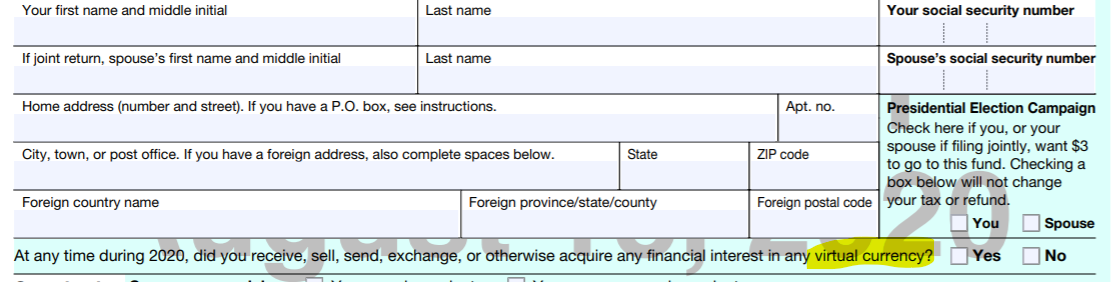

They’re on to you, and they want their cut. The new Internal Revenue Service (IRS) tax return 1040 for U.S. citizens has been released. For cryptocurrency holders and traders, there’s something new on the front page: Virtual Currency.

Uncle Sam is watching and he wants his cut.

Doing taxes is never fun. The IRS’s forms are complicated to fill out and, and that’s why many people opt to use a tax service like H&R Block, or an online program like TurboTax. (Pro Tip: The IRS has a list of free tax filing software. Anyone making under $69,000 a year can use it).

IRS Muddies the Waters

The murkiness occurs when tokens are thrown into the mix. Some tokens generate income either through proof of stake or interest. Does the IRS treat interest made form DeFi the same as interest made from CeFi or a traditional bank account? Are utility tokens “virtual currencies?” Are PoS block rewards treated the same as Bitcoin, or should they be treated like dividend re-investments? The answers are not entirely clear, but one thing is for sure: Traders and investors should think about what they are doing now when planning for how they will pay taxes next year. Slapping questions related to virtual currencies on page one of the form shows just how important the issue is becoming to regulators.

Path of Least Resistance

Despite the complicated nature of these taxes, cryptocurrency has some allies at the top. Tom Emmer and the Congressional Blockchain Caucus recently wrote a letter to the IRS to push favorable regulations for proof of stake tokens. The technology, according to Emmer, is powerful, and the U.S. could lag behind by over-regulating. Some guides, such as the materials on Coinbase, offer suggestions on how to report crypt assets to the taxman. With each trade considered a taxable event, this is a lot of work. Whatever happens, capital gains and losses can wash themselves out, so traders should keep careful track of everything. It should be noted that long-term capital gains are taxed at a much lower rate. So timing a sell in a way that it lasts over a year could be beneficial. Despite a lot of details to iron out and the struggles ahead, legislators have still not decided exactly how to treat digital currencies. Some, like attorney Justin Wales, are concerned that the IRS is encroaching on liberty by asking the nitty-gritty of traders’ crypto deals. https://twitter.com/WinstonOnoWales/status/1296573451591794689?s=20 However, the IRS is perhaps most concerned about getting its piece of the pie through taxes.

Top crypto platforms in the US

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Harry Leeds

Harry Leeds is a writer, editor, and journalist who spent much time in the former USSR covering food, cryptocurrencies, and healthcare. He also translates poetry and edits the literary magazine mumbermag.me.

Harry Leeds is a writer, editor, and journalist who spent much time in the former USSR covering food, cryptocurrencies, and healthcare. He also translates poetry and edits the literary magazine mumbermag.me.

READ FULL BIO

Sponsored

Sponsored