A U.S. bankruptcy court has approved Voyager Digital’s proposed $1 billion sale of its assets to Binance.US., as the exchange undergoes significant withdrawals.

In addition to approving the deal, U.S. Bankruptcy Judge Michael Wiles in New York said Voyager could solicit creditor votes on the sale. The bankrupt crypto lender said it would seek to expedite a U.S. national security review of the deal. The court said the sale would become final pending a future court hearing.

CFIUS concerns

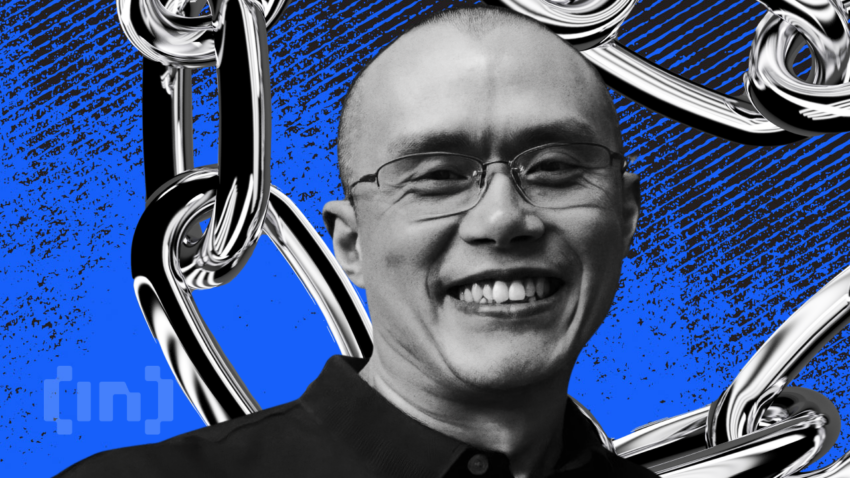

At the court hearing, Voyager attorney Joshua Sussberg responded to concerns from by the U.S. Committee on Foreign Investment in the United States (CFIUS). The interagency body that vets foreign investments into U.S. companies for national security risks has increasingly been targeting China. Although he was born in China, Binance chief executive Changpeng Zhao has been a Canadian citizen for 30 years. Sussberg said Voyager would cooperate in discussing any issues that could lead to CFIUS opposing the transaction.

According to CFIUS, its review “could affect the ability of the parties to complete the transactions, the timing of completion, or relevant terms.” In addition to $20 million cash, Sussberg said the deal would migrate Voyager’s customers to Binance.US’s crypto exchange. This would enable customers to then make withdrawals for the first time since July last year.

If the sale goes through, Voyager estimates that customers could recover some 51% of the value of their deposits. These figures are based on the values at the time of Voyager’s bankruptcy filing. However, a lower payout could occur if CFIUS chooses to allow the transaction since Voyager would be forced to repay customers with the little crypto it retains.

Binance bumps

Following its bankruptcy in July, Voyager had initially sold off its assets to FTX. However, the deal was subsequently aborted, following the exchange’s demise. Consequently, Binance was able to put forward another bid through its American division, which had previously failed due to national security concerns. Voyager then selected Binance.US as “the highest and best bid for its assets.”

Although Binance now seems to be playing a similar role as FTX used to in bolstering the crypto economy, it’s also facing recent difficulties. A recent Forbes report revealed that Binance had lost a substantial percentage of its assets through BNB and BUSD outflows over the last two months. The $12 billion in asset outflows from Binance over the past 60 days represented almost 25% of its assets.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.