BeInCrypto comprehensive Latam Crypto Roundup brings Latin America’s most important news and trends. With reporters in Brazil, Mexico, Argentina, and more, we cover the latest updates and insights from the region’s crypto scene.

This week’s roundup features Argentina’s new crypto tax guidelines, Worldcoin’s expansion to the Dominican Republic, and other key stories.

Argentina Introduces New Tax Guidelines for Cryptocurrency Income

Argentina’s Tax Administration has introduced updated guidelines for taxing cryptocurrency income, impacting both domestic and foreign individuals. According to the new rules, gains from the sale of cryptocurrencies are subject to Income Tax, sparking increased interest among taxpayers and analysts due to the evolving regulatory landscape around assets like Bitcoin and Stablecoins.

The tax obligations vary depending on the type of taxpayer. Individuals and undivided estates not considered companies are taxed differently than legal entities. For individuals and estates, the disposal of cryptoassets is classified as second-category income. The tax rate depends on whether the income originates in Argentina or abroad.

For Argentine-sourced income, a schedular tax of 5% to 15% applies, depending on the currency used in the transaction. Taxpayers can also deduct acquisition costs and related expenses, simplifying the declaration of these profits. In contrast, a flat 15% tax is imposed on foreign-sourced income.

Read more: Complete Guide to Filing Cryptocurrency Taxes in 2024

Additionally, income generated from holding cryptoassets on exchanges or through decentralized finance (DeFi) protocols is also subject to taxation under the new guidelines.

As the Latam crypto scene grows, these stories highlight the region’s increasing influence in the global market. Stay tuned for more updates and insights in next week’s roundup.

Binance Gives Cybersecurity Seminar to Mexican Law Enforcement

Binance hosted a cybersecurity and cryptocurrency training seminar for law enforcement officials in Mexico City, as revealed in a press release shared with BeInCrypto. The seminar covered technical concepts and case studies and was attended by approximately 35 investigators from four different agencies.

“It is essential for us as public servants to stay at the forefront of understanding and handling emerging technologies such as cryptocurrencies. The impact of virtual assets on organized crime and other illicit activities requires an advanced response adapted to these new challenges,” said Felipe de Jesús Gallo Gutiérrez, head of the Criminal Investigation Agency.

Read more: Binance Review 2024: Is It the Right Crypto Exchange for You?

This initiative aligns with Binance’s strategic focus on Latin America. In an exclusive interview with BeInCrypto, Global Chief Marketing Officer Rachel Conlan highlighted the region as a key growth area. Last year, Binance launched a crypto transfer service across nine Latam countries, including Mexico.

Worldcoin Expands to Dominican Republic Amid Regulatory Challenges in the EU

Worldcoin, a digital identity and cryptocurrency platform aiming to promote digital inclusion, has extended its services to the Dominican Republic as regulatory pressures push it out of the European Union.

As of October 9, residents over 18 in Santo Domingo can obtain a verified World ID using Worldcoin’s Orb device at three designated locations. This verification allows users to prove their humanity online without revealing personal details.

Worldcoin’s expansion into Latin America is timely, as concerns about artificial intelligence (AI) continue to grow. The rise of AI has heightened fears of blurring the lines between human and AI-generated activity in digital environments, increasing the demand for secure identity verification solutions.

Read more: What Is Worldcoin? A Guide to the Iris-Scanning Crypto Project

A survey conducted by Ipsos in the Dominican Republic revealed that 80% of respondents are concerned about AI’s potential to confuse human and artificial activity. Worldcoin’s offerings could play a critical role in fostering trust in online interactions.

Venezuela’s Cryptocurrency Market Soars 110%

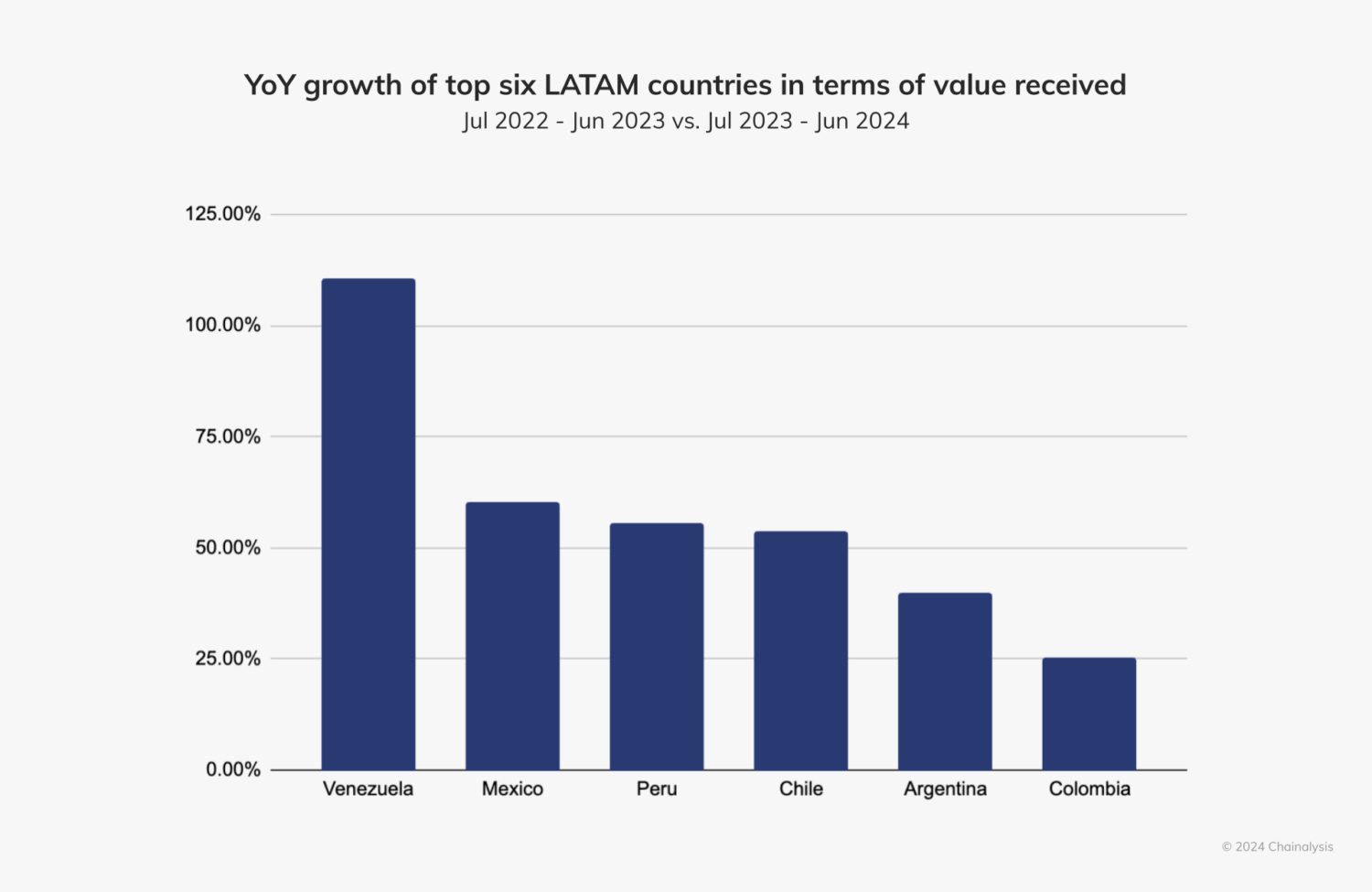

Venezuela’s cryptocurrency market surged by more than 100% during the second quarter of 2024, fueled by a parallel rise in the value of the US dollar, according to Chainalysis’ latest report. The market reached $11.7 billion, reflecting a 110% year-on-year increase, making Venezuela one of the fastest-growing crypto markets in Latin America.

Economic instability, particularly the devaluation of the bolivar, has driven Venezuelans toward cryptocurrencies, with stablecoins becoming a favored option for preserving value. Partial dollarization, where 85% of transactions are made in U.S. dollars, has also contributed to this trend.

“The Maduro regime has recently hinted at a renewed interest in cryptocurrencies without providing concrete plans. Regardless of the outcome of such political developments, Venezuela remains one of the fastest growing crypto markets in Latin America. Venezuela’s year-on-year growth of 110% far exceeds that of any other country in the region,” Chainalysis noted.

Read more: Crypto Regulation: What Are the Benefits and Drawbacks?

However, regulatory uncertainty remains. The restructuring of Venezuela’s crypto regulatory body, SUNACRIP, after a 2023 corruption scandal, has left a void. Despite this, Venezuela is expected to remain a leader in crypto adoption in Latin America, with growing interest in decentralized finance (DeFi) signaling a potential shift toward broader commercial use of cryptocurrencies.

As the Latam crypto scene grows, these stories highlight the region’s increasing influence in the global market. Stay tuned for more updates and insights in next week’s roundup.