Decentralized finance has come a long way in the last few years, especially lending and farming. Abracadabra Money offers an innovative approach to stablecoin loaning in the form of borrowed MIM — Magic Internet Money.

The Kashi Lending Technology introduced by SushiSwap paved the way for Abracadabra, allowing the protocol to provide isolated lending markets. This means that lending risks are not shared collectively. As a result, the platform can offer currency pairs not supported by other decentralized exchanges since the platform is not affected when something goes awry. Let’s take a closer look at the magic behind Abracadabra and its tokenized ecosystem.

Want to get reviews on the best crypto projects like Abracadabra Money? Join BeInCrypto Trading Community on Telegram: read reviews, discuss crypto projects, ask for technical analysis on coins and get answers to all your questions from PRO traders & experts! Join now

What is Abracadabra Money?

Abracadabra Money is a DeFi crypto lending platform. It allows users to make money using their interest-bearing assets as collateral in exchange for stablecoin loans. The stablecoins that run the Abracadabra ecosystem are called Magic Internet Money, or MIM. Like all stablecoins, MIM is backed by the US dollar. Further, Abracadabra uses collateralized interest-bearing tokens (ibTKNs) to mint MIM on its multi-chain lending platform and provide users with loans. This is what makes Abracadabra unique.

ibTKNs refer to lent-out cryptocurrencies that slowly accumulate value while the borrower holds them. They are a type of liquidity provider (LP) token. These interest-bearing assets can be in the form of ethereum, USDT, or even USDC that has been deposited into farming pools such as Yearn.Finance. Later, when repaid, the amount will be more than the amount initially borrowed. And this is all done via a lending pool system. Furthermore, Abracadabra is multi-chain, meaning MIM coins can be transferred across multiple blockchains.

How does Abracadabra Money work?

To better understand how Abracadabra Money works, you must first understand how traditional DeFi lending platforms operate. In most cases of yield farming, a user will choose to deposit or stake a liquid asset like USDT, for example. In exchange for this, they receive “illiquid” interest-bearing tokens like yUSDT. While these tokens won’t provide liquidity, they accrue interest over time. So, users are essentially supplying liquid tokens to receive illiquid tokens that will gain more value.

On the other hand, other platforms allow you to do the opposite; depositing a liquid asset like ethereum as collateral in exchange for another liquid asset (as is the case with stablecoin DAI). In this case, you would exchange liquid tokens for another form of liquid token.

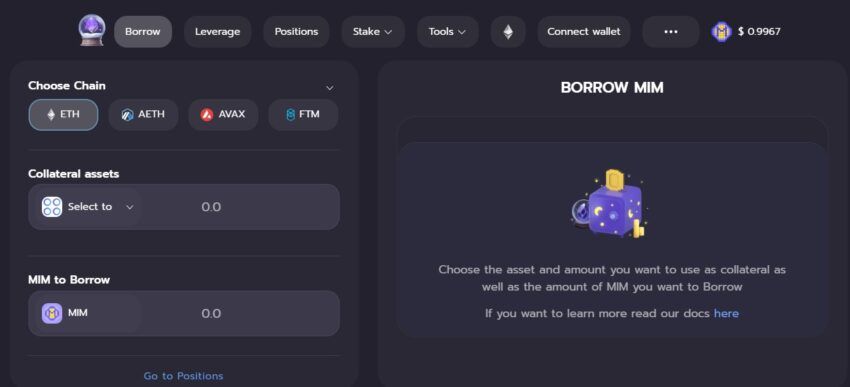

However, Abracadabra Money takes this approach further, allowing users to deposit illiquid tokens that accrue interest over time (ibTKNs) as collateral. In exchange, the platform mints the liquid asset MIM. This allows users to leverage their yield farming positions by making illiquid assets liquid. To illustrate this, the illiquid yvUSDT tokens issued on the Yearn USDT vault can be used as collateral on Abracadabra for a loan. Effectively, the user could borrow up to 90% of the collateralized value and accrue the APY on the original deposit made on Yearn. And this can be done continuously, exchanging MIM back into USDT to deposit back into Yearn for more APY and collateralizing again.

Pros and cons of Abracadabra Money

Like any other decentralized finance platform or lending protocol, there will always be risks. And Abracadabra Money certainly has its perks when it comes to providing leveraged farming opportunities. But the platform still comes with its caveats. It’s always important to consider the pros and cons of any financial project. So let’s take a look.

Pros

- Risk tolerance levels and collateral ratios of assets can be adjusted individually

- Available on multiple major chains

- No hosting costs

- It makes use of otherwise illiquid tokens

Cons

- It may not be beginner-friendly due to technicalities.

- May have risks involved regarding smart contract exploits or bugs

- Possibility of liquidation

Magic Internet Money (MIM) token

The Abracadabra Money platform utilizes two tokens: Magic Internet Money (MIM) and SPELL.

The MIM tokens are yield-bearing stablecoins. And users are loaned MIM in exchange for their interest-bearing asset deposits. Users can collateralize crypto assets to mint MIM on multiple blockchains. These include Avalanche, Arbitrum, Fantom, Ethereum, and Binance Smart Chain. Lastly, when MIM is repaid, the platform burns MIM from the supply, reducing its overall circulation in the market.

SPELL token

SPELL is Abracadabra’s native Ethereum token and the governance and utility token used for incentivization. Further, the Abracadabra Money project is community-governed, and the SPELL tokens are used for voting on platform developments. In addition to governance rights, the SPELL token rewards liquidity providers who provide tokens to the Abracadabra pools. This is all done through yield farming and bonds.

SPELL sits at a current price of $0.0007 and ranks at #286 with a market capitalization of $76,332,263.

Token supply:

- Circulating supply: 107,405,628,969

- Max/Total supply: 196,008,739,620

SPELL tokenomics

The SPELL supply was allocated as follows:

- Liquidity providers incentives: 63%

- Team member rewards: 30%

- SPELL distribution: 7% (supply split evenly between SushiSwap and Uniswap v3)

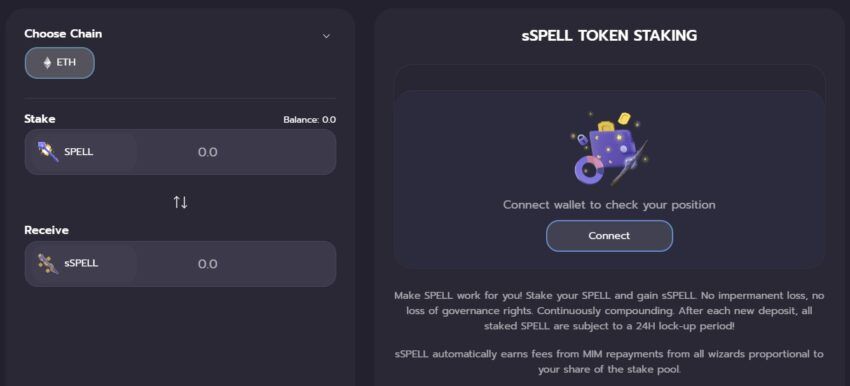

sSPELL Token

To activate the governance rights and rewards, users must stake their tokens. Firstly, Users can stake SPELL to receive eSPELL and earn a portion of interest, liquidation, and borrowing fees. These portions are in direct proportion to the amount of sSPELL one owns. The collected sSPELL fees are automatically restaked by Abracadabra to compound rewards. Once you stake, however, there’s a 24-hour lock.

Abracadabra Money introduces DeFi 2.0

Undoubtedly, Abracadabra Money is innovating the DeFi landscape, introducing DeFi 2.0 to the web3 space. It has provided a lucrative lending system for untapped interest-bearing tokens, which would otherwise be sitting doing nothing. Further, Users are essentially taking the “receipts” from lending platforms and putting them up for collateral to take out loans. And, in effect, their original stablecoins are earning an annual rate. Furthermore, the receipt costs just 0.8% yearly, allowing users to obtain 90% of their liquid money back. The previous 1.0 era of rewarding yield farmers in exchange for liquidity is ending. Now, protocol-owned liquidity is sweeping through the arena, and investors remain bullish.

Frequently asked questions

Can I make money in Abracadabra?

What does Abracadabra Money do?

Who is the founder of Abracadabra Money?

What is Abracadabra SPELL crypto?

What blockchain is Abracadabra Money on?

Who owns Abracadabra?

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.