A comparison of Dogecoin and Bitcoin may seem a little odd from certain vantage points. Bitcoin, the world’s first cryptocurrency, was designed to challenge the global financial system, while Dogecoin began as a meme-themed joke. However, Dogecoin has since evolved beyond its origins to emerge as a crypto with potential. Besides, it has been financially rewarding for investors, just as Bitcoin has been. So, with that in mind, comparing DOGE and BTC isn’t exactly a case of apples and oranges — and that’s exactly what this guide sets out to do.

KEY TAKEAWAYS

➤ Bitcoin is a deflationary asset with a 21 million supply cap, while Dogecoin is inflationary.

➤ Dogecoin processes transactions faster and cheaper, but Bitcoin offers stronger security and decentralization.

➤ Bitcoin dominates in market cap and institutional adoption; Dogecoin benefits from strong community backing and wide accessibility.

➤ Both coins show growth potential but require careful risk assessment due to high volatility.

What is Bitcoin (BTC)?

Before we get any further in the Dogecoin vs. Bitcoin comparison, let’s first quickly skim through what both these assets are all about.

➤ Bitcoin (BTC) was created in 2009 by an elusive creator who goes by the pseudonym Satoshi Nakamoto. To this date, nobody seems to know who the person or group behind that pseudonym is — although there are speculations and even misleading claims that could give you secondhand embarrassment.

At its core, Bitcoin is built on a pretty simple concept. It is a decentralized digital money or asset that can be sent or received peer-to-peer (p2p) over the internet. And by “decentralized,” we mean it is independent of any third party, including central banks and governments.

Bitcoin is nothing like anything that came before, evident by the massive Bitcoin adoption, including digital payment services such as PayPal or Venmo, which still depend on the legacy financial infrastructure for facilitating transactions. Its key properties can be surmised along the following points.

Key characteristics of Bitcoin

- Each transaction involving BTC is recorded and tracked on the Bitcoin blockchain using blockchain technology.

- A blockchain is similar to a bank’s ledger, i.e., a comprehensive log of customers’ funds, where it is coming in from and going out, etc. The Bitcoin blockchain also records every translation ever made using BTC. The only difference is that a blockchain is digital and decentralized, which means it is distributed across the entire network. All participants in the network are collectively in control of it (rather than any single company, government, or entity). That makes it practically immune from any effort to rig, manipulate, or assume total control over the network.

- Because Bitcoin is decentralized, any two people, regardless of their whereabouts, can send BTC to one another directly without involving a bank or other financial institutions. Bitcoin, therefore, is at the very core of peer-to-peer transactions.

- Bitcoin’s total supply is capped at 21 million, which makes it an inherently deflationary asset.

- You do not necessarily have to buy an entire bitcoin to add the asset to your portfolio. You can buy just a fraction of one.

What is Dogecoin (DOGE)?

Dogecoin was launched in 2013 as a joke by software developers Billy Marcus and Jackson Palmer. They were online buddies from Reddit but had never met each other in person.

➤ Marcus and Palmer combined two of the most popular online trends 2013 — the still new but ascendant cryptocurrency Bitcoin and the popular “Doge” meme featuring a Shiba Inu. However, to their surprise, DOGE became almost an instant hit among a good chunk of crypto enthusiasts and investors from all over the world.

In fact, it took the meme-themed coin’s website (www.dogecoin.com) less than a month to score its first 1 million hits. Despite its beginning as a joke, DOGE is a full-fledged cryptocurrency with its own blockchain and mining system.

A big part of DOGE’s initial success can be attributed to a very active Reddit community. The Dogecoin subreddit was teeming with subscribers who would send DOGE back and forth to keep the transaction volume up. They would also share and exchange information on DOGE while encouraging fellow crypto enthusiasts to join the DOGE community.

Also, for the vast majority of the coin’s existence, DOGE was priced at just a fraction of the penny. The relatively low price of the coin, coupled with its abundance, also helped fuel adoption.

What gives DOGE value?

The value of all assets — digital or conventional — is determined by market dynamics. DOGE is not an exception to that reality, and its value is inherently based on supply and demand.

However, unlike Bitcoin, which is by design a deflationary asset due to its limited supply, DOGE has no such hard cap. Therefore, its demand has to be constantly on the up for it to sustain (and grow) its value. While DOGE has been historically stuck at a fraction of a penny, a real breakthrough came in early 2021 when the price jumped around 7,000%.

What was even more striking is that retail investors alone caused that massive spike after the world’s richest person, Elon Musk, started showering praises on Dogecoin (sometimes at the expense of Bitcoin).

And now that we have the basics out of the way let’s quickly delve into the similarities between the two coins, something that is important for any cryptocurrency comparison explainer.

➤ DOGE can go as high as $2.50 or above by 2030. You can check the detailed Dogecoin price prediction piece for more insights and updated info about DOGE’s prospective price performance.

Similarities between Dogecoin and Bitcoin

The initial development of Dogecoin was based on a lot of copied source code from the core chunks of Bitcoin, Litecoin, and Lucky Coin.

To put things into perspective, Dogecoin is a Lucky Coin fork, which is a fork of Litecoin, which in turn, is a Bitcoin fork. So, you could say that Dogecoin’s source code has copious similarities with that of Bitcoin. On that count, both these cryptocurrencies have a lot in common.

Both these coins use the proof-of-work (PoW) consensus mechanism.

➤ Simply put, PoW is a form of validating transactions, adding new blocks of transactions to the blockchain, and mining new coins by undertaking the mining process. The word “work” in PoW refers to the task of generating a hash (or a long string of characters) that matches the target hash for the current block.

The miner who first finds this hash earns the right to add that block to the blockchain and earn block rewards. This element is what underlines the very existence of the blockchain technology.

Both Bitcoin and Dogecoin have two primary use cases — to transact value and to serve as a store of value. You could use both to make payments for goods and services at crypto-friendly merchants that accept BTC and DOGE. Alternatively, you could also invest in them and hold them over time.

The major differences between Dogecoin and Bitcoin

The key differences between the two coins include:

Dogecoin vs. Bitcoin: Purpose of both coins

As already mentioned earlier, the foundational objectives of both assets were the polar opposite. While Bitcoin aspired to make a real-world impact by making the global financial order fair, inclusive, and democratic, Dogecoin at launch was just a fun project.

No doubt, DOGE has evolved since and is now ranked among the top cryptocurrencies by popularity and market cap. However, due to the nature of its origin, it still has some serious distance to traverse before being as “mainstream” as, say, Bitcoin or Ethereum.

For example, going by the numbers, the vast majority of institutional investors would still prefer investing in Bitcoin rather than investing in a meme coin like DOGE.

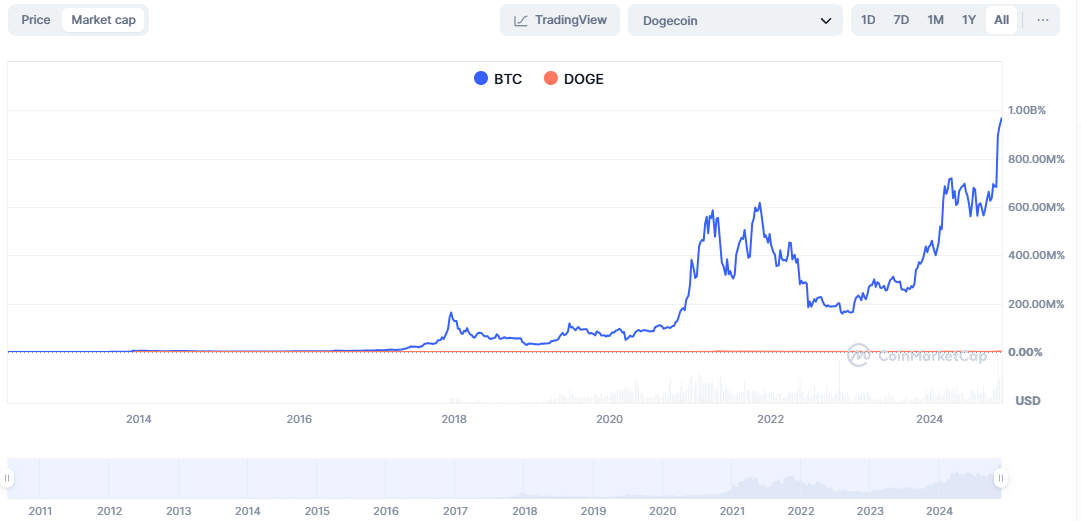

Dogecoin vs. Bitcoin: Market capitalization

At this point, it is not even a contest. Bitcoin is way ahead of DOGE in terms of market cap.

As of Nov. 26, 2024, BTC has a market cap of about $1.85 trillion, as opposed to DOGE’s approximately $59 billion. The gap between the two was even larger for most of DOGE’s history — especially prior to the early 2021 boom when it started hitting one high after another.

Before that, DOGE had not even touched the $1 billion mark. That said, DOGE being the smaller of the two, has more room for growth, and it is possible that the gap between the two would become smaller over time.

Dogecoin vs. Bitcoin: Transaction time

Transaction time is one aspect where DOGE far outshines BTC. The average transaction processing time in the Dogecoin network hovers somewhere around 1 minute. In comparison, the average transaction time, or rather the transaction speed by the Bitcoin network can be as high as 10 minutes, although it can sometimes stretch up to an hour or more.

Also, being a lot more popular than its counterpart, the Bitcoin network sees more traffic and, therefore, is prone to network congestion.

Dogecoin vs. Bitcoin: Supply

The supply-demand dynamics of the two coins are also as different as their market cap or transaction times.

Bitcoin is a fundamental deflationary asset, which means its supply decreases over time. With a lowering supply, the asset’s demand should theoretically grow, which then paves the way for a spike in its price.

There will only be a total of 21 million BTC in existence, of which around 19.79 million are in circulation, as of November 2024. The supply of new BTC (block rewards) reduces by 50% every four years via an “event” known as “halving.” More on that in a bit.

Meanwhile, DOGE follows an inflationary monetary policy due to its (theoretically) infinite supply.

Dogecoin vs. Bitcoin: Halving

A Bitcoin halving event occurs every four years, following which the reward for mining BTC reduces by half. The point of halving is to reduce the fresh supply of coins in a phased manner until the last BTC to enter circulation is mined in 2140.

The last Bitcoin halving event occurred on Apr. 19, 2024, reducing the block rewards from 6.25 BTC to 3.125 BTC. This event follows the pattern of previous halvings in 2020, 2016 and 2012, associated with a notable increase in the Bitcoin price.

The next Bitcoin halving will occur in 2028, reducing the block reward further, which is likely to influence the market due to the reduced supply of BTC.

➤ In contrast, the Dogecoin blockchain has ceased its halving process, meaning miners continue to receive a constant reward of 10,000 DOGE for each block they mine. This ongoing reward system is set to continue indefinitely, differentiating Dogecoin from Bitcoin, where the supply becomes more limited over time.

Dogecoin vs. Bitcoin: Encryption

The proof-of-work consensus mechanism in the Bitcoin network follows the SHA-256 standard. For those out of the loop, the U.S. National Security Agency (NSA) created the SHA-256 standard in 2001. It has since been counted among the most advanced encryption methods.

Dogecoin, meanwhile, utilizes the Scrypt hash method — the same encryption standard you will find in the Litecoin network. While Scrypt is not as state-of-the-art as SHA-256, it compensates for that shortcoming by making mining more accessible to the average user.

This is why mining Dogecoin is much easier and less expensive than mining Bitcoin.

Dogecoin vs. Bitcoin: Security

Prior to joining the big leagues of the crypto space, Dogecoin had a relatively quiet period during which development came to almost a standstill. In fact, it had a grand total of zero (0) developer updates between 2015 and 2020.

However, by 2022, the DOGE community started seeing many more development activities. As a result, updates are now coming a lot more regularly than ever before.

➤ Despite sharing a lot of Bitcoin’s codebase, the security in the Dogecoin network is not quite as tight as that in Bitcoin.

For perspective, the Dogecoin blockchain has a hashrate of 540 TeraHash per second (TH/s) — that’s 540 trillion hashes per second. The corresponding figure for the Bitcoin blockchain, meanwhile, is a whopping 238 ExaHash per second (EX/s) or 238 quintillion hashes.

This is crucial because the stark difference between the hash rates in both networks means it is comparatively a lot easier to carry out a 51% attack on Dogecoin.

For those out of the loop, a 51% attack refers to a scenario wherein a single user or entity takes control of the blockchain network by owning most of its hashing power. At that point, the attacker becomes the de facto controller of the network.

➤ If you are betting big on Bitcoin, do note that its price can go as high as $4,20,248 by 2030. Check out our detailed BTC price prediction piece for more insights and updated info.

Bitcoin vs. Dogecoin compared

| Bitcoin | Dogecoin | |

| Created in | 2009 | 2013 |

| Global crypto market cap (as of Nov. 27, 2024) | $1.91 trillion | $59 billion |

| Coins in Circulation (as of Nov. 27, 2024) | 19.79 million BTC | 143.82 billion |

| Ranking (by market cap, as of Nov. 27, 2024) | 1 | 7 |

| Price (as of Nov. 27, 2024) | $96,000 (approx.) | $0.40 (approx.) |

| Maximum Coin Supply | 21 million | No limit |

| Halving period | 4 years | N/A |

| Block rewards | 3.125 BTC (Till Halving 2028) | 10,000 DOGE |

| Average Transaction Time | 10 mins (approx.) | 1 min (approx.) |

| Encryption standard | SHA-256 | Scrypt |

| Known as | Digital gold | Meme coin |

Dogecoin or Bitcoin: Which is a better investment?

As we move through 2026, it’s clear that both DOGE and BTC present unique benefits and drawbacks. DOGE continues to offer quicker transactions, while Bitcoin remains unmatched in its proven track record as a reliable investment option. Looking at the current scope, the potential for growth in both cryptocurrencies remains significant.

That said, it’s crucial to approach these predictions with caution. DOGE and BTC are known to be highly volatile, which is why it’s important to conduct thorough research and consider your risk tolerance before making investment decisions.

Disclaimer: This content is for informational purposes only and does not constitute investment advice. Cryptocurrency markets are highly volatile, and investing in them involves significant risk. Always conduct your own research and consult a qualified financial expert before making any investment decisions.

Frequently asked questions

Both these cryptocurrencies have their fair share of advantages and disadvantages. Transaction time is one aspect where DOGE far outshines BTC. However, Bitcoin offers stronger security and decentralization. Bitcoin dominates in market cap and institutional adoption; Dogecoin benefits from strong community backing and wide accessibility. Please refer to the chart above for a quick comparison.

Dogecoin is more efficient than Bitcoin in terms of transaction time and fee. Dogecoin has a transaction per second (tps) rate of about 33, while Bitcoin’s is about 7 tps. However, Dogecoin is less secure than Bitcoin and that’s a very important consideration too.

Bitcoin is comparatively a lot more secure than Dogecoin. While the former has SHA-256 encryptin standard and a hash rate of 238 EX/s, Dogecoin uses Scrypt enryption and has a hash rate of 540 TH/s.

No, they are both cryptocurrencies, but they are not the same thing. Dogecoin is a meme coin, while Bitcoin is often considered a store of value. They may have similarities in terms of design, but they are very different in the eyes of investors.

Bitcoin was created in 2009 as the first decentralized cryptocurrency, primarily being a digital currency and a store of value. It aims to enable secure, peer-to-peer transactions globally without needing a central authority. On the other hand, Dogecoin started in 2013 as a playful alternative to traditional cryptocurrencies, inspired by the “Doge” meme. Though it also facilitates peer-to-peer transactions, Dogecoin was not initially intended to be taken as seriously as Bitcoin. However, it has since garnered a significant community and use cases, often emphasizing tipping and charity in online communities.

Dogecoin typically offers faster transaction times and lower transaction fees than Bitcoin. This is partly because Dogecoin uses a different mining algorithm (Scrypt) than Bitcoin (SHA-256), which affects how transactions are processed and blocks are added to the blockchain. Bitcoin’s block time is about 10 minutes, while Dogecoin’s is around 1 minute, making Dogecoin transactions faster on average. Additionally, the transaction cost is generally lower with Dogecoin than with Bitcoin.

Bitcoin’s mining process is energy-intensive, primarily due to its proof-of-work consensus mechanism, which requires substantial computational power. This has raised concerns about its environmental impact, particularly carbon emissions. Dogecoin, while also using proof-of-work, has a less intensive mining process compared to Bitcoin, resulting in a relatively lower environmental footprint. The differences in blockchain technology between Bitcoin and Dogecoin also contribute to their respective environmental impacts.

Bitcoin’s scalability is limited by its block size and transaction speed, leading to potential network congestion. Various solutions, like the Lightning Network, have been proposed and implemented to address these issues. Dogecoin, with faster transaction speeds and lower fees, handles scalability better in the short term, but its infinite supply and less robust security measures might pose long-term challenges. Both cryptocurrencies use blockchain technology, but their different use cases and approaches to scalability highlight the importance of peer-to-peer transactions and efficient mining processes in maintaining network performance.