Jupiter Asset Management recently faced a significant challenge with its Gold & Silver fund, domiciled in Ireland. The fund’s investment in a Ripple XRP Exchange Traded Product (ETP) had to be reversed.

This incident highlights the varied regulatory challenges concerning crypto investments within the European Union.

Why Jupiter Asset Management Backed Off From Its XRP Investment

According to the Financial Times, this was due to Ireland’s strict regulations against incorporating crypto assets in Undertakings for Collective Investment in Transferable Securities (UCITS) funds. Jupiter’s investment, initially valued at $2,571,504 in 21Shares’ XRP ETP, contradicted Irish rules. Hence, the fund had to cancel this holding.

“The trade was made, picked up by our regular oversight process and then cancelled,” Jupiter spokesperson said.

Meanwhile, other European Union countries, such as Germany, allow more flexibility in crypto investments, as evidenced by DWS’s Fintech fund, which includes an Ethereum exchange-traded note. Such disparities underline the need for a unified regulatory approach across the EU.

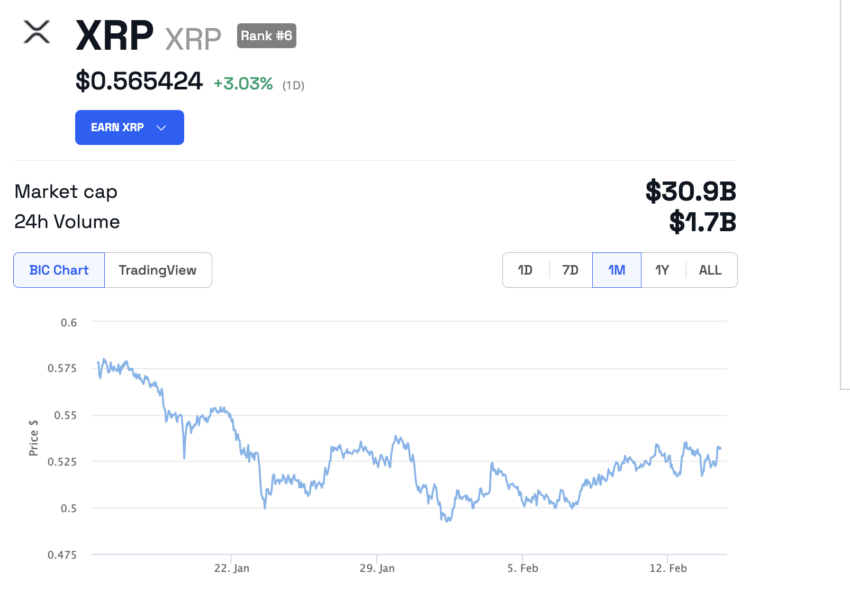

Despite the incident, the price of XRP remains unaffected. As of writing, it is trading at $0.5654, up 3% in the past 24 hours.

Read more: How To Buy XRP and Everything You Need To Know

Furthermore, the case of Jupiter’s fund sheds light on the broader challenges fund managers face. They must navigate the fine line between exploring innovative investment opportunities and adhering to strict regulatory frameworks. The inconsistency in regulatory attitudes across the EU complicates this task even further, creating a fragmented investment ecosystem.

During the Future of Asset Management conference, European regulators expressed reservations about allowing crypto assets in UCITS funds. They suggested alternative investment funds might suit retail investors seeking crypto exposure. This cautious approach indicates the broader European emphasis on investor protection within regulated fund structures.

Read more: Crypto Regulation: What Are the Benefits and Drawbacks?

Meanwhile, in the United States, the path to approval of the spot XRP ETFs appears fraught with challenges, notably due to regulatory uncertainties surrounding Ripple’s XRP. BlackRock, a leading global investment firm, has consciously decided against launching a Ripple XRP ETF.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.