As the centerpiece of Wirex’s foray into decentralized payments, WPAY facilitates governance, rewards, and much more. While the Wirex lending platform already utilizes a native WXT token, WPAY serves a distinct role, making it a must-watch for anyone interested in the future of digital payments. Here’s what to know about the WPAY token and its place within the expanding Wirex Pay ecosystem in 2026.

KEY TAKEAWAYS

➤ While WXT is the utility token for the main Wirex app, WPAY is a governance token that powers the decentralized Wirex Pay network, focusing on community-driven decision-making and long-term rewards.

➤ WPAY’s supply is carefully allocated: 38.14% to the treasury, 20% to node operators, and 20% to the team — with varying lock-up and vesting periods, ensuring sustainable growth and stability over time.

➤ Wirex Nodes form the network’s backbone, validating transactions and earning 20% of WPAY’s supply and up to 40% of the network’s revenue share.

What is WPAY?

WPAY is the native governance token of the Wirex Pay network. It empowers users by allowing them to stake for rewards and participate in decision-making. As the driving force behind Wirex Pay, WPAY focuses on decentralizing the Wirex payment network, all while helping to create a community-led ecosystem.

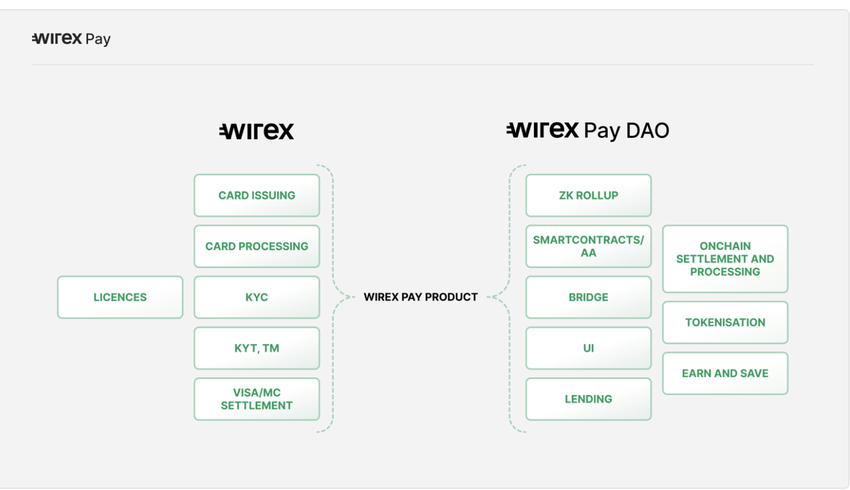

Wirex vs. Wirex Pay: What’s the difference?

While Wirex is the broader financial platform offering services like fiat-to-crypto exchanges and crypto debit cards, Wirex Pay is its blockchain-powered branch, focusing entirely on decentralized payment solutions. The original Wirex token (WXT) supports Wirex’s traditional services, whereas WPAY governs and incentivizes the Wirex Pay network.

Did you know? The Wirex Pay DAO is the decentralized governance body for the Wirex Pay network. It lets WPAY holders vote on key proposals, such as how treasury funds are used and which new features should be developed, ensuring that the community has direct control over the network’s direction.

Wirex Nodes lay the foundation of the Wirex Pay network, validating transactions and ensuring the network remains secure and decentralized.

“WPAY represents a key step in building the future of payments. Through Wirex Pay, we’re offering a unique opportunity for users to engage with the crypto world in a practical and secure way, ensuring that digital currencies are not just speculative assets but usable in everyday life.”

Pavel Matveev, Co-founder of Wirex Pay

Let’s now take a closer look at how WPAY fits into the entire Wirex ecosystem.

Real-world visualization of the Wirex ecosystem

Think of Wirex as a popular chain of retail stores (like Amazon) that makes it easy for people to shop for a diverse range of products and offers cashback and discounts to loyal customers through a membership card called WXT.

Now, Wirex Pay is like a new, premium branch of this retail chain that’s entirely community-operated. Here, customers aren’t just buyers — they’re also decision-makers. Instead of using a regular membership card, they use WPAY — a VIP pass that lets them vote on what new products should be added to the store and earn rewards for holding this pass.

The foundation of this new branch is built by a network of Wirex Nodes — which operate like a group of dedicated store managers and engineers. They ensure everything runs smoothly, from security to customer service, and in return, they receive a significant share of the store’s revenue, along with exclusive bonuses.

In short, Wirex is the original, straightforward shopping experience, while Wirex Pay is the community-led, exclusive branch where every customer has a say in how the store is run. The Wirex Nodes? They’re the core team ensuring the new store remains profitable and secure.

How do WPAY tokenomics work?

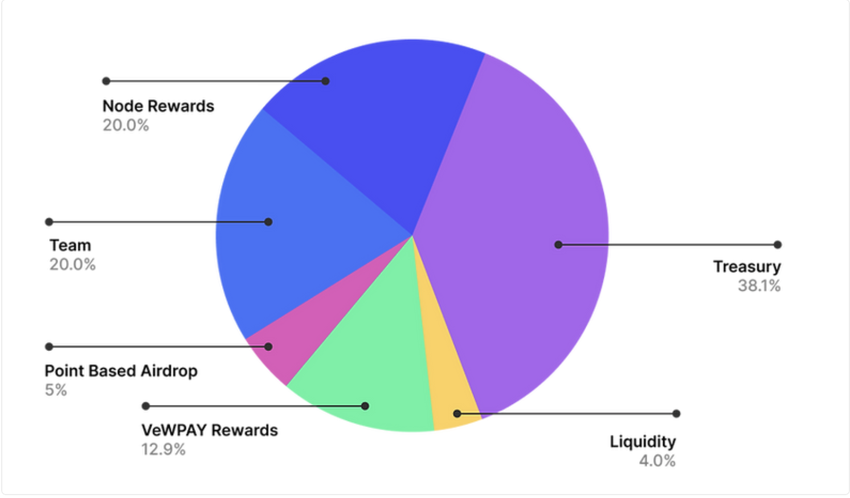

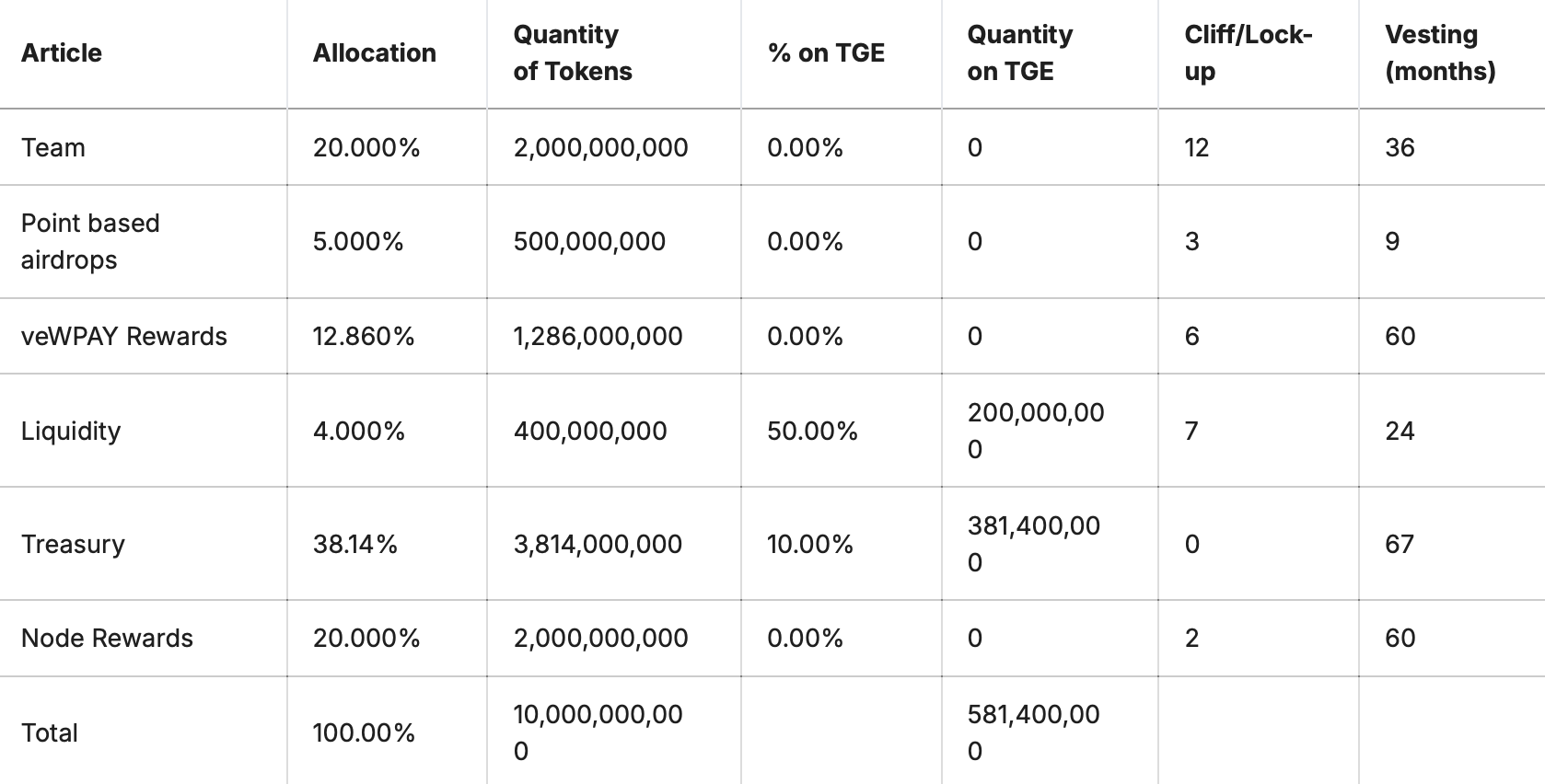

WPAY’s tokenomics are designed to keep the Wirex Pay network healthy, sustainable, and rewarding for everyone involved. The total supply is 10 billion WPAY tokens, and each portion is set aside with a specific purpose/ user base.

Node operators: 20%

These are the backbone of the network, ensuring it remains secure and functional. Node operators receive 2 billion WPAY in total, but it’s not handed out all at once. There’s a 2-month lock-up (think of it like a no-touch zone), and after that, the tokens are released gradually over the next 60 months.

This way, the people running the nodes receive a steady stream of rewards rather than a one-time payout.

Team allocation: 20%

The team behind Wirex Pay gets 20%, too, but there’s a catch: they can’t access any of their tokens for the first 12 months (the lock-up).

Then, these tokens are gradually released over 36 months, which means they have to stick around for a while to benefit fully. It’s like a “stay and grow” strategy, making sure they stay invested in the project’s future.

Point-based airdrops: 5%

For early users who helped get Wirex Pay off the ground, there’s 500 million WPAY set aside as a thank-you.

However, there’s a 3-month wait before they can access it, and it’s released over the next nine months. This approach keeps excitement high without flooding the market with tokens all at once.

veWPAY rewards: 12.86%

This part is for stakers — people who lock up their tokens to support the network. There’s a 6-month lock-up, and then the rewards trickle out over 60 months.

This time period is designed to be lengthy in order to keep the ecosystem stable and encourage long-term involvement. Think of it as a reward for patience.

Liquidity & market-making: 4%

This small chunk (400 million WPAY) ensures there’s enough liquidity on exchanges. To prevent big price swings, the tokens are locked for seven months and then released over 24 months.

Treasury allocation: 38.14%

The Wirex Pay DAO Treasury holds the biggest portion — 3.81 billion WPAY. These funds help pay for new projects, marketing, and anything else the community decides is worth investing in.

The treasury has no lock-up period (immediate access), but the tokens are released over a long 67 months to keep the ecosystem growing steadily.

Breaking down the jargon:

- Lock-up (cliff) period: This is like a waiting period before you can even think about touching your tokens. You will not have access until this period ends.

- Vesting period: After the lock-up, tokens are released gradually. It’s like getting your salary paid out in small portions instead of a lump sum. This prevents any sudden rush of tokens into the market.

The idea behind all these steps is to ensure that everyone — whether node operators, team members, or early supporters — has a stake in Wirex Pay’s long-term success without causing sudden dumps or spikes in token supply.

WPAY vs WXT: How do these tokens differ?

The Wirex ecosystem comes with two distinct token types — WXT and WPAY. Here is a quick visualization of their key differences:

| Aspect | WPAY | WXT |

| Purpose | Governance token for the Wirex pay network | Utility token for the broader Wirex financial platform |

| Primary use | Voting in the Wirex Pay DAO, staking for rewards, and node operations. | Fee discounts, premium feature access, and rewards in the Wirex app |

| Supply | Fixed supply of 10 billion tokens | A fixed supply of 10 billion WXT |

| Allocation | Distributed across node operators, treasury, staking, and team | Primarily used within Wirex for transaction fee reductions. |

| Unique features | Empowers users to participate in governance decisions | Enables Cryptoback™ rewards and reduces transaction fees |

| Staking and rewards | Yes, through veWPAY rewards and staking | No staking option; primarily used for immediate app benefits |

| Community control | Strong focus on community governance and proposals | Centralized utility within the Wirex platform |

| Node support | 20% of the supply is dedicated to node operators | Not applicable |

| Target ecosystem | Wirex Pay’s decentralized payment network | Broader Wirex financial ecosystem (crypto and fiat services) |

| Vesting and lock-up | Varying vesting and lock-up periods for allocation categories | No vesting or lock-up for its utility purposes |

WPAY roadmap and future ecosystem role

Since the mainnet launch on Aug. 28, 2024, Wirex Pay has hit a few of the key milestones that were set out in its initial roadmap. The mainnet launch was the first major step in making the Wirex Pay network fully operational and bringing all core features like staking, governance, and transaction validation online.

Right after the launch, Wirex Pay moved into its node sale phase, where early adopters could buy Wirex Nodes — essentially licenses to validate transactions and earn rewards.

With the mainnet and node sale completed, the focus is now shifting to expanding WPAY’s role and integrating more community-driven features.

Here’s what’s planned:

- WPAY Governance token launch: The (already launched) governance token allows users to vote on key proposals, such as network upgrades and treasury allocation.

- Partnership expansions: The goal is to connect with more web3 projects and DApps to grow WPAY’s utility beyond just payments.

- New staking options: Introduction of flexible staking periods to attract both short-term and long-term holders.

- Additional features for the Wirex Pay DApp: Enhancements like improved user interfaces and new DeFi features are on the horizon.

Fact check: New staking options include rolling out flexible staking periods and introducing restaking models that allow users to use the same staked assets across multiple services.

Why keep a close eye on WPAY?

WPAY isn’t just another ecosystem token — it’s the backbone of Wirex Pay’s decentralized ecosystem. From governance to rewards, it’s designed to empower users and support the network’s sustainable growth, making it central to the Wirex Pay experience.

Remember to prioritize safety and security when interacting with decentralized ecosystems and buying or trading crypto tokens. Ensure to do your own research (DYOR) and never invest more than you can afford to lose.

Disclaimer: This article is for informational purposes only and should not be considered investment advice.