If you are a crypto BUIDLer (a task runner for Ethereum smart contract developers) — the infrastructure protocol 0x might interest you. The project itself comes with several use cases, like DEX development and smart contracts support. This price prediction, though, will focus on ZRX — 0x’s native utility token. Is it prudent to purchase ZRX tokens, keeping a long-term vision in mind? This ZRX price prediction piece aims to answer that question.

This projection model considers the fundamentals, tokenomics, key on-chain metrics, DEX popularity, and technical analysis of the ZRX coin. From the growth potential to key developments to the price action, this price projection covers what you should know about investing in 0x (ZRX).

NOTE: This article contains out of date figures and information. It will be updated with fresh analysis for 2025 and beyond in the New Year. In the meantime, please see our Ox Price Prediction tool for the most recent, data-informed projections.

- ZRX price prediction based on the fundamental analysis

- 0x (ZRX) price forecast based on token economics

- ZRX price forecast using on-chain metrics

- ZRX social growth and sentimental drivers

- ZRX price prediction using technical analysis

- 0x (ZRX) price prediction 2023

- 0x (ZRX) price prediction 2024

- 0x (ZRX) price prediction 2025

- 0x (ZRX) price prediction 2030

- 0x (ZRX) long-term price prediction until 2035

- How accurate is the ZRX price prediction?

- Frequently asked questions

ZRX price prediction based on the fundamental analysis

Centralized crypto bodies earned some serious notoriety in 2022. FTX, Three Arrows Capital, Celsius: the list of casualties is extensive.

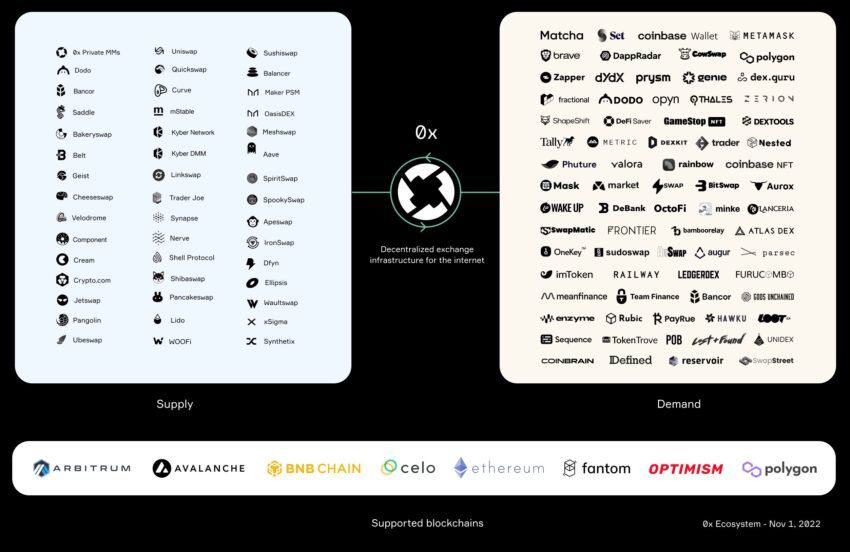

These concerns, however, are slowly putting an end to crypto’s “centralization era.” Increasingly, crypto users are favoring decentralized exchanges (DEXs). Led by powerful smart contracts and a transparent modus operandi, many DEXs still require better, more efficient infrastructure to truly thrive. All of this makes 0x — the project under discussion — increasingly desirable.

Here are some of the fundamentals that make 0x of interest:

Did you know? 0x helps build DEXs on the Ethereum blockchain.

- Primarily focuses on the exchange of ERC-20 assets but has plans to become interoperable.

- Supports ERC-721 token transfers, making sense for an NFT-specific DEX.

- Offers a wide range of smart contracts to cover every exchange-specific requirement.

- Currently supports staking and liquidity bridging as part of its 2019 update.

- Has an extensive list of investors, including Blockchain Capital, Nascent, and more.

- The ZRX token comes with voting rights and stake functionality, with a focus on incentivizing holders.

When asked about how they handle liquidity, 0x protocol tweeted this detailed explanation:

There will always be a requirement for infrastructure providers like 0x as new DEX marketplaces come to market or expand. Holding the token also makes sense for developers and those looking to accumulate passive earnings.

0x (ZRX) price forecast based on token economics

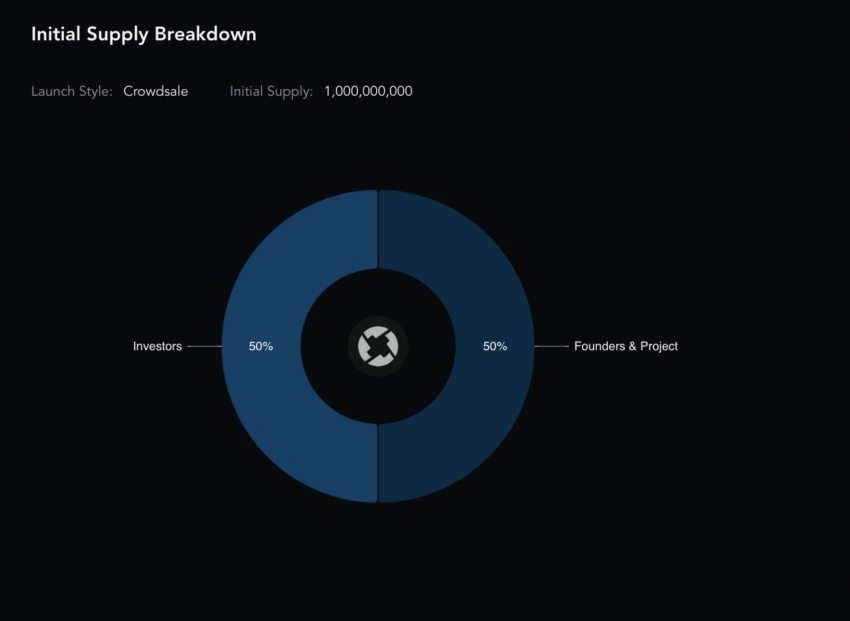

0x has a transparent token supply structure. The token sale took place on Aug. 16, 2017, with 1 billion ZRX tokens in play. Here is what the allocation looked like:

- 50% went to standard token sale participants or retail investors

- 10% of the supply went to the investors and advisors

- 10% went to the team, with a 4-year vesting schedule

- 15% was retained for ecosystem expenses

- 15% went to the developer fund

Here is what the token supply schema looks like:

Investors in the diagram identify as retail investors.

Coming to the market cap, 0x was sitting at $924.08 million on April 21, 2022. The 24-hour trading volume at that time was $1.2 billion. The market cap is currently at $319 million.

Over the past 22 months, the market cap has dropped by 60%. This shows that 0x still has enough legroom to move up.

The price drop of ZRX tokens can be attributed to a significant drop in trading volumes.

Trading volumes have been low for some time now, showing a reduced interest in ZRX tokens throughout the bear market. Things might pick up only if trading volumes improve.

ZRX price forecast using on-chain metrics

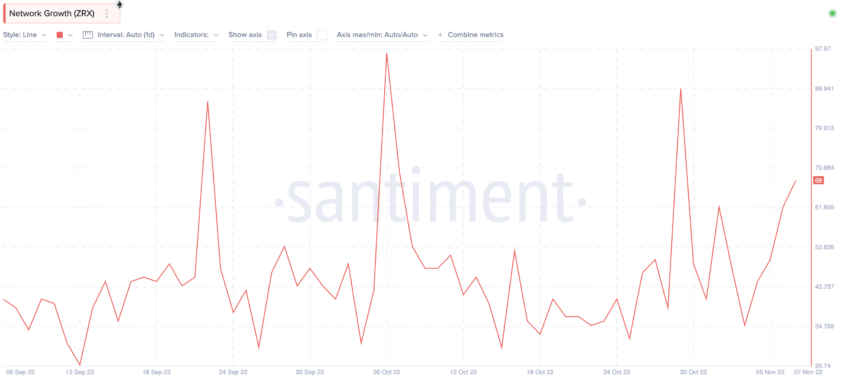

0x is a smart contract-friendly project. So, on-chain metrics and ecosystem activity are major in developing ZRX price-prediction models. Despite the market downturn, ZRX network growth has been steady throughout 2022. However, the peak came in Oct. 2022, and the price has since dropped. Post this peak, the prices started improving, showing how closely the network growth is related to price surges.

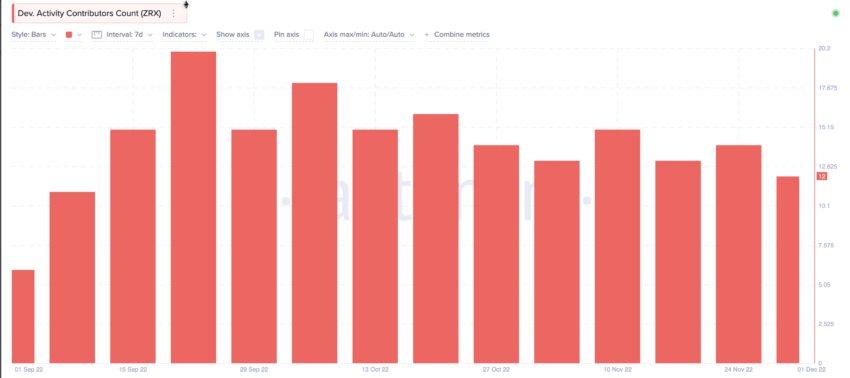

The network activity, especially the developer contributions, has also been steady despite the bear market. The peak was around the second to last week of Sept. 2022.

Finally, development activity in Dec. 2022 was at an all-time high, indicating renewed interest in DEXs past the immediate shock of the FTX collapse.

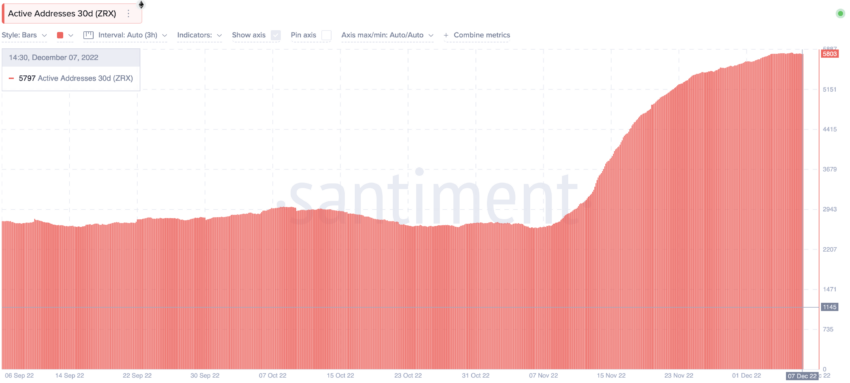

There has also been a surge in the number of active addresses holding ZRX tokens as of 2022.

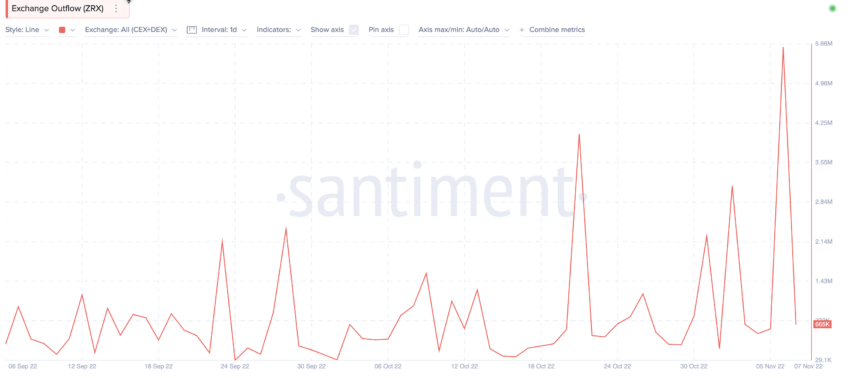

Plus, November saw a surge in the exchange outflow of ZRX. This means people are taking the token off of exchanges, preferably to hold or use for developer activities.

Most metrics suggest growing developer and token-holding sentiments. This might soon impact the price action of the ZRX coin.

ZRX social growth and sentimental drivers

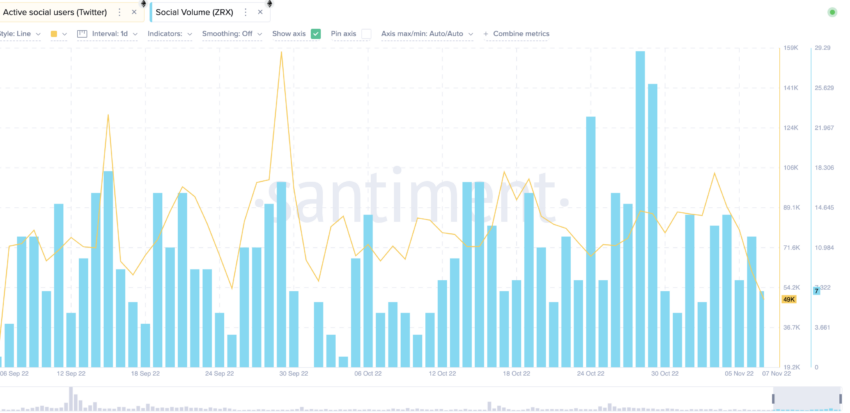

The social activity of ZRX has been steady. However, the prices dropped in early November 2022 despite decent trading volumes.

Active social users on Twitter and the overall social volume have both also remained steady. The project has dropped more than 92% from its past highs. However, interest in ZRX seems to be intact.

Another positive is that the top 100 ZRX holders do not hold more than 85% of the supply. This is not the case with many other tokens more susceptible to whale activity. Instead, the top 100 holders of ZRX own less than 75% of the total circulating supply. This indicates transparency and that the token is frequently changing hands.

0x has several developments in the pipeline, including:

- A 0x explorer for transparent and quick verification of transactions.

- API support for letting devs use the 0x explorer across apps

- A move from being a singular Ethereum blockchain project, instead powering DEX building across multiple chains and projects.

Things are looking positive for ZRX, including from a social perspective. The bear market is currently hindering the token.

ZRX price prediction using technical analysis

Before we start, here are a few insights regarding the position and price of ZRX:

- Price as of 2022: $0.1846

- All-time high price: $2.53 in Jan 2018

- Global rank: 141 as of Dec. 7, 2022

Now let’s check the weekly chart pattern and begin trend hunting:

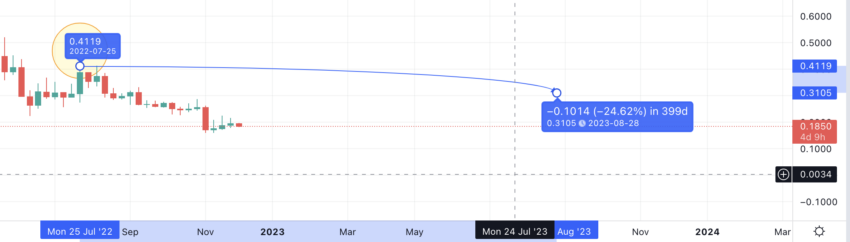

We can clearly see five higher-high formations (gray circles) followed by another four lower-high formations. Now, if we draw a vertical line between the two highest points, we can see a mirror-like pattern.

So ZRX might make another swing high to complete the previous pattern.

Predicting the next high: Price change, trend, and patterns

We measure the percentage change between the first and second high of the first pattern to predict the next high point.

399 days and a percentage growth of 31.81 or 32%.

Hence, per the pattern, the next high should be 399 days from the last high (July 25, 2022). It should also be at a 24% lower level than $0.4293.

Note: 32% growth is approximately equivalent to a 24% loss.

If we connect the forecast line, this is what we get:

ZRX will reach $0.3105 on Aug. 28, 2023.

Why would ZRX, with its growing network activity, take such a long time to reach a high? This daily chart shows us the answer.

On the daily chart, ZRX forms a clear head and shoulders pattern with a downward breakdown. The RSI (momentum indicator) is downward-sloping, and the immediate price trend doesn’t look strong.

0x (ZRX) price prediction 2023

0x successfully breached the $0.52 mark, fulfilling our price prediction expectation for 2023. Here is what we predicted and how things went:

We’ve found that ZRX will reach $0.3105 on Aug. 28, 2023.

But what could the low be in the same year, and is this projected high the max ZRX can go in 2023?

If ZRX continues to follow the foldback pattern, the next pattern would be like this:

Also, after ZRX reaches a high of $0.3105, there should be a cool-off period, similar to the surge period as per the first pattern.

According to this chart, the first high was made within 35 days of ZRX beginning trading. Notice the 42% uptick (30% loss as per the mirror pattern). The immediate high should be 35 days after ZRX cools off from the high of $0.3105.

So, ZRX might lose 30% over those next 35 days to settle at $0.2079 by Oct. 2, 2023. That’s the projected low. After that, the new higher high pattern will begin.

Per the original pattern, the first higher high should settle at 35 days from the last point: $0.2079. There can be a price surge of 42%.

Hence, the price comes out to be $0.2969. This is not higher than the 2023 high level of $0.3105 we identified earlier.

0x (ZRX) price prediction 2024

Outlook: Bullish

Based on how 0x has breached our 2023 price prediction level, we expect the 2024 price level to be higher than the expected $0.37, which we shall discuss in the subsequent sections. However, the March 2025 price expectation of $0.7237 might make sense for 0x in the coming days.

Predicted ROI from the current level: 92%

0x (ZRX) price prediction 2025

Outlook: Bullish

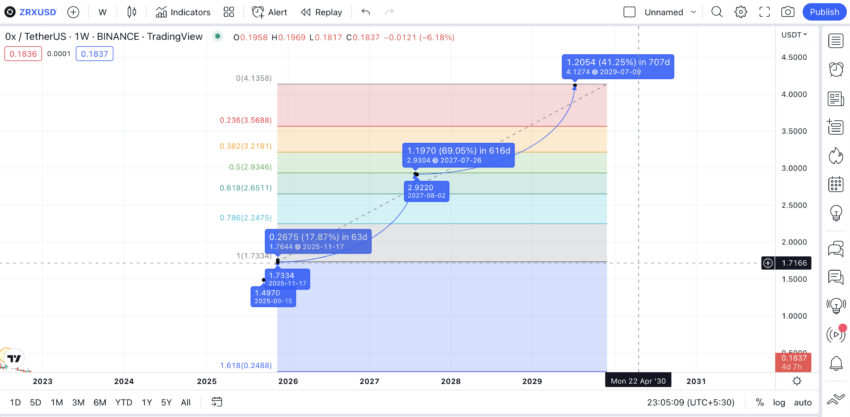

We have the first point of an upcoming pattern, $0.2969 (on Nov. 6, 2023). Now, let’s compare the same with the first pattern and plot the long-term price action of ZRX.

First high to second high = 399 days and 31.67%

Second high to third high = 105 days and 96.82%

Third high to fourth high = 175 days and 110.86%

Fourth high to fifth high = 63 days and 18.07%

Now, if we use the same data $0.2969 level onwards, here are the points and timelines we get:

- ZRX price prediction 2024 suggests a price level of $0.3763 on Dec. 9, 2024.

- ZRX price prediction 2025 suggests a level of almost $0.7237 by March 25, 2025

- However, the ZRX token might reach a high of $1.5121 by Sep 15, 2025.

- Another level of $1.77 might be possible by Nov. 17, 2025.

The average price for 2025 should be somewhere around the 90-cent mark. Also, you can use the Fib retracement levels to find the lows for 2025.

As per the Fib levels, the lowest point could be at $0.4797, coinciding with the 78.6% Fib indicator.

Predicted ROI from the current level: 370%

0x (ZRX) price prediction 2030

Outlook: Very bullish

By the end of 2025, ZRX would have extinguished the five high-pattern formations. However, it would have crossed multiple highs to break the usual higher and lower high patterns. Therefore, if the network growth remains good and 0x protocol is extensively used, we could predict a parabolic rise, as per the Fib level plotting from the 2025 high of $1.77.

If the same path persists, ZRX could even breach its all-time high price level of $2.53 by mid-2027. Also, if we retrace the same path, ZRX might reach $4.135 by the end of 2029.

ZRX price prediction 2030 model shows a probable level of $4.67 by the end of that year.

Predicted ROI from the current level: 1140%

0x (ZRX) long-term price prediction until 2035

Now that we have identified the key levels for 2030 let us extrapolate further and consider ZRX price forecasts for 2035.

You can easily convert your ZRX to USD

| Year | | Maximum price of ZRX | | Minimum price of ZRX |

| 2024 | $0.7237 | $0.30 |

| 2025 | $1.77 | $0.885 |

| 2026 | $2.03 | $1.38 |

| 2027 | $2.53 | $1.77 |

| 2028 | $3.03 | $2.12 |

| 2028 | $3.78 | $2.45 |

| 2029 | $4.135 | $3.18 |

| 2030 | $4.67 | $3.64 |

| 2031 | $5.13 | $4.00 |

| 2032 | $6.67 | $5.20 |

| 2033 | $8.01 | $6.24 |

| 2034 | $8.81 | $6.87 |

| 2035 | $10.57 | $7.08 |

High or low network activity and changing adoption rates can deflect the price predictions from the charted paths.

How accurate is the ZRX price prediction?

We have kept this ZRX price prediction model as realistic as possible. We have also considered the current state of the crypto market to place the highs accordingly. Hence, you can rely on this price prediction model to find the average price of ZRX in the short term and even the long term. Of course, crypto is a volatile space, and the price action of ZRX can change significantly in the short term. However, the growing faith in decentralized exchange adoption makes us optimistic about growing 0x adoption and ZRX’s longer-term price.

Frequently asked questions

Does ZRX have a future?

How is 0x coin doing right now?

What is the 0x trend?

Is 0x ZRX good for long term investment?

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.