Bitcoin may seem like a foreign, confusing cryptocurrency to acquire. However, it really isn’t that hard to buy Bitcoin online. In fact, you can buy Bitcoin instantly with a debit card or credit card, should you so choose. With this guide, we’re going to go over how to buy Bitcoin with a credit card and the best place to buy Bitcoin as well.

KEY TAKEAWAYS

► To buy Bitcoin with a credit card, download an exchange app, add a credit card to your payment methods, and complete your order.

► You can buy Bitcoin with a credit card on exchanges like Paybis, and Coinbase.

► Bitcoin is the first cryptocurrency, it was created by the anonymous individual or group known as Satoshi Nakomoto.

► Users who want to purchase Bitcoin with a credit card should remain cognizant of the fees and store their BTC in a safe wallet.

How do I buy Bitcoin with a credit card?

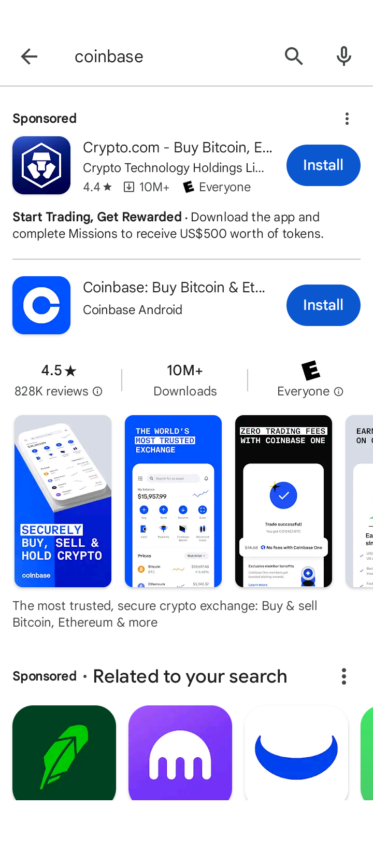

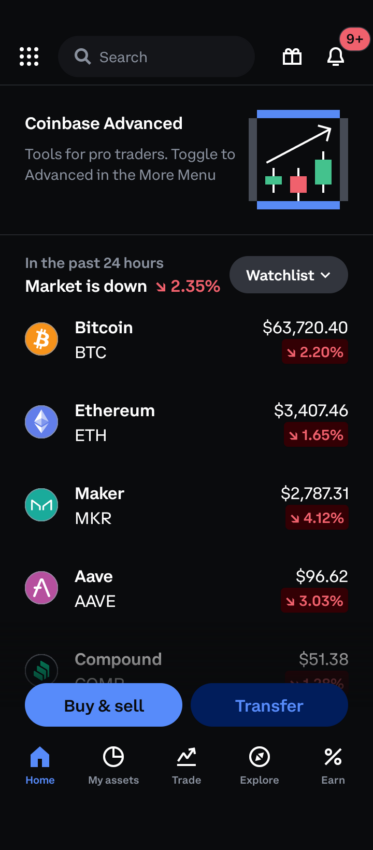

Generally, you want to sign up for an exchange and enter your credit or debit card information to buy Bitcoin fast. You can buy as much Bitcoin as you’d like. All you need to do is sign up for an exchange, fill out the proper verification, and select the amount of Bitcoin you’d like to buy with whichever payment method you prefer. For our demonstration, we will use Coinbase.

1. Download the Coinbase mobile app in your app store.

2. Search for and press Bitcoin on the home tab.

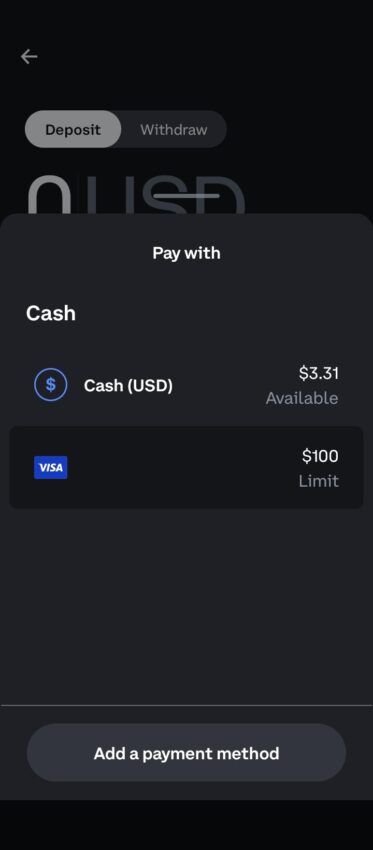

3. If you don’t have a credit card approved already, select “Add a payment method” to continue.

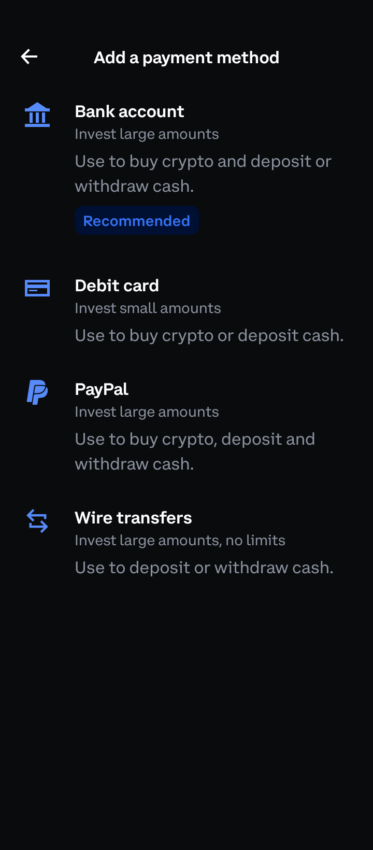

4. Select “Debit card” to add a credit card as a payment method.

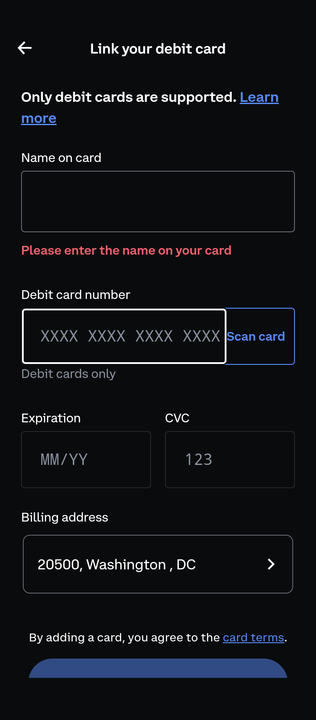

5. Enter your credit card information to continue.

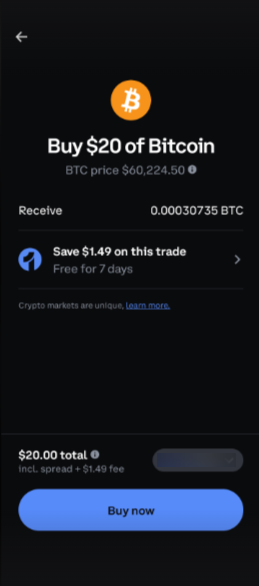

6. After you have added your credit card, select “Buy now” to buy Bitcoin with a credit card.

Users should be advised that some credit card companies may treat crypto purchases as cash advances. This can result in additional fees.

What is Bitcoin (BTC)?

Bitcoin is the first cryptocurrency ever. An anonymous individual or group, Satoshi Nakomoto, created Bitcoin as an alternative to the financial environment and monetary system at the time, inscribing the message in the Bitcoin genesis block:

The Times 03/Jan/2009 Chancellor on brink of second bailout for banks.

Satoshi Nakomoto

This ominous message references the headline of The Times newspaper article from January 3, 2009, which reported on the Great Financial Crisis (GFC) and the potential government bailouts. It is widely believed that Satoshi included this as a commentary on the instability of the traditional financial system.

Since its inception, Bitcoin has become the greatest-performing asset in modern times. It regularly dominates around 50% of the total cryptocurrency market capitalization and is usually the most expensive cryptocurrency as well.

Where can you buy Bitcoin online with a credit card?

Most cryptocurrency exchanges nowadays allow you to input a debit or credit card so you can buy Bitcoin. This list will break down the best places to do just that.

1. Paybis

Paybis is a cryptocurrency exchange that allows you to buy Bitcoin with a debit or credit card. It is a platform registered with the FinCEN Department of the Treasury in the US and supports over 180 countries around the world.

Your first purchase is entirely free without any transaction fees. Afterward, it charges a 2.49% fee for every purchase. Then there’s a payment processing fee, which must meet a minimum of 10 USD. Otherwise, Paybis charges 4.5% of every transaction via USD, EUR, and GBP, and up to 6.5% for other fiat.

2. Coinbase

Coinbase is another easy way to buy Bitcoin online. It is based in the United States and was created by Fred Ehrsam and Brian Armstrong. To start, Coinbase requires you to create an account like any other exchange. However, it does follow some know-your-customer (KYC) policies, so it asks that you verify a photo ID with them. Once done, you can buy Bitcoin instantly with a debit card. Note that Coinbase requires you to enter a bank account for bigger purchases, as compared to a debit card, which is for smaller ones.

The aforementioned exchanges were chosen based on a few factors. The platform type was crucial, as customers may have different situations that require specific platform utilities. Availability and fees were also crucial factors when selecting exchanges.

Platforms to buy Bitcoin with credit card compared

| Platform | Platform | Supported countries | Fees | Min. purchase |

|---|---|---|---|---|

| Paybis | Money service business | 180+ | 2.49%-6.5% | $4 |

| Coinbase | Brokerage | 100+ | $0.99-$4.19 | Varies |

Why should I buy Bitcoin with a credit card?

It is not recommended for everyone to buy Bitcoin with a credit card. Some cryptocurrency enthusiasts want to remain anonymous; on the other hand, buying Bitcoin with a credit card is one of a few ways to get Bitcoin instantly.

After all, linking a bank account can take days to process, while a card link can happen instantly. Moreover, purchasing with the former method can take days to process, on top of the days it takes to verify said account.

However, not every exchange is a safe space to hand over information. Some are scams that are used to steal credit card numbers, so be wary of where you’re signing up.

Many exchanges charge higher fees for a card purchase, and some limit the amount of Bitcoin that can be bought with a card. This is partly due to the fact that credit card companies can reverse charges. Exchanges generally prefer bank transfers or other methods of purchase.

What should I do after I buy Bitcoin with a credit card?

Generally, it isn’t recommended that you keep your Bitcoin on an exchange after purchasing. Instead, it’s safer to move crypto into a hardware or desktop wallet. In that case, if an exchange is hacked, your Bitcoin will be safe from theft. Here are some wallet suggestions to store your Bitcoin.

Hardware wallet

A hardware wallet is an external wallet, such as Ledger or Trezor, that stores your Bitcoin offline in a device that can’t access the internet. Think of it as an external hard drive but with extra security.

For example, there are only two buttons on the wallet to make transactions, making it very difficult to say yes or no to a prompt accidentally. Most hardware wallets also have their own custom operating systems to prevent hacks and come with paper recovery sheets to store that information.

Desktop wallet

A desktop wallet is a downloadable wallet, protected by a password or other security measure. Essentially, after buying your Bitcoin on an exchange, you send it over to your desktop wallet via the wallet’s public key. It is then safe there instead of being on an online exchange.

Paper wallet

A paper wallet is the safest way to store your Bitcoin, even if it’s one of the less conventional ones. Paper wallets are literally pieces of paper with a QR code on them that houses your wallet key. To access the wallet, one must scan their wallet with a QR reader on their mobile device.

From there, they can make a transaction with the stored assets. A paper wallet is the safest form of security because it literally cannot be hacked into. However, it’s also possible to lose this piece of paper or have it torn, so it’s important only to use this method if one can ensure the paper’s safety.

Can I only buy Bitcoin online?

There are multiple ways to buy Bitcoin with a credit card or without one. Ideally, the easiest way to buy Bitcoin offline is with a Bitcoin ATM.

Bitcoin ATMs are available in a variety of locations all around the world, and allow users to purchase Bitcoin either with a debit card or cash, should they so please. Sometimes, they must have an existing account, though other times, the user can just purchase it with their preferred method without one.

Stay safe when buying Bitcoin with a credit card

If you’d like to just buy BTC with a credit card, there are many places to do that. However, those looking to buy cryptocurrency with a credit card should stay aware of any additional costs. You should also store your BTC in a safe, non-custodial wallet. Please be advised that investing in any financial asset is risky, and you could potentially lose money.

Frequently asked questions

Where can I buy bitcoin with a credit card?

Do exchanges charge fees for credit card purchases?

What is a hardware wallet?

Can I buy bitcoin offline?

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.