Cardano is one of the most prominent Ethereum rivals, with a tech stack quickly receiving favorable reviews. With the arrival of SundaeSwap, a DEX built for the Cardano blockchain, there is further reason to be optimistic.

You can’t have a widely used ecosystem without a reliable DEX to facilitate easy swaps. SundaeSwap is just such a DEX, one that has a unique design and aims to position itself at the heart of the Cardano ecosystem. We take a look at SundaeSwap, its features, history, and issues it is addressing, among other things.

In this guide:

What is SundaeSwap?

SundaeSwap is a decentralized trading protocol that will run natively on Cardano (ADA). The DEX is the first of its kind on the Cardano blockchain.

For those unaware, Cardano is a next-generation blockchain that runs on technology that differs from Ethereum and its smart contracts. The network has long been a mainstay of the market, but its steady and methodical approach to development has only just resulted in several major updates.

Those updates include the introduction of smart contracts. As such, a native, scalable decentralized exchange, SundaeSwap has a perfect place for it in the ecosystem.

Built on a next-generation blockchain, SundaeSwap has some unique design elements to address. But in a nutshell, SundaeSwap is an automated market maker that, in its early form, will serve as something like Uniswap for the Cardano blockchain.

An introduction to SundaeSwap

SundaeSwap began its development in 2021 and has been gaining steam since. While it initially met with enthusiasm from the Cardano community, it has only recently begun to gain the attention of those outside that group. The team appears to be following the same development philosophy as Cardano itself, namely that it is taking a measured and methodical approach.

SundaeSwap was founded by Mateen Motavaf and Artem Wright, who respectively serve as the Chief Executive Officer and Chief Operating Officer. Currently, the team is composed of ten individuals who have several years of experience in fintech and high-tech startups.

The whitepaper for SundaeSwap was published on Jun. 1, 2021, which went over the fundamentals of the protocol. One of the more novel ideas of the project is its Initial Stake Pool Offering (ISO), which will determine how the SUNDAE token is distributed to its participants. The ISO has been delayed but is expected to take place in the coming weeks.

In the six or so months since the publishing of the whitepaper, the team has released numerous updates, but the project remains in its early stages. Currently, the focus lies on releasing version 1 of its product, which the team feels will be a good bedrock for future upgrades.

SundaeSwap has received funding from some of the industry’s most notable venture firms, including Alameda Research, cFund, and Double Peak. It has also partnered with MLabs and Runtime Verification to facilitate a robust integrated ecosystem.

What makes SundaeSwap stand out?

A glance at the whitepaper will tell you that Uniswap’s design inspires SundaeSwap. But it has to adapt that model to the Cardano network, which has some peculiarities as compared to Ethereum. One of these unique features of SundaeSwap is the Constant Product Pool, which makes swapping more efficient.

But what really makes SundaeSwap stand out is how it is adapting traditional AMM models to the Cardano blockchain, which has a different accounting model and virtual machine. The team is well aware that the solutions they propose are nascent in nature and that there is room for improvement.

As such, they treat this first implementation as a preliminary one, with future improvements and upgrades being key to the growth of the DEX. This is true for the Cardano blockchain as a whole, which has slowly but surely been refining and adding new features to its network.

How does SundaeSwap work?

As previously mentioned, SundaeSwap is essentially Uniswap for Cardano in its current form. As an automated market maker, it has liquidity pools in which liquidity providers allocate two assets. These liquidity providers receive LP tokens for their contribution of liquidity.

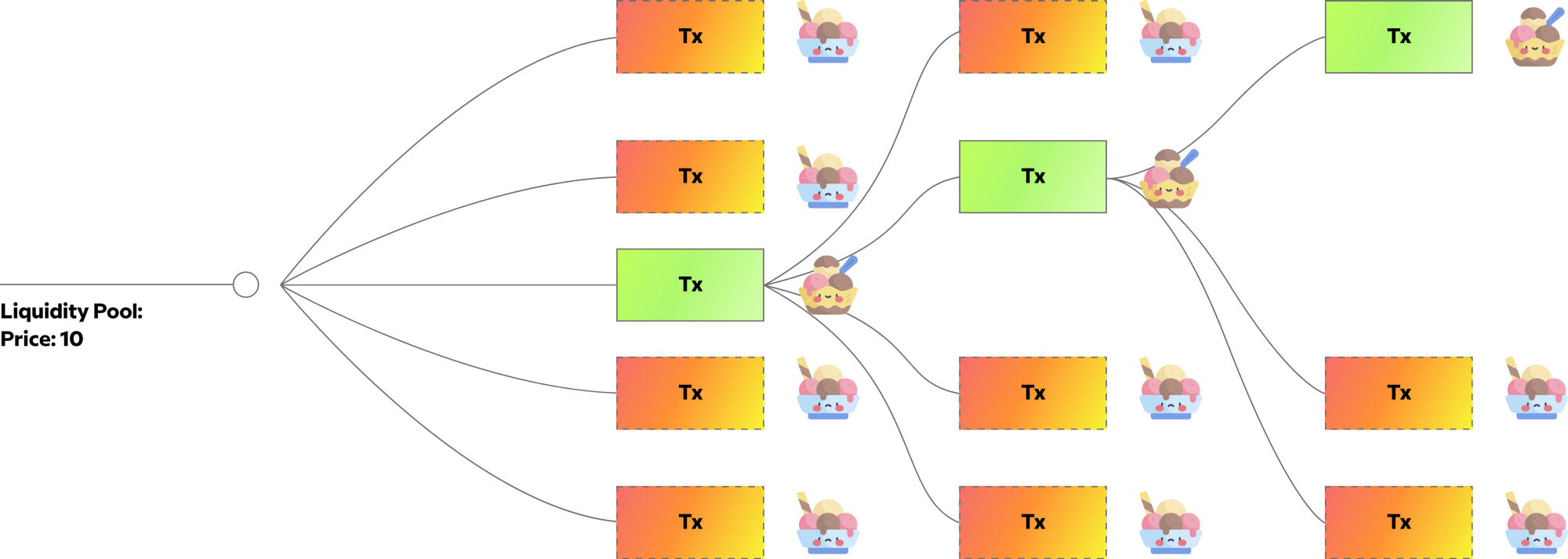

Where SundaeSwap differs is its use of a “Constant Product Pool” model, which increases the efficiency of trading. It is worth noting that — because Cardano works on the Extended Unspent Transaction Outputs (eUTXOs) model as opposed to UTXO model — there are some challenges that arise with implementing AMMs.

To facilitate swaps, SundaeSwap uses a “SundaeSwap Pool Factory” token that, in conjunction with a minting policy, ensures that asset pairs are unique. This reduces the dilution of liquidity and poor slippage.

However, concerning the matter of the concurrency issue surrounding the eUTXO model, the team clarified the matter, providing three potential solutions. The first is to create a DEX without a single liquidity pool, the second is to use an order book model, and the last the use of a hybrid model for the exchange.

However, SundaeSwap says that they have a different solution that will address this scaling problem in the future. They haven’t yet revealed a great deal of details on this, but say that it will arrive imminently.

But besides this particular accounting model quirk that comes with using the Cardano blockchain, SundaeSwap works roughly the same as Uniswap — at least in the initial version. Future upgrades may result in a very different DEX.

SUNDAE and the tokenomics

The SUNDAE token is SundaeSwap’s DEX token, which will have a total supply of 2 billion minted once the DEX launches. The distribution of these tokens will happen over time, with the public receiving 55%, the team 25%, investors 13%, recruitment efforts 5%, and advisors 2%.

5% of the supply will be allocated towards the SundaeSwap’s Initial Stake Pool Offering (ISO), with 1% distributed over five epochs.

How to participate in the SundaeSwap ISO

SundaeSwap’s Initial Stake Pool Offering (ISO) experienced a delay before. The team last announced in Jul. 2021 that it would take place after the Alonzo hard fork on the Cardano mainnet.

However, they did release details about the ISO itself. The chief takeaways from the announcement was concerned with the distribution of assets. You will need the Yoroi or Daedalus wallet to participate in the ISO.

As mentioned before, there will be five epochs, with 1% of the total supply dedicated for each epoch. Each epoch itself lasts five days. The ISO has a shorter duration because the team wants to support the long-term success of the DEX.

The ISO involves stake pools, which makes for a fairer distribution of rewards among delegators. On this subject, the team is also keen on making the ISO as democratic as possible, and to that end, SundaeSwap will implement diminishing rewards to reduce opportunities for whales to claim most of the rewards.

To participate, all users will have to do is use either the Daedalus or Yoroi wallet to stake ADA to the SundaeSwap stake pool. Contributions will receive SUNDAE proportional to how much they have staked.

Simply search for the SundaeSwap stake pool, like any other Cardano stake pool. The airdrop of the SUNDAE token should happen after the first three epochs. You will receive SUNDAE automatically via smart contracts if you have staked in the pool.

Roadmap

The DEX hasn’t been launched yet, with the website saying that the app will be coming soon. But it is expected to launch within the coming weeks, with the ISO to go with it.

The team does post frequent updates on development progress, with the most recent update covering wallet integration. Other updates that have taken place recently include integrating directly via the Ogmios protocol to power stats rollups and tests related to governance.

The team acknowledges that there will be some challenging developmental tasks in the future, but they also believe that the hardest parts of development have been overcome. This puts it in a good position for launch and the weeks that follow.

Specifically, these future updates include a more robust role for the SUNDAE token and scalability improvements. Additional future work focuses on increasing throughput, providing concentrated liquidity and secondary derivative markets, and improvements to decentralization.

SundaeSwap: Cardano’s Uniswap?

SundaeSwap holds a great deal of potential in nurturing the growth of the Cardano ecosystem. Like how Uniswap became critical to the growth of the DeFi space, so too can SundaeSwap serve a role for Cardano.

There will be challenges and a lot of development work, but the team appears confident and determined. And if it does take even a fraction of the position that Uniswap has for Ethereum, it could prove to be the catalyst for the growth of Cardano.

Frequently asked questions

What is SundaeSwap on Cardano?

When can we buy SundaeSwap tokens?

How do you get the SundaeSwap token?

What is a DEX token?

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.