Ravencoin is a use-case-specific project. It’s decentralized and meant for intermediary-free asset transfers. Despite the innovation, its native coin RVN hasn’t seen significant price growth since the 2021 bull market. But could the asset have still have legs? This Ravencoin price prediction considers the fundamentals and technical analysis around RVN to map out a potential future long-term price path.

NOTE: This article contains out of date figures and information. It will be updated with fresh analysis for 2025 and beyond in the New Year. In the meantime, please see our Ravencoin Price Prediction tool for the most recent, data-informed projections.

- Ravencoin price prediction and the role of fundamentals

- Ravencoin tokenomics and price forecast

- Other key metrics and the future price expectations around RVN

- Ravencoin price prediction and technical analysis

- Ravencoin (RVN) price prediction 2023

- Ravencoin (RVN) price prediction 2024

- Ravencoin (RVN) price prediction 2025

- Ravencoin (RVN) price prediction 2030

- Ravencoin (RVN’s) long-term price prediction until the year 2035

- Is the Ravencoin price prediction theory accurate?

- Frequently asked questions

Want to get RVN price prediction weekly? Join BeInCrypto Trading Community on Telegram: read RVN price prediction and technical analysis on the coin, ask and get answers to all your questions from PRO traders! Join now

Ravencoin price prediction and the role of fundamentals

Before we delve into the complex charts and pattern hunting, let us ponder how Ravencoin works. In simple terms, Ravencoin supports the transfer of assets like securities, commodities, and even VDAs. This ecosystem is useful in that it can offer speed and security relevant to asset creation and even asset transfer.

What’s important is that Ravencoin draws its identity from a fork of quintessential Bitcoin code, making it a secure proof-of-work chain. Bruce Fenton is the brain behind Ravencoin, as were Joel Weight and Tron Black. Crucially, Bruce Fenton served as Bitcoin Foundation’s Executive Director for three years, starting in 2015.

“Back to listing. Ravencoin, no ICO, community project, humble people, no listing fee.”

Changpeng Zhao, Former CEO of Binance: X in 2018

Ravencoin, similar to Bitcoin, adopts the Unspent Transaction Output (UTXO) model, effectively reducing the risk of double spending and enhancing security. Although it is a fork of the Bitcoin blockchain and uses a modified version of Bitcoin’s code, Ravencoin sets itself apart by employing a unique mining logic.

Regarding functionality, Ravencoin’s native coin, RVN, is primarily designed to facilitate the transfer of assets, serving as a mode of transaction. Additionally, RVN is considered a store of value, akin to how Bitcoin (BTC) is perceived in the cryptocurrency market.

Over time, we can expect Ravencoin to bring voting systems and integrated messaging support to its ecosystem.

Did you know? In 2022 Ravencoin went through a halving process, which reduced the block rewards from 5,000 RVN to 2,500 RVN.

Ravencoin tokenomics and price forecast

First things first, the supply is capped at 21 billion. It also has 63.41% of the fixed supply, which forms the circulating supply for RVN. Ravencoin’s token distribution methodology makes the token model special. The launch didn’t have an ICO. Instead, from the very start, RVN coins acted as miner rewards. For Ravencoin, the halving mechanism is still in play, which happens after every 2.1m block or roughly four years.

The tokenomics model, courtesy of the proof-of-work schema, makes us optimistic about the Ravencoin price forecast, especially in the long term.

Other key metrics and the future price expectations around RVN

If you are looking at RVN as a short-term investment option, here is a detail you shouldn’t miss. The 4-week volatility metric is dropping again after forming a peak. However, the chart from January 2023 suggests that every time the volatility peaked before, the price of RVN took a hit. Yet, the current development seems optimistic as despite the peaking volatility, the prices didn’t correct a lot. This means we might see RVN surging soon once the volatility drops.

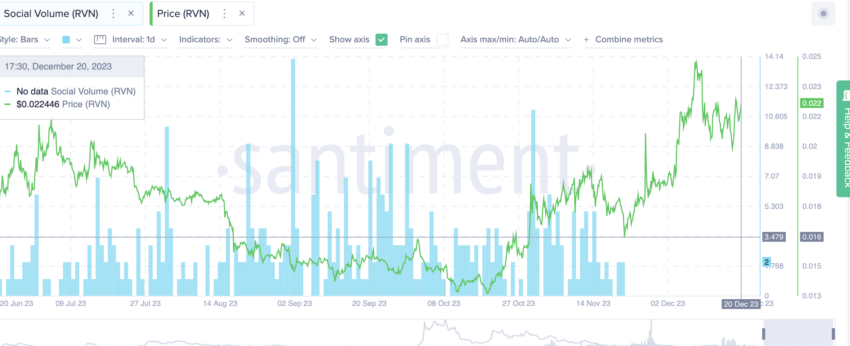

The historical chart of the social volume shows that any social activity relevant to Ravencoin can spur a price surge. Do note that this chart is from early January 2023, and you might want to refer to the next chart to see how the social metrics have impacted the price of RVN for the better part of 2023.

If you look at the yearly market cap chart of RVN, you will notice the prominent higher high. The peaking market cap might be a good adoption indicator and should help with the price rise.

Overall, the additional metrics hint at some Ravencoin price consolidation. This brings us to the technical analysis — a segment we shall explore next.

Ravencoin price prediction and technical analysis

Our early 2023 price analysis

Our earlier analysis was successful as the crucial level of $0.03355 was breached for a new high. Here is what we discussed:

Before we go long-term with the Ravencoin price forecast, here is a quick daily chart for your reference, as you can see RVN is close to completing a cup and handle pattern. Currently trading at $0.028, RVN needs to breach the upper trendline of the formed handle to scale higher, towards $0.0330 and $0.03355, respectively.

The green line (50-day moving average) seems to be closing in on the blue line (100-day moving average). If that crossover (golden) happens, we can expect the prices of RVN to break the mentioned trendline and head higher.

Our December 2023 analysis

RVN, in December 2023, seems to be forming another Cup-and-Handle pattern. A surge above the $0.25 mark, with high volume, can lead to a price surge at the counter. And this aligns with our fundamental analysis.

Let us go over the weekly chart to understand the broader pattern, if any.

Pattern identification

The weekly chart shows the following pattern. RVN starts trading and makes a peak after a few trading sessions. Once there, the prices have been moving in a lower-high formation to date.

If RVN breaches above the previous high, we might expect the pattern to repeat as a mirror image or a foldback. And we are expecting that to happen for a host of reasons.

The two red arrow-like lines on the weekly chart show a bullish divergence. The momentum seems to be moving higher while the price remains relatively flat. Therefore, there might soon come a small price rally of sorts.

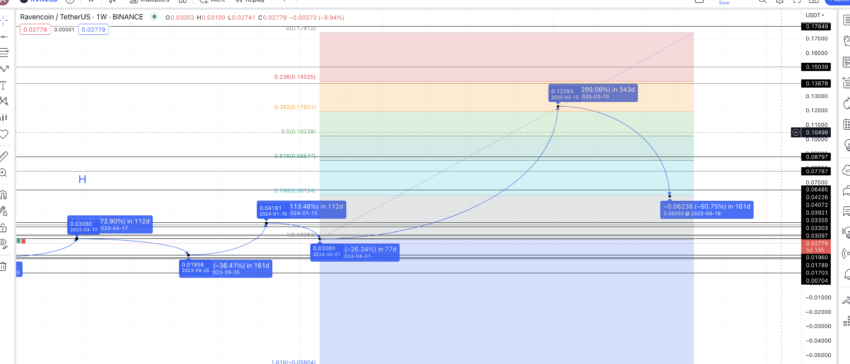

Let us now mark all the points on the chart to locate the price percentage changes and the time difference between those.

Price changes

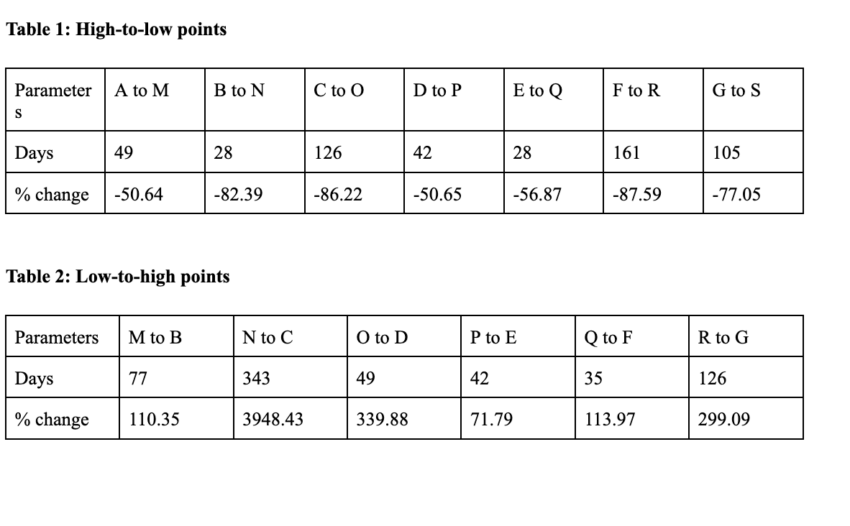

The next task is to locate the high after S. If the next high is above G, we can mark it G1, which might kickstart a new pattern. Let us take the price changes for the high-to-low points and low-to-high points across separate tables.

Using the tables above, we can locate the high-to-low average as -70.20% and 77 days. If the market conditions remain strong, the minimum drop percentage can be 50.64, and the maximum days taken can go as high as 161.

Similarly, the low-to-high average values are 828.43% and 112 days. In the case of bearish market conditions, the maximum growth percentage can be 71.79%, per Table 2. The maximum number of days for the same or any other growth percentage to surface can be 343 days.

We will use the above-mentioned data sets to predict the future price of RVN.

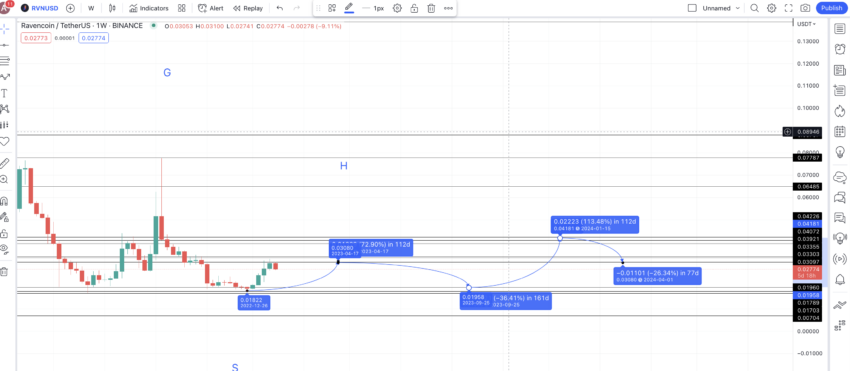

Ravencoin (RVN) price prediction 2023

Our 2023 RVN price prediction was successful. Here is what we discussed:

We have the last low at S. Considering the current market conditions, we can expect RVN to go high by 71.79% (minimum hike) in 112 days. This puts the Ravencoin price prediction for 2023 at $0.03151, close to April.

This point follows the lower-high formation, and we can mark it as H. The next low, or T, can surface at $0.01960, which coincides with the previous support at S. This translates into a drop of 36.41% — lower than the minimum drop from the table above.

Do note the prices might go higher than the proposed high depending on the market rally. The projected highs and lows are the maximum average levels where we can expect the price of RVN to rest.

Ravencoin (RVN) price prediction 2024

Outlook: Bullish

If 2023 takes support at $0.0196 or even at $0.14 (the actual low), the next high should follow a growth rate of over 100%. Taking support shows that buyers might end up preventing the price from dropping lower. And they might try their best to push the prices higher.

We can expect the prices to increase by over 110% —̉ 113.97% to be exact — per Table 2. Also, if you remember our short-term price action, you will notice that $0.033 was a strong resistance level for RVN to breach.

A short-term RVN target in case you want a quick entry and exit.

This puts the RVN price prediction for 2024 at $0.0418. Moreover, the low from this level can take support at the previous high of $0.03080 — keeping the previous growth trajectory into consideration. Even the Fibonacci levels indicate that $0.03080 aligns with the 78.60% of the mentioned retracement indicator.

Projected ROI from the current level: 87%

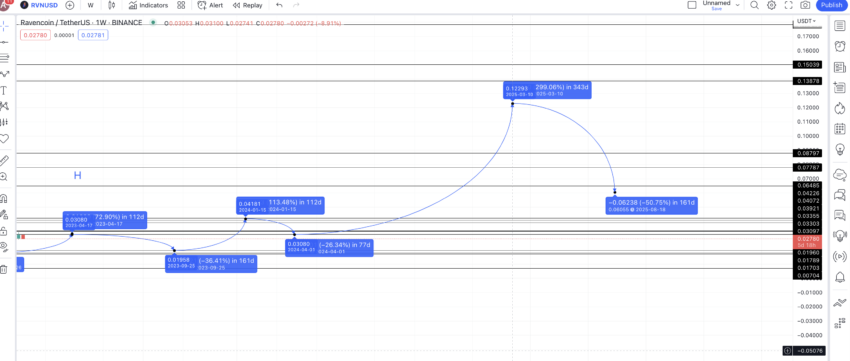

Ravencoin (RVN) price prediction 2025

Outlook: Bullish

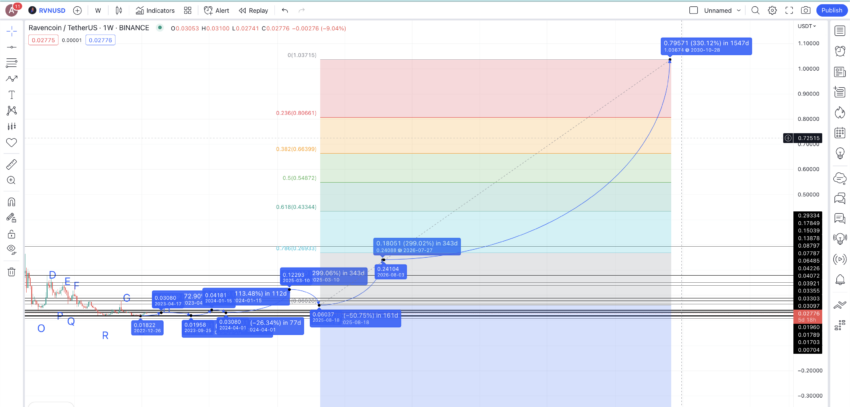

From $0.03080, we could again trace a high of 299.09% — considering the building strength at RVN’s counter. As it is a sizable price increase, we can expect the timeframe to go as high as 343 days — the maximum from Table 2.

This assumption might put the Ravencoin price prediction for 2025 at a high of $0.12290. At this point, you can see a clear uptrend as the maximum price prediction for 2025 would finally cross above the previous pattern’s high of $0.077 — which we marked as G.

The minimum price prediction for 2025 puts the level at a drop of 50.64% — the minimum drop from the tables above. This surfaces at $0.060 — a level coinciding with the 78.60% Fib level — validating the calculations further.

Projected ROI from the current level: 450%

Ravencoin (RVN) price prediction 2030

Outlook: Bullish

Let’s assume that the crypto market turns bullish and the market cap of Ravencoin improves by 2025. If so, we can expect the next high to follow another 299.09% stint over the next 343 days (in a year). This would put the next high at $0.241. This could be the 2026 price prediction for Ravencoin.

Note: We expect the price to go up this much in 2026 as the next halving for RVN is slated for the same year.

Meaning, this could be the maximum average price in 2026, and the absolute future price might vary depending on the condition of the crypto market.

Now that we have the maximum price level for 2026 and the minimum price level for 2025, we can use the levels to extrapolate further. If we trace the same growth path using the same slope, we can expect the price of RVN coins in 2030 to go as high as $1.036.

Projected ROI from the current level: 4539%

Ravencoin (RVN’s) long-term price prediction until the year 2035

Outlook: Bullish

Now that we have the price of RVN coins until 2030, we can extrapolate our Ravencoin price prediction theory to trace the average price points through 2035. While the following table might help, it is important to note that the price history might evolve depending on the market sentiments and fundamentals of Ravencoin.

You can easily convert your RVN to USD here

| Year | | Maximum price of RVN | | Minimum price of RVN |

| 2023 | $0.03492 | $0.01368 |

| 2024 | $0.0418 | $0.03080 |

| 2025 | $0.12290 | $0.060 |

| 2026 | $0.241 | $0.149 |

| 2027 | $0.3133 | $0.2443 |

| 2028 | $0.517 | $0.4032 |

| 2029 | $0.646 | $0.5038 |

| 2030 | $1.036 | $0.642 |

| 2031 | $1.398 | $1.09 |

| 2032 | $2.10 | $1.302 |

| 2033 | $2.72 | $2.12 |

| 2034 | $3.27 | $2.55 |

| 2035 | $4.09 | $3.19 |

Is the Ravencoin price prediction theory accurate?

This Ravencoin price prediction considers RVN’s price history and short-term trends. We have also analyzed the fundamentals and tokenomics while compiling the RVN price model. Hence, this forecast theory is both practical and reliable. Of course the crypto market is volatile, and global events, both positive and negative, can impact the price of Ravencoin at any given time. Yet, this model makes a strong case for a bullish long-term price of RVN.

Frequently asked questions

Will Ravencoin reach 1 USD?

What will Ravencoin be worth in 2030?

Is Ravencoin crypto a good investment?

What makes Ravencoin special?

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.