Famous crypto influencer, Lark Davis, has listed seven reasons why the cryptocurrency bull market will continue in 2022.

Lark Davis is one of the most well-known cryptocurrency influencers. His YouTube channel is subscribed to by over 473,000 users.

His Twitter account is followed by over 757,000 people. In a recently published series of tweets, he shared 7 reasons why the cryptocurrency rally will continue in 2022.

Among the most important reasons, Lark Davis mentions the upcoming spot ETF for bitcoin (BTC). He also mentions the phenomenon of lengthening cycles, and significant upgrades to the ethereum (ETH) network.

In addition, he mentions bullish expectations for the largest altcoins. He highlights the importance of the NFT market and blockchain gaming. And, directs attention towards institutional investors. Here we go!

1. Spot ETF for bitcoin

The first reason that Lark Davis presents is the long-awaited spot ETF (exchange-traded fund) for Bitcoin.

As reported by BeInCrypto, the first ever ETF for Bitcoin was approved in October. However, it is a fund based on cash-settled future contracts rather than physical Bitcoin from the spot market.

Therefore, the cryptocurrency community is still waiting for an ETF that is directly linked to the spot price of BTC. Currently, the ETF is only linked to paper bets on its future movements.

According to Davis, a spot ETF is likely to be accepted in 2022. Predicting the possible impact on the Bitcoin price, the influencer refers to the analogous situation in the gold market. He states:

“For reference gold had a strong rally before the spot ETF was approved followed by a year of down prices followed by multi year mega rally.”

2. Lark Davis and bitcoin’s lengthening cycles

The phenomenon of lengthening cycles of Bitcoin and the entire cryptocurrency market is already more than a hypothesis.

Historical analysis indicates that each successive BTC cycle has been longer than the previous one, and the significance of the four-year halving rhythm is slowly diminishing. Moreover, the ROI over successive cycles is also diminishing, so hodlers should expect lower returns over time.

Therefore, Lark Davis argues that based on the fact of lengthening cycles, the peak of the BTC price in this bull market will be in 2022.

He refers here to the analysis of Benjamin Cowen, with whom BeInCrypto recently had the opportunity to discuss the same topic. Furthermore, Davis points out that if this happens, “the 4-year cycle theory is dead (likely).”

It is worth adding that Cowen himself points out that there is a chance that the peak of the current bull market will occur even in 2023. In his opinion, each subsequent cycle extends by 1-1.5 years.

3. Ethereum network upgrades

Another important catalyst for the prolonged bull market is the development of the Ethereum (ETH) blockchain.

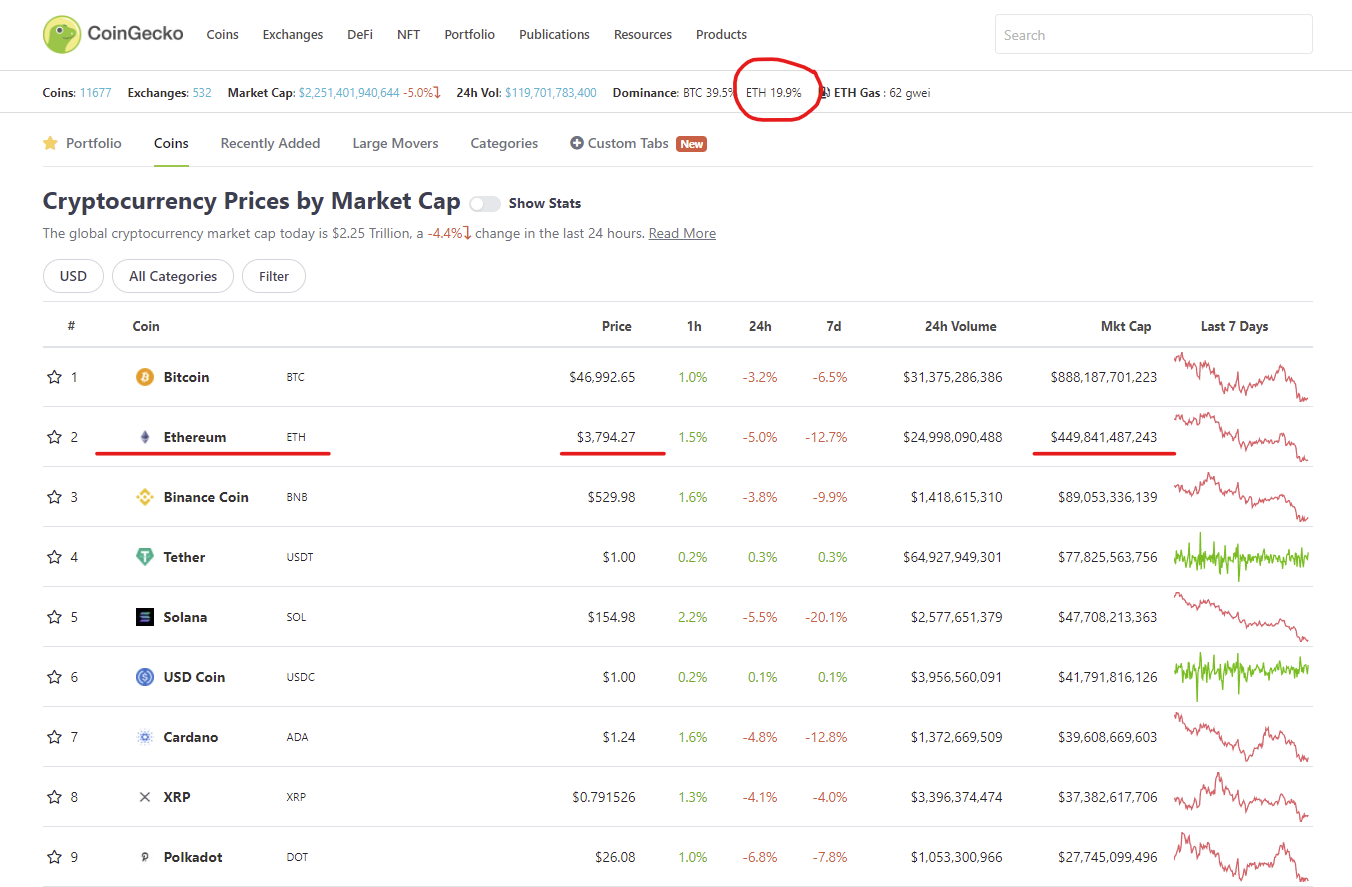

This network is steadily increasing its share of the cryptocurrency market, and at the press time, its dominance is 20%, according to CoinGecko. Moreover, ETH’s market cap of $450 billion already represents more than 50% of BTC’s market cap of $888 billion.

Among the major changes that Ethereum is undergoing, Lark Davis lists: the transition to Proof-of-Stake protocol, triple halving, limited sharding roll out, which is expected to lead to a 3-4 times increase in transactions per second.

The implementation of most of these upgrades is scheduled for 2022, hence the possible extension of the bull market to the actual implementation of these changes. The influencer then adds:

“ETH remains the king of smart contracts, so what happens there has implications for the whole market.”

4. Development of major altcoins

The fourth reason on Davis’ list is the rapid growth of the major alternative blockchain networks to Bitcoin and Ethereum.

The progressive diversification of the crypto market is a healthy sign of a growing and rapidly evolving industry. At the same time, it requires time for sustainable growth. Innovation of the best projects will not slow down in 2022.

At the forefront of dominant altcoins, Lark Davis lists Polkadot (DOT) and Cardano (ADA). Their networks “are coming online which will draw in even more money to the market.”

He adds to this list the development of other layer-2 solutions that have grown rapidly in 2021. These include Avalanche (AVAX), Polygon (MATIC) and Solana (SOL).

5. Lark Davis Sums up the NFT market

The development of the NFT market was very dynamic in 2021. Every week there were reports of new sales records for digital artworks, songs by famous artists or top pieces of CryptoPunks or Bored Apes collections.

In addition, more and more well-known brands are choosing to release their own NFT collections in search of new channels to reach their audiences.

Just this month, BeInCrypto reported that the Bundesliga, Germany’s top soccer league, and Ubisoft, the world’s largest video game publisher, have decided to make similar moves.

Lark Davis highlights the importance of NFT as a gateway to mass adoption of cryptocurrencies:

“NFTs are continuing to capture public interest and brands are moving in heavily. NFTs will be a first access point for millions into crypto.”

6. Video games and the metaverse

The sixth argument for extending the cryptocurrency bull market to 2022 is the development of blockchain-based video games and metaverse projects. Many large projects in this niche are still in development, with major games announced for next year.

This does not change the fact that the price of virtual land in the largest blockchain games is already surging rapidly.

In late November, BeInCrypto reported the sale of a plot of land in Axie Infinity (AXS) for a record $2.3 million. Previously, a plot of land in Decentraland (MANA) was sold for $900k in June this year.

An additional catalyst for the adoption and popularity of blockchain-based video games is the growth of the Play-to-Earn (P2E) sector.

It allows video game fans to indulge in their hobby while earning cryptocurrencies that they can later exchange for local fiat currencies. For example, many P2E sector players in the Philippines make a living from playing their favourite titles.

Highlighting the potential influx of new users and cash into the crypto market in 2022, Lark Davis comments briefly:

“Gaming will bring in tens of millions or more new users. The metaverse is a future multi trillion dollar industry.”

7. Lark Davis: Big institutional money

The final argument for extending the bull market until 2022 is big money from institutional investors.

According to Davis, they are only “starting to figure out that this is the best tech investment class of this decade.” Reports of MicroStrategy’s next big Bitcoin purchases are almost routine by now.

However, Michael Saylor’s company is being joined by other groups of large investors, for example from South Korea.

More and more American cities are introducing the option of paying their salaries in BTC or launching crypto retirement plans. An influx of big money from institutions is predicted by Cathie Wood, according to whom an allocation of just 5% of their funds will push the BTC price to $500,000.

Above all else, Lark Davis points to rampant inflation, which will further strengthen the value of deflationary cryptocurrencies. In conclusion, Davis points out that “the mega bull cycle will likely ‘end’ in 2022.”

He then adds that the next bear market will be “fundamentally different” and encourages profit-taking on the way up.