What if we told you there was a dual-layered blockchain project focusing on building universal applications? One chain that can seamlessly shift between layer-1 and layer-2 without losing efficiency? If it sounds too good to be true, it’s time to learn about the Nervos Network — an innovative blockchain scaling solution. This CKB price prediction will consider the potential of the Nervos Network while assessing the future value of its native utility coin.

KEY TAKEAWAYS

➤Nervos Network combines layer-1 and layer-2 blockchains for universal application compatibility.

➤CKB price predictions project significant growth, with potential ROI reaching 1171% by 2030.

➤PoW mechanism, strong roadmap, and investor support position Nervos Network as a notable project.

- Nervos Network (CKB) long-term price prediction

- CKB price prediction using technical analysis

- Nervos Network (CKB) price prediction 2024 (concluded)

- Nervos Network (CKB) price prediction 2025

- Nervos Network (CKB) price prediction 2030

- CKB price prediction using fundamental analysis

- How accurate is the price prediction model?

- Frequently asked questions

Nervos Network (CKB) long-term price prediction

Outlook: Bullish

Below are the yearly price prediction points up to 2035.

| Year | | Maximum price of CKB | | Minimum price of CKB |

| 2024 | $0.002 | $0.01 |

| 2025 | $0.03258 | $0.01400 |

| 2026 | $0.05372 | $0.0333 |

| 2027 | $0.06983 | $0.0349 |

| 2028 | $0.10475 | $0.0649 |

| 2029 | $0.12570 | $0.09804 |

| 2030 | $0.192 | $0.1190 |

| 2031 | $0.240 | $0.187 |

| 2032 | $0.312 | $0.193 |

| 2033 | $0.468 | $0.365 |

| 2034 | $0.655 | $0.393 |

| 2035 | $0.983 | $0.766 |

Note that the average price of CKB tokens for any year might float between the maximum prices.

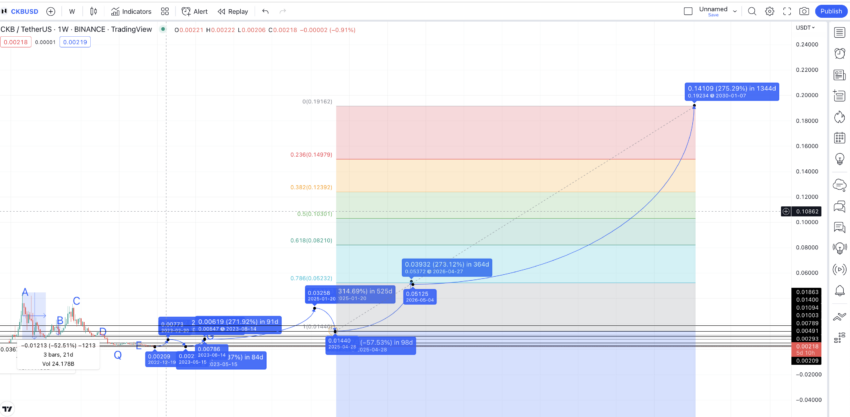

CKB price prediction using technical analysis

Now, let’s shift to technical analysis. We started checking for patterns in 2022, and here is the updated chart, primed for 2025. Do note that the 2022 pattern still holds.

Let us begin with this raw weekly chart and try to locate a pattern from the 2022-2025 chart:

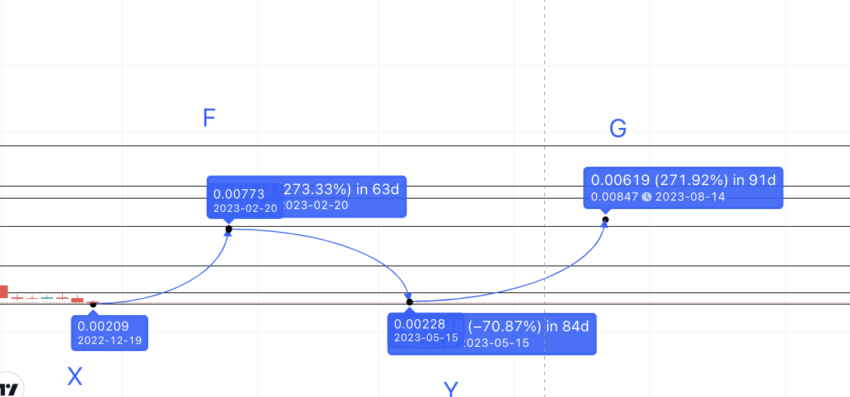

We can see a clear pattern where a low is followed by a high, and so on. Note that the highs are alternates: one higher high followed by a lower high and a higher high. However, E is the only exception as a lower high after D. This can be due to the massive CKB sell-off post the unlock event.

The lows till P were higher lows, signaling some strength at the CKB counter. However, since the coin unlocking event in May, the prices dipped, forming a new low at Q and then recently at X.

In our Nervos Network price prediction model, we assume that the market conditions might change. A new high above E might show up, furthering the old and relatively successful pattern.

Price Changes

Outlook: Bullish

For deciding on the next high, we shall plot the distance and price difference between the previous lows and the subsequent highs.

Here is the data for the same:

M to A = 63 days and 804.37% price change; N to B = 49 days and 191.85% price change; O to C = 56 days and 225.03% price change; P to D = 35 days and 39.53% price change; Q to E = 91 days and 104.44% price change.

Now the average distance from the next low to the next high comes to 59 days and 273%.

On plotting the same from X (assuming it is the current low), we get the next high at $0.00781. This is justified as it coincides with N, one of the higher lows from the old pattern. This means there is strong resistance at this point.

Nervos Network (CKB) price prediction 2024 (concluded)

We moved back to the weekly chart and plotted the next high from Y. Also, as Y was higher than X, CKB should have successfully defeated the lower low pattern by then.

As CKB was already trading at $0.015 at the time of writing, we expected the prices to go as high as $0.02 in 2024.

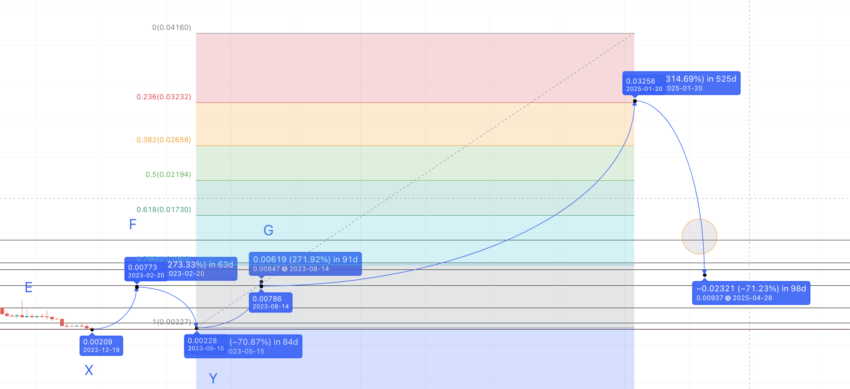

Nervos Network (CKB) price prediction 2025

Outlook: Bullish

We can use the Fib indicator to connect the low Y and the new high (say G) and plot a CKB price prediction for 2025.

The current slope puts the price of CKB at $0.03258 for 2025. The low can be at a 71% drop from the high and somewhere within the 100-day mark — according to data set 2.

However, the strong support line at $0.01400 (coincides with D — one of the peaks) could keep the price of CKB from falling lower than that.

Nervos Network (CKB) price prediction 2030

Outlook: Bullish

The low in 2025 may steady itself at $0.01440 or even $0.01863 (another strong support level). If so, we can expect prices to increase aggressively in the years to come.

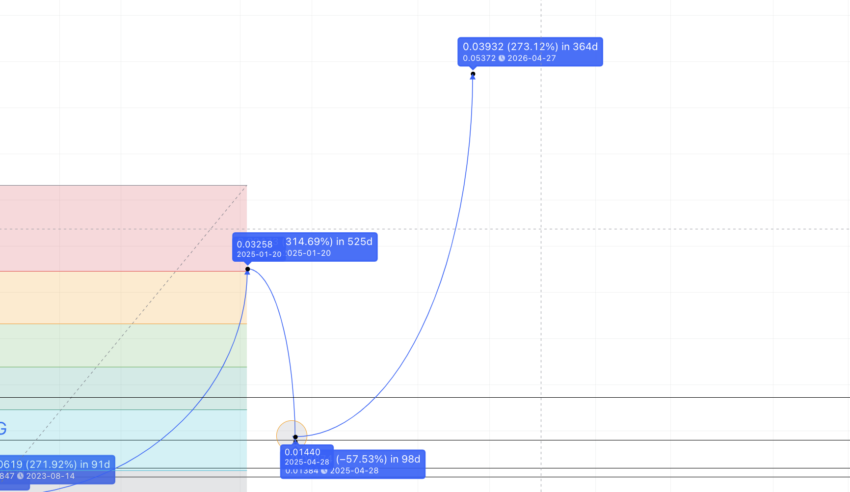

The next high, perhaps in 2026, can be at a 273% peak from the 2025 low of $0.01440. We have purposefully kept it at 364 days for the sake of clarity. If Nervos Network lives on this long, we can expect a 273% move from the previous year’s low. So the high in 2026 can be anywhere close to $0.05372.

By that time, the price of CKB tokens would be at their all-time high levels.

If we again connect the Fib levels using the lows and highs, the CKB price for 2030 surfaces at $0.192. Do note the slope of growth till 2030 remains the same as before.

Here is what the CKB price prediction path might look like if we zoom out:

Projected ROI from the current level: 1171%

CKB price prediction using fundamental analysis

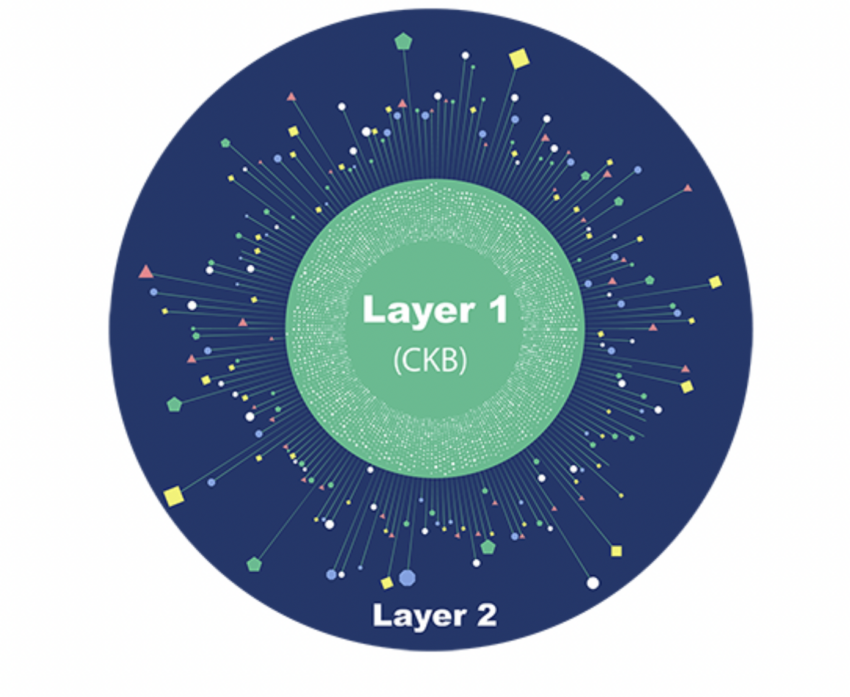

The Nervos Network is two blockchain layers paired as one. Here is what a simple version of that might look like:

Did you know? The Nervos network supports smart contracts, can host DApps, and follows a mineable, proof-of-work consensus.

Here are some Nervos Network insights to help us consider the possible fate of CKB going forward:

- CKB is deployed as a form of compensation meant to incentivize the resources to keep the network safe.

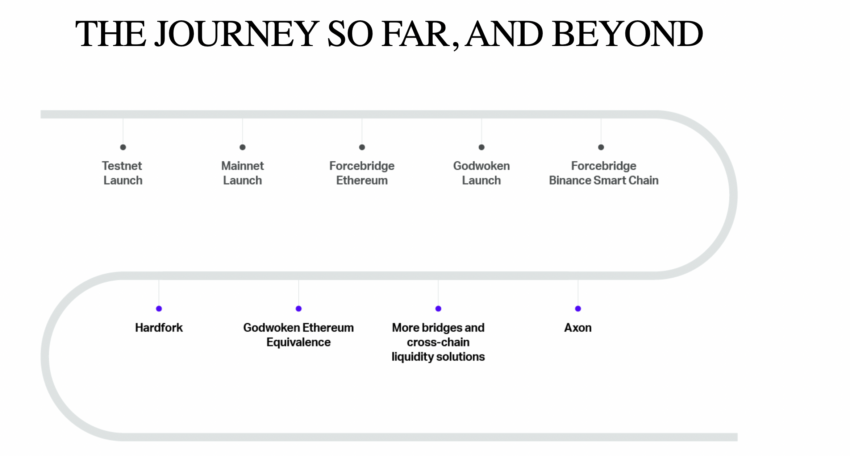

- It has a very tech-heavy roadmap focused on bringing cross-chain bridges, custom chains via a new Muta framework, and a layer-2 sidechain named Axon. There’s even a DEX template. Axon is already alive and kicking.

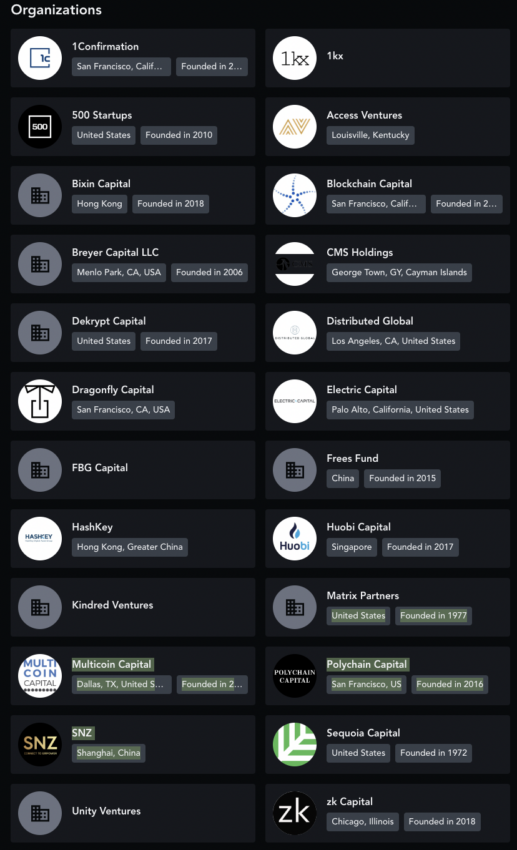

- The Nervos ecosystem has a celebrated lineup of investors.

The project looks strong, and the PoW consensus mechanism makes the Nervos network even more desirable since Ethereum moved away from mining.

How accurate is the price prediction model?

The CKB price prediction model takes fundamentals, on-chain metrics, and even sentimental factors into consideration. Even with the technical analysis, we’ve considered several factors, including patterns, calculations, short-term momentum, and key resistance and support lines. Therefore, you can expect these Nervos Network price forecasts to be reliable and practical. Regardless of the projections, the price of the Nervos Network (CKB) can vary with the broader crypto market conditions.

Disclaimer: This analysis covers Nervos Network (CKB) and is for informational purposes only. Cryptocurrency investments, including CKB, are volatile and risky. Always DYOR and consult a financial advisor before investing.

Frequently asked questions

Does CKB have a future?

What will CKB be worth in 2030?

What price can CKB reach?

Is CKB coin a good investment?

Is Nervos on Ethereum?

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.