This Voyager token price prediction piece will hinge heavily on technical analysis, as the parent firm is not fundamentally strong. Therefore, we shall primarily focus on the trading and sentimental attributes of the Voyager Token in an effort to predict its future price. Here’s what that future of VGX could look like.

- The state of Voyager: Sentiments and more

- Key metrics and the VGX price prediction

- VGX price prediction and technical analysis

- Voyager (VGX) short-term analysis

- Voyager Token (VGX) price prediction 2023

- Voyager Token (VGX) price prediction 2024

- Voyager Token (VGX) price prediction 2025

- Voyager Token (VGX) price prediction 2030

- Voyager Token (VGX’s) long-term price prediction until 2035

- Is the VGX price prediction model accurate?

- Frequently asked questions

Want to get VGX price prediction weekly? Join BeInCrypto Trading Community on Telegram: read VGX price prediction and technical analysis on the coin, ask and get answers to all your questions from PRO traders! Join now

The state of Voyager: Sentiments and more

After the bankruptcy filing, Voyager has been in a restructuring phase. However, in September 2022, the firm announced that FTX would get access to its assets — with the now-defunct centralized exchange initially emerging as the best bidder. But when FTX went belly up, Voyager was left out in the cold.

Did you know? Before the bankruptcy shenanigans, Voyager was a notable crypto broker, specializing in commission-free trading.

The next important movement came on Dec. 19, 2022, when Binance U.S. emerged as the new highest bidder. The FTX rival acquired Voyager’s assets worth $1 billion.

This time has been more smooth sailing. A report indicated that last Jan. 11, 2023, District Judge U.S. Judge Michael Wiles approved the Voyager-BinanceUS takeover. The move might explain the short rally at the VGX’s counter.

The encircled zone shows the rally post-10 January 2023.

Key metrics and the VGX price prediction

It is evident that any good news at Voyager’s counter can push the price of VGX higher. Let’s look at some of the other important metrics to see if we can gain some additional insights to support the VGX price prediction.

“Voyager is selling crypto for cash on Coinbase at a rate of $100M a week.”

Lark Davis, Founder of Wealth Mastery: X

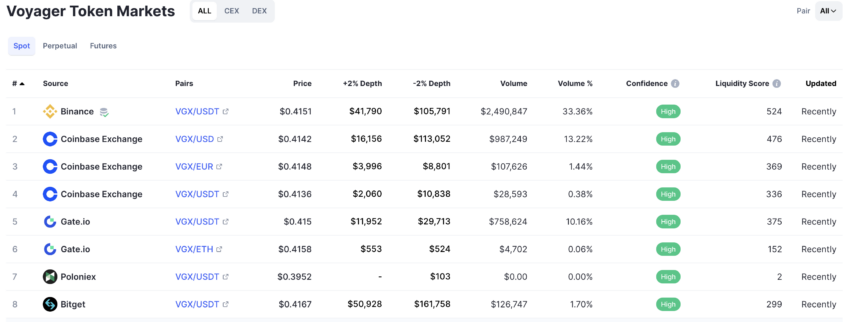

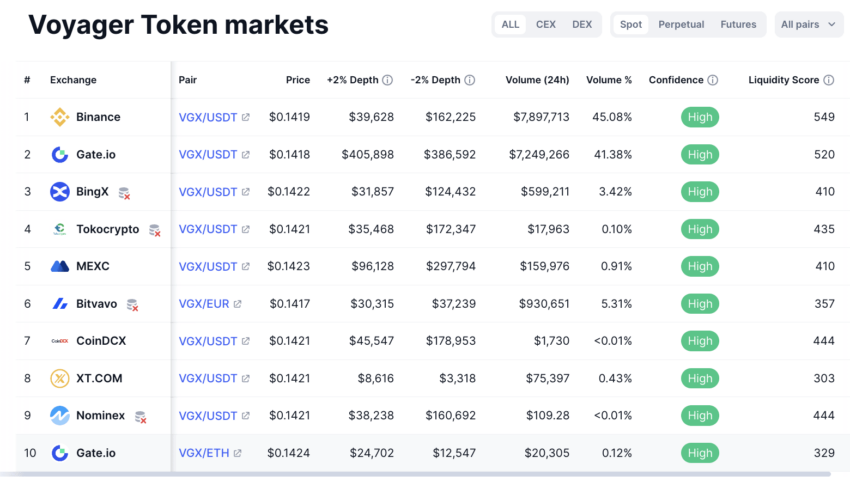

Despite all the restructuring, VGX is still an actively traded crypto asset. Binance’s VGX-USDT pair is the hot favorite, attracting 45.08% of the overall trading volume.

As of December 2023, the exchange cluster has changed, with Coinbase not supporting VGX anymore.

Token markets amid the chaos

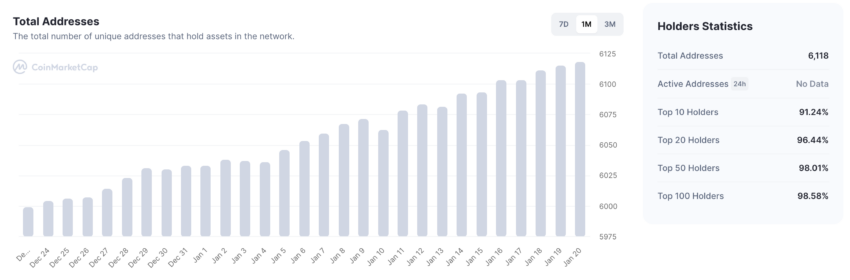

Also, here is how the active address count was in February 2023 for VGX. The number of addresses holding the VGX token increased steadily. The only cause for concern is that the top 100 VGX holders held 98.58% of the circulating supply.

Read below to understand how optimistic the scene was for VGX in February 2023.

As an investor, another VGX metric might just look optimistic. The price volatility is down from the September peaks. And the prices have also started to move up. If VGX remains a mainstream token even after restructuring, we can expect the price and volatility to be inversely correlated.

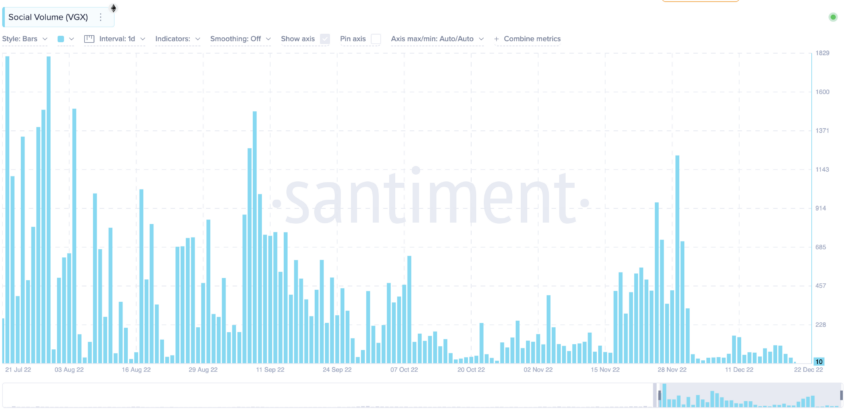

And finally, we have the social volume, signifying the social chatter at VGX’s counter. The chart from December 2022 suggests that the chatter peaked in July 2022 — when Voyager filed for bankruptcy. We saw another peak forming in November 2022.

The social volume is now down, but we expect that to change once Binance US official acquires the assets. It will be interesting to see how the price of VGX reacts following the acquisition.

Interestingly, despite the weak fundamentals, the social volume has been constantly peaking, showing interest in the token.

VGX price prediction and technical analysis

Now we have touched upon some key aspects of the VGX token; it’s time to shift our focus to technical analysis. Here are a few insights to consider:

- The highest price of VGX is $12.54, which it reached in 2018. However, these prices haven’t been realized since the VGX-USDT pair started trading.

- The market cap of Voyager tokens peaked on Feb. 22, 2021, when the value reached $1.5 billion. The trading volume at the market cap peak was $44.25 million. As of Jan. 13, 2023, the market cap was $100.1 million, and the trading volume was $9.07 million.

A quick look at the latest market cap chart shows that even though VGX is hurting, in terms of market cap, the market cap is trying to push past the lows. Even the trading volume levels are improving.

Notice that the turnover ratio, as of February 2023 — trading volume/market cap — is higher at the current levels. This shows lower volatility — something we established earlier.

In December 2023, the volatility for VGX seems to be making another low post the November peak. This could be optimistic for the 2024 VGX price prediction levels.

Voyager (VGX) short-term analysis

Despite the weakening fundamentals, the price action reveals an interesting pattern. Voyager is currently trading inside a triangle or rather a pennant pattern, with the upper trendline being breached with respectable volume. In case VGX breaches the $0.16 and then the $0.21 level, we can expect some upward strength at the counter.

Pattern identification

Notice that the chart shows the price of VGX starting at a high and then making lower highs, illustrating a downtrend. If any future price pattern moves above the previous high, you can expect the price of the Voyager token to defeat the continuing downtrend.

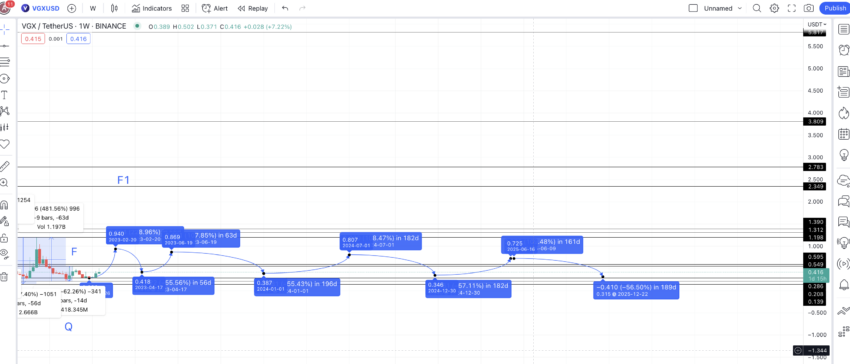

Here is the weekly chart with all the key points market — which would help you calculate the price of Voyager tokens going into the future:

Also, if we see a price level moving higher than the previous high, we can expect it to realize the path from A to F, but in reverse.

Price changes

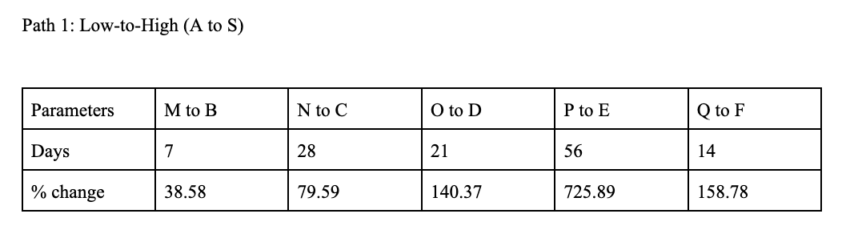

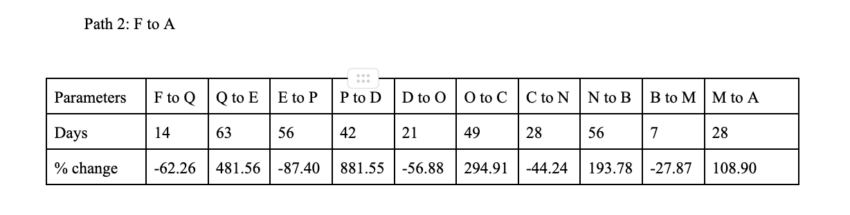

To locate the future price points, we must identify price change percentages from A to S (only the lows to the subsequent highs) and from S to A.

The max distance from the low to the high is 56 days. The average percentage rise could be 228.64% — from the table above.

Hence, from the low at S, the next high could be at $0.940 — using the average values from above. As the pattern breaks here, we can mark this high F1.

It’s now time to trace the second path — F to A — to help locate the next set of lows from F1.

Using the table above, we can easily locate the average low-to-high and the average high-to-low distance and price change percentages.

Calculations

The high-to-low average (column with negative values) comes to be 25 days and 55.73%. Note that the timeframe of the price change isn’t absolute and can change depending on the state of the crypto market.

The low-to-high average comes to be 48 days and 392.14%. We will proceed with the minimum percentage hike of 108.90% in some cases owing to the negative news surrounding Voyager’s business.

Voyager Token (VGX) price prediction 2023

We predicted a generous high, but VGX could only go as high as $0.65 in 2023. Here is what we predicted for VGX.

We already have the F1 or the initial high of 2023 at $0.940. The next drop till Q1 should adhere to the average high-to-low percentage dip of 55.73%. The time can vary depending on the state of the market. If we initially take 56 days (maximum high-to-low distance from the tables), the dip can surface somewhere in April 2023 at $0.418.

The next high could be at the peak of 108.90% — the minimum gain percentage from the table above. This puts the next high at $0.869 — which is lower than the previous 2023 high of F1. This lower low formation at the beginning of the new pattern confirms the weakness in the price action of VGX.

Voyager Token (VGX) price prediction 2024

Outlook: Bearish

The next low, post the second high of 2023, can again go as deep as 55.73%. However, by this time, we expect the market conditions to improve, and hence, the dip might move into 2024. Therefore, we can expect the price of Voyager Token to surface at $0.387 by early 2024.

Provided VGX keeps trading in 2024 with decent trading volume, the next peak can show up by mid-2024 at a high of 108.90%. This level puts the high at $0.807. However, for that, VGX needs to show bullishness and high trading volume levels.

Projected ROI from the current level: 466%

Voyager Token (VGX) price prediction 2025

The next low puts the VGX price prediction low for 2024 at $0.346. However, suppose VGX manages to stay alive, and Voyager attracts some positive user sentiments. In that case, we can expect a 2025 high surface at a price peak of 108.90% — like the earlier instances. This puts 2025 high at $0.725. The VGX price prediction for 2025 low surfaces is at $0.315.

Notice that even our price prediction model puts the price of Voyager Token in decline starting in 2023.

Projected ROI from the current level: 408%

Voyager Token (VGX) price prediction 2030

Outlook: Bullish

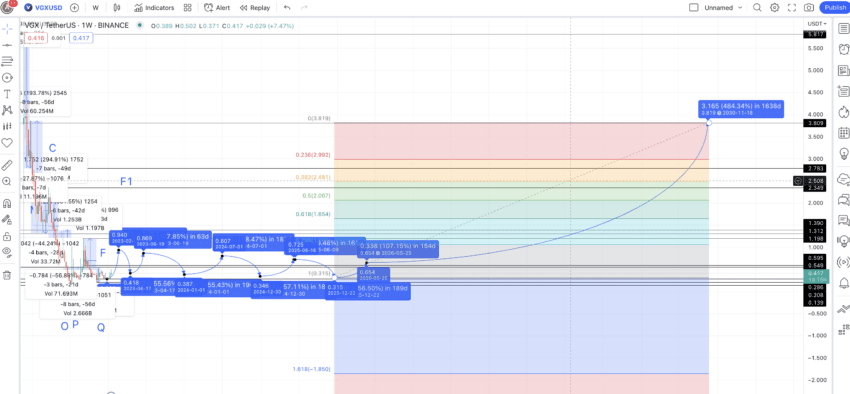

Even with a minimum price rise of almost 109% from the last low, the VGX price prediction for 2026 surfaces at a high of $0.654. However, to project the path till 2030, we can connect these high and low levels using the Fib indicator.

The same growth path provided VGX survives till 2030 puts the VGX price prediction for 2030 high at $3.819. The low, in 2030, can surface at a 38.2% drop — $2.481, to be exact.

Projected ROI from the current level: 2580%

Voyager Token (VGX’s) long-term price prediction until 2035

Outlook: Bearish

If Voyager tokens keep up with historical data and continue to survive even post-2030, here is a table to help you trace the prices each year till 2035. Do note, though, that the prices of Voyager tokens each year might depend on the circulating supply of the tokens, market cap, and even the previous highest price.

You can easily convert your VGX to USD here

| Year | | Maximum price of VGX | | Minimum price of VGX |

| 2023 | $0.645 | $0.0941 |

| 2024 | $0.807 | $0.346 |

| 2025 | $0.725 | $0.315 |

| 2026 | $0.654 | $0.405 |

| 2027 | $0.85 | $0.527 |

| 2028 | $1.27 | $0.990 |

| 2029 | $1.657 | $1.02 |

| 2030 | $3.819 | $2.481 |

| 2031 | $4.001 | $3.12 |

| 2032 | $4.812 | $3.75 |

| 2033 | $4.33 | $3.37 |

| 2034 | $5.41 | $4.22 |

| 2035 | $7.03 | $5.48 |

Note that with the fundamentals in a bad state — Voyager filing for bankruptcy and selling off assets — the future price of VGX is uncertain. Therefore it is advisable to take each level with a pinch of salt.

Is the VGX price prediction model accurate?

This VGX price prediction model considers the historical data and the most updated state of Voyager. Hence, it is accurate based on technical analysis. However, in a space as volatile as crypto, where news and sentiments can push the prices higher or lower, the VGX price prediction piece might not stay relatable for the entire course — say, till 2035. The final prices of Voyager tokens will depend on whether VGX manages to survive through this difficult phase.

Frequently asked questions

What will VGX be worth in 2025?

How high will VGX go?

What is VGX coin used for?

Does VGX have a max supply?

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.