The International Monetary Fund (IMF) is in discussions with El Salvador to address the macroeconomic and financial risks associated with Bitcoin (BTC).

These talks aim to create a complete plan to manage risks, ensuring El Salvador’s economy stays stable and grows while using Bitcoin as a legal tender.

Fiscal Stability Focus: IMF’s Plan with El Salvador

On August 6, the IMF released a statement highlighting the progress made in the ongoing negotiations. An IMF mission, led by Raphael Espinoza, engaged in both in-person and virtual discussions with Salvadoran authorities.

The talks focused on strengthening public finances, improving bank reserves, and increasing transparency. The IMF stressed that El Salvador needs to improve its primary balance by about 3.5% of GDP over three years. This plan involves managing public wages better while still spending on essential social services and infrastructure.

“Progress was also made on developing a plan to gradually strengthen financial system reserve buffers in a manner consistent with continued private sector credit and growth. This is also being supported by efforts to reduce the government’s reliance on domestic financing through the planned consolidation and potential support from the Fund and other multilateral development banks,” the IMF added.

Read more: How To Buy Bitcoin (BTC) and Everything You Need To Know

The IMF and El Salvador acknowledged the potential fiscal and financial stability risks from the Bitcoin project. While many risks have not yet materialized, both parties agree that more efforts are needed to increase transparency and reduce potential problems. These efforts include drafting legislative proposals to tackle corruption, money laundering vulnerabilities, and procurement weaknesses.

“The IMF attacked El Salvador over its Bitcoin Law, warning that it could cause instability there. Now it is engaging in strategic talks as President Nayib Bukele oversees a Renaissance. While the IMF wishes to discuss risks associated with Bitcoin adoption, Bukele might turn the tables to discuss destructive US monetary policy, dollar depreciation, and dedollarization with the institution, which receives the vast majority of its financing from the US taxpayer,” Manuel Ferrari, Money On Chain Co-Founder, told BeInCrypto.

El Salvador adopted Bitcoin as its legal tender in September 2021 under President Nayib Bukele’s leadership. The IMF had previously warned that this move could raise macroeconomic, financial, and legal issues. Despite these concerns, the Salvadoran government has remained committed to its Bitcoin strategy.

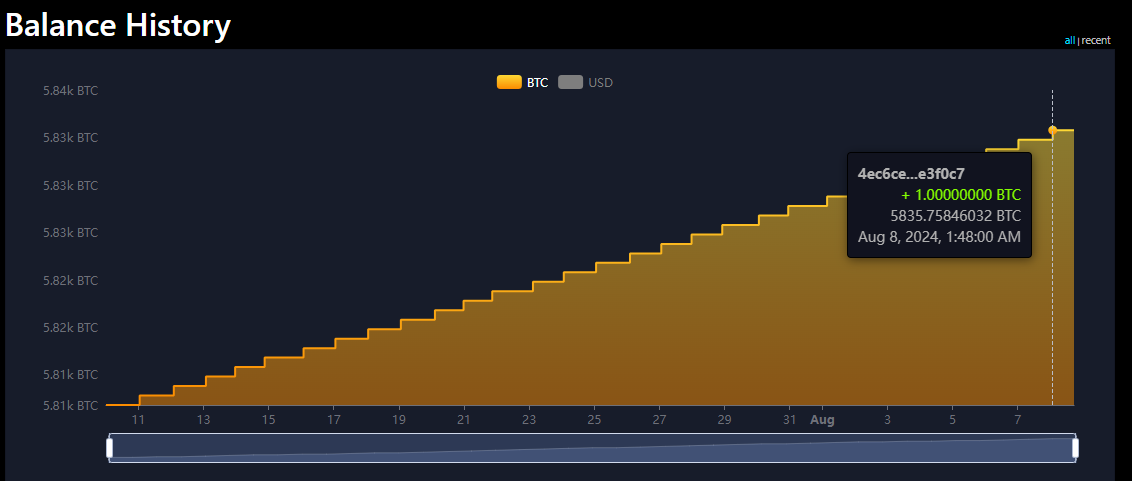

Earlier this year, President Bukele announced a plan to implement the Dollar Cost Averaging (DCA) strategy, buying one Bitcoin daily. This approach aims to accumulate Bitcoin steadily, regardless of market conditions.

Read more: Who Owns the Most Bitcoin in 2024?

Despite market volatility, El Salvador continues its Bitcoin purchases. The Bitcoin Office Mempool shows that the country holds approximately 5,835 BTC, valued at around $334.04 million at current market prices.