Finance-focused blockchain Injective will stake 50 million of its native Injective (INJ) coin in the near future. In the last month, the number of staked coins grew to about 47 million.

The total amount of coins staked has risen steadily to 47.7% of INJ’s supply in the past year. The Injective team has promised to stake another 50,000,000 INJ.

How Injective Upgraded for Tokenization

The Injective project offers a 15.96% staking yield. There has also been a steady increase in the number of delegates on the Injective network.

Read More: What is Tokenization on Blockchain?

Adding more staked coins and delegates suggests the network is gearing up for a bumper 2024. These efforts, together with Injective’s recent upgrades, may see the network’s usage increase. A proof-of-stake mechanism secures the blockchain.

The total value locked (TVL) on Injective’s decentralized finance marketplace grew a staggering 42% to $49 million in the last 24 hours. Dojoswap, a decentralized exchange on the network, saw an influx of $27 million alone.

The project recently rolled out a Volan upgrade. The upgrade was launched on January 11, 2024.

The changes included a real-world asset (RWA) module for institutions. The RWA module contains a special permission layer.

New Application Programming Interfaces (APIs) reduce latency by 90%. A new cross-chain improvement enables the Injective blockchain to interact with other networks through improved order routing. The number of Injective core developers has fallen off in recent weeks from 22 to 14.

Tokenization Needs Laws to Succeed

Injective was built especially for advanced decentralized finance services. It was founded by Albert Chon and Eric Chen in 2018.

Injective emphasizes cross-chain interoperability, which is growing increasingly important as cryptocurrencies vie for mainstream adoption. Additionally, stablecoin issuer Circle and oracle specialist Chainlink both offer interoperability solutions.

The asset tokenization segment that Injective’s upgrade targets is poised to grow rapidly in 2024. In saying that, technology like Injective’s modules will not be the bottleneck.

Staci Warden, the CEO of the Algorand Foundation, said all counterparties must move in sync for tokenization to succeed. Otherwise, blockchains’ advantages to finance will not be fully realized.

Warden’ says tokenizing an asset on a blockchain is trivial from a technological standpoint compared to regulatory questions. For example, the question of whether stablecoins are equivalent to fiat currency value is still up for debate in many regions.

“The fear is, and the reluctance is not the tokenization side; it’s the cash side. So if you can tokenize assets and you can have tokenized cash on chain, [then] you can do an atomic swap. The problem is, will that cash side hold value, will that stablecoin hold value?”

INJ Price Predictions

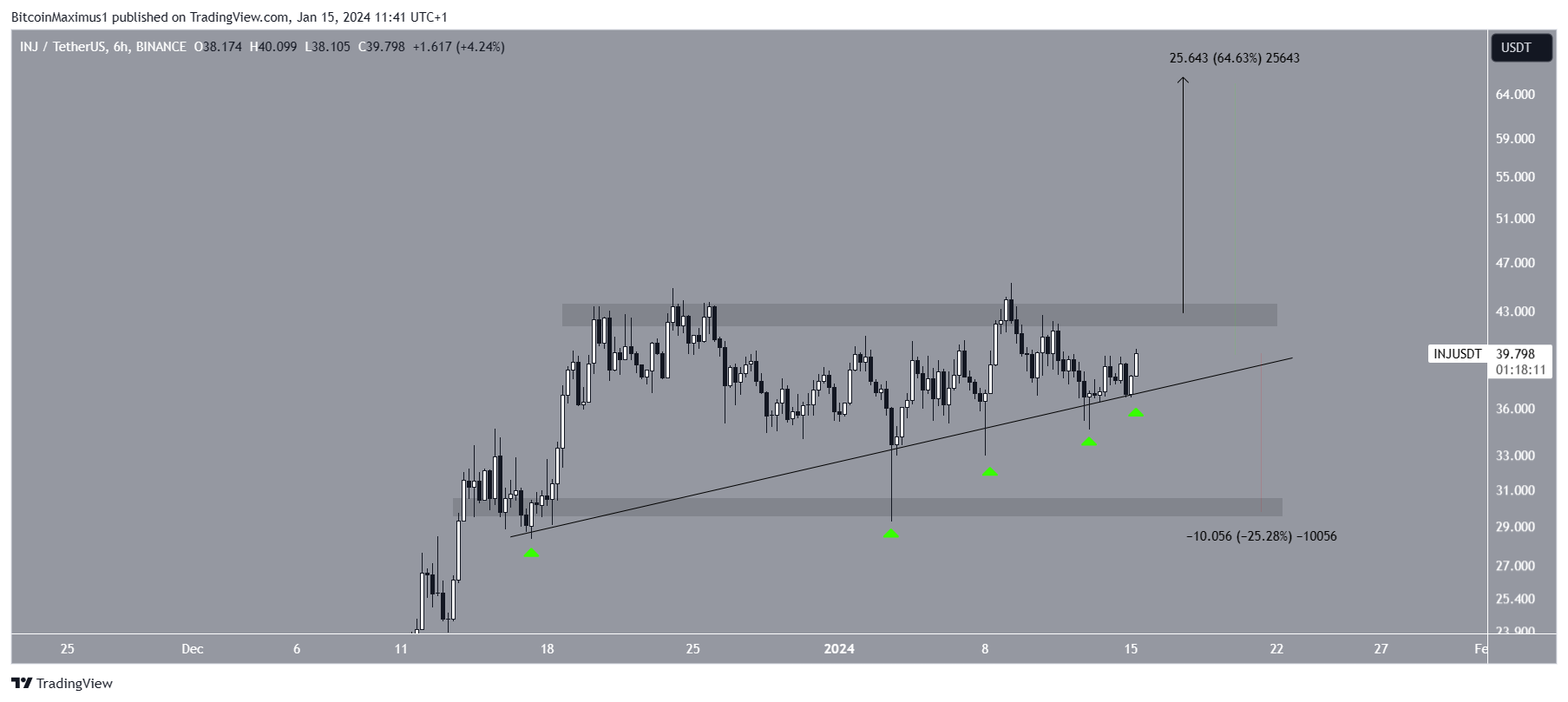

The Injective (INJ) price has traded inside an ascending triangle pattern since December 16. Ascending triangles are considered bullish patterns, meaning that they lead to breakouts most of the time.

Today, INJ bounced at the support trend line for the fifth time (green icons), beginning an upward movement. The triangle’s resistance is at $43.

A breakout that travels the entire pattern’s length would take INJ to $66, a 65% increase from the current price. Despite this bullish price prediction, closing below the triangle’s ascending support trend line will invalidate the positive outlook. Then, INJ could fall 25% to the closest support at $30.