Crypto tax evasion in the United States is about to become more difficult following the subtle change made by the Internal Revenue Service (IRS) to its form 1040.

America’s tax body continues to push for greater cryptocurrency tax compliance despite lingering confusion over some of its guidelines.

Plausible Deniability for Crypto Tax Evasion Out the Window

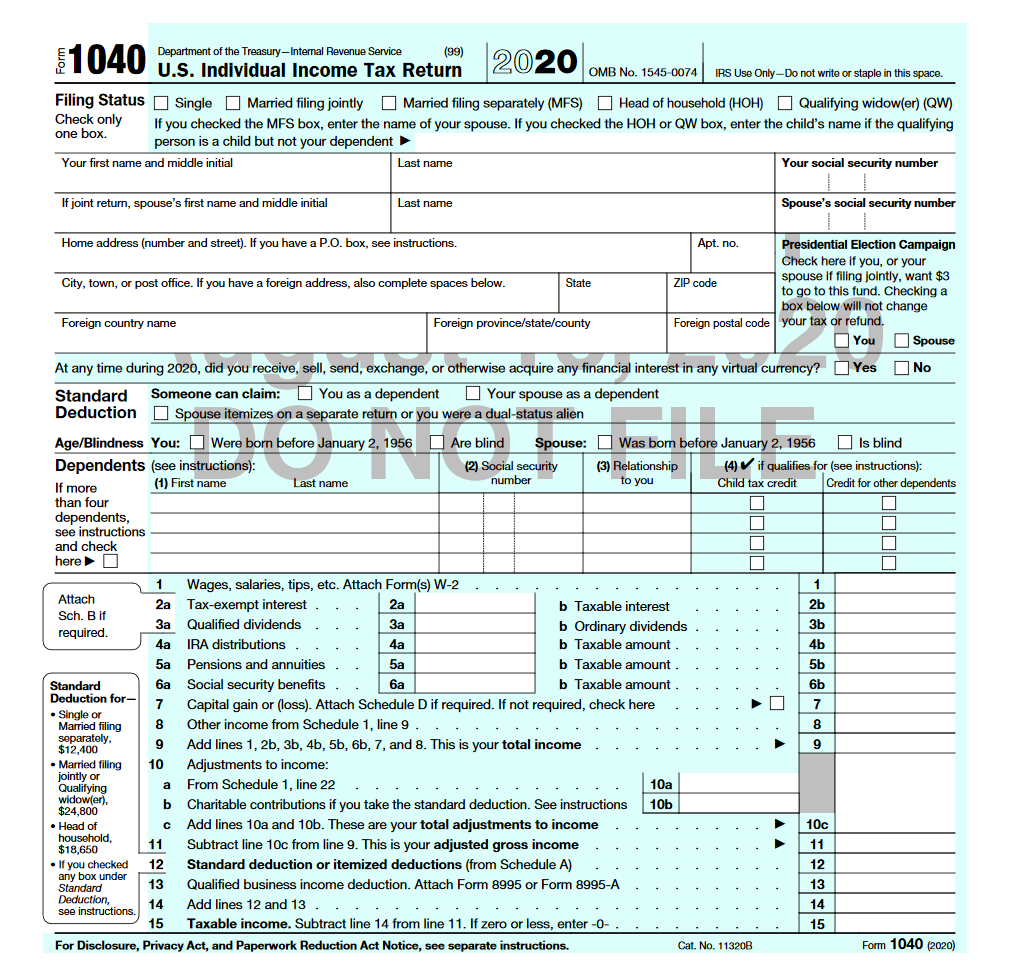

As Wall Street Journal (WSJ) reported on Sept. 25, the position of the “crypto question” on the IRS standard 1040 form now has a new “unmissable” position. A draft of the tax form published by WSJ shows the crypto query appearing immediately beneath the fields for name and address.

US Cryptocurrency Tax Laws Still Require Polishing

The IRS push for compliance aside, crypto taxation in the US still constitutes a “compliance nightmare” with several calls for a more streamlined set of guidelines. Back in August, the Congressional Blockchain Caucus called on the IRS to adopt a common-sense approach to taxing proof-of-stake. The IRS for its part has also clarified certain matters related to the treatment of digital assets for tax purposes. In February, the tax agency stated that video game currencies like Fortnite’s V-bucks were not taxable assets. A couple of bills currently before Congress also deal with the issue of crypto taxation. One of such bills — the Virtual Currency Tax Fairness Act — contains a provision for a de minimis tax exemption for crypto transactions below $200.

Top crypto platforms in the US

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Osato Avan-Nomayo

Osato is a reporter at BeInCrypto and Bitcoin believer based in Lagos, Nigeria. When not immersed in the daily happenings in the crypto scene, he can be found watching historical documentaries or trying to beat his Scrabble high score.

Osato is a reporter at BeInCrypto and Bitcoin believer based in Lagos, Nigeria. When not immersed in the daily happenings in the crypto scene, he can be found watching historical documentaries or trying to beat his Scrabble high score.

READ FULL BIO

Sponsored

Sponsored