Internet Computer (ICP) price is making its way back up, but it may not be as simple despite positive cues.

The investors’ bullishness seems to be saturating, opening up the opportunity for bears to make profits on their stance.

Internet Computer Investors Push for a Decline

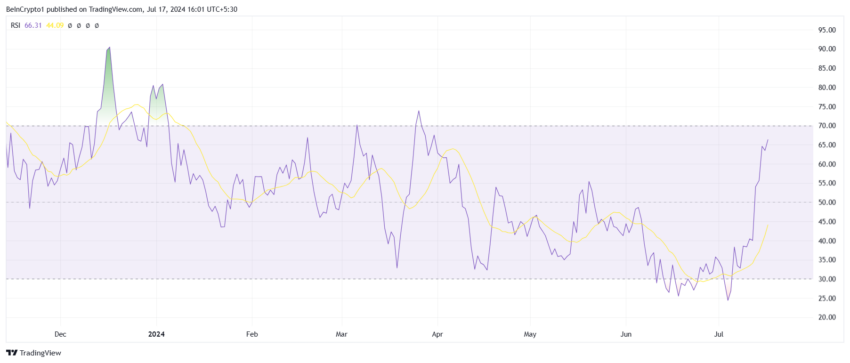

ICP price is nearing a bearish turnaround as the broader market cues and ICP holders’ sentiment are switching. Signs of the same are coming from the Relative Strength Index (RSI), which is nearing the overbought zone.

When an asset’s RSI approaches this high level, it suggests that the asset has been overbought and may experience a downward price adjustment in the near future.

In anticipation of this potential decline, bearish traders in the ICP market have been actively placing short contracts. These traders are betting that the ICP price will correct, allowing them to profit from the decline. The increasing likelihood of a price drop has reinforced their bearish sentiment, leading to a rise in short positions.

The recent surge in ICP’s price, however, has had significant consequences for these bearish traders. The sharp price increase resulted in the highest number of short liquidations seen in more than four months, amounting to $470,000. Short liquidations occur when traders are forced to close their short positions at a loss due to rising prices, which can amplify price movements further.

Read More: Internet Computer (ICP) Coin Explainer for Beginners

Despite these substantial liquidations and the losses incurred, the bearish sentiment remains strong among many traders. They continue to expect a price drop, believing that the recent gains are unsustainable. As a result, they persist in placing short contracts, anticipating that a market correction will eventually vindicate their positions.

ICP Price Prediction: Stuck Under Key Resistance

ICP price has risen by more than 37% in the last week, bringing the altcoin to trade at $10.04 at the time of writing. However, the altcoin faces resistance at $10.83, a level that has been rigorously tested as a support floor.

By the time ICP makes it to this resistance, the aforementioned saturation could prevent a breach. This might lead to the altcoin either slipping below $8.55 or consolidating above it.

Read More: Internet Computer (ICP) Price Prediction 2023/2025/2030

On the other hand, if $10.83 is flipped into support, the altcoin would have a decent shot at reclaiming the recent losses. A push to $12.98 would further the rise and invalidate the bearish thesis.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.