Bitcoin has had its fair share of forks. Bitcoin Private, Bitcoin SV, and Bitcoin Cash, to name just a few. This Bitcoin Gold price prediction looks at one of the better-known Bitcoin spin-offs — Bitcoin Gold or BTG. Is BTG a good investment? We take a closer look at the fundamentals, token economics, and key metrics of this proof-of-work protocol in this Bitcoin Gold price prediction.

NOTE: This article contains out of date figures and information. It will be updated with fresh analysis for 2025 and beyond in the New Year. In the meantime, please see our Bitcoin Gold price prediction tool for the most recent, data-informed projections.

- Bitcoin Gold price prediction and fundamental analysis

- Bitcoin Gold price prediction and the tokenomics

- Bitcoin Gold price forecast and other key metrics

- Bitcoin Gold price prediction and technical analysis

- Bitcoin Gold (BTG) price prediction 2023

- Bitcoin Gold (BTG) price prediction 2024

- Bitcoin Gold (BTG) price prediction 2025

- Bitcoin Gold (BTG) price prediction 2030

- Bitcoin Gold (BTG’s) long-term price prediction (up to 2035)

- Is the Bitcoin Gold price prediction model accurate?

- Frequently asked questions

This article may be outdated, we suggest you visit our new Bitcoin Gold Price Prediction tool.

Bitcoin Gold price prediction and fundamental analysis

Bitcoin Gold isn’t Bitcoin. It’s not that different, either. Bitcoin Gold came to the fore in 2017 as a Bitcoin fork. It aimed to address the issues concerning Bitcoin’s jarring transaction speeds while maintaining the presence of a digital currency.

Did you know? Bitcoin Gold was created to change Bitcoin’s existing SHA-256 proof-of-work algorithm to Equihash, in an attempt to democratize the mining process.

Bitcoin Gold borrows the sturdiness and security of Bitcoin while opening up newer DApp-specific avenues. And the altchain even introduced a new PoW algorithm to combat the scalability problem that Bitcoin occasionally runs into.

Its native coin, BTG, works as a standard digital currency but even has voting and governance-centric exposure — making blockchain development more probable. It was one of the few Bitcoin forks to have received institutional attention, making this Bitcoin Gold price prediction timely and appropriate.

“Bitcoin -> Bitcoin (FOREVER) Still If you need another version of Bitcoin then FORK it!”

Kashif Raza, Founder of Bitinning: X

And Bitcoin Gold is doing relatively well, passing the 1 million on-chain transactions mark. Plus, Bitcoin Gold is about the slogan: “One CPU, One Vote.”

Bitcoin Gold was never meant to compete with Bitcoin. It was introduced to add a slew of experimental features to the ecosystem, making it more scalable. And if Bitcoin’s dominance increases over time, we might also see Bitcoin Gold looking up.

Bitcoin Gold price prediction and the tokenomics

As it is derived from Bitcoin, the Bitcoin Gold tokenomics model is similar to the original blockchain. There is a fixed supply of 21 million BTG coins. At present, 83.40% of the same comprises the circulating supply. Moving to the token holding pattern, 30% of the fixed supply is dedicated to the project development, whereas the community and the ecosystem get 15% each.

And while not every token is meant to be shelled out as a mining reward, the token economics still looks transparent and ecosystem- and development-focused. Plus, it has a decreasing issuance, making it disinflationary for now.

Bitcoin Gold price forecast and other key metrics

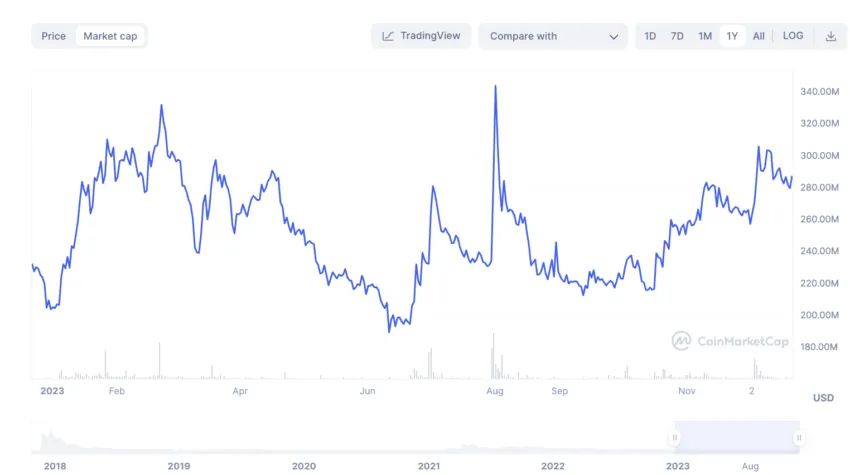

If you plan to invest in BTG, you must account for the price volatility. As of early 2023, the volatility was increasing, making higher highs. Even though the prices are increasing, the rise in volatility led to near-term consolidation.

As of December 2023, the volatility metric seems to have bottomed out and is on the verge of forming a lower high. This augers well for the price action in the short term.

Social chatter surrounding Bitcoin Gold has increased from November 2022 onwards. As per December 2023 data, the prices started surging in response to the increase in social volume. Therefore, following Bitcoin Gold across all social channels is advisable if you are looking to gauge possible price hike opportunities.

If you look at the more recent social volume data, there has been a surge from August onwards, which is a good sign for the price action.

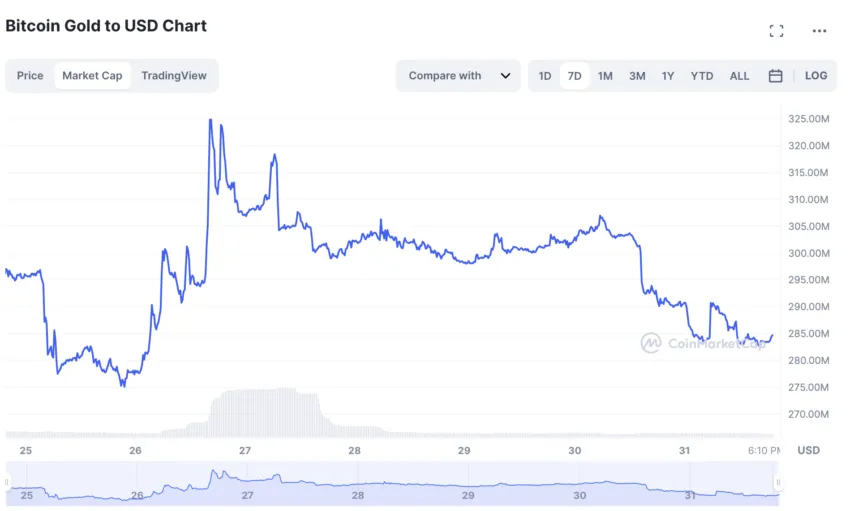

The seven-day market cap chart of Bitcoin Gold shows that both trading volume and market cap levels have dropped considerably as of Jan. 31, 2023. The drop in trading volume is more drastic, meaning fewer BTG coins are being traded, leading to more price volatility. The more recent market cap chart is hinting at an increase in trading volume and price strengthening, courtesy of the formation of higher highs.

Overall, the metrics indicate that there might be some price consolidation in the near future for BTG. Yet, an increase in social presence and chatter might be able to offset that.

Bitcoin Gold price prediction and technical analysis

We shall now go pattern hunting, using our Bitcoin Gold price prediction model to identify future price levels of BTG.

Short-term price prediction: early 2023

Our short-term price prediction of BTG was successful as it broke past the same in August to chart a $19 high. Read on for our detailed analysis:

The daily chart shows BTG has broken down from the ascending wedge pattern, which is mostly bearish. If we draw the Fib lines using the previous swing low and the crucial rejection level at a high, it looks like there is some strong support at $15.63.

The price dip was expected as the daily RSI formed a bearish divergence. In the previous segment, we mentioned volatility and a price consolidation, which is ongoing as per the daily chart.

Also, the chart shows a green wavy line trading under the blue line. If the green line (50-day moving average) crosses above the 100-day moving average (blue line), we might see the fate of BTG reversing.

Let’s look at the weekly chart to identify patterns for long-term Bitcoin Gold price prediction.

Our December 2023 analysis

The BTG/USD daily chart shows the formation of a small cup and handle pattern. In case the volume surges and the bullishness holds, the level for breach for BTG is $19, after which we can expect it to start moving toward the 2024 price prediction level.

Pattern identification

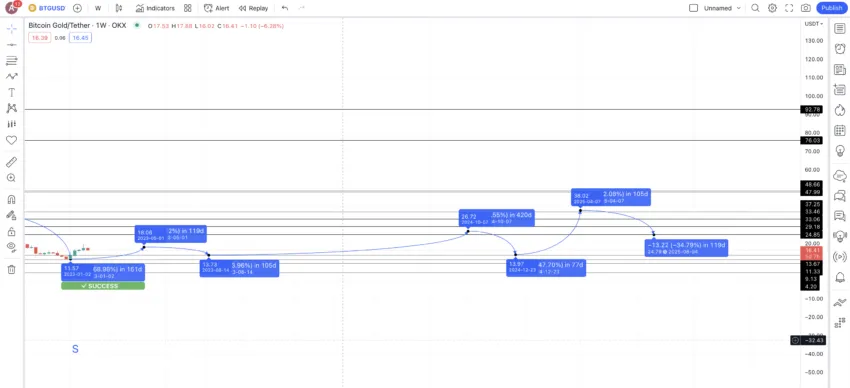

BTG’s weekly price chart shows a clear pattern emerging. A couple of highs lead to the peak, after which there is a steady price decline courtesy of lower highs.

Here are all the points marked for your reference:

Do note that if Bitcoin Gold breaches its previous high — G to be precise — this pattern might end, and a new one with an eye towards the peak may start.

Price changes

We have all the crucial levels in sight. Now we need to locate the price change percentages and time taken from one point to the other, for lows to highs and vice versa.

Using the data from the provided tables, we can identify and analyze the average price percentages and timeframes for both high-to-low and low-to-high transitions. For the high-to-low average, we observe a significant decrease of -71.40% over a span of 106 days. Conversely, the low-to-high average shows a remarkable increase of 759.04%, which occurs over a slightly longer period of 119 days. With these values in hand, we can plot and predict future price patterns based on these observed trends.

Bitcoin Gold (BTG) price prediction 2023

Our 2023 Bitcoin Gold price prediction level was successfully breached. Read on for our approach.

If G is the last point on the chart, we can expect the drop or the next low S to follow the high-to-low average of -71.40%. The timeframe can go as high as 287, per data from Table 1.

But there was a low point in early 2023. And that low surfaced at a 70% drop from G and in 161 days — successfully aligning with our projections.

From this point, S or $11.57, we can expect the next high to the peak. Yet, considering the chances of an upcoming consolidation, we might have to settle for a minimum up move of 56.78% — from table 2. The time taken can be 119 days, per the average.

Therefore, the Bitcoin Gold price prediction for 2023 might surface at $18.06.

Also, the next average minimum price could drop as much as -71.40%, but Bitcoin Gold has strong support at $13.67. This could be the level where the next drop surfaces. Hence, the minimum price prediction for 2023 remains $11.57.

Bitcoin Gold (BTG) price prediction 2024

Outlook: Bullish

The next high could surface at the peak of 94.45% — the second lowest price percentage hike in table 2. This could be due to the growing strength of the broader crypto market.

Therefore, in the next 420 days (we used the maximum distance using table 2), the next high might surface at $26.72 by the end of 2024.

The low from this point could surface anywhere between 35 days to 287 days, per the levels mentioned in table 1. Therefore, we can expect the minimum price of BTG in 2024 to surface at $13.97 by the end of 2024.

Projected ROI from the current level: 63%

Bitcoin Gold (BTG) price prediction 2025

We can expect BTG to have a different growth trajectory from this level. The 2024 high, if reached, should be higher than our 2023 high projection. This would defeat the lingering lower high pattern and push the same towards a higher high and in an uptrend.

The price peak percentage could now be the third lowest level of percentage growth or 172.46%. This places the high at $38.02 by mid-2025.

The next low could surface higher than the low in 2024. The support line above the last low holds at $24.85 — which could be the 2025 low for Bitcoin Gold.

Projected ROI from the current level: 131.68%

Bitcoin Gold (BTG) price prediction 2030

Outlook: Bullish

From the last low or that in 2025, the next high could be as far as 219.12% (fourth lowest percentage value from table 2). The time taken for such a move could be high and can take 420 days even. This places the 2026 high for Bitcoin Gold at $79.13.

Using the 2025 low and 2026 high, we can draw the Fib levels till 2030 and project the future price accordingly.

If we retrace the same path, we can see Bitcoin Gold going all the way up to $267.43 by the end of 2030.

Projected ROI from the current level: 1529%

Bitcoin Gold (BTG’s) long-term price prediction (up to 2035)

Outlook: Very Bullish

We now have the long-term future price of Bitcoin Gold till 2030. However, we can use the same calculations to trace the path till 2035. The table shows the price BTG coin is expected to reach through 2035, per current market conditions.

Note: The BTG coin price level, each year, might vary, depending on the sentiments surrounding the crypto and even broader financial market conditions.

You can easily convert your BTG to USD here

| Year | Maximum price of BTG | Maximum price of BTG |

| 2023 | $19.64 | $10.82 |

| 2024 | $26.72 | $13.97 |

| 2025 | $38.02 | $24.85 |

| 2026 | $79.13 | $49.06 |

| 2027 | $106.82 | $83.32 |

| 2028 | $149.55 | $116.65 |

| 2029 | $194.42 | $151.64 |

| 2030 | $267.43 | $208.60 |

| 2031 | $320.91 | $250.31 |

| 2032 | $385.09 | $300.37 |

| 2033 | $500.62 | $390.48 |

| 2034 | $550.69 | $429.53 |

| 2035 | $660.83 | $515.45 |

Is the Bitcoin Gold price prediction model accurate?

This Bitcoin Gold price prediction model is practical and relatable. Firstly, we consider fundamentals and other key metrics before moving to short-term and long-term technical analysis. Plus, our analysis of the price and patterns is data-backed, creating a well-rounded and well-informed Bitcoin Gold price forecast.

Frequently asked questions

What will Bitcoin Gold be worth in 2030?

What does Bitcoin Gold do?

What is Bitcoin Gold’s all-time high?

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.