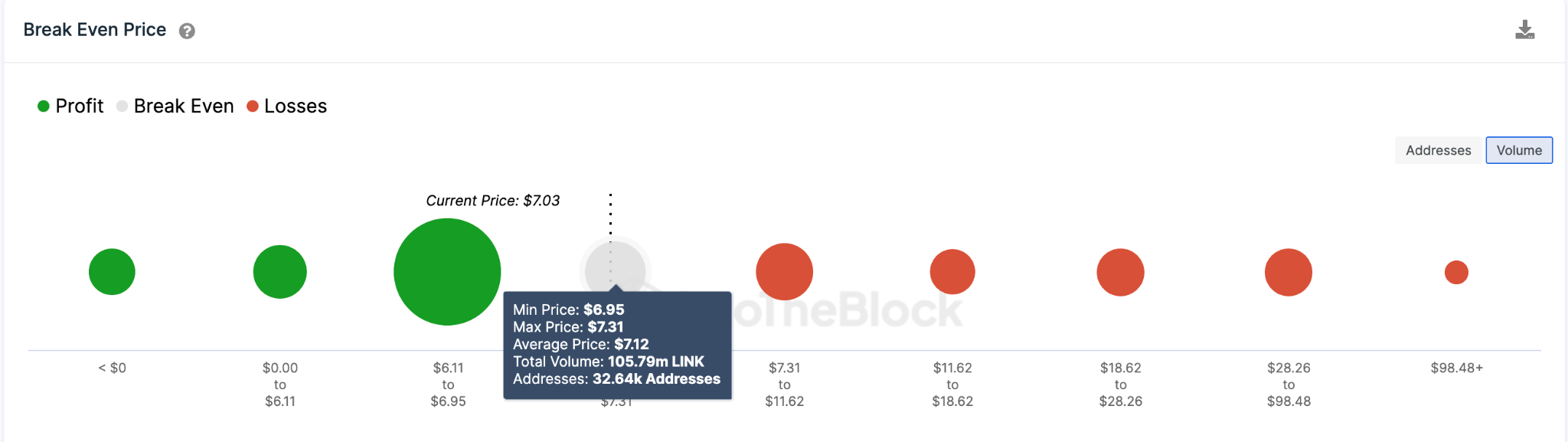

Chainlink bulls that bought 105 million LINK at an average price of $7.00 are expected to have enough in their tank to defend the $6.95 territory, according to Break-Even price data presented by IntoTheBlock.

But as things stand, a portion of the 32,500 addresses that bought 105 million LINK at the maximum price of $7.13 could try to prevent the breakout.

Once LINK can breach that resistance, it could rally toward the previous year-to-date high of $8.63. However, the 67,000 holders that bought 89 million coins around that price zone could mount another roadblock.

Conversely, the bears could invalidate the bullish stance if Chainlink loses the $6.95 support. If that happens, LINK holders can brace for a further price drop toward $6.11. Here, 80,000 addresses that bought 553 million tokens can offer formidable support.

Trusted

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.