(LINK) Chainlink Price Prediction & Forecast [Updated 4 March 2019]

Thinking of investing in Chainlink in March 2019? Here is our honest price prediction and forecast.

Overview

- Fundamental Analysis

- Technical Analysis

- Specialists’ Perspective

- Chainlink Price Prediction 2019

- Chainlink Price Prediction 2020

- Chainlink Price Prediction 5 years

- Our Prediction

Update (Mar 4, 2019): Among cryptocurrencies this year, Chainlink (LINK) has displayed relative stability and even growth. While the token has not continued its early climb, it continues to show relative support in the $0.40 range. This is indicative of the strong support structure and fundamental value proposition that have made Chainlink a stable token through 2018. In spite of these bullish indicators, the overall crypto market remains bearish. For this reason, our short term prediction for LINK is stability-based. However, in the long term, we see LINK as a bullish token — with a five-year prediction of $5 or more.

Chainlink (LINK) is one of the relatively-stable survivors of both the 2017 initial coin offering (ICO) boom and the 2018 cryptocurrency bear market. It is a blockchain platform providing payment and transactional middleware between on-chain and off-chain finance operations.

The platform has been performing well in the past months. Q1 2019 has brought stable market performance for the LINK token. LINK currently stands at 34th on Coinmarketcap. The LINK token is trading at $0.42, down from 2019 highs in January of over $0.55.

The Chainlink node network was created in 2015. LINK tokens first went public in a 2017 initial coin offering (ICO). The network is a decentralized oracle platform built to collect and verify data from both blockchain and legacy systems. In this way, Chainlink bridges the gap between digital currency and traditional fiat currency needs.

There is considerable competition from multiple similar blockchain oracle platforms seeking to connect traditional, real-world financial data with blockchain technology. However, in spite of this competition, Chainlink has thrived and continued to build on its robust Oracle concept.

A mainnet launch is pending. CEO Sergey Nazarov and the Chainlink team have built a reputation of transparency and reliability through hard work and solid product offerings. While the mainnet launch is eagerly anticipated, it is believed that it will not happen until the team is confident that all bugs and issues have been satisfactorily solved.

The LINK token is traded on major cryptocurrency exchanges, including Binance, Bitthumb, Bittrue, CoinBene, Huobi, Mercatox, and OKEx. Its major trading pairs are Bitcoin (BTC), Ethereum (ETH), Tether (USDT), and Ripple (XRP). Approximately $10 million USD in LINK tokens is currently traded each day. They currently trade around $0.42 USD.

While the platform is solid, the general market is not. For that reason, we expect the LINK token to remain relatively stable through the course of 2019 — with little change above the current $0.45 price range.

Fundamental Analysis

The fundamentals of LINK revolve around Chainlink’s blockchain-agnostic interoperability solution. In stark contrast to its major competitors, which rely on parent and child chains or sidechains, Chainlink utilizes oracles as agents to verify and aggregate data. This data is then recorded via smart contracts onto the blockchain. The oracle concept is built on reputation, order-matching, and aggregation. Reputation develops as transitions are processed. This can include gathering data, presenting data, and recording and verifying data amongst oracles. Types of data include account balances, purchases, market information, and poll results. The concept has been given veracity through extensive enterprise buy-in. The biggest partner to date is the Society for Worldwide Interbank Financial Telecommunication (SWIFT). SWIFT verifies account balances for retail card purchases. In other words, it approves or denies card transactions at the time of card swipe. SWIFT offers Chainlink affiliation by association with major credit cards such as Visa, Mastercard, and American Express. However, Chainlink is also affiliated with other enterprise partners. These include several blockchain projects, including Request Network and Zepelin_os. Partnerships such as these are the key to Chainlink’s continued market growth.

Technical Analysis

The past 12-18 months have been a time of great turmoil for the cryptocurrency market. After a short-but-steep growth trajectory, cryptocurrency hit unprecedented all-time highs in January 2018. Unfortunately, the market has been mostly moving downhill from there. After launching an ICO in September 2017, LINK followed this pattern — with one notable exception. While other tokens have either stabilized or continued to decline in value over the past three to four months, the performance of LINK has been very positive. The token even briefly landed in the top 30 on CoinMarketCap in January 2019. It currently sits at 34th, which is still a respectable rank. LINK, an ERC20 token, has a total supply of one billion tokens. Currently, about 350 million are in circulation. The market cap is close to $150 million, with a $2.9 million 24-hour volume. While it did lose value through the 2018 bear market, LINK currently sits at around $0.42. This is close to 40 percent of its ATH price of $1.38 and is indicative of positive future performance.

Specialists’ Perspective

Most experts agree that interoperability with traditional fiat money systems and real-world networks is the key to all future blockchain success. Projects such as Chainlink speak directly to this theory. Analysts such as those at CryptoCoinSpy noted the plethora of official partnership announcements coming from Chainlink in Q4 2018. These partnerships include bZx, Hydrogen, Kaiko, Kaleido, Morpheus Network, TownCrier, and Wanchain. While this abundance of partnerships has clearly bolstered the market position of Chainlink in the short term, what it has done for the company’s long-term goals is even more important. Chainlink already has a reputation for an authentic, practical, tech-focused approach to its blockchain project. Continued enterprise adoption serves to strengthen that market opinion and bring Chainlink closer to fulfilling the goal of blockchain and fiat interoperability. Another major Chainlink strong point that experts appreciate is its agnostic approach to blockchain networks. While LINK is its proprietary token, Chainlink is designed to integrate seamlessly with any sort of data — financial or otherwise. InvestInBlockchain notes that the LINK token is highly functional, offering the ability to pay node operator fees, format data, engage in computation and guarantee uptime. While it currently resides live on the Ethereum test site Ropsten, the mainnet launch is imminent. Project progress can be monitored on Github and Glitter. Chainlink’s biggest strength could be its team. Led by respected blockchain thought leader Sergey Nazarov, Chainlink is known for a team that encompasses knowledge and careful execution. This is in stark contrast to some of its competitors, with projects built on hype and fantastical promises. With these fundamentals in place, specialists see positive growth for LINK — both in the long and short term.

Chainlink Price Prediction 2019

Chainlink (LINK) prices are forecast by some experts to reach as high as $0.75 in 2019, with lows potentially going down to $0.30 USD according to TradingBeasts and WalletInvestor. Given the fact that the LINK token is already surpassing 2019 Q1 expectations, however, a lot could change — and the coin could increase in value even higher than expected. CoinFan predicts a 2019 price of $3.18. Analysts at CaptainAltcoin suggest that, with 2019 potentially being heavily focused on oracles, anything is possible. Specialists appreciate the fact that LINK maintains relevance and is continuing to show both short-term and long-term growth patterns. While the state of the cryptocurrency market over the next year is incredibly uncertain with the volatility investors have come to expect from cryptocurrencies, it is clear that Chainlink offers a solid concept and product. This product comes from a team of programmers and developers who are committed to realizing their expectations and producing the strongest possible iteration of their platform. While a number of experts predict substantial growth, we are not as bullish. The coin represents real-world solutions. At the same time, the overall market remains bearish. This is proven by the declines from early highs already in Q1. For that reason, we see LINK remaining stable at $0.45 throughout the year.Chainlink Price Prediction 2020

Chainlink (LINK) is expected to do well in 2020. Prices could hit as high as $1.50 in 2020. The pending mainnet launch will strengthen its market position tremendously. As this launch is anticipated to take place in 2019, positive ramifications will certainly take effect by 2020. This could move its rank higher on CoinMarketCap, potentially hitting the top 20, or even the top 10, cryptocurrencies. Continued rapid adoption and affiliations with major enterprise partners will also drive market performance in 2020. The Chainlink concept is expected to continue to grow in relevance as blockchain technology permeates traditional business models — offering value and flexibility to fiat-based business entities. An extended bear market could mean lower performance in 2020, with worst case prices around $0.50. LINK does not appear to follow typical market trends, however. The LINK token may escape the volatility of the overall market and begin its own price corrections over the next few years.Chainlink Price Prediction 2021

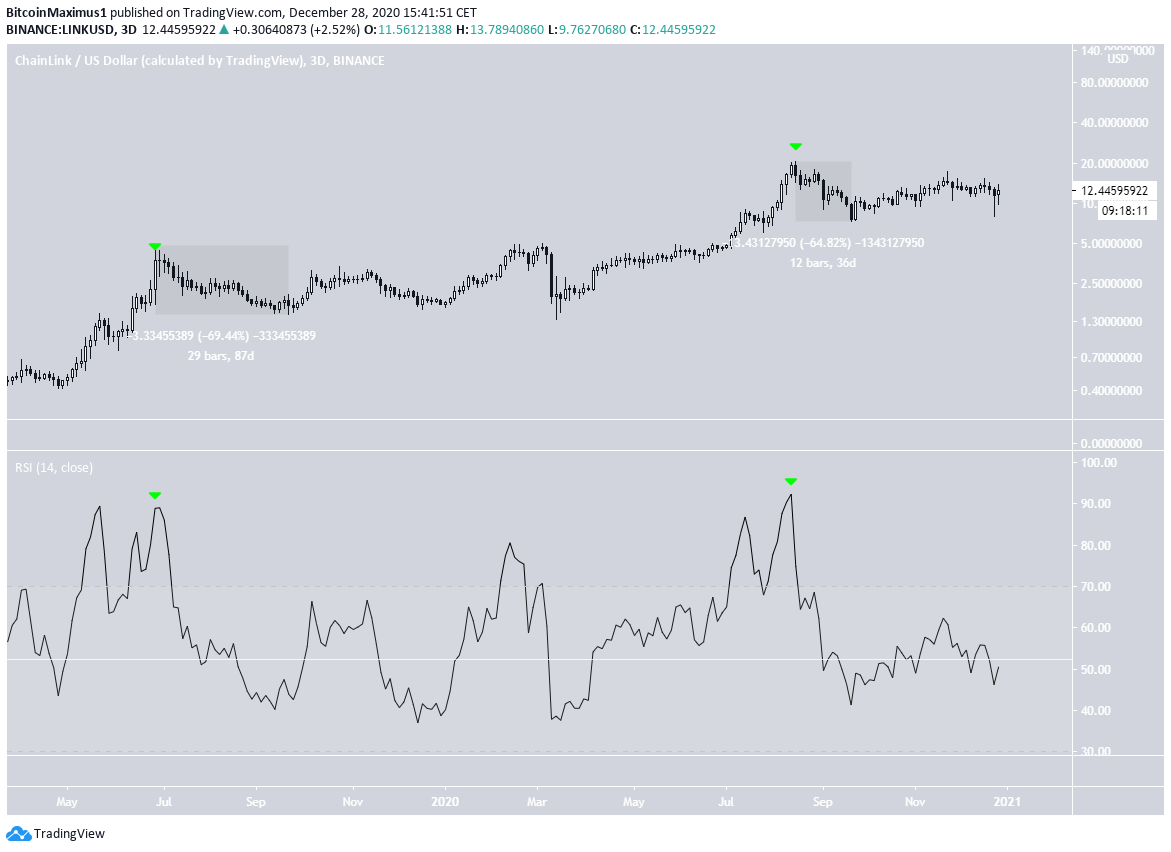

In our most recent LINK analysis, we suggested that LINK is in a bullish corrective structure and could decrease all the way to $5. The decrease is expected to transpire throughout the first quarter of 2021. In June 2019, LINK reached a then all-time high price of $4.80, which was combined with an overbought value in the 3-day RSI. In Aug 2020, LINK reached a new all-time high price of $20,71, which was also combined with an overbought value in the 3-day RSI. A significant drop ensued both times, which ad a rate of magnitude between 65-69%. While the rate of change was very similar, the amount of time it took to transpire was not, since it required 87 days in 2017 but only 36 in 2020. This suggests that while the rate of increase is similar, the movement transpired 2.4 times slower in 2020. Using these ratios we can now determine the date after the 2017 high which coincides with that on Dec. 31, 2021 and then use the rate of change to determine the price.

Chainlink Price Prediction 5 years

Five-year predictions for the price of Chainlink (LINK) are also positive. It may be considered a strong long-term investment and may see prices increase by as much as 10 times or more in the years to come. This would put prices at $5 by 2023. With a strong team of developers and programmers who are clearly committed to delivering a top-quality product to stakeholders, the future is bright for Chainlink. Blockchain technology value is increasing and adoption is exploding. Any blockchain company that can continue to produce and deliver in alignment with customer expectations will see continued success — regardless of overall market status. For these reasons, we at BeInCrypto are bullish long-term on the LINK token. In spite of the many challenges facing blockchain and cryptocurrency adoption and growth, LINK’s value proposition should continue to deliver results.Our Prediction

At BeInCrypto, our future price predictions are based on realistic, evidence-based cryptocurrency analysis practices. We value transparency and honesty in our forecasts. As such, our prediction for ChainLink (LINK) is that it will remain stable at or around the $0.45 range in the year 2019. LINK has demonstrated solid performance in the first two months of 2019. The token has exceeded most expectations and forecasts. We believe this is due to the commitment of the Chainlink team to building a high-quality and lasting product that is both consistent and flexible. We appreciate the team’s ability to restructure its roadmap and timelines according to market needs in the rapidly changing blockchain technology space. While the entire company had a relatively quiet 2018, Q4 brought the news that — unlike other blockchain platforms that have focused on media exposure and a strong marketing platform at the expense of a solid product — Chainlink is truly committed to its business model and to meeting the needs for interoperability in the blockchain space.| Period | Chainlink Price Forecast | |

| Best Case Scenario | Worst Case Scenario | |

| 2019 | $0.45 | $0.30 |

| 2020 | $1.50 | $0.50 |

| 2021 | $12.4 | $5 |

| 5 years | $5+ | $0.50 |

Top crypto projects in the US | April 2024

Trusted

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Jon Buck

With a background in science and writing, Jon's cryptophile days started in 2011 when he first heard about Bitcoin. Since then he's been learning, investing, and writing about cryptocurrencies and blockchain technology for some of the biggest publications and ICOs in the industry. After a brief stint in India, he and his family live in southern CA.

With a background in science and writing, Jon's cryptophile days started in 2011 when he first heard about Bitcoin. Since then he's been learning, investing, and writing about cryptocurrencies and blockchain technology for some of the biggest publications and ICOs in the industry. After a brief stint in India, he and his family live in southern CA.

READ FULL BIO

Sponsored

Sponsored