Fluctuations in price in the crypto market provide ample opportunity for traders to profit. However, the same circumstance that gives traders extra advantage can also prove their downfall. With the market open 24 hours in such a volatile environment, traders can miss the mark when it comes to timing their trades perfectly. However, the introduction of crypto trading bots has proven to lessen these adverse trading conditions substantially. And in particular, grid trading bots have worked wonders for many traders. But what is grid trading, and why should you use it?

While grid trading is more common in foreign exchange markets, crypto traders can add these strategies to their trading arsenal. In this guide, we delve into the mechanics of this type of trading and reveal a successful grid trading strategy you can implement yourself.

BeInCrypto Trading Community on Telegram: watch Trading Basics course, read technical analysis on coins & get answers to all your questions from PRO traders & experts!

What is grid trading?

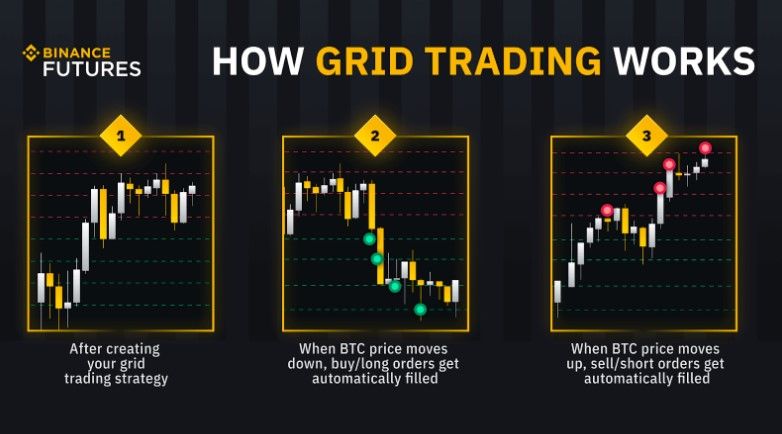

Grid trading is an automated trading strategy where a trader places incremental orders below and above a set price level. This quantitative trading process is an attempt to profit from the crypto market’s volatility. Automated orders are executed via grid trading bots to establish a successful grid trading strategy.

In this way, the bots automatically place orders within predetermined price ranges. This creates a trading grid of orders that covers various potential market movements. So, in essence, traders set the ranges based on the idea that the asset price will fluctuate within that range and then take profits from the up and down price movement.

How does grid trading work?

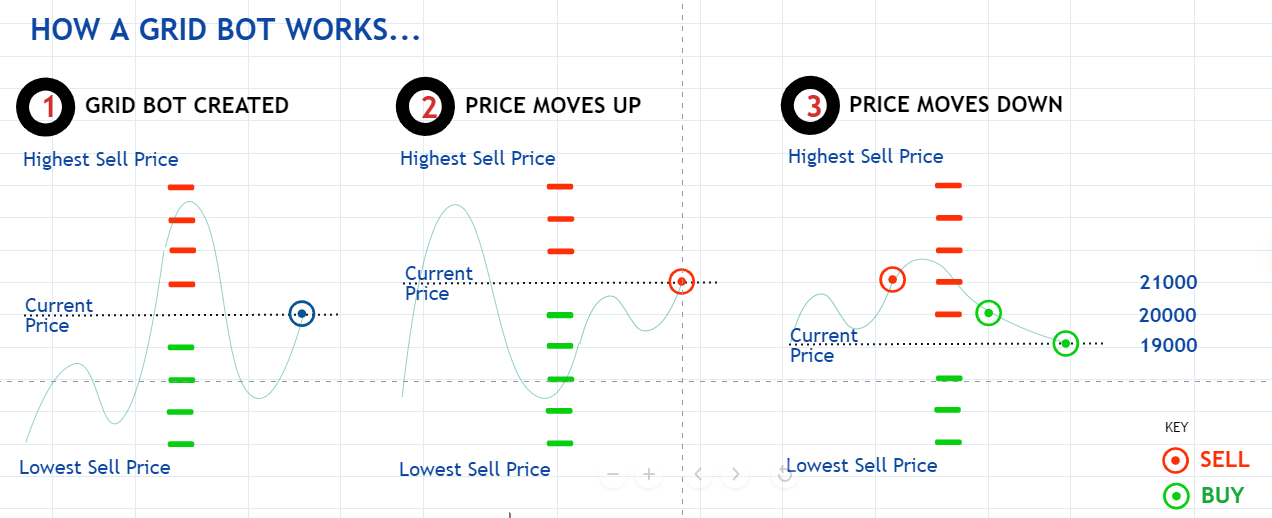

Every trader starts by determining trading range parameters on a crypto exchange of their choice. That is the upper and lower limits where they will place their buy and sell orders. Grid trading executes predetermined orders in order to establish the maximum profit for every trade within the price ranges of the designated grid structure.

The grid is the area in which these trades are plotted, and the price levels resemble gridlines on a grid. Keep in mind that the distance between each gridline is typically always the same.

Next, the trader will set the maximum price level in which no sell orders can execute above and also set a minimum price level where no orders are executed below. Buy orders have corresponding sell orders set at levels above the buy orders.

Let’s use ethereum as an example. You can set buy orders at $500 increments below the price. So if ETH’s price is $2,000, you can set an order at $1,500, $1,000, and $500. Likewise, you would do the same with the sell orders but $500 increments “above” the current price. The bot would automatically execute these buy and sell orders according to these parameters.

Constructing a trading grid

When you plot your strategy on a chart, you will see the grid begin to take form. To construct a successful trading grid, consider the steps below.

Determine starting price

This step is crucial because you can’t create a grid without a baseline. By now, you should be familiar with the price action and can determine the range in which the asset is trading.

Choose the interval

You need to determine the “pip” intervals you will use in your strategy. Pips refer to increments, such as every $100 dollars below or above the price. So, you can begin by selecting ten pips as an illustration. If the asset price is $200, your buy orders will remain at $190, $180, and so on. Setting up stop-losses automatically sells positions at a predetermined price after a certain amount of loss occurs. This minimizes loss while maximizing profits.

With-the-trend or against-the-trend

Determining this can get tricky if you don’t know what to look for. Trading “with the trend” means plotting your orders in the direction of the asset’s price trend. So, with a price of $500 with ten pips, you set buy orders at $510, $520, and so on. This strategy requires an exit when things go well to lock in profits. However, trading “against the trend” means you take positions in the opposite direction of the trend. This often results in taking advantage of corrections and retracements.

Pros and cons of grid trading

Grid trading comes in handy when prices move in a sideways market or within a specific range. This is because assets fluctuate inside a tight range for an extended time. While this type of trading provides immense benefits to traders, such as customizability and exchange liquidity, there are still some caveats to consider. Let’s go over the pros and cons below.

Pros

- Low entry point: The bots enable traders to enter positions at levels they would otherwise be unable to enter manually. This is often the case because one must constantly monitor the price action to achieve those lower entry points. This also works for the opposite effect: achieving maximum selling points.

- High automation: The underlying trading strategy for this type of trading is logical. This makes it easy for bots to execute their programmed tasks which are unrelated to the market’s sentiments and trends. In effect, this provides high automation levels that perform efficiently.

- Enhanced risk management: When using a bot, you can directly configure the settings to highly impact your rewards and profitability. This, in turn, gives you more control and lowers the loss of risking highly speculative trades.

- Removes emotions from trading: Emotions such as anger, fear, and greed are driving factors when it comes to crypto investments, especially trading. Using trading bots minimizes the emotional attachment since the process is automated and processed through logic and rules.

Cons

- Long waiting for larger timeframes: Long timeframe windows require you to hold for weeks at a time, or even longer. This will eventually cut down on profits. In this scenario, patience is key.

- The system fails if the market is too directional: In order for this strategy to succeed, there must be constant pullbacks in the market. This type of market trajectory will only work against you since losses cannot be averaged.

- Constant monitoring: This happens when a trading bot is not used. A trader needs to be vigilant of the price action, and with a market that stays open 24 hours, it’s near impossible. This will inevitably cause traders to miss out on important timed orders.

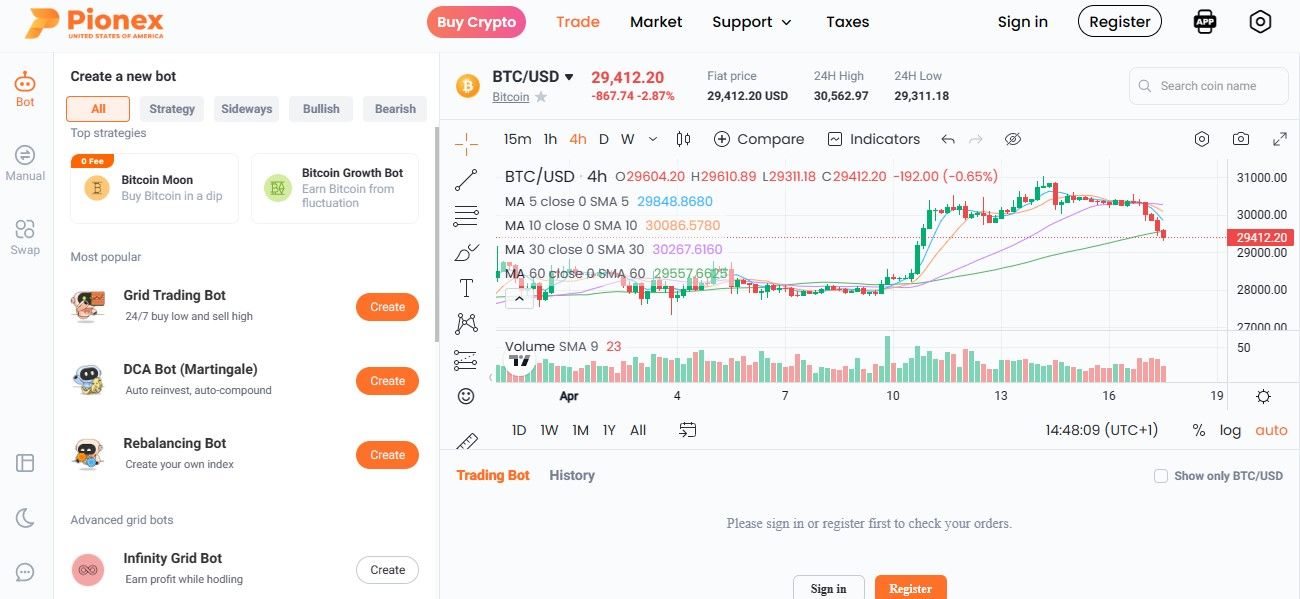

Grid trading bots

Bots have been around for a long time in trading markets. And when it comes to the 24-hour cryptocurrency market, it’s a good idea to learn to use them. Grid trading bots are merely trading codes or algorithms that automate the entire grid process. Traders program the bots to execute orders at specified interval prices, allowing them to take a break from the screen.

The benefits include faster rational-thinking decisions, trade customization, and the opportunity to continue to make profits in a quiet market. For example, Binance has both an internal trading bot and grid bots. In fact, Binance has the largest number of trading bots of all exchanges that support bots. It uses real-time data and pre-set indicators and rules to come up with profitable trading signals. You can choose from any that suits your trading needs; some can be used for margin and others for futures trading.

Setting up a successful grid trading strategy

Grid trading has been proven to provide immense trading advantages in both forex and crypto markets. And while there may be some risks involved, as in any investment, the pros definitely outweigh the cons. The success of these strategies relies mainly on three components: solid entry strategy, defined risk management, and strategic position sizing.

Entry strategies can be determined based on other trading indicators or the overall price pattern in the chart. As for risk management, this includes setting up your “stop losses” and “take profit” levels to protect profits and contain losses. To manage your money, determine the size of each trade and the number of trades placed in each grid. In sum, if you plan your trade orders strategically and incorporate the help of grid trading bots, you can considerably improve your chances of success.