The Intercontinental Exchange (ICE) owned institutional crypto platform Bakkt has been approved to raise funds to “fund its long-term vision.” The move signals that not all is well at the once-called savior of the crypto market.

On February 14, Bakkt announced that its shelf registration statement had been declared effective by the US Securities and Exchange Commission.

Bakkt Crypto Firm Needs to Raise $150M

Bakkt was launched in the bear market of 2018 and launched in 2019 amid huge hype and fanfare. It is owned by the Intercontinental Exchange (ICE), which also owns the New York Stock Exchange. Therefore, the launch was seen as the first key stepping stone for institutional investment into crypto.

The firm filed an amended Form S-3 with the SEC on February 7. It requested permission from the financial regulator to issue up to $150 million in registered securities in the public markets.

That permission has now been granted according to the announcement, which read:

“This registration statement allows Bakkt, so long as it is effective, to raise up to an aggregate of $150 million of capital in one or more offerings over the subsequent three years.”

Bakkt believes the flexibility of a shelf registration will provide the company with significant benefits when raising capital in the future, it added.

Read more: Bitcoin Price Prediction 2024/2025/2030

It also stated that there was “significant uncertainty” associated with its expansion to new markets and revenue growth, given how quickly the crypto ecosystem ebbs and flows.

It also warned that it had been unable to generate sustainable operating profit and sufficient cash flows. The future success of the company will depend on its ability to raise capital. On February 8, Bakkt issued a statement reading:

“Management remains confident about our business and will continue to focus on delivering for our clients, making progress on our primary business objectives, and working efficiently to scale our business and move toward profitability.”

BKKT Share Price Slides

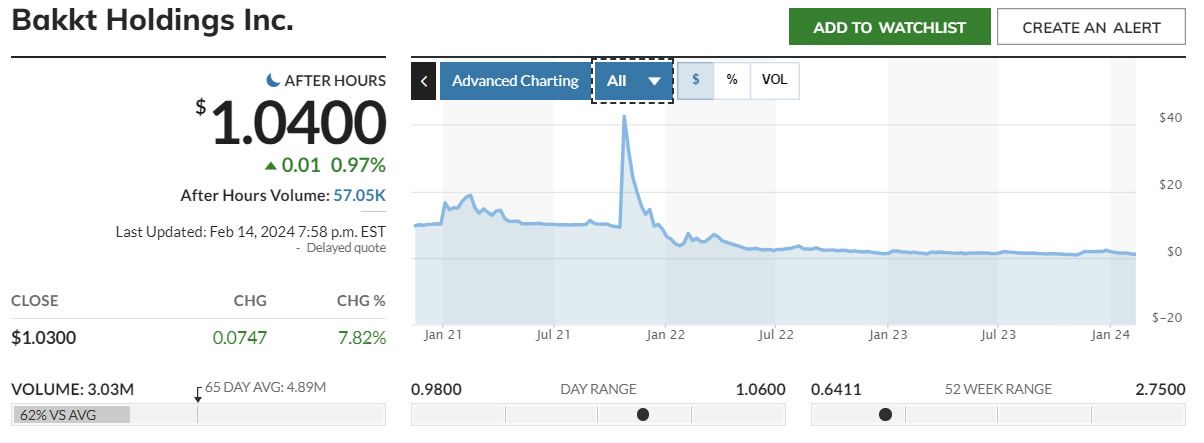

Bakkt share prices (BKKT) rebounded with a 7.8% gain to reach $1.04 in after-hours trading on February 14.

However, its stock has slumped more than 97% from its all-time high of $40 in October 2021. BKKT has even lost 25% in value in just the past two weeks.

Read more: Crypto vs. Stocks: Where To Invest Your Money

The sales of securities or company stock could further dilute BKKT prices over the next three years.

Moreover, the firm now faces stiff competition in the institutional crypto market, especially now that major asset managers are offering spot ETFs.