The decentralized finance industry is moving so fast that every week a new way of earning emerges. This week, it has been Aave’s turn to shine, and credit delegation could become the new rage in DeFi.

DeFi markets are holding on to all of the collateral that has been loaded into them over the past month and are just under their all-time high of $2.2 billion in terms of total value locked. The space has grown so fast over the past few months that it has outpaced the growth of cryptocurrency markets themselves, which have been mostly range-bound for the past two months.

Compound Finance kicked it all off with its token distribution model, which encouraged investors to deposit collateral and provide liquidity in return for double-digit interest rates and a share of the daily COMP token distribution. Balancer followed suit with a similar system, and Kyber Network also jumped aboard with its Katalyst upgrade this week that allows for KNC staking opportunities.

The fifth-largest DeFi platform by TVL, Aave, has taken a slightly different approach to liquidity farming with its new reputational lending and credit delegation model.

Credit Delegation, The Next Big Thing?

Aave is a decentralized lending and borrowing platform based on Ethereum. It works in a similar way to most other DeFi platforms, issuing its own ERC-20 token to represent deposited crypto collateral. The platform was launched in November 2017 as a peer-to-peer lending project called ETHLend. It rebranded to Aave in September 2018 and went live on its mainnet in January 2020.

As opposed to trying to boost liquidity by offering incentives such as token distributions, Aave has opted for a credit delegation system whereby users can select who to offer credit to by reputation. Aave founder and lawyer, Stani Kulechov [@StaniKulechov], recently posted a simplified explanation of how it works:

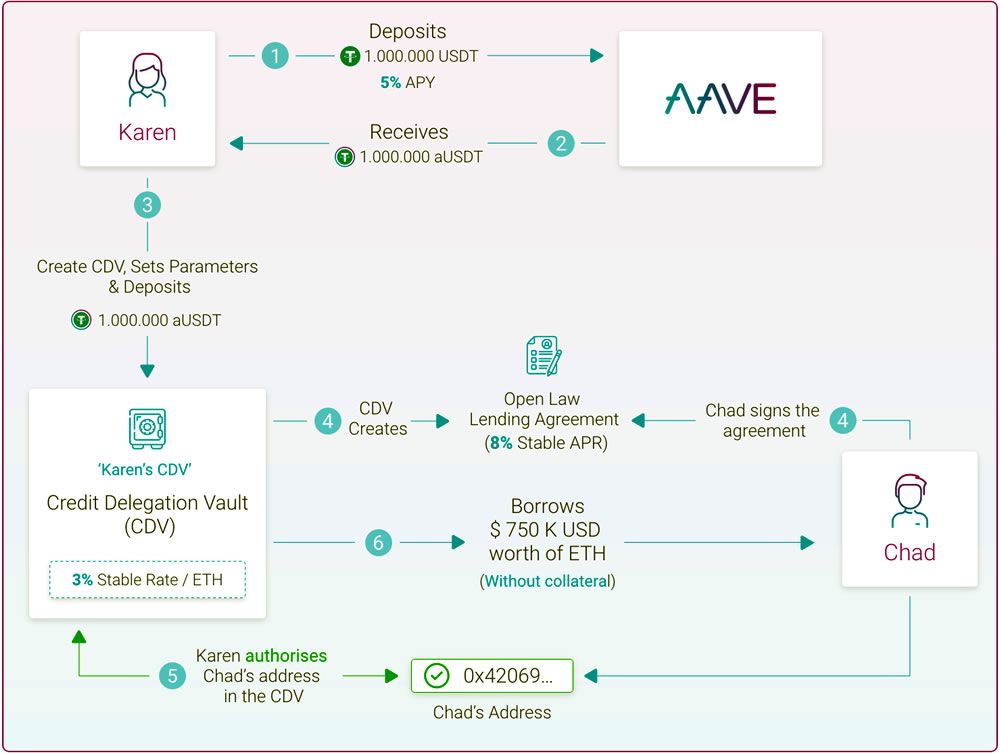

Aave is starting native Credit Delegation (CD). Aave depositors can delegate their credit lines. For example, Karen deposits an asset such as USDT to Aave and delegates her credit line to Chad, who draws funds such as ETH from Aave Protocol.

The two participants can agree upon the terms of the loan between themselves, digitally signing it with legally binding blockchain signatory provider Open Law.

Kulechov explained further that once the agreement is in place, the lender (Karen in this example) creates the Credit Delegation (CD) Vault smart contract, which allows her to set the credit line and currency according to the agreement. The borrower (Chad) can draw the credit via the borrow code function and repay via a repay function, with the open credit line offering flexibility to the debtor.

He added that by delegating credit, the lender is able to earn more under collateralized lending rates while depositing to the platform, while the borrower is able to get access to liquidity without providing collateral themselves. Kulechov concluded;

Credit Delegation allows Aave to scale DeFi TVL into financial debt markets worldwide, making DeFi the liquidity backbone for finance. The overall DeFi narrative expands from deposit capital to DeFi to source capital from DeFi.

The system does not just apply to individuals as crypto credit delegators could be DeFi funds seeking additional credit exposure, and borrowers could be cryptocurrency exchanges, market makers, money lenders, institutions, businesses, NGOs, or governments.

Smart contracts add the flexibility of limiting credit lines, delegating specific crypto assets, and closing the loans once certain conditions are met.

The move could be good for Aave, which is currently playing catchup to the likes of Compound, the current industry leader. Balancer and Synthetix have also surged in popularity over the past month and Aave wants a piece of the pie.

LEND Price Update

Aave’s native LEND token has been on fire recently. In fact, pretty much all DeFi tokens have surged over the past month leaving their traditional crypto brethren in the digital dust.

At the beginning of 2020, LEND was priced at around $0.016 with a market capitalization of roughly $18 million. Prices remained flat until late April when things started to move. In the past few weeks LEND prices have surged to a two-and-a-half-year high of $0.20 which marks an astronomical 1,150% increase this year.

Its market cap has surged to $240 million, and the total value locked on the platform is currently $154 million, an increase of over 300% in the last three months. LEND is the eleventh most valuable DeFi token in terms of market cap. while assets like Compound (COMP), Synthetix (SNT), and Maker are leading the pack.

Other Aave News

Silicon Valley venture capital firm, ParaFi, which is heavily invested in DeFi protocols, has now eyed Aave for its next round of funding. This week, the San Francisco-based company announced that it has invested $4.5 million into Aave, with a particular interest in its flash loans.

ParaFi partner, Santiago Roel Santos [@santiagoroel], congratulated Aave on its recent developments:

Building credit natively in DeFi will take this space from being a tech used mostly by hobbyist to more mainstream adoption. A great step forward by @AaveAave and @StaniKulechov in that direction. Keep building.

He added that the firm was initially drawn to the novelty of Aave’s flash loans, ‘which solve for market inefficiencies across DeFi markets, and unlock new use cases.’

ParaFi aims to participate in Aave’s governance model once it makes a move towards a DAO based system. ParaFi, which was launched in 2018, has already invested in MakerDAO, Compound, and the Kyber Network.

Aave also has a grants venture whereby funds are channeled to developers working on projects that will be integrated into the platform. In a recent update, Aave stated that since the Ecosystem Grants Round was announced on April 1, it has received more than 30 applications and has funded 23 of them, offering over 70,000 aDai (its own collateral-based token) to developers.

Some of those projects include portfolio apps, complex financial products, games, and interfaces to make it easier to deposit and save money. A second round of grants has already been initiated.