On May 12, 2020, Bitcoin will be undergoing the third halving of the block reward to happen in the fairly short history of the asset. As this event has drawn closer, it has bred much speculation inside the cryptocurrency community about what is going to happen in the aftermath. Previous halvings saw short term dips in price which then led to longer-term rallies, each reaching new highs. However, current global economic turmoil, as well as a different topography of the cryptocurrency scene, means there are no guarantees going into this moment. To make sense of what is happening, BeInCrypto has compiled this handy guide as to what the halving is, how it may affect the market, as well as what forces may make this time around a whole different beast.

In This Article:

- The Bitcoin Halving, Explained

- What Have Previous Halvings Looked Like?

- How Is This Time Different?

- What Will Happen After the Halving?

- Final Take

The Bitcoin Halving, Explained

The Bitcoin halving event is a key feature of the way Bitcoin is designed to work as a currency. As you probably know already, Bitcoin is created by miners, basically users with powerful computers who solve complex cryptographic functions in order to verify the network. Whenever a miner successfully creates a block, they are rewarded with newly minted Bitcoin. When Bitcoin was first launched, mysterious creator Satoshi Nakamoto wanted to make sure that Bitcoin had not only a fixed total supply, but also a controlled rate of production, in order to keep the currency from inflation. This means hard coded into the Bitcoin protocol were the following rules:

1. A new block will be created roughly every 10 minutes.

2. Each block will reward its creator with 50 newly created BTC.

3. Every 210,000 blocks (roughly every 4 years) the block reward will be cut in half.

4. This will continue until a total of 21 million Bitcoin have been mined, at which point new blocks will not be rewarded with newly created coins, putting a hard cap on existing supply.

All of this was done so that Bitcoin had built-in scarcity, which should over time drive up value. This is based upon the basic economic principle of supply and demand. The supply of Bitcoin will become increasingly limited over time, as not only is less and less mined but also some coin will be irretrievably lost every year. Hence, the value of Bitcoin in circulation should continue to push prices higher.

What Have Previous Halvings Looked Like?

Understand that there have only previously been two block reward halvings so far in Bitcoin’s history. That doesn’t make for a lot of data to work with, however, we can still see some trends emerging which may well prove to repeat history a third time. First off, let’s look at more or less the whole of Bitcoin’s price history, with the halvings marked in red.

It isn’t hard to see that there is a general trend to the upside, and that larger bull runs do indeed follow not too far behind each event. You can also see how we are on the cusp of the next halving, and how the price is moving in anticipation. That all being said, let’s look at the previous two cycles a little closer.

The first halving to occur on November 29th, 2012, came at a time when Bitcoin was much smaller and less well known. We can see the day of the event marked here by the red vertical line. Notice how in the days and weeks immediately after the halving, there really isn’t much change in the asset’s price. Even as some light upside comes in, it isn’t until about two months later that the market really begins to take off.

That being said, we can see that after this some real growth came into the price of Bitcoin, and we never again saw lows in these ranges.

Moving forward to the following halving four years later, on July 10th 2016, we can see how there was a pronounced pump in the price leading up towards the halving, followed by a notable drop not even a month later. It then takes several months before we see the price get back on its feet, but sure enough once it does, growth continues, and this in fact led us into the 2017 bull run, which saw Bitcoin reach the still-current All Time High (ATH) of about $20,000.

As mentioned, two data points really aren’t enough, but the philosophy behind the halving dictates that price should rise in its wake, and we have in fact seen this for both previous events. Note however the price doesn’t necessarily rise immediately after the day in question, and furthermore larger markets will invariably move slower than smaller ones, and Bitcoin is certainly a bigger market than in either previous halving event. However, that isn’t the only thing different this time around, and not all of them are so optimistic.

How Is This Time Different?

We’ll start with what might be the most obvious issue this time around: The previous two halvings didn’t occur during a global pandemic and financial crisis. Bitcoin and the greater market took a massive hit just months before this halving, and seeing as the world economy is very much still in turmoil, it is hard to imagine that Bitcoin will be spared further downside as much of the world still sees it as a speculative asset. Institutions traditionally flock to safe havens, like gold, when fear enters the market, and Bitcoin has yet to prove itself as a store of value in many of their eyes. This could stand to be compounded by the fact that due to the ongoing health crisis, millions worldwide are out of work. Even if some governments are stepping in with stimulus packages, it is unlikely that a lot of retail investors will be lining up to spend their money on digital asset investing.

Of course, there is another way to look at it. If economies are failing and governments begin printing infinite money, then it could cause fiat currencies to experience rapid inflation in the coming years. This could lead to more citizens turning to Bitcoin as a means of locking in and even growing the value of their money. It’s worth noting that since the massive selloff in March, Bitcoin actually has rebounded impressively, and at the time of this writing has pretty much recovered all of the losses it incurred in the greater market bloodbath. This isn’t to say that there couldn’t be another dip either before or after the halving, but it is clear the market is not in the exact same place it was four years ago.

It could also be mentioned that there were some significant market fluctuations leading up to the previous halvings, though not as dramatic.

The first halving saw a drop of about 56%, similar to our recent one, though it was about 100 days prior to the event and after notable growth.

The second halving had a notable fluctuation just about 23 days before the happening, with a 30% drop occurring after a rather impressive rally of almost 80%. In light of both of these, the recent drop seems not too outside of historical action. It’s true the previous volatility was not caused by the same extreme economic conditions we are in now, but in many ways that just makes Bitcoin’s retracement heading into the halving more optimistic.

It has also been noted that the Relative Strength Index (RSI) on the weekly time frame has never been this low going into a halving. While there is still time before the big day, the previous iterations definitely were closer to oversold territory. This could be seen as an optimistic sign as well, as it means there is more room in the market for upside, and depending on how the coming days play out this may help protect from a dip immediately following the halving as we saw lat time. None of this is a guarantee of course.

What will Happen After the Halving?

For one, obviously, nobody knows for sure. Many, many things could happen because there are so many variables this time around. However, there are a few predominant theories floating around, which are worth looking into here.

The Halving is Already Priced In, Meaning Price Dips or Moves Sideways

This is a question that sees endless debate on social media. Based on the fact that the halving is a predictable event, and all players in the market are theoretically aware of it, some put forth the idea that not much will happen when the block reward halves. There could even be a bit of a dip in the days after because of a “sell the news” mentality. To be fair, this would be fairly consistent with what we saw in the immediate wake of the previous halvings. Some of course worry that it is exactly this pattern, matched with a much harsher global economic environment, that could lead to a worse version of this playing out, at least over the next few months.

The Halving Will Cause Miner Capitulation, Hurting the Price

The idea here is simply that when the block reward halves, less efficient miners will have to stop operating because they will no longer be making a profit. Miners often only have small margins for profits to begin with, so this could mean quite a few ASICs turning off after May 12. This effect has already been seen in the recent Bitcoin Cash halving which happened on April 8th. After the event, we see a significant drop in the average hashrate on the network, just as is expected with Bitcoin.

The concern is that some miners may also begin selling off stores of Bitcoin in order to stay afloat, which could also drive the price lower, which would then cause more miners to shut down, etc. Obviously this won’t actually lead to a runaway crash situation, but nonetheless could trigger a temporary sell-off.

The Stock to Flow Model Will Hold, and the Price Will Rise

For those who aren’t aware, the Stock to Flow (S2F) model basically says that assets with a high ratio between existing supply (stock) and yearly production (flow) are generally among the highest priced and best stores of value. The whole philosophy has been very well laid out by popular cryptocurrency market analyst PlanB, and the following chart is often referenced showing how with each halving, the S2F ratio for Bitcoin gets higher, inevitably bringing it up into line with assets like gold and silver.

The chart may look confusing at first, but mainly note how the price of Bitcoin (the multicoloured data points) follow the S2F ratio (the purple line) as it spikes after each halving. It takes time, and in fact, last time around it took months before the market saw real traction, but it still happened.

Final Take

These theories range from fairly optimistic to fairly pessimistic, but in many ways each of them is realistic. By that, we mean that elements of all three could play out, but none of them is a guarantee on their own. For one, while awareness of the halving event is likely priced in, the actual shift in market pressure isn’t. It really can’t be until miners are actually earning less for each block. True, this won’t come as a surprise for miners when it happens, but the actual amount of Bitcoin available hasn’t changed yet, so neither has the supply/demand ratio, so the market can only shift so far in anticipation of this event.

Next, it is true that there will inevitably be some form of miner capitulation happening after May 12th, but this is not really a problem for Bitcoin as a whole. For one, hashrate changes are always met with difficulty adjustments, and though this takes some time, it should simply result in a rebalancing of the network. As Andreas Antonopolous recently pointed out in an interview with BeInCrypto:

If 50% of the mining capacity turned off tomorrow morning, we’d be back to where we were in 2018 in terms of hashrate.

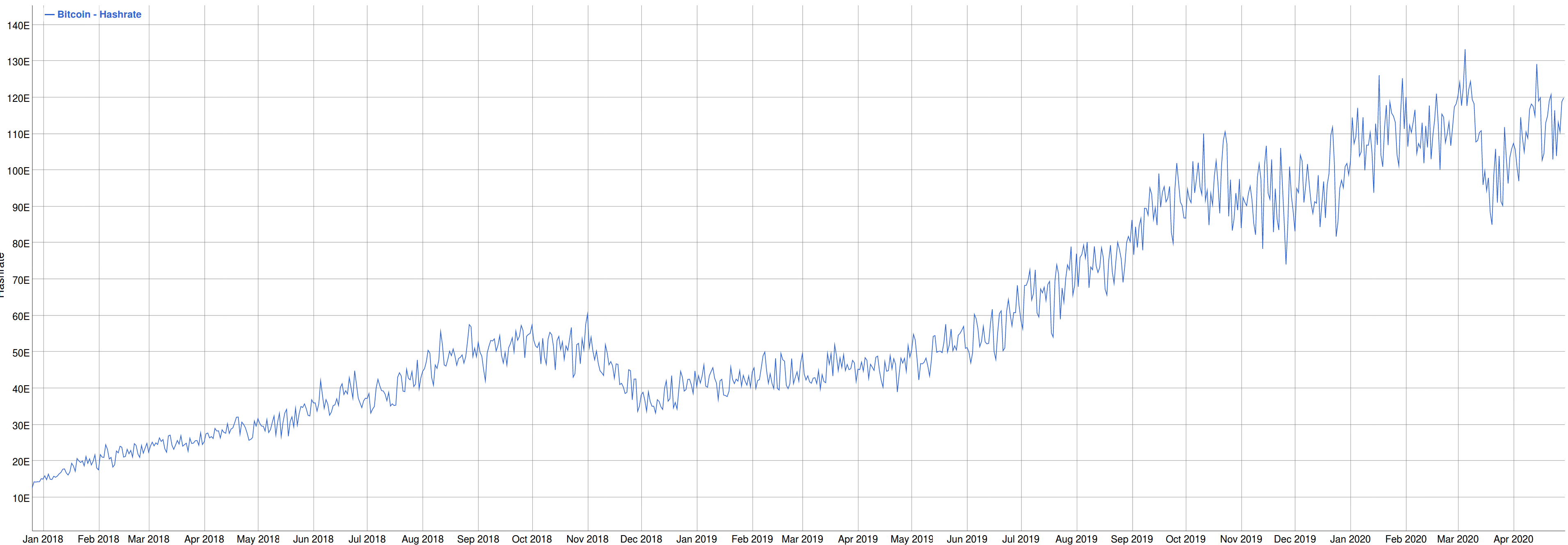

Also keep in mind that hashrate does not drive price action, though obviously they are connected. Just look at how the Bitcoin hashrate has exploded since the beginning of 2018, when prices were near all-time highs.

Even without showing the Bitcoin chart for the same time period, we all know that it in no way resembles this type of growth.

As for the S2F model, while it is certainly not a proven roadmap, its projections are rooted in sound economic principles tied to the factors we just outlined above. Assuming the nature of Bitcoin and how it is created does not change significantly, then there is a lot of reason to believe in this forecast.

However, to bring us back down to earth, the harsh truth is that all of the technical and fundamental analysis in the world will break down under extreme economic conditions, the type that the world seems to be only beginning to feel. If Bitcoin can move into this crisis to fulfil the financial promise it was created for, then this upcoming halving event may be just the catalyst to prove just how strong of an asset cryptocurrency can truly be. However, the pressure of this current environment could also perhaps do just the opposite and erode away the upside that we normally would have seen after a halving, leading to an overall underwhelming coming few years that could hurt Bitcoin’s image globally. There is truly no way to know yet, but now you should be pretty well versed on the factors and theories that are going into the 2020 halving, which stands to be truly historical for Bitcoin almost no matter what happens.