Friend.tech, the newest social app for web3, is taking online communities by storm. Friend.tech discussions are all over Twitter (now X), with users clamoring to access invite codes and join.

Identified as a market where users can trade the popularity, likeness, and network strength of creators and influencers, Friend.tech aims to become a better version of the DeSo (decentralized social) BitClout — an open-source, decentralized social network. This guide explores every aspect of this new social app — from use cases to registration and potential red flags. Here’s what you need to know.

- What is the Friend.tech app?

- How does Friend.tech work?

- Need to Buy ETH in one click?

- How to get on Friend.tech?

- Friend.tech features

- What’s pushing the share prices higher, fundamentally?

- Friend.tech airdrop: everything you need to know?

- What’s good about Friend.tech?

- Security and privacy concerns: Friend.tech cons

- How to avoid being scammed

- What is the future of Friend.tech?

- Frequently asked questions

What is the Friend.tech app?

Definition first! Friend.tech is a decentralized social network where friends or, rather, their networks become Shares or Keys. You can invest in your friend’s social network or any set of users to tokenize their credibility. This decentralized social app is different than anything we have ever seen. Out here, every user is like a social token. You can buy that social token, sell it for a higher price, or keep holding it as the token appreciates in line with the users’ credibility.

The shares, on the other hand, give access to gated influencer-specific chat rooms, exclusive content, and more.

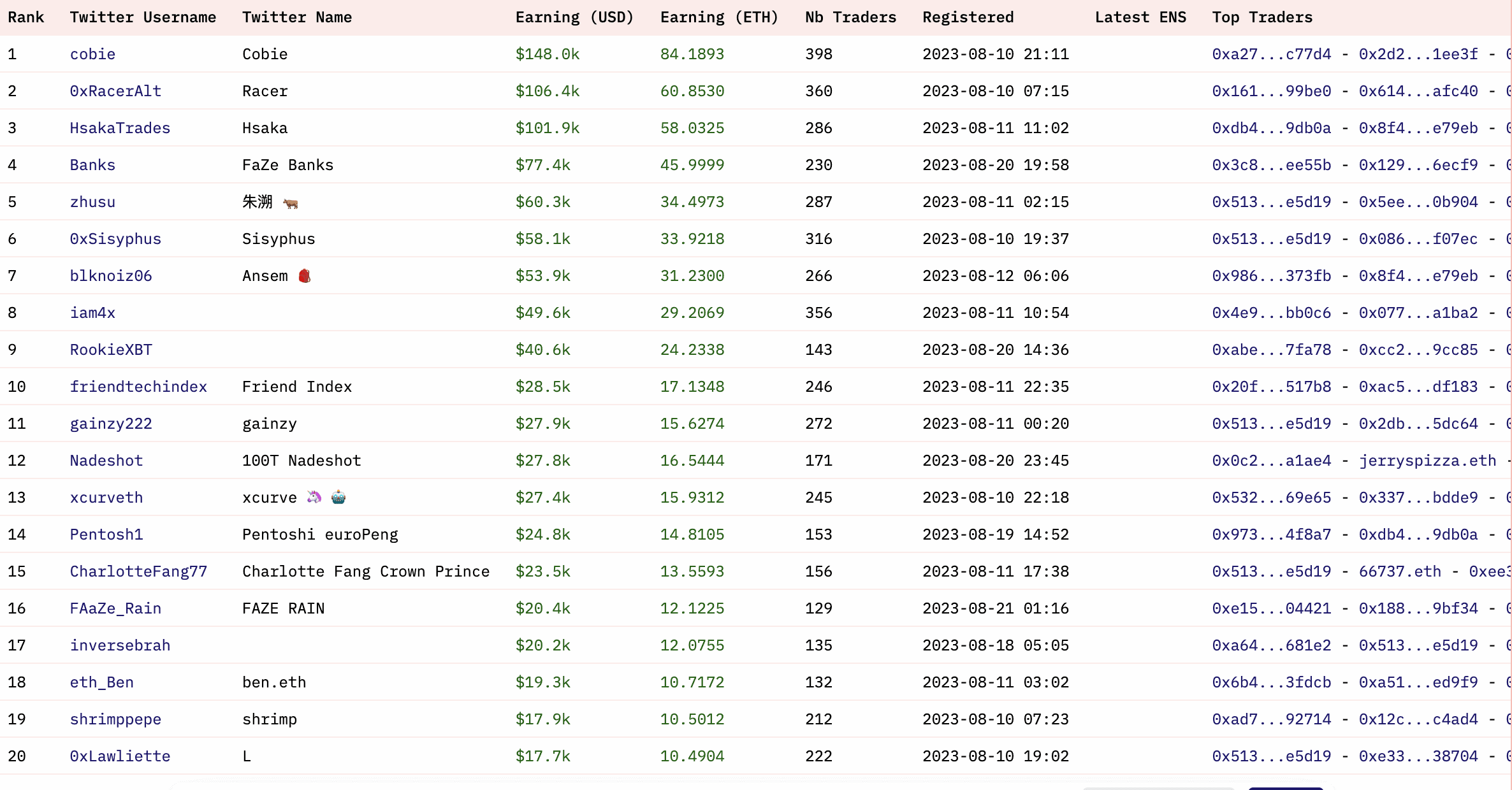

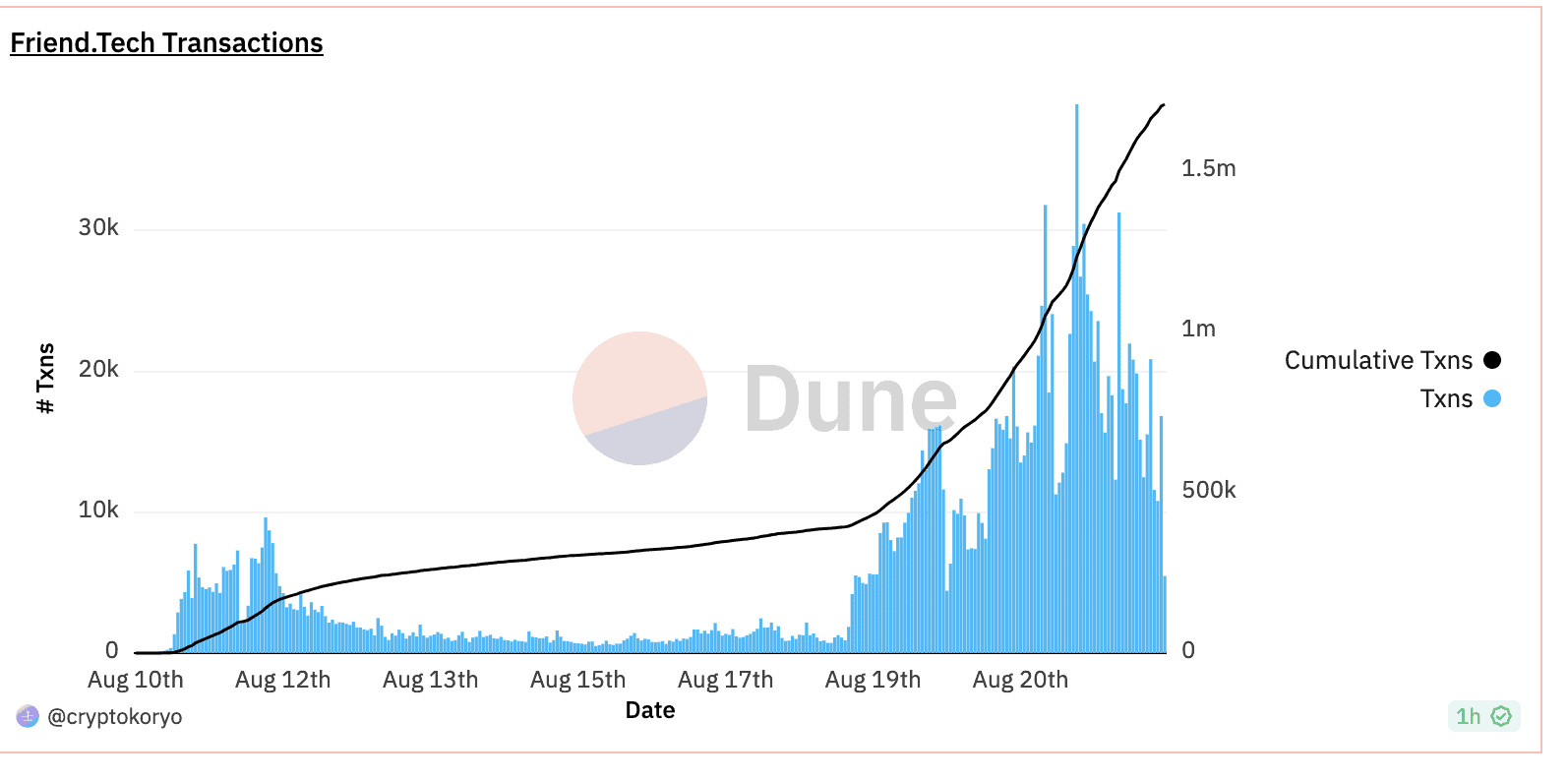

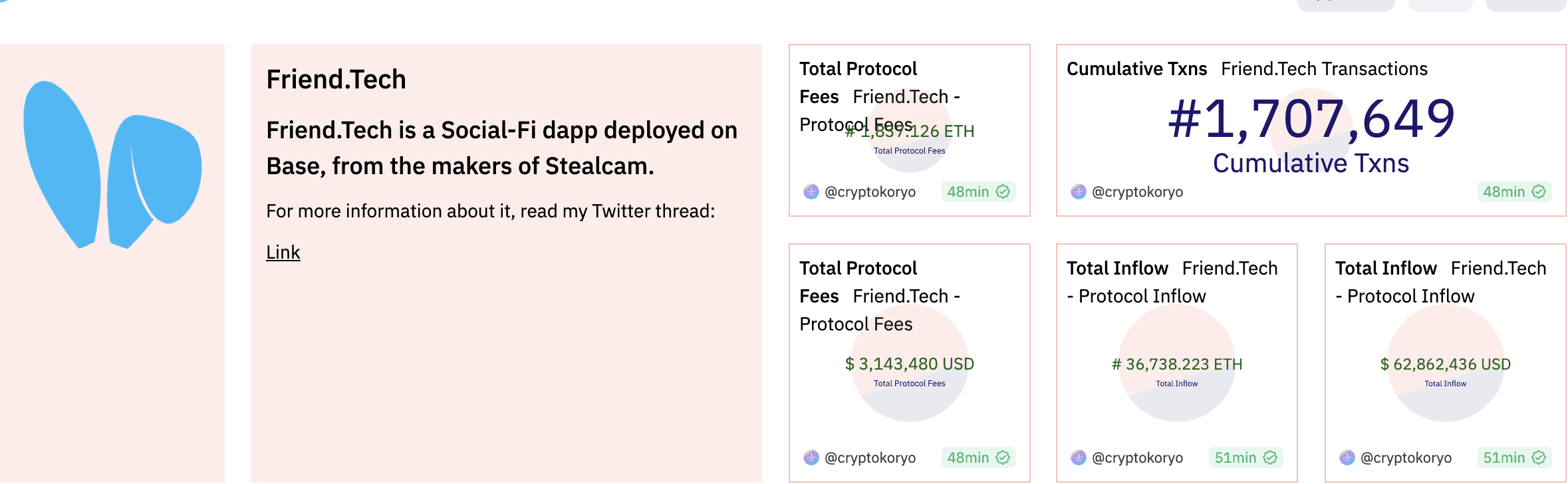

As of Aug. 21, 2023, the app has accumulated over 80,000 users, with over 1 million trades worth $50 million.

“Biggest takeaway from Friend Tech so far

Using tokens that give you access to crypto gigabrains, celebrities, and attractive women as a medium for speculation is a lot more fun than doing the same with tokens that give you access to discords with angry 30-year-old unemployed men.”

Cirrus, software engineer and NFT investor: Twitter

The team behind Friend.tech

Ideated by Twitter user oxRacerAlt and Shrimppepe, Friend.tech comes from the home of other established projects, including the Stealcam. While it is a quintessential social app, there have been many interpretations of its nature, with some calling it a social media hub for crypto personalities and some terming it a breeding ground for the next generation of creator tokens.

Simply put, Friend.tech is a platform aimed at creator monetization. The follower base of influencers or Friend.tech users buy shares (keys) to get a direct line with them.

You can think of it as the basic price to enter a group, as the influencer can only interact via group messages, even to direct messages and requests. If you have purchased shares and joined a group, you can later sell the shares to exit the group.

A more technical way of looking at Friend.tech is to consider it a DApp — built atop the Base Network.

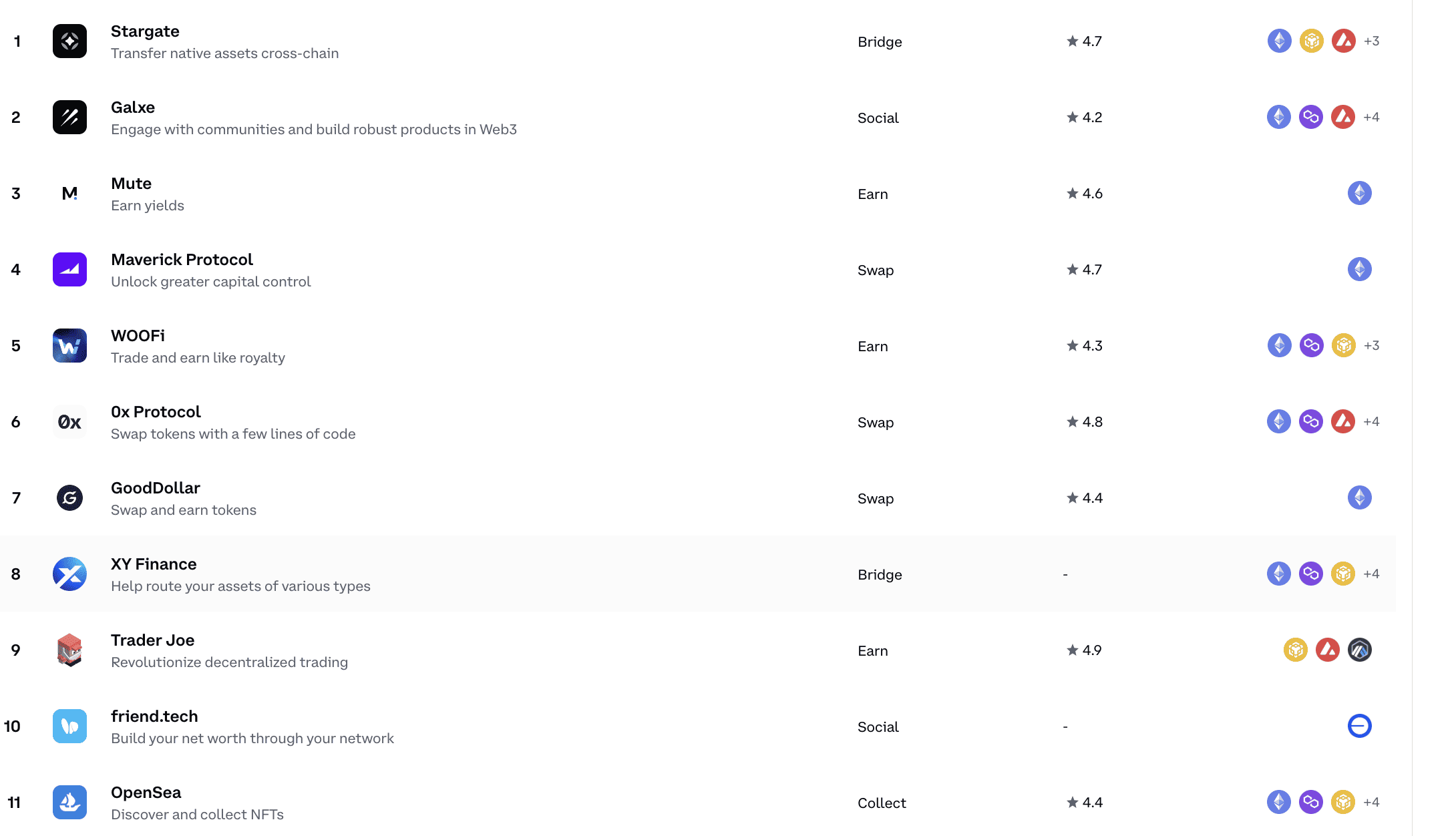

Did you know? Base Network is a layer-2 solution for the Coinbase ecosystem. And while there are many apps built on Base, including Mute, Stargate, and more, Friend.tech is arguably the most popular one.

Just to reiterate, Friend.tech is still in the invite-only beta stage, and we are waiting on an official launch. Only then can we get more clarity on the specific features.

How does Friend.tech work?

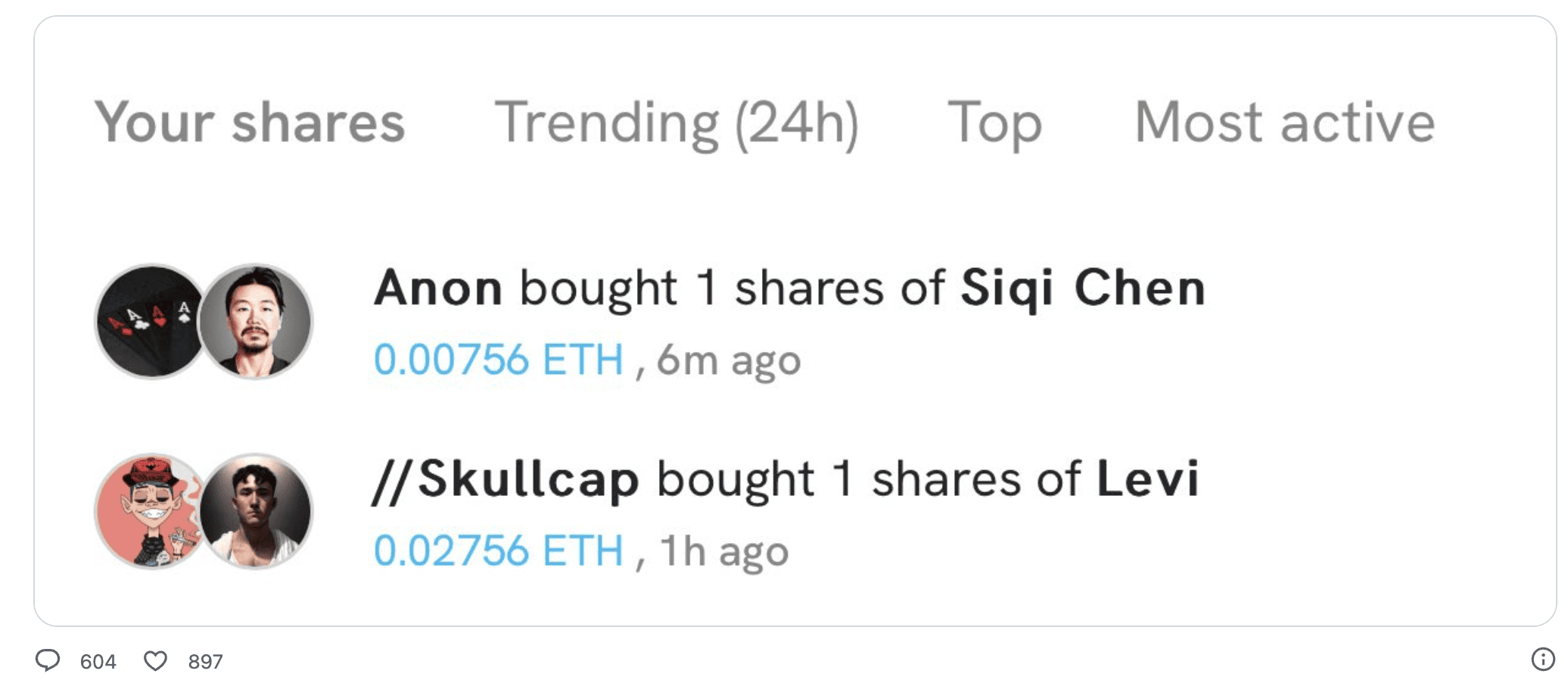

The concept behind Friend.tech is fairly simple. As a user or a follower, you can buy shares to join a particular influencer group.

This gives a direct line to the influencer and access to the private group chats. The money spent by you is inclusive of the platform fee and also what the influencer or the creator gets. If you are into specifics, every share-related buy-sell transaction attracts a 10% fee — half of which goes to the person you are buying from or selling to, and the other half goes to the Friend.tech treasury.

What makes it unique?

There have been many so-called decentralized social network offerings over the past few months, including Damus, Mastodon, and more. Yet, Friend.tech is different as it actually allows users to tokenize their presence.

As the influencer group expands, the number of group shares also increases. In this case, the rise in the number of shares doesn’t dilute the price of joining or the price at which shares are sold.

Instead, the build-up of shares increases the base price of joining the group. Individuals who want to leave the group can sell their shares — a method of liquidation.

As friend.tech is in its infancy, you can look at it as a way to tokenize friends. For instance, you can buy shares of your friend’s profile, eventually amping up their popularity. As mentioned earlier, the first share buy happens at a base price — a value determined by the follower base on the friend, engagements received, and also overall influence.

“Friend Tech really cements the ETH L1 / L2 thesis. The fact it has been tried on other platforms and DIDN’T work just adds to it.

Kunal Goel, research team at Messari: Twitter

As a creator, you sell shares (keys) of your account or, rather, your social presence. If your engagement keeps increasing, the prices of your shares keep going up, and vice versa. Therefore, friend.tech aims to combine the social benefits of interaction with financial benefits. For creators, the financial benefits include incentives, and for the followers, flipping shares at higher prices — provided the creator’s popularity increases — is the way to procure monetary perks.

Other novel takes on Friend.tech

Over time, shares tied to a specific creator or a profile might be known as social tokens. And they might even experience volatility if a lot of trades start gracing the platform.

Based on this take, some analysts have started tagging Friend.tech as a SocialFi project. The buy-sell nature of popularity or influence as community tokens or creator tokens adds the Fi or the Finance part to it. Another interesting take supporting this is how the price of creator shares is calculated. While we shall discuss this at length, the relationship depends on the shares relevant to a given group.

Here is the thread that captures it all:

Need to Buy ETH in one click?

As there is a quadratic equation involved, the floor price of the share might increase or decrease steeply, qualifying the entire gig as SocialFi one.

How to get on Friend.tech?

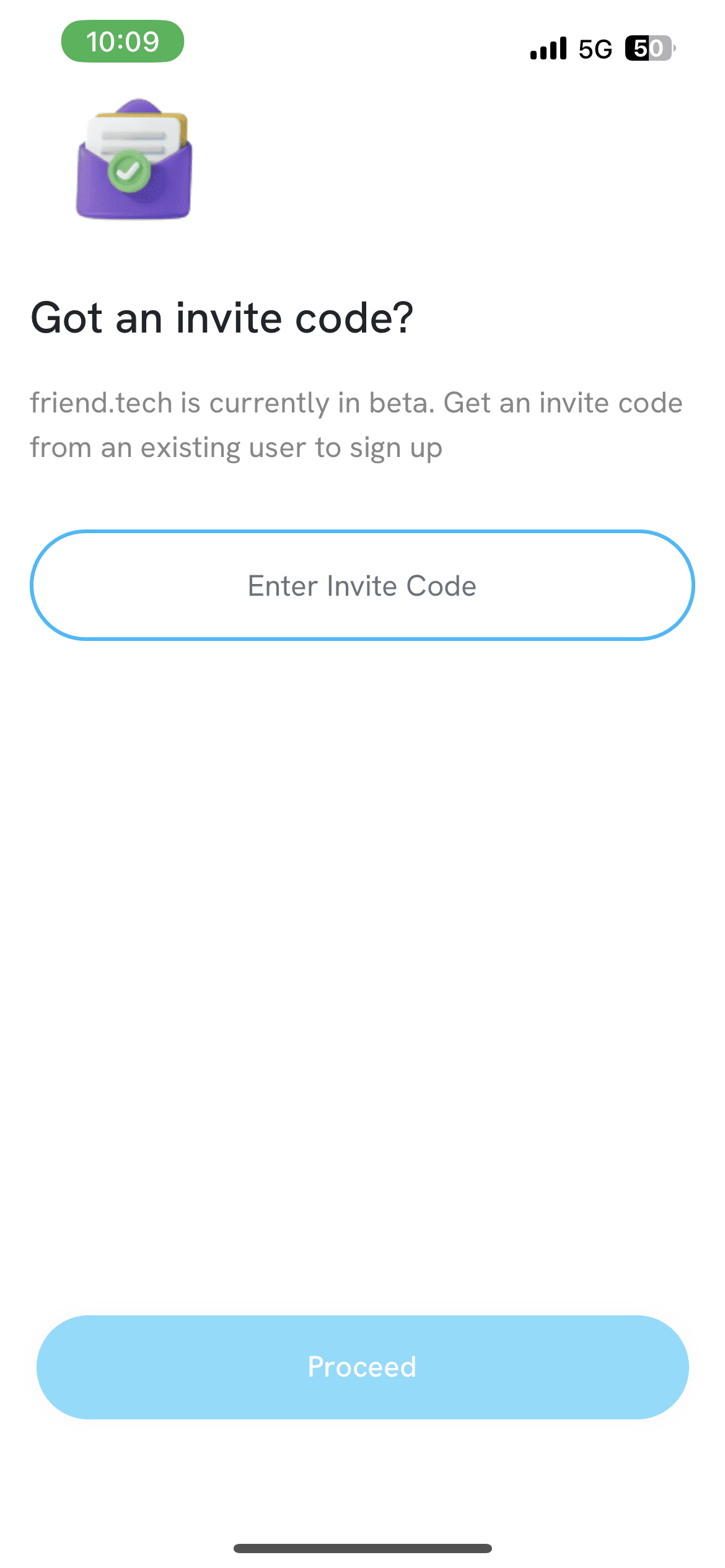

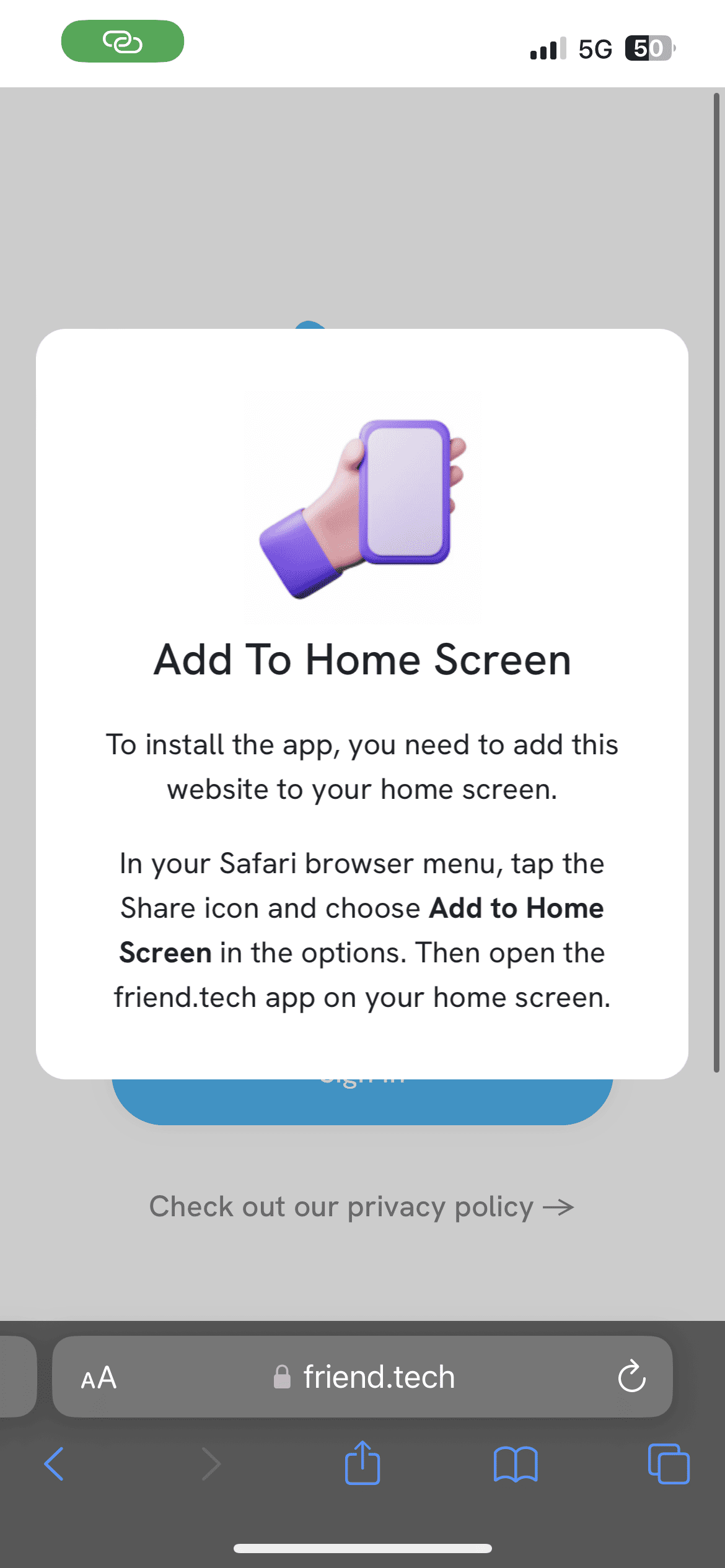

Onboarding Friend.tech is simple. Firstly, you need to visit the “Friends.tech” link from the Safari browser on your phone. For that to work, your iOS needs to be updated to the latest version.

Once the link becomes live, look for the “share” button at the bottom of the screen and tap the “Add to Home Screen” shortcut. Open the icon on the home screen and feed in an invite code.

Note: You can get the code from an existing member of the Friend.tech platform. Each registered member has three codes to give out, and the best way to get them is to look on Reddit or Twitter (X).

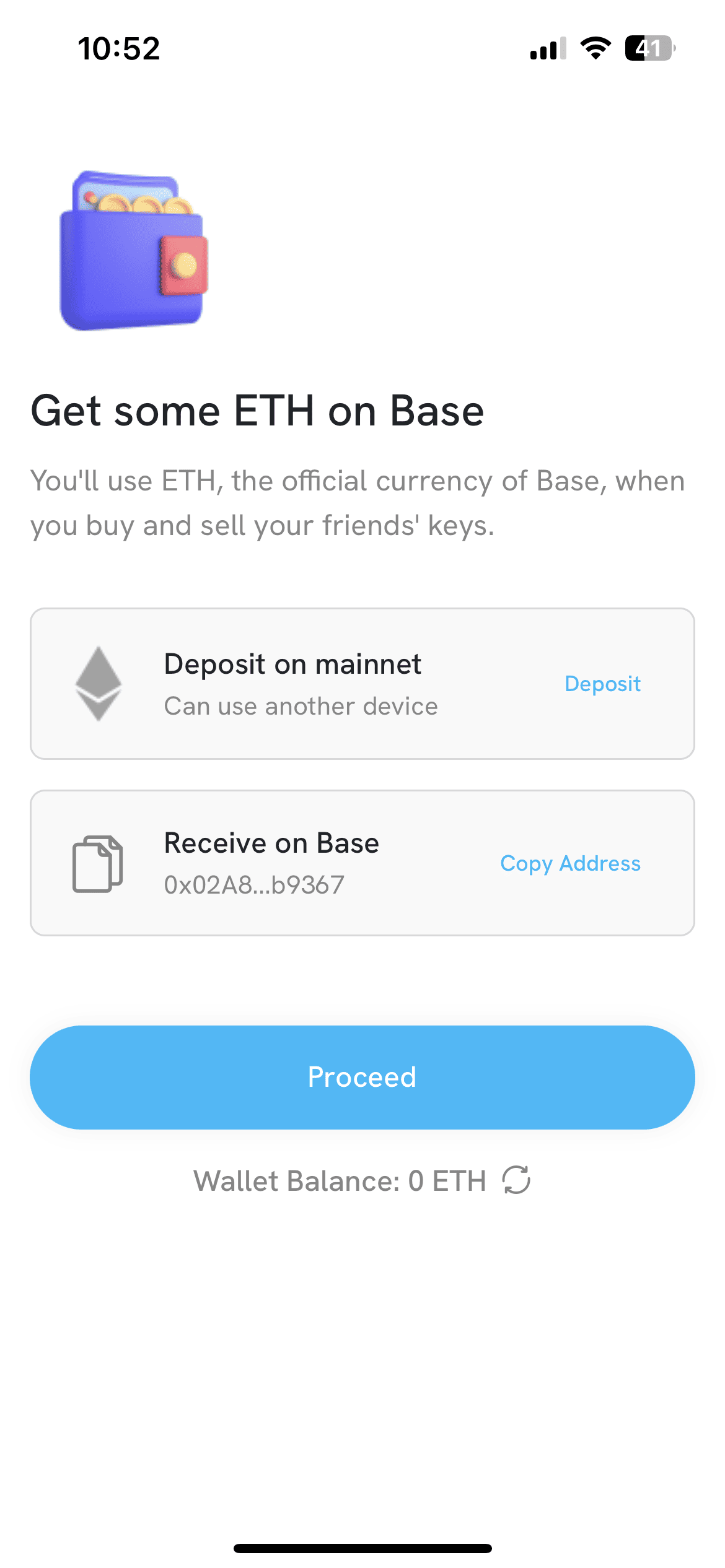

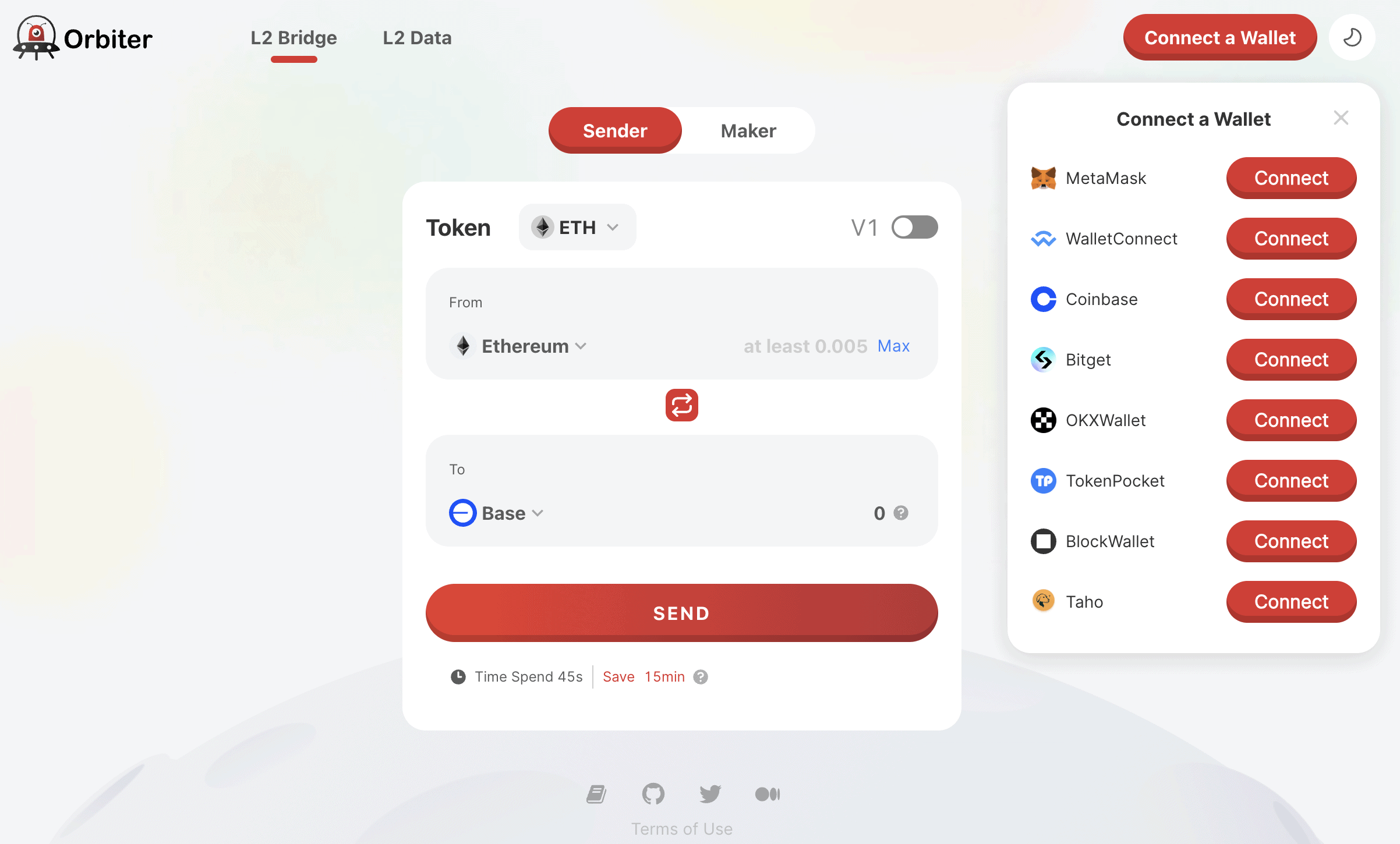

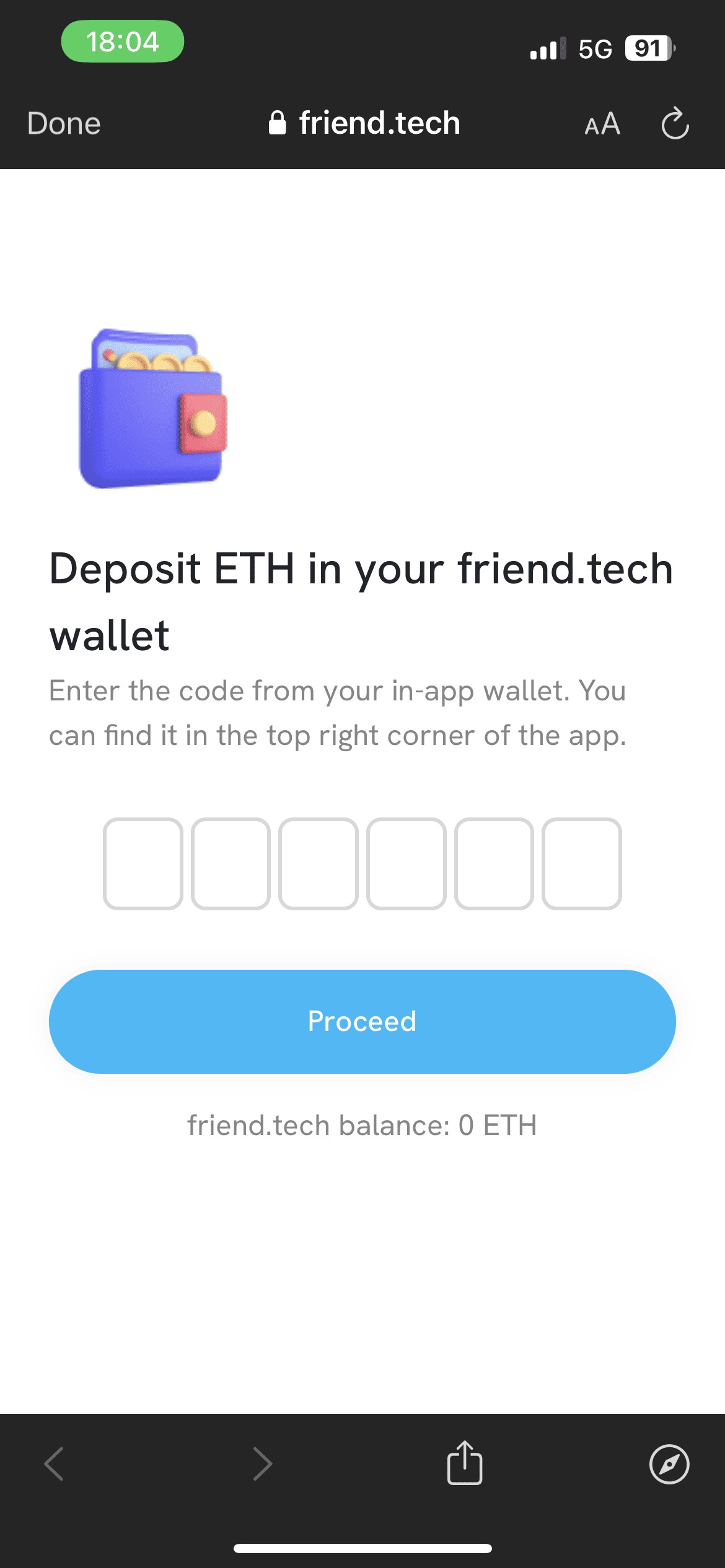

Once you are in, you need to log in using your Google account and link the Twitter (X) profile. Post that, you need to bridge some Ether (ETH) — 0.01 ETH minimum —from the Ethereum mainnet or Arbitrum to the base wallet address that will be displayed. You can do this using Orbiter.Finance. Notably, the base wallet addresses might take some time to reflect the ETH that you send to them from the mainnet.

Note: You should send ETH to your Base chain wallet addresses and not a standard Ethereum wallet. And to withdraw funds, you would need a third-party wallet, into which your friend.tech crypto wallet should be imported. In every case, you need to pay the gas fees.

Here is a detailed post discussing this:

New innovations from the app

Friend.tech has also revealed a BuildonBase bridge to facilitate quite intra-UI transfer of ETH, making the adoption curve less steep for users.

If you have ETH on the mainnet, you can move this to the base ETH by paying the transaction fee. You should have at least 0.01 ETH in your base account to access the Friend.tech dashboard.

Once you are inside the app, you can even generate invite codes, share with friends, and get points in the process. These points might be a step towards farming the Friend.tech airdrop.

Also, if you simply plan on using Friend.tech for trading shares, the FriendMEX platform can offer decent options. Here is a post that explains the best way to use it:

Friend.tech features

Every user is either a creator or a follower at Friend.tech. Here is what that means:

Imagine you have a friend who is a creator and new to Friend.tech. You can purchase shares of their account or follow them at the base price. Depending on how big the friend’s network grows, the share prices appreciate, which is good for them as a creator and you, a shareholder.

Someone can even buy shares of your account, depending on what value your network offers. At Friend.tech, the quality of the network is the net worth of the individual.

Friend.tech has recently renamed Shares to Keys, depicting its true utility as a way to unlock chatroom access to followers.

How the “share” prices are determined?

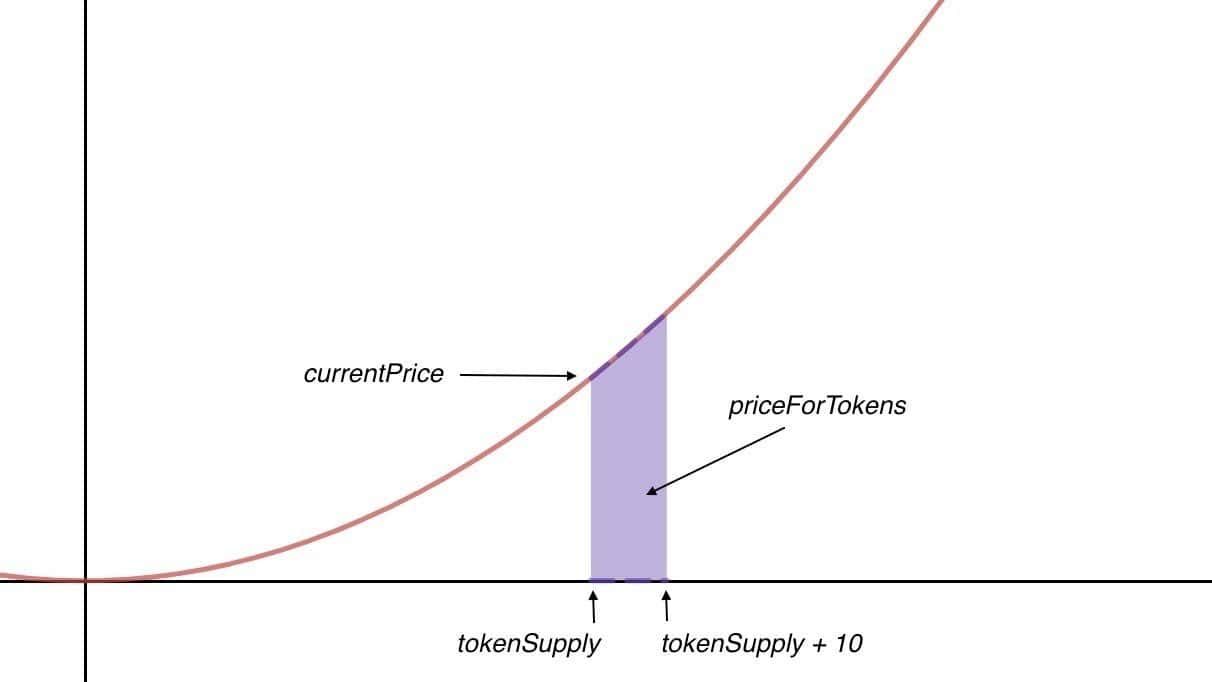

While the concept of shares or keys looks self-explanatory, the price appreciation needs highlighting. As mentioned previously, the price of keys follows the concept of the bonding curve, which often leads to exponential price surges.

In the case of friend.tech, the price of a share in ETH follows a mathematical relationship to the supply of the shares within a given group. Therefore, the more shares purchased, the higher the chances of the prices increasing.

The bonding curve conundrum

The buy-and-sell price relationship relates to the fact that with higher share purchases, the number of outstanding shares for a group also increases.

The price follows the following relationship:

The buying price of ETH = n ^ 2 /16000 (where n is the total outstanding supply, and 16000 is the scaling factor or constant selected by Friend.tech’s economic model.

The selling price follows a slightly different relationship:

Selling price of ETH = (n-1) ^ 2 /16000

Based on the equations, the difference between the buying and selling prices of shares should increase over time. However, the spread rate, which is equal to the (buy-sell/ selling price) x 100, should decrease. So when friend.tech grows, the spread rate will reduce, and only people with large accounts — more outstanding shares — will be better positioned to make profits.

Here is a more detailed thread that clearly describes the mathematics behind Friend.tech’s tokenomics model:

Also, here is a flipside of the bonding curve that you should be aware of:

If you want a more detailed deep dive into Friend.tech’s bonding curve and smart contract analysis, here is a thread that captures everything:

It is worth noting that one can even solve the “supply” function if the current share price of the creator is known — which is easy considering it gets displayed below the creator’s name.

Did you know? The concept of the bonding curve works similarly for automated market makers. This allows users to buy and sell assets against a set pricing formula.

What’s pushing the share prices higher, fundamentally?

While the bonding curve has been playing its part in pushing the prices higher, there are other reasons for this. These include:

- There might be bots implemented, which can automatically make the initial “key” purchases.

- A higher purchase number also amplifies the number of outstanding shares or keys, increasing the buy roof price by pushing the supply higher.

- More people are onboarding the platform in expectation of rewarding airdrops.

- Several popular names are already on Friend.tech, including trading influencers like RookieXBT, NBA sensation Grayson Allen, and more.

These are some of the reasons for the surge in revenue generated by Friend.tech. There are a few more reasons, including Paradigm’s latest round of funding.

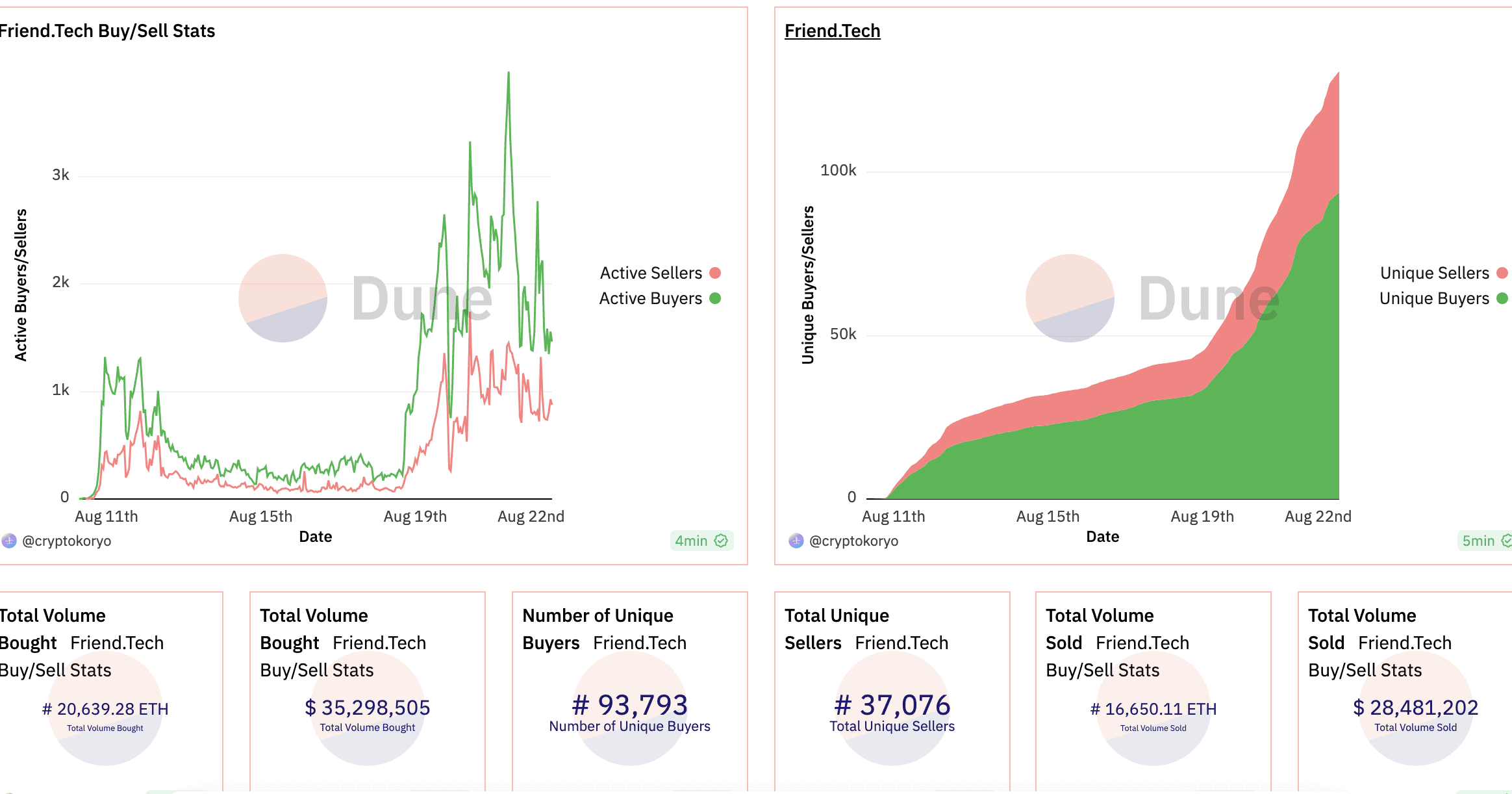

Here is a thread that captures how the number of active buyers and sellers spiked after the Paradigm funding news.

Friend.tech airdrop: everything you need to know?

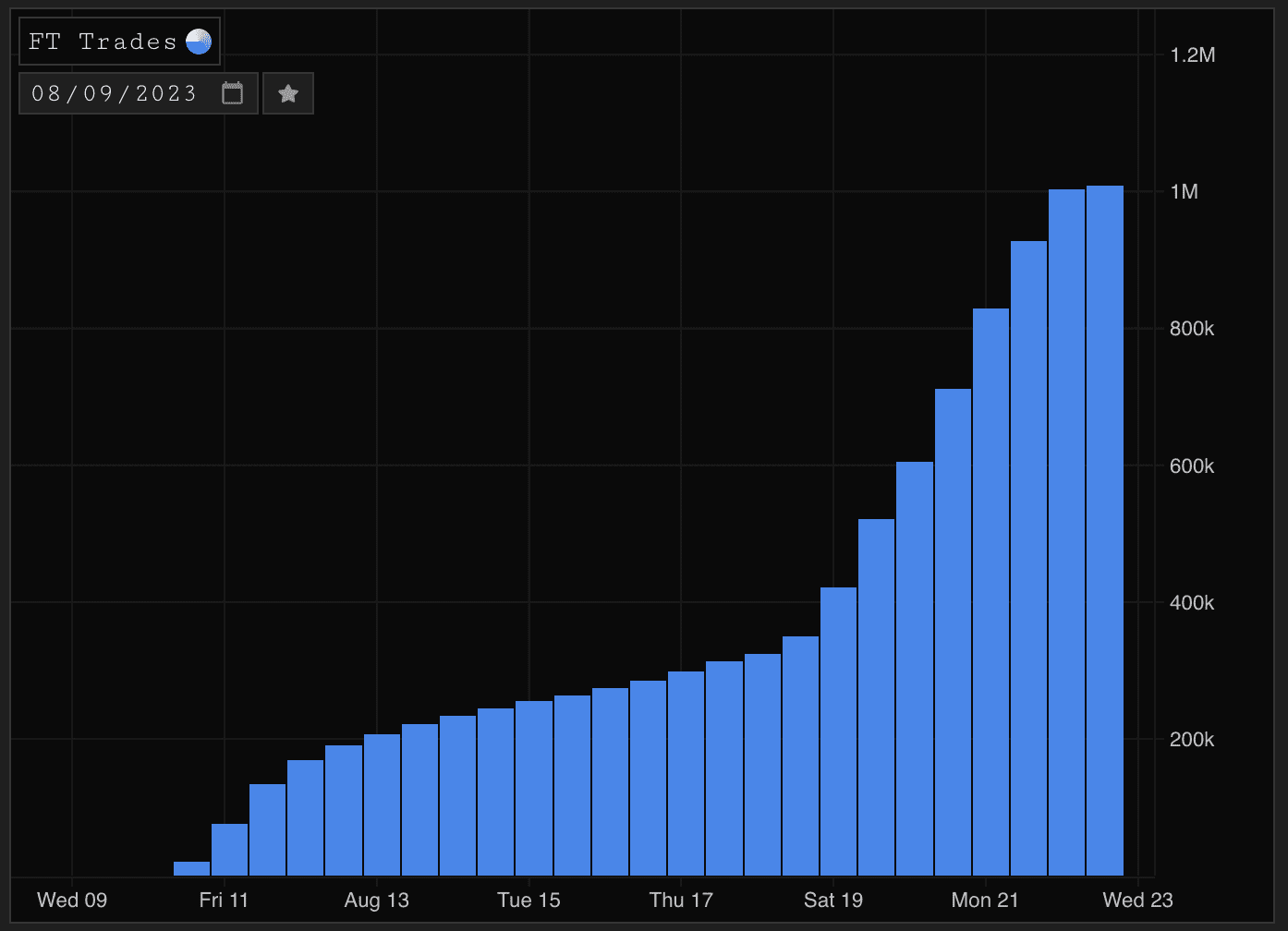

Hype around the potential of the Friend.tech airdrop has been pushing share buying at a clip. Yet, before we delve deeper into the airdrop discussions, let us track the numbers associated with this Coinbase-specific social network.

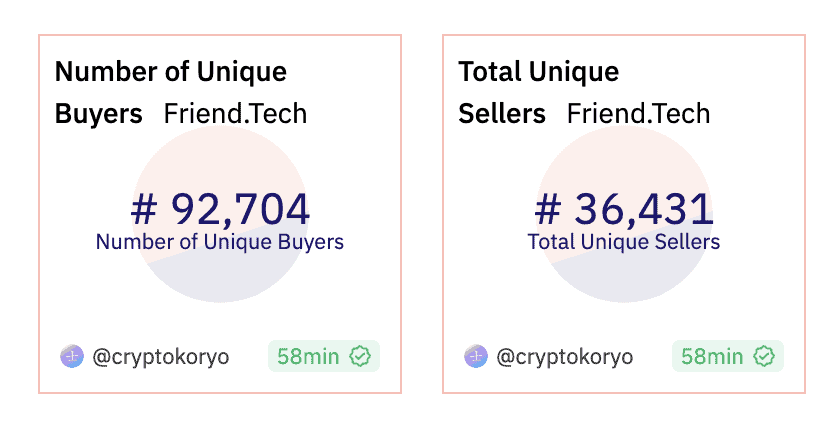

Key numbers and the airdrop setup

As of Aug. 23, 2023, there are close to 93K unique buyers in the space. Let us look closer at the airdrop qualification and other related aspects.

Firstly, friend.tech received a $50 million Series A round funding from Paradigm with the valuation pitch bringing in token warrants. And token warrants being part of valuation decks usually translate to token launches and, eventually, airdrops. Also, airdrop discussions often bring in more users and revenue, which is good news for both friend.tech and Paradigm.

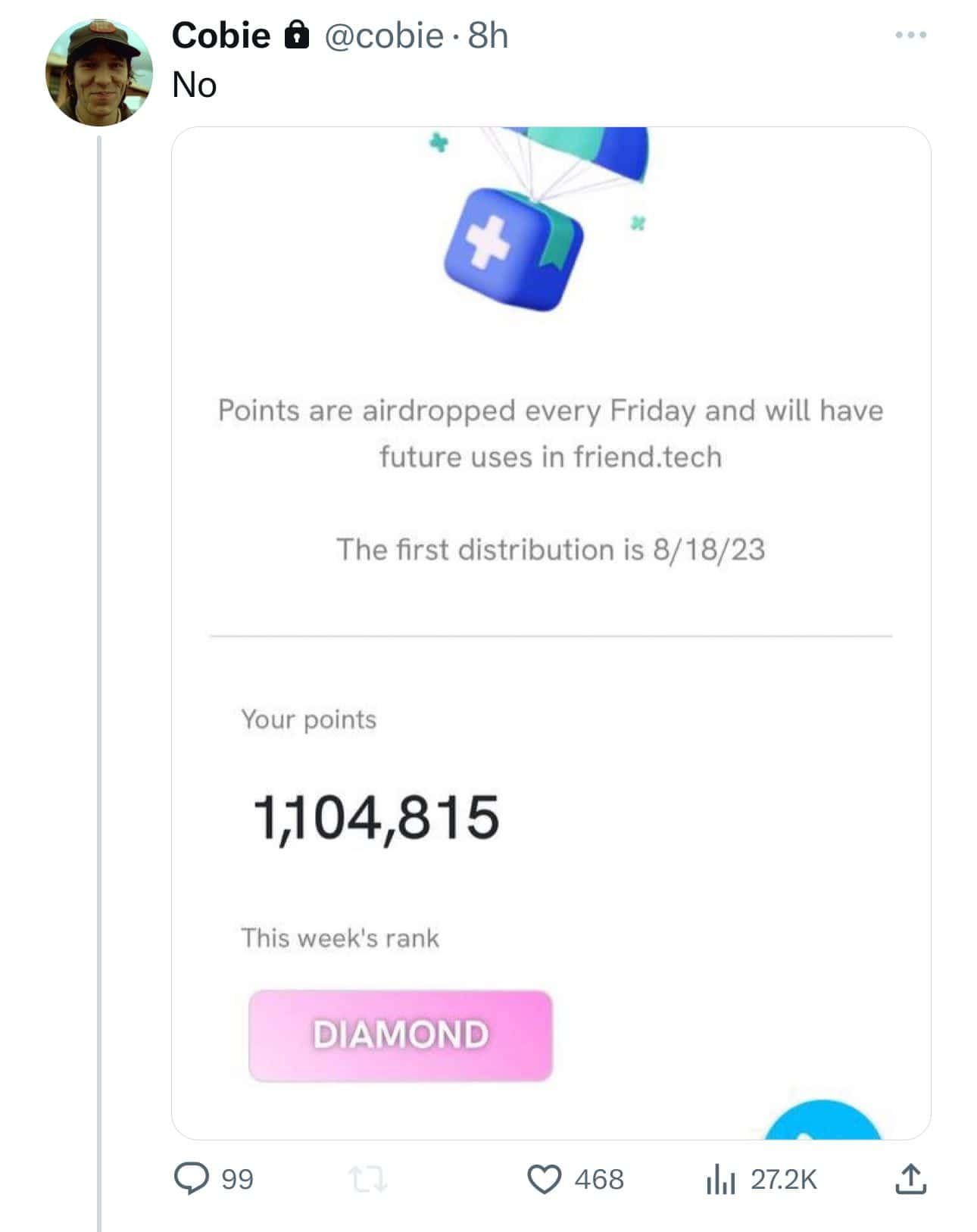

As for the qualification, Friend.tech announced on Aug. 15, 2023, that 100,000,000 points would be distributed to the beta app testers over a period of six months.

It will be interesting to see what these points mean by the end of the invite-only beta period. Speculations are rife that these could be saleable points.

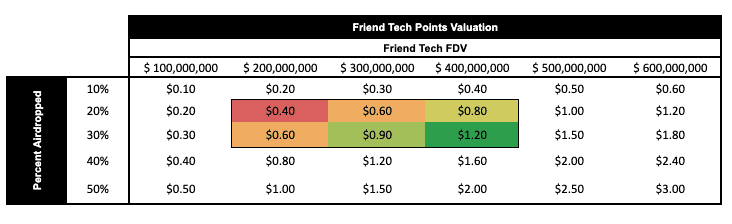

Possible airdrop value?

Let us dive deeper into what these points could mean, assuming Friend.tech generates a fully diluted value of $200 million over the next six months.

Notably, over 3 million in fees was generated in under two weeks. Also, buying and selling shares on Friend.tech generated 1 million in fees in less than 24 hours from its launch. That makes the $200 million figure in 6 months a realistic proposition.

Now assuming that 30% of the FDV is airdropped to the users as points, Friend.tech might give away $60 million to users. And with 100 million points to work with, each point could be valued at $0.60.

Now imagine what would be the earning potential for the likes of Cobie, profiles that already have close to 1.2 million points.

The airdrop schedule started on Aug. 19, 2023, benefitting 44,000 users in the process. Friend.tech will airdrop points to eligible users every Friday.

But what makes a user eligible?

The process is simple. You need to be on friend.tech first! Once you are inside, you can start by buying your share, which will allow people to buy additional shares, 5% of which will return to you. You can even trade other profiles to push up your transaction volume.

You can even send out three of your invite codes to accrue additional points.

What’s good about Friend.tech?

There are a few good things about Friend.tech — and no, we aren’t talking about the money the platform has to offer. Friend.tech simplifies the web3 UI miraculously. Firstly, once you make the deposit, no signatures are required to initiate transactions. Entering the app once is all you need.

Another good thing about Friend.tech is that you need not install the app from the Play Store or the App Store. It simply works as an app without elaborate downloads and installs.

The pros seem to be rubbing off with Friend.tech recording a higher number of daily transactions like Optimism — one of Ethereum’s more popular layer-2 networks.

Security and privacy concerns: Friend.tech cons

A number of several security and privacy concerns have cropped up surrounding Friend.tech. Let’s take a look at a few:

Privacy concerns

The first one stems from its Twitter (X) linking requirements. As your X account might be a popular interface for hackers to use, it is better to head over to the settings and security and disconnect “X” from the connected app module. Many users have also tweeted about disconnecting Twitter accounts for the sake of improved privacy.

However, this concern came to the fore after a “Leaked Database” fiasco associated with Friend.tech was misreported. The DeSo platform later clarified that there was no leak, and all the information was scrapped and put together and was already publically available.

Also, for now, accessing Friend.tech is only mobile-specific. Your smartphone might contain sensitive information, and giving access to it via a new app might not be prudent.

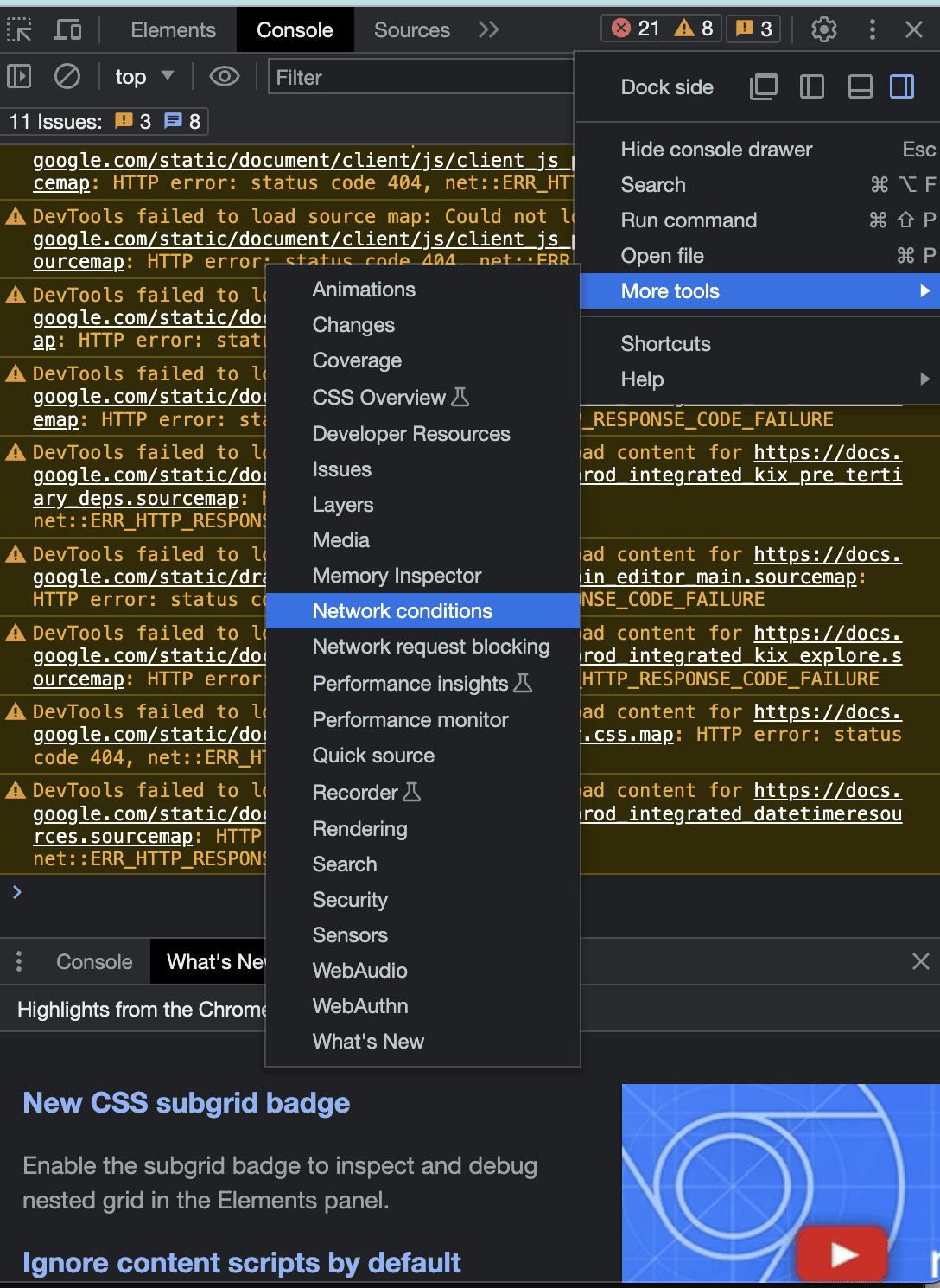

A workaround is to use Friend.tech on a PC by tweaking a few things. If you are on Mac, press “Option + Command +I” simultaneously to open developer tools. Once there, follow the instructions per the image, uncheck the “Use browser default” option, and select “Android device” as the makeshift version to activate the browser to be Friend.tech compatible.

Here is a detailed set of instructions in case you want a deeper dive:

Security concerns

Co-founder credentials also seem questionable as Shrimppepe, one of the names associated with the project, was allegedly tangled in the murky space of security fraud.

Also, Shrimppepe and 0xRacerAlt were associated with a failed NFT project — Kosetto.

Here is a tweet that reveals something alarming:

Another concern was notably explored by Cygaar — a software engineer with a massive Twitter (X) following. Cygaar back-engineered the backend to highlight a few genuine concerns:

- The API setup reads prod-api.kosettoo.com, which seems to be a repurposed version of the one associated with the older project. This seems to validate our previous concerns.

- There isn’t any “bot” protection on the backend, which might not be good considering the chances of inflated share prices. Employing bots to front-run purchases can lead to rug pulls in the future.

- The wallet keys still reside on Friend.tech’s server, which is partially custodial and might be prone to hacks.

Here is the detailed thread for your reference:

And finally, if you head over to the website, there is no account of the privacy policy, which might be disconcerting to some.

How to avoid being scammed

To sum it up, here are some of the tips to use the Friend.tech app without getting doxxed or scammed:

- Users can start by disconnecting their Twitter accounts from the app.

- While setting it up on the phone is easy as you only need to tap add to the home screen and get started, we would recommend using the same on the desktop by changing the user agent to Android. This keeps privacy intact.

- Every time you plan to buy and sell shares, look at the spread, number of shares outstanding, and even the buy and sell rates to avoid getting scammed.

- Other digital assets might be cropping up with the growing popularity of Friend.tech. However, we would advise discretion, and right now, the only social token is the user share and not a random token listed elsewhere.

- Friend.tech is built on the Coinbase-specific Base chain, which is one of the layer-2 networks of Ethereum. And to move ETH to a wallet address of layer 2 networks, you need to pay gas fees. Therefore, do not fall for scams or offers that tell you to onboard in return for zero gas fees.

- Try using an anonymous email to register.

- Fund the base wallet from a new and fresh wallet.

What is the future of Friend.tech?

Friend.tech is a cool concept. However, we have seen that crazes fizzle out quickly in the crypto and web3 space. Remember Ordinals, PEPE, Reddit NFTs, and other innovations. Yet, Friend.tech hinges a lot on creator economy and social tokenization, ensuring that if creators produce relatable and good content, their shares might remain in demand.

Regardless, it will be interesting to see if Friend.tech adds new features into the mix, like tipping, to make the process more utilitarian. That said, the share pricing mechanism still looks a tad sketchy, as it tempts users to keep buying and selling their shares, only to spike the prices and earn trading fees in return. While the pricing model doesn’t look completely sustainable, investing in a creator itself seems rewarding and future-facing.