Render is a GPU rendering solution built atop Ethereum. With the Render Network, users can rent GPU capabilities on demand. Simply put, Render Network introduces the concept of blockchain in 3D rendering. Yet the question is, will the innovative use case be good enough to push RNDR prices higher? This Render Token price prediction explores all future possibilities in detail.

KEY TAKEAWAYS

‣Render Token (RNDR) prices are projected to grow significantly by 2035, with highs potentially reaching $1,357.15, assuming successful roadmap execution and increasing use cases.

‣RNDR operates on the Ethereum blockchain, providing decentralized GPU rendering for applications in gaming, 3D modeling, and more.

‣The price of RNDR is influenced by market adoption, the Render Token roadmap, and on-chain metrics like token holding patterns.

- Render Token (RNDR) long-term price prediction until 2035

- Render Token price prediction and technical analysis

- Render Token (RNDR) price prediction 2024 (concluded)

- Render Token (RNDR) price prediction 2025

- Render Token (RNDR) price prediction 2030

- How does Render work? The role of fundamentals

- What is the future of Render?

- Frequently asked questions

Render Token (RNDR) long-term price prediction until 2035

Here is a quick RNDR price prediction table, all the way up to 2035.

| Year | Maximum price of RNDR($) | Adjusted minimum price of RNDR($) |

| 2025 | 62.80 | 10.72 |

| 2026 | 90.78 | 22.50 |

| 2027 | 330.45 | 53.84 |

| 2028 | 458.79 | 74.75 |

| 2029 | 587.12 | 95.66 |

| 2030 | 754.40 | 122.91 |

| 2031 | 843.80 | 137.47 |

| 2032 | 972.14 | 158.38 |

| 2033 | 1100.47 | 179.29 |

| 2034 | 1228.81 | 200.20 |

| 2035 | 1357.15 | 221.11 |

Do note that the successful completion of the Render Token roadmap, an increase in the number of Render Token use cases, and other factors can also amplify these price projections.

Render Token price prediction and technical analysis

Now we can move to the technical analysis. This approach can help us predict the price of RNDR in the days, weeks, months, and years to come.

Long-term analysis and calculations

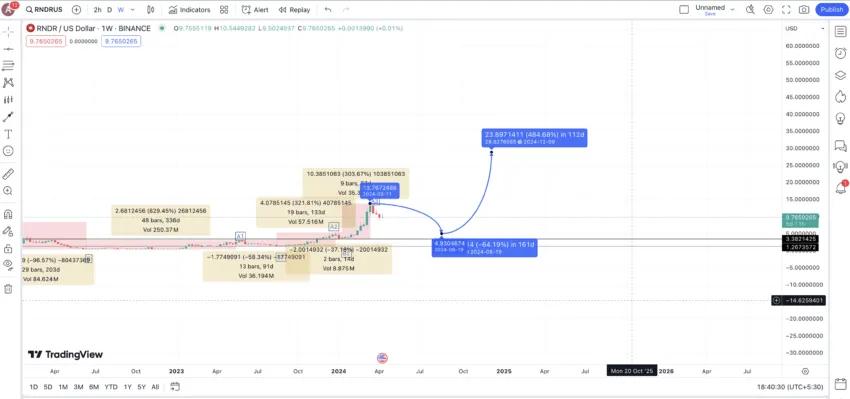

To analyze the long-term price of RNDR, we can now pull up the weekly chart and try to locate patterns. At first glance, it looks like a continuation pattern, with the prices surging after periods of profit booking.

We took one step forward and plotted the possible points to help us analyze future prices with historical inputs. Let us now find the price differences and timeframes between these points. That can help us locate the average price moves of RNDR.

| A to B | -96.57% in 203 days |

| B to A1 | 829.45% in 336 days |

| A1 to B1 | -58.34% in 91 days |

| B1 to A2 | 321.81% in 133 days |

| A2 to B2 | -37.18% in 14 days |

| B2 to A3 | 303.67% in 63 days |

Using the values from Table 1, we can locate the average price hike and average price drop percentage for RNDR. The values come out to be approximately 485% in 177 days and -64.03% in 103 days. We shall use these data points to chart the future price of RNDR until the year 2035.

Render Token (RNDR) price prediction 2024 (concluded)

Now that we have the last high as A3, a 64.03% correction in 103 days was imminent. Therefore, in 2024, we expected the price of RNDR to go as low as $4.90. As of December 2024, it is trading close to $7, in line with our expectations.

Render Token (RNDR) price prediction 2025

Outlook: Bullish

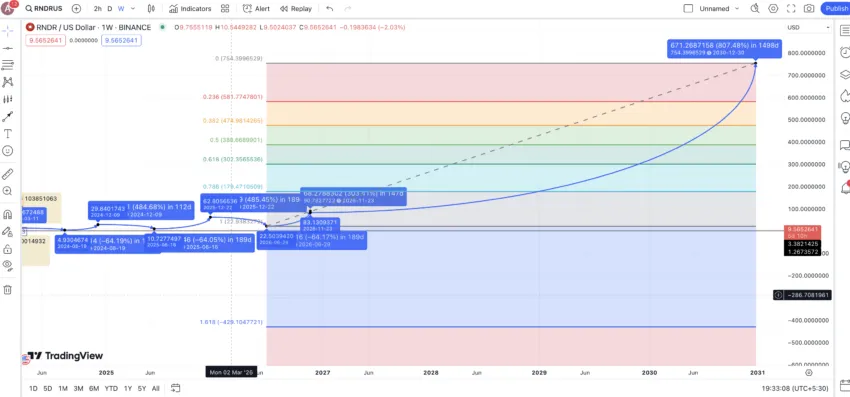

According to the available data points, once the 2024 high is in, say, at $28.80, we can again expect RDNR to correct by 64.03%. This puts the expected minimum price of RNDR for 2025 at $10.72. Do note that timelines can vary depending on the state of RNDR tokenomics, how strictly the Render Token roadmap is being followed, the popularity of GPU mining and distributed computing, and other factors.

From the lowest Render Token price prediction value for 2025, we can expect an average price hike of 485% to hold. This would put the RNDR price forecast at $62.80 by the end of 2025.

Projected ROI from the current level: 540%

Render Token (RNDR) price prediction 2030

Outlook: Very bullish

Once the price of RNDR hits the expected high of $62.80 by the end of 2025, in 2026, we can again expect it to drop by 64.03%, based on our “average price” calculations. This puts the minimum Render Token price prediction for 2026 at $22.50.

However, after this RNDR price forecast, the token might not surge by 485% as the bears are expected to come in with pending profit-booking bills. Therefore, the more conservative price surge for RNDR in 2026 could be 303.67%, according to Table 1.

This puts the 2026 RNDR price forecast high at $90.78.

Now, if you extrapolate these findings using the 2026 low and the 2026 high, we can chart the future price of RNDR until 2030. This puts the 2030 high at $754.40.

Projected ROI from the current level: 7598%

How does Render work? The role of fundamentals

Render Network is an Ethereum-based project. That means RNDR, the native token, is ERC-20 compatible and can be stored in compatible wallets like MetaMask and more. Another crucial fundamental element associated with RNDR is the token-holding pattern. Render analytics reveal that both holders and traders have been increasing their positions over the past year, instilling confidence regarding the future price of RNDR.

Did you know? RNDR token has a pretty specific utility as it is given to users who contribute idle GPU power to the ecosystem. Each contributor is known as a Render node.

Render’s cloud-specific GPU-related abilities are useful for powering online gaming ecosystems, metaverses, and more. Therefore, the fundamental utility of Render is related to gaming, play-to-earn ecosystems, 3D modeling, and even crypto mining — projects that use GPU-specific power.

Render making wave in the DePin space:

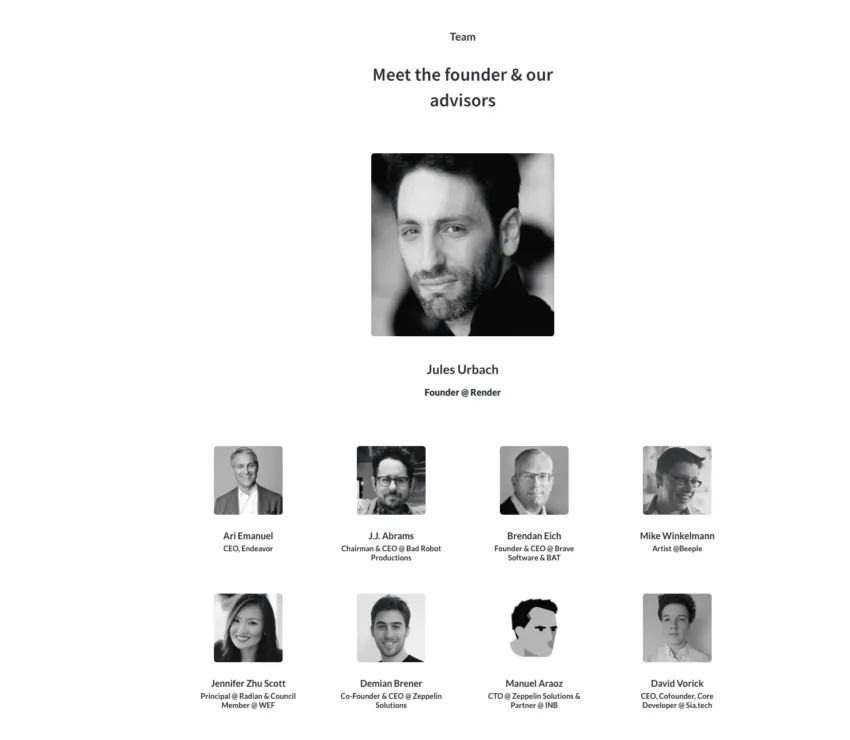

Another key fundamental aspect that could drive RNDR adoption is support for Render Token staking via the ReHold application. Finally, if you’re looking to vet the project for scams and put a face to the project, Render Network offers full transparency over its founder and team.

The Render Network’s features and the clear-cut token utility make it desirable.

“The founder of the AI company Perplexity (and former OpenAI research scientist) Aravind Srinivas recently noted that search assisted by LLMs like ChatGPT could cost 7x-8x as much as a normal search.

The decentralized compute bull case is in inning 1 for @RenderToken.”

Tom Dunleavy, Partner at MV Capital: X

What is the future of Render?

The Render Network pushes forth the concept of blockchain-based rendering, distributed computing, and cloud-based GPU rendering, all while incentivizing users with Render tokens. Therefore, while the ecosystem is innovative, its native RNDR token might also be a worthy portfolio addition, especially in the long run. Remember that crypto markets are inherently volatile, and profits are never guaranteed.

Disclaimer: This price prediction is based on historical data and technical analysis. Cryptocurrency investments are highly volatile and risky. This information is for educational purposes only and should not be considered financial advice. Always do your own research and consult with a professional before investing.

Frequently asked questions

What will Render’s price be in 2025?

Can Render Token reach $1000?

What is the Render price prediction for 2040?

What is RNDR all all-time high?

Is RNDR moving to Solana?

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.