Wrapped Ethereum (WETH) facilitates smoother trading between Ethereum and ERC-20 tokens and aims to strengthen the decentralized finance (DeFi) ecosystem. This comprehensive guide explains the inner workings and applications of WETH. Here’s what to know in 2025.

KEY TAKEAWAYS

• Wrapped Ethereum (WETH) is an ERC-20 token that allows trading with Ethereum in the DeFi ecosystem.

• WETH resolves the incompatibility between ETH and decentralized applications by tokenizing Ether (ETH).

• WETH plays a role in providing liquidity, enabling lending and borrowing, and supporting yield farming on DeFi platforms.

• You can convert ETH to WETH using decentralized applications, exchanges, and wallets.

What is Wrapped Ethereum?

WETH is an ERC-20 token that acts as a tokenized representation of Ethereum (ETH) at a 1:1 ratio. Wrapping Ethereum into a tokenized form, or rather tokenization, allows it to seamlessly engage with DApps, DeFi protocols, smart contracts, and trading pairs on the Ethereum network.

Note that WETH is not the only wrapped token that exists. A few other examples of popular wrapped tokens include Wrapped Bitcoin (WBTC), Wrapped Litecoin (WLTC), Wrapped Bitcoin Cash (WBCH), and Wrapped Zcash (WZEC). Wrapped tokens can be created on any blockchain where you can create tokens, such as Binance Smart Chain, Ethereum, and Polkadot.

WETH’s importance lies in its ability to enhance interoperability within the Ethereum ecosystem, bridging the gap between ETH and ERC-20 tokens. So what gives WETH its value and significance? What problem does Wrapped Ethereum solve? Let’s investigate.

Why does Wrapped Ethereum matter?

At a basic level, DeFi protocols are powered by smart contracts. These are basically autonomous computer programs designed to automate the necessary steps in a contractual agreement.

ERC-20 is the most prominent smart contract standard (or token standard) on Ethereum. The term “token standard” here refers to a set of rules that a token has to follow to be compatible with other Ethereum-based platforms and services.

The ERC-20 standard serves as a widely accepted blueprint for token creation within the Ethereum ecosystem and across other compatible networks, such as Avalanche and Polygon. This standardized approach streamlines the development of DApps and smart contracts by eliminating the need for custom codes to accommodate each new token.

The problem, however, is that Ethereum existed long before ERC-20 was first introduced as a token standard. The two are not mutually compatible, meaning you can’t trade ERC-20 tokens for ETH and vice versa. It’s like trying to mix oil and water; it just doesn’t work.

“Wrapping ETH removes the obstacle of needing separate interfaces for ETH and ERC-20 tokens in DApps. This enables developers to handle ETH and other tokens within the same DApp”

Ethereum Community, via Ethereum.org

As a result, many DApps and crypto wallets that can handle ERC-20 tokens seamlessly are not necessarily compatible with ETH. WETH resolves this issue by bridging the two types of assets, enabling the exchange of ETH for ERC-20 tokens and vice versa. You could say that WETH is a tradable ERC-20 version of ETH that is compatible with DeFi protocols.

Wrapped Ethereum unlocks a new array of opportunities in the decentralized finance space for the Ethereum community. It enables you to easily allocate funds to DeFi protocols and/or trade ERC-20 tokens seamlessly.

ETH vs WETH: Why do you need the latter

The ERC-20 standard is a crucial token standard on the Ethereum network because it streamlines the development of DApps and smart contracts. WETH is required because ETH itself is not ERC-20 compliant, making it incompatible with many DApps and DeFi protocols that require ERC-20 tokens.

Wrapped Ethereum (WETH) resolves the aforementioned issues by converting ETH into an ERC-20-compliant token, facilitating smoother transactions and enhancing interoperability within the DeFi ecosystem.

How does Wrapped Ethereum work?

The process of creating wrapped tokens requires custodians to manage the underlying assets, ETH. For example, when you decide to wrap Ethereum, a custodian — which could be a smart contract, a multi-signature wallet, or even a merchant — takes charge of your ETH and provides you with WETH in exchange.

In the case of WETH, it’s as straightforward as visiting a DEX like Uniswap to convert ETH to WETH.

Note that the original ETH morphs into WETH, maintaining its value, much akin to how dollar-pegged stablecoins operate.

Within the Ethereum blockchain ecosystem, WETH is essential for exchanging tokens on decentralized platforms. For example, certain decentralized applications are incompatible with ETH as collateral but can function smoothly with WETH.

Even though ETH is still necessary to cover gas fees, you can swap your WETH tokens with other ERC-20 tokens on DeFi platforms.

Just rebalanced my PENDLE/WETH UNI V3 position on ApertureFinance. Took ten seconds. No fees. Non-Custodial.

Stephen, Founder of DeFi Dojo: X

Pros and cons of Wrapped Ethereum

| Pros | Cons |

|---|---|

| Interoperability | Gas fees |

| DeFi compatibility | Learning curve |

| Liquidity | Custodial risk |

| Price stability | Limited utility |

| Simple token swaps | Extra steps to convert |

Pros:

- Interoperability: WETH enables seamless interaction between Ethereum and other ERC-20 tokens on decentralized platforms, increasing the ecosystem’s overall efficiency and convenience.

- DeFi compatibility: As an ERC-20 token, WETH is compatible with various DeFi applications and protocols.

- Enhanced liquidity: WETH plays a crucial role in providing liquidity within decentralized exchanges (DEXs) and other DeFi platforms. That makes it easier for users to trade and execute transactions.

- Price stability: Wrapped Ethereum maintains a 1:1 peg with Ether, ensuring that its value remains stable and consistent. That is a key requirement for smooth trading and predictable pricing in DeFi applications.

- Simplified token swaps: WETH simplifies the process of swapping between Ether and other ERC-20 tokens by acting as a standardized medium of exchange, which streamlines the user experience.

Cons:

- Additional step: Converting Ether to WETH adds an extra step in the trading process, which may be inconvenient for some users.

- Custodian risk: The process of wrapping Ether requires a custodian, which could be a smart contract, merchant, or multi-signature wallet. Entrusting assets to a custodian introduces a certain degree of counterparty risk.

- Limited utility outside DeFi: WETH’s primary use case is within the DeFi ecosystem. Its utility and demand may be limited outside of DeFi applications and platforms.

- Learning curve: For new users, understanding the concept of wrapped tokens and their role in the Ethereum ecosystem may require some learning and adaptation.

- Gas fees: Converting Ether to WETH and vice versa incurs gas fees on the Ethereum network, which may still be high during periods of network congestion.

Use cases of Wrapped Ethereum

The primary function of Wrapped Ethereum is to serve as a bridge between ETH and ERC-20 tokens, thereby unlocking an array of use cases in DeFi applications.

One of the key use cases of WETH is providing liquidity for decentralized exchanges. As an ERC-20 token, WETH can be readily pooled with other ERC-20 tokens on DEXs, such as Uniswap and SushiSwap.

While compatibility simplifies token swaps, it also enhances the overall trading experience. In a way, WETH is that versatile “middleman,” specializing in ensuring smooth transactions between parties with minimal friction.

Furthermore, WETH plays an important role in decentralized lending and borrowing platforms. By converting ETH to WETH, users can leverage the value of their assets while simultaneously maintaining a standardized token format that is compatible with a wide range of DeFi protocols. In other words, WETH functions as a universal collateral, providing users access to various financial services in the DeFi space.

Another noteworthy use case of Wrapped Ethereum is its integration with yield farming and staking platforms. As an ERC-20 token, WETH can be staked or locked up in liquidity pools to earn rewards, creating new passive income opportunities for crypto enthusiasts. This way, WETH enables investors to maximize the potential of their digital assets.

How to get Wrapped Ethereum

Here is a quick guide to wrapping and unwrapping ETH for quick integrations across the decentralized finance ecosystem.

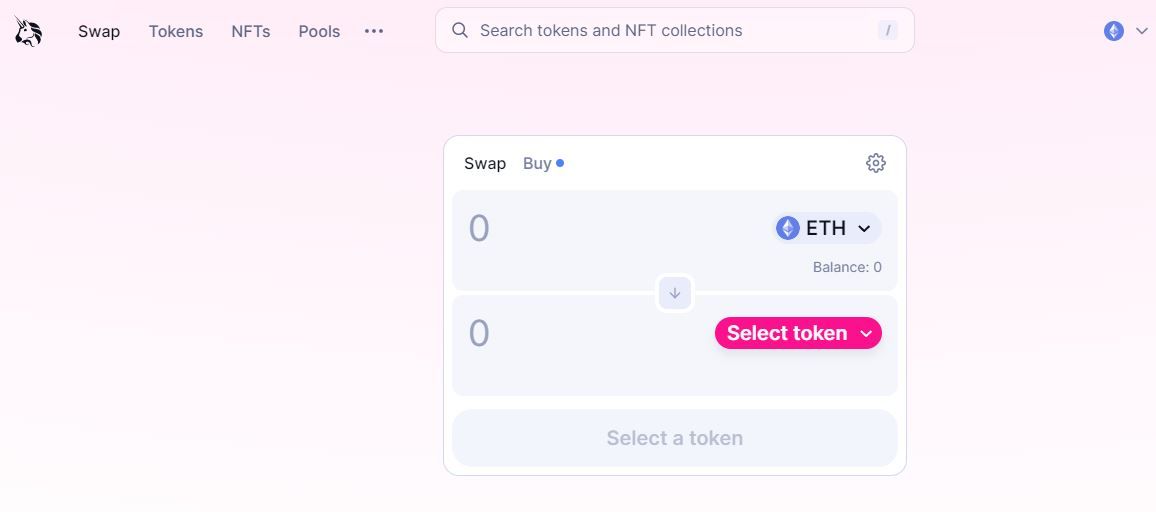

1. Via UniSwap

First, you need to have a crypto wallet, such as MetaMask. Ensure that your wallet has some ETH in it. Next, connect your wallet (in this case, MetaMask) to an Ethereum-based DEX like Uniswap.

Follow these steps to transform your ETH into WETH:

- Log in to your MetaMask account and install the browser extension on Google Chrome or any other compatible web browser.

- Visit this Uniswap https://app.uniswap.org/#/swap

- Connect your wallet.

- Choose ETH as the top asset and WETH as the bottom asset.

- Specify how much ETH you wish to wrap.

- Click the “Wrap” button.

- MetaMask will send a notification giving you a tentative idea of the expected gas fees and the net transaction amount.

- Hit the “Confirm” button. Soon enough, you’ll find the Wrapped Ethereum in your wallet.

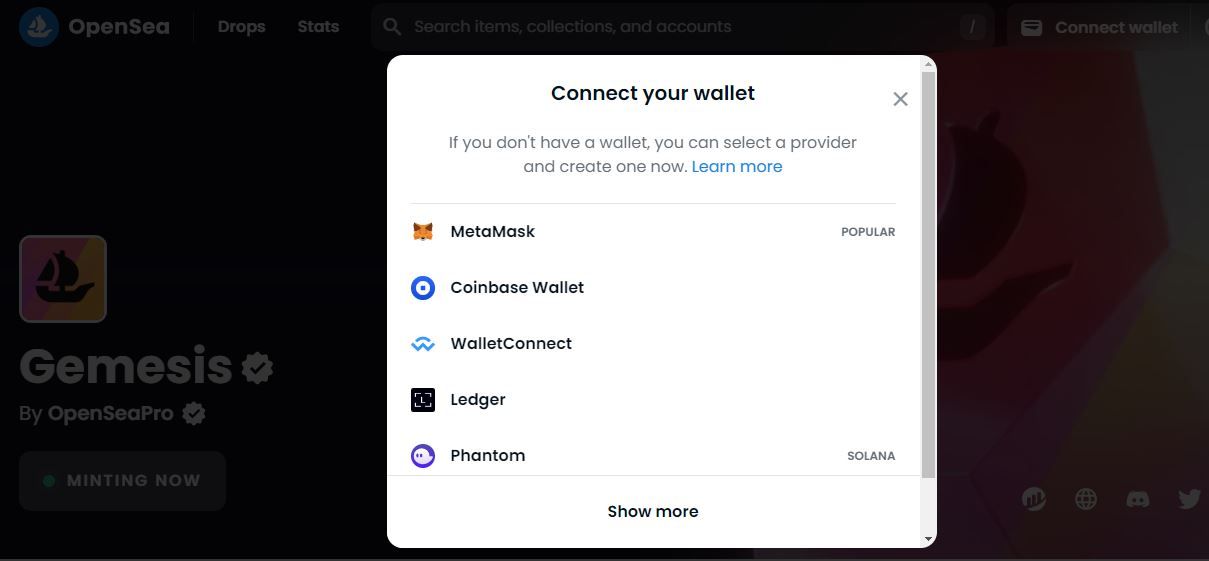

2. Via OpenSea

- First, locate the “Wallet” button in the top-right corner of OpenSea and click on it.

- Click on the three-dot menu next to Ethereum and choose “Wrap.”

- Now, enter the amount of ETH you want to convert to Wrapped Ethereum before clicking the “Wrap ETH” button.

- A MetaMask pop-up window will emerge, requesting the user to authorize the transaction.

- Once the wrapping process is over, a confirmation message will be displayed. The newly acquired WETH will be visible in the wallet section of your OpenSea account. The WETH will have a pink Ethereum diamond logo next to it so you don’t confuse it with your ETH stash.

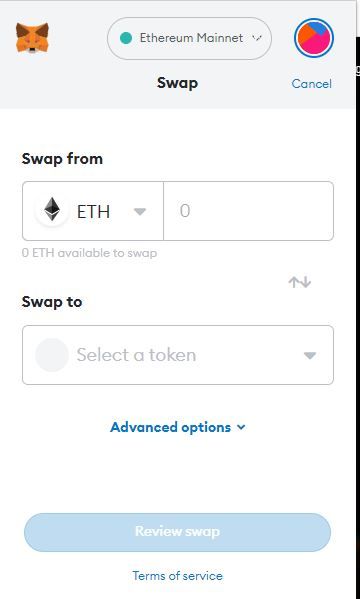

2. Via MetaMask

- After launching the MetaMask wallet, first, confirm that the chosen network is “Ethereum Mainnet.”

- Proceed by clicking “Swap” and then choose wETH in the “Swap to” field.

- Following that, enter the amount of ETH to be exchanged. Then click “Review Swap.”

- A window will appear displaying the conversion rate quote. Given that it’s a conversion from ETH to WETH, the rate should be 1:1.

- To complete the transaction, press “Swap.”

How to unwrap WETH

You can unwrap Wrapped Ethereum using the same methods as wrapping it via a WETH smart contract on OpenSea.

The only difference is that instead of selecting “Wrap ETH,” you have to choose “Unwrap WETH.”

Similarly, you can also convert WETH back to ETH via Uniswap or MetaMask. The unwrapping WETH procedure closely mirrors the ones described above for wrapping ETH on both platforms.

When unwrapping, you have to alter the values or parameters, i.e. (from WETH to ETH instead of ETH to WETH). And just like that, your wrapped digital asset will be back to its original state.

Holding WETH unlocks multiple possibilities

It’s no secret that Ethereum’s vast DeFi ecosystem offers a wide range of staking and investment possibilities. Incorporating Wrapped Ethereum further broadens these opportunities for investors and traders alike. From trading pairs to tokenization and yield farming, WETH facilitates a broad range of activities on the Ethereum network, enhancing overall market fluidity and user experience.

Disclaimer: This article is for informational purposes only and is not intended as investment advice. Decentralized ecosystems present significant risks and you may lose money. Profits are never guaranteed.