While mining was once the dominating way to earn rewards on a blockchain network, staking has certainly replaced it. Projects like Ethereum are moving to staking via upgrades, while others launch staking support from the get-go. One such project gaining traction is polkadot (DOT).

In this guide, we’re going to walk through what the protocol is and then teach you how to stake polkadot.

The basics of polkadot (DOT)

Polkadot launched in 2020 with the aim of establishing a platform of blockchain networks similar to Ethereum. The project operates via a mainchain (relay chain) and a set of parallel chains or parachains.

Parachains are developer-built networks existing on top of the Polygon protocol. Parachains each have their own rules and policies, essentially acting as their own decentralized application (DApp), if you will.

Polkadot runs on a Proof-of-Stake (PoS) consensus method, meaning users must stake, or lock-in, their assets to participate. In staking their assets, users increase the security of the network, for which they receive interest as an incentive to continue staking.

The parachains process and manage the transactions, which are then sent to the relay chain for permanent validation. This two-step process means the relay chain is less congested, ensuring Polkadot can scale to hundreds, if not thousands, of transactions per second.

Where Polkadot’s PoS system differs from others, however, is in its validator and nominator categories. Validators work similar to other PoS networks, in that they simply validate blocks full of transactions. However, other projects randomly nominate a validator based on their stake.

On Polkadot, nominators vote on who can validate blocks. The validator path is the easiest way to stake polkadot, requiring the least amount of steps compared to staking, but both provide you with interest on your investment.

At press time, Polkadot comes in tenth in the list of projects with the highest market cap. The asset launched in August 2020 with a price range of anywhere from $4–6 dollars. However, the project quickly picked up steam as the new year started, seeing a massive price increase to the $30–$40 dollar range. Despite a significant drop in the summer of 2021, polkadot remains in the mid-20’s and lower 30’s in terms of price.

What to note before staking polkadot

While staking polkadot sounds like a great way to earn some passive income, it’s not the easiest process to get going. There are a few steps to consider before participating in the network.

Nomination period

Every four hours, nominators vote on whom they’d like to be a validator. At the four-hour mark, new users can propose their intentions by staking more DOT than others. If you only stake a little bit of DOT, don’t expect to become a validator right away.

Slashing

If a staker acts with bad intent, the protocol diminishes their holdings — the term of which is slashing. For example, if the bad actor attempts to validate an altered transaction or if they remain offline for a good while. Should any bad behavior be the case, a staker will lose a percentage of their held assets.

Inflation

Finally, understand that polkadot is an inflationary currency like the U.S. dollar. There is no limit to the number of DOT in existence, and the amount in circulation will consistently rise for as long as the project exists. Some users may not mind this inflation as much, but others may be put off from the network forever due to the design decision.

Pros of staking polkadot

1. Earning a passive income

As with staking in any blockchain-based project, users earn rewards for their staking efforts. By simply holding assets in a wallet and remaining connected to the network, you can earn a passive income.

2. Participating in a greater community

Validators and nominators work hard to ensure the Polkadot network is a safe and secure place to transact. By becoming a staker, you get to join that community and contribute to the overall effort, with rewards for doing so.

3. It’s not hard to start

While there are various ways to start staking DOT — some more complex than others — it’s easy to start by signing up for an exchange and buying some DOT! From there, you can make the process as easy or difficult as you’d like.

Cons of staking polkadot

1. Funds are locked away

When staking, your funds are locked into the Polkadot network. While you can technically pull them out whenever you need, doing so means forfeiting your interest rates and starting over from 0.

2. The pressure is on

If you stake polkadot, you’re also signaling to the network that you’d like to participate. If you don’t remain connected and staked to the network, you may face slashing and lose your earnings. Participating isn’t a massive ask by any means, but it does require some dedication and effort.

Also, if a validator you voted on acts poorly, you can also be subject to slashing. It’s worth taking the time to study potential validators before nominating to prevent losing money.

How to stake polkadot

Now that you’re aware of the pros and cons of staking DOT, let’s talk about how to do so in the first place.

1. On-chain: becoming a masternode

As mentioned above, there are various ways to begin staking DOT. The first method we’ll detail is becoming a masternode.

Masternodes are for hardcore DOT supporters only. Setting one up is quite difficult, requiring you to have a dedicated machine connected to the network 24/7. That connected machine must also be a powerful one, meaning you’ll have to invest in good hardware to start.

The Polkadot wiki includes a guide for setting up a masternode, but it stresses that the process is for dedicated users only. Becoming a masternode requires downloading specific software and learning to operate one via binary commands.

2. Using an exchange

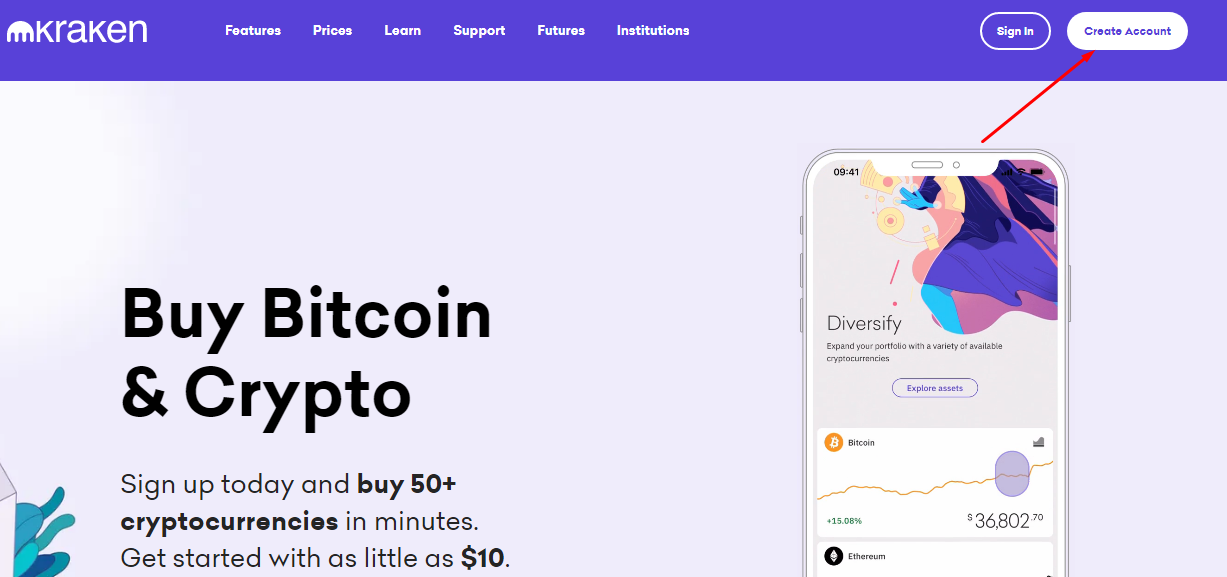

Using an exchange is probably the easiest way to stake DOT. We’ll use Kraken for this guide specifically.

Step 1: Sign up for Kraken by heading to the Kraken website and clicking Create Account.

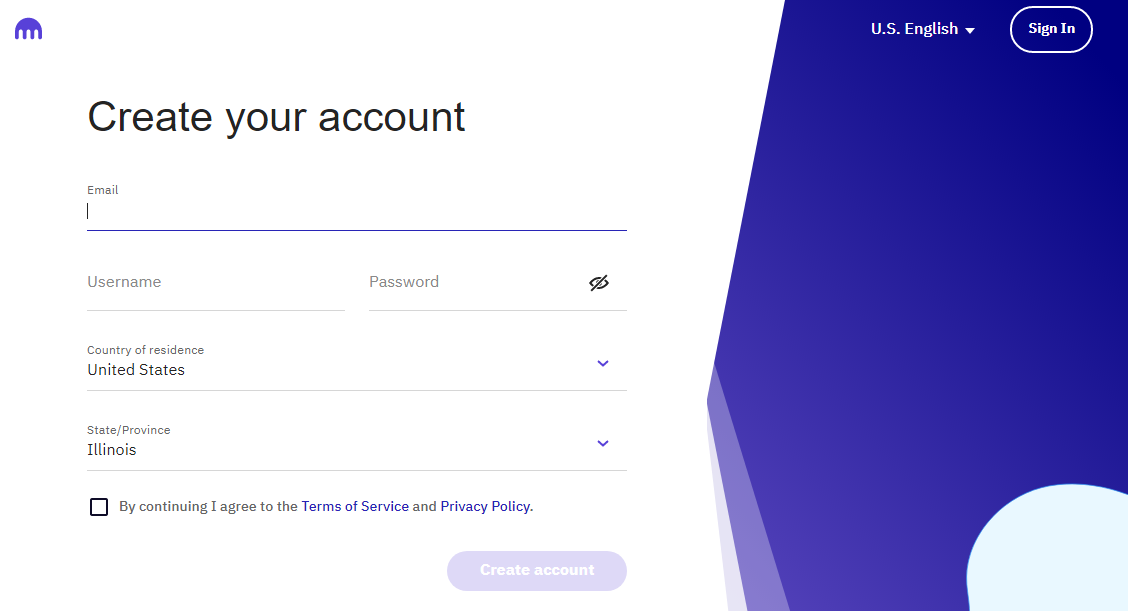

Step 2: Fill out your account information and click Create Account.

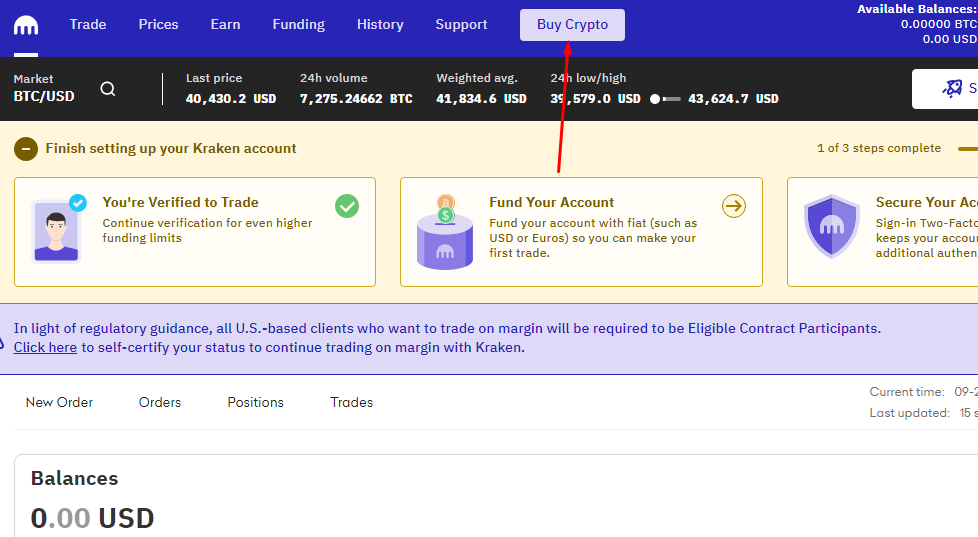

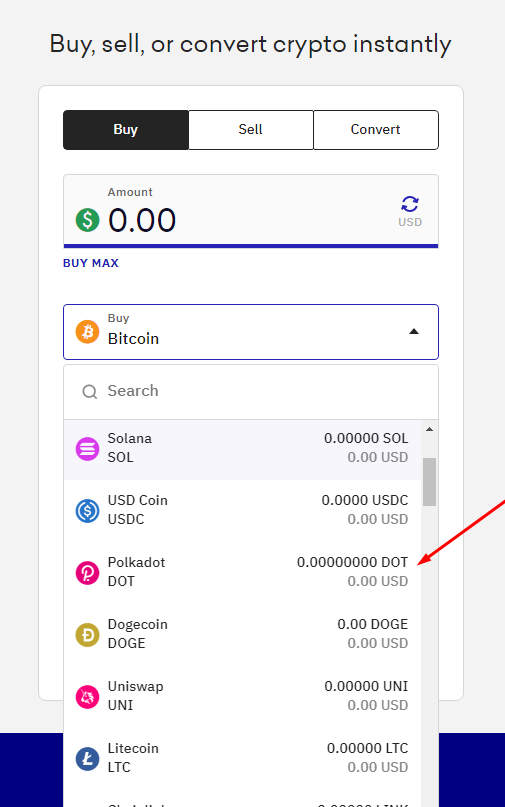

Step 3: Once logged in, select Buy Crypto.

Step 4: Make sure you’re in the Buy section, and select Polkadot from the dropdown menu.

Step 5: From there, fill out your bank information, and you’re officially an owner of the polkadot cryptocurrency.

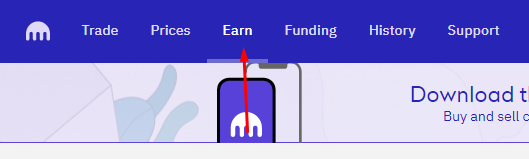

Step 6: Now, select the Earn tab on top of the exchange.

Step 7: You’ll be taken to a list of stake-able assets. Select Stake on the top right of the page.

Step 8: Select Polkadot in the preceding drop-down box, enter the amount you’d like to stake, and select Stake.

Now you’ve learned how to stake polkadot on Kraken! Understand that there are a few pros and cons to using this exchange, however.

Utilizing an exchange to stake might be easier than setting up a node, but it also comes at a cost. Your exchange of choice will take a percentage of all staking rewards you earn, meaning you’re earning a little less than you would otherwise. Each exchange has different rates, so be sure to check rates before picking one for good.

3. Utilizing a polkadot wallet

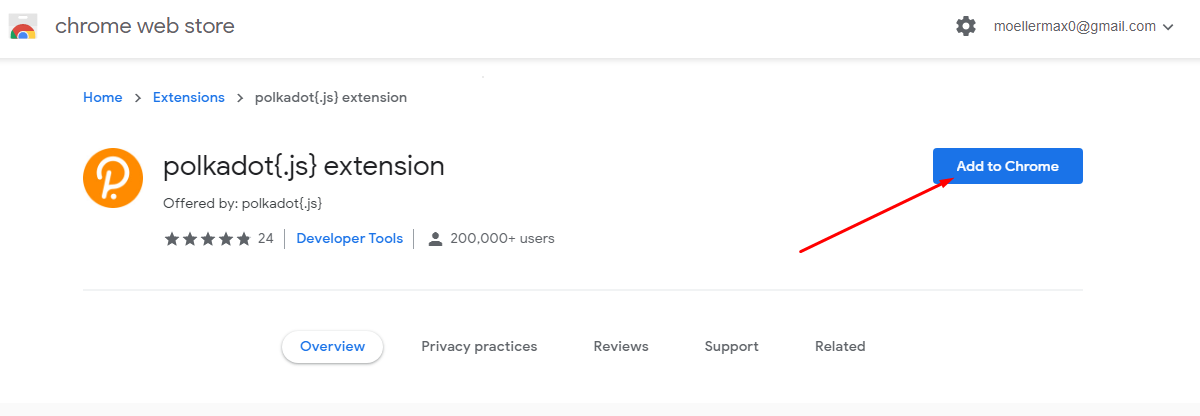

While using a polkadot wallet is a little more complex than using an exchange, it can be much more rewarding. With this guide, we’ll walk you through setting up staking with polkadot’s official browser extension, Polkadot{.js}.

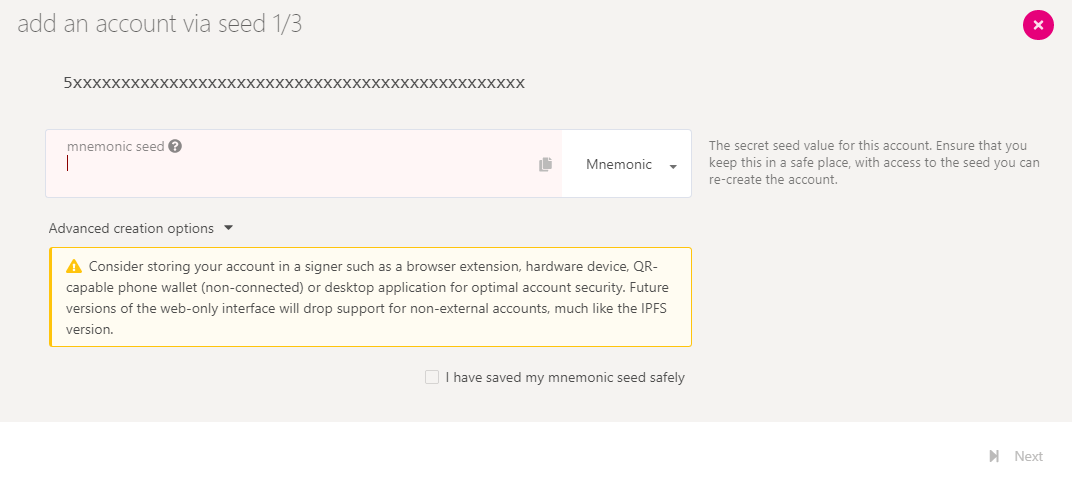

Head to this link to install the browser extension. From there, open the extension and click Create Account. The extension will create a seed phrase for you, which you should write down as a backup in case you lose your wallet. Once done, you’ll create a password for your Polkadot account, as well as a name for it.

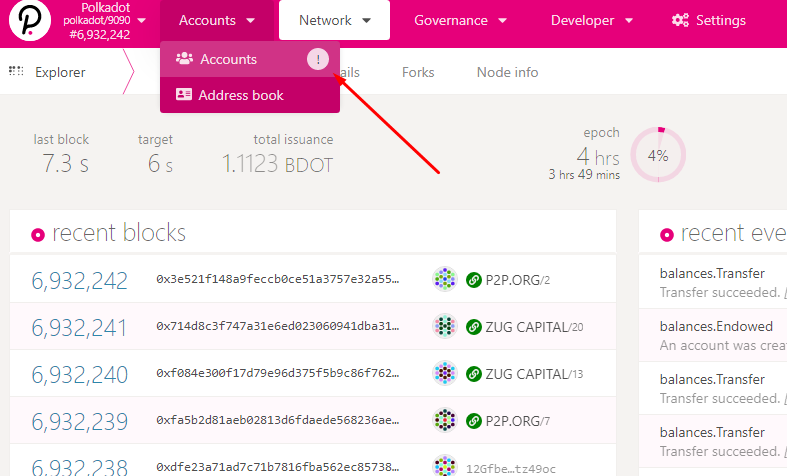

Next, select the options tab under the Accounts menu, and click the Display Address Format For dropdown box. Click on Polkadot Relay Chain to select Polkadot. Then, make sure your wallet is funded with DOT before continuing. Now it’s time to head to the web browser.

Go to this link and select Accounts on the top left.

Click on Add Account and enter your seed phrase from the Polkadot{.js} web extension you made earlier.

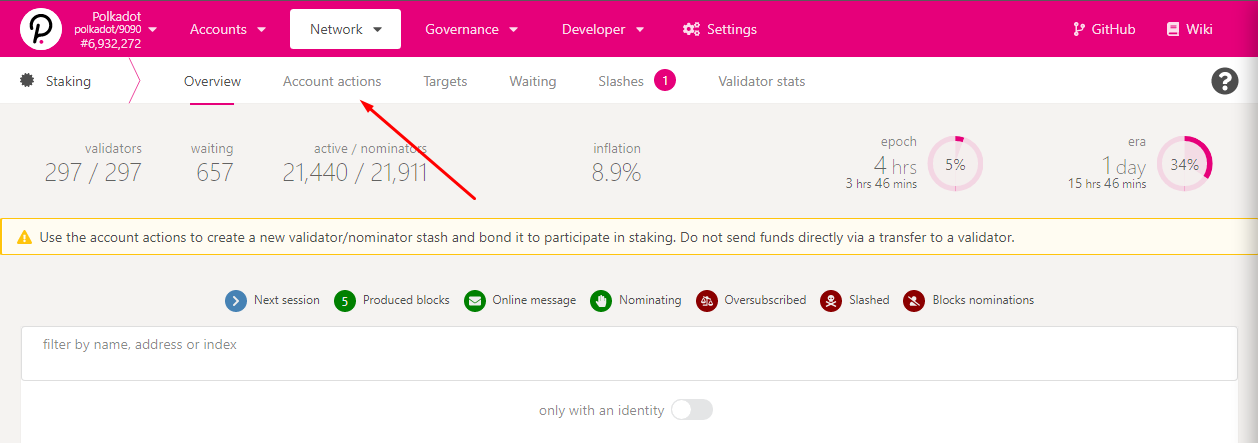

Once done, click on Network, navigate to Staking, and select Account Actions from there.

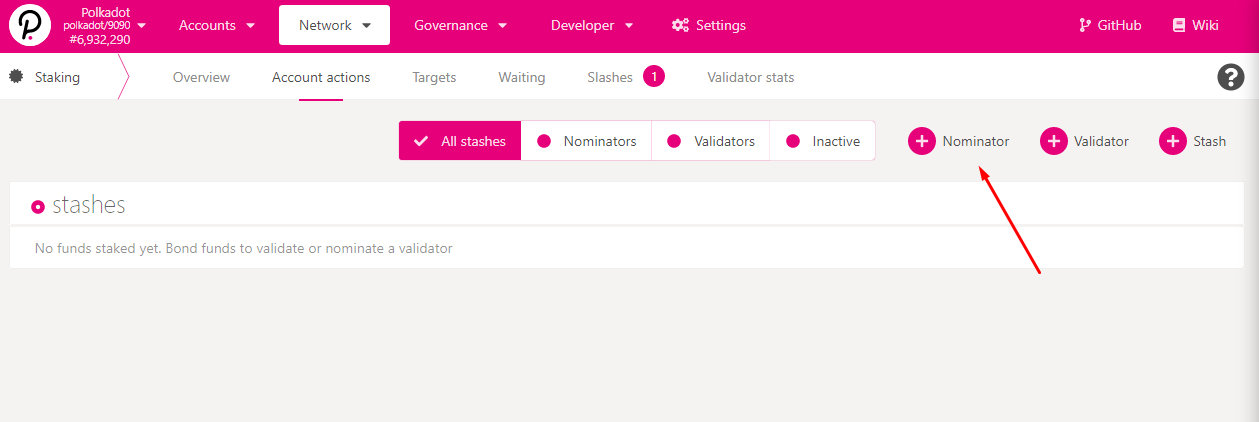

In the Account Actions page, click on the Nominator button. Here, you can type in the amount of DOT you’d like to bond to your account, as well as choose a payment destination for your rewards.

Once your assets are bonded, you’ll be taken to a list of validators. Vote on 16 of those, confirm the transactions via a pop-up, and your assets are officially staked!

Is polkadot worth staking?

Whether or not you should stake polkadot is entirely up to you. Know that you’ll have to reach a minimum threshold of staked DOT to earn rewards, which is usually around 40 DOT. If you can afford that much DOT and are willing to stake it and participate in the network, then it’s likely the asset is worth your staking.

What are the risks in staking polkadot?

As mentioned earlier, it’s possible to nominate a bad actor as a validator. If this happens, your staking rewards and holdings are slashed as punishment. To avoid this, be careful with the validators you choose to nominate.

Polkadot is brimming with potential

Staking on Polkadot can not only be lucrative, but it is also an excellent way to contribute to a pioneering project. Fortunately, there are multiple ways to stake, giving a wide net of users the chance to secure the network and earn from it. Should Polkadot meet its high aspirations, the staking process could result in some appreciable earnings.