The Binance Coin (BNB) price showed decisive bullish signs by reclaiming the $260-$265 resistance area. Reclaiming the $325-$342 area would be another significant bullish sign.

The BNB price has decreased since reaching a high of $398.30 on Nov. 8. The decrease created a long upper wick (red icon), validating an ascending support line from which it previously broke down. The extremely long upper wick is considered a sign of selling pressure.

On Nov. 21, the Binance Coin price seemingly broke down from the $260-$265 support area (green circle). This is both a horizontal and a Fib support level.

However, it reclaimed the area shortly afterward, rendering the previous breakdown as only a deviation.

While the RSI has moved above 50, it did not generate bullish divergence before the increase.

If the upward movement continues, the closest resistance area would be between $325-$342. This is created by the 0.5-0.618 Fib retracement resistance levels (white). If the BNB price resumes its rate of increase, it could reach it in the next 24 hours.

To conclude, the technical analysis from the daily time frame does not provide a clear BNB price prediction.

BNB Price: Two Potential Outlines

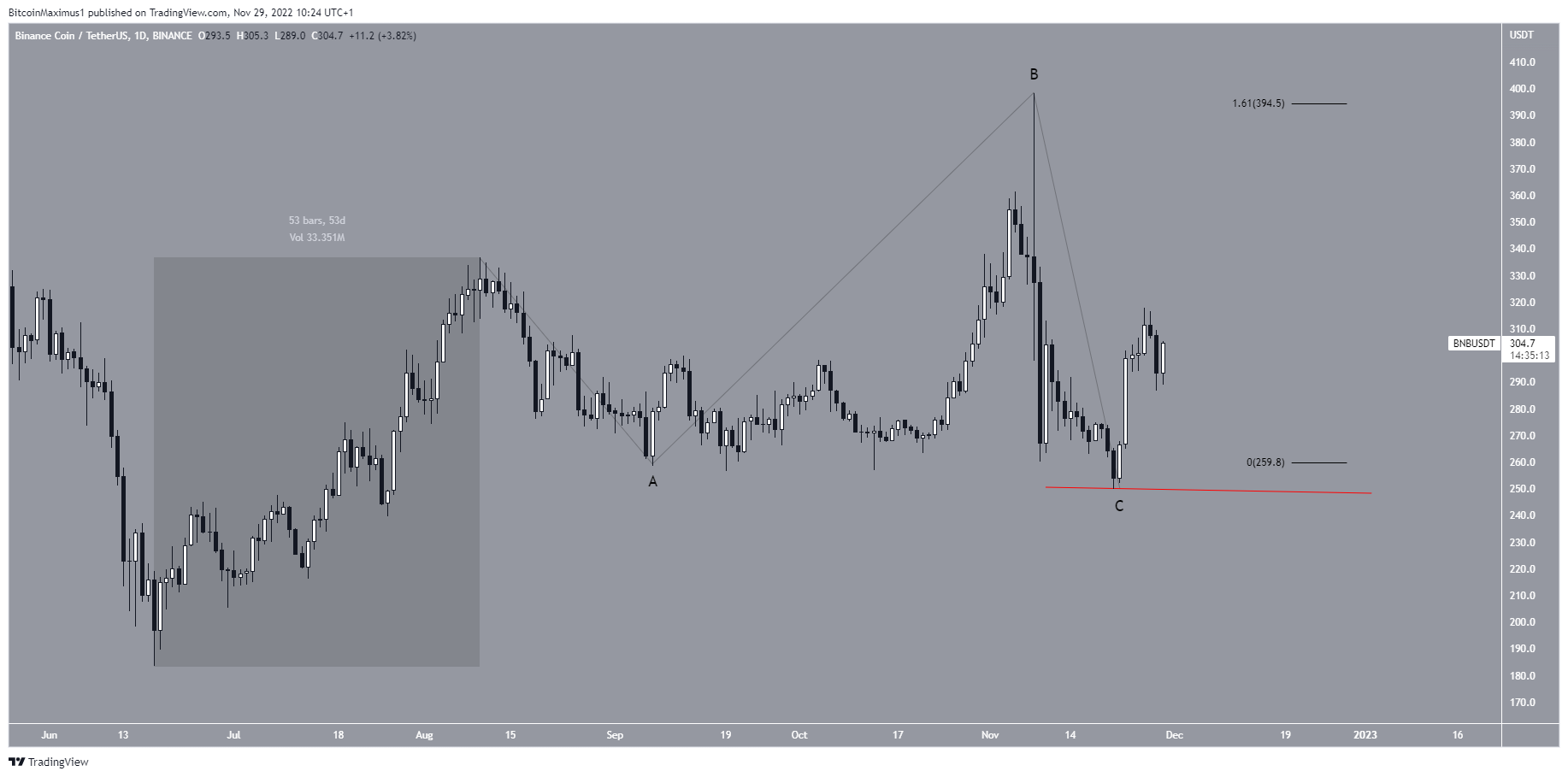

A closer look at the wave count technical analysis provides two outlines for the future price. Firstly, it is worth noting that the structure from June 18 to Aug. 11 (highlighted) is unclear. What is interesting is the ensuing price movement.

The bullish option indicates that the movement is an irregular flat correction (black). In it, waves A:C had very close to a 1:1.61 ratio, common in such structures.

If the count is correct, it means that the BNB price correction is complete and new highs above $400 will follow.

A drop below the wave C low (red line) at $250 would invalidate this bullish Binance Coin price prediction.

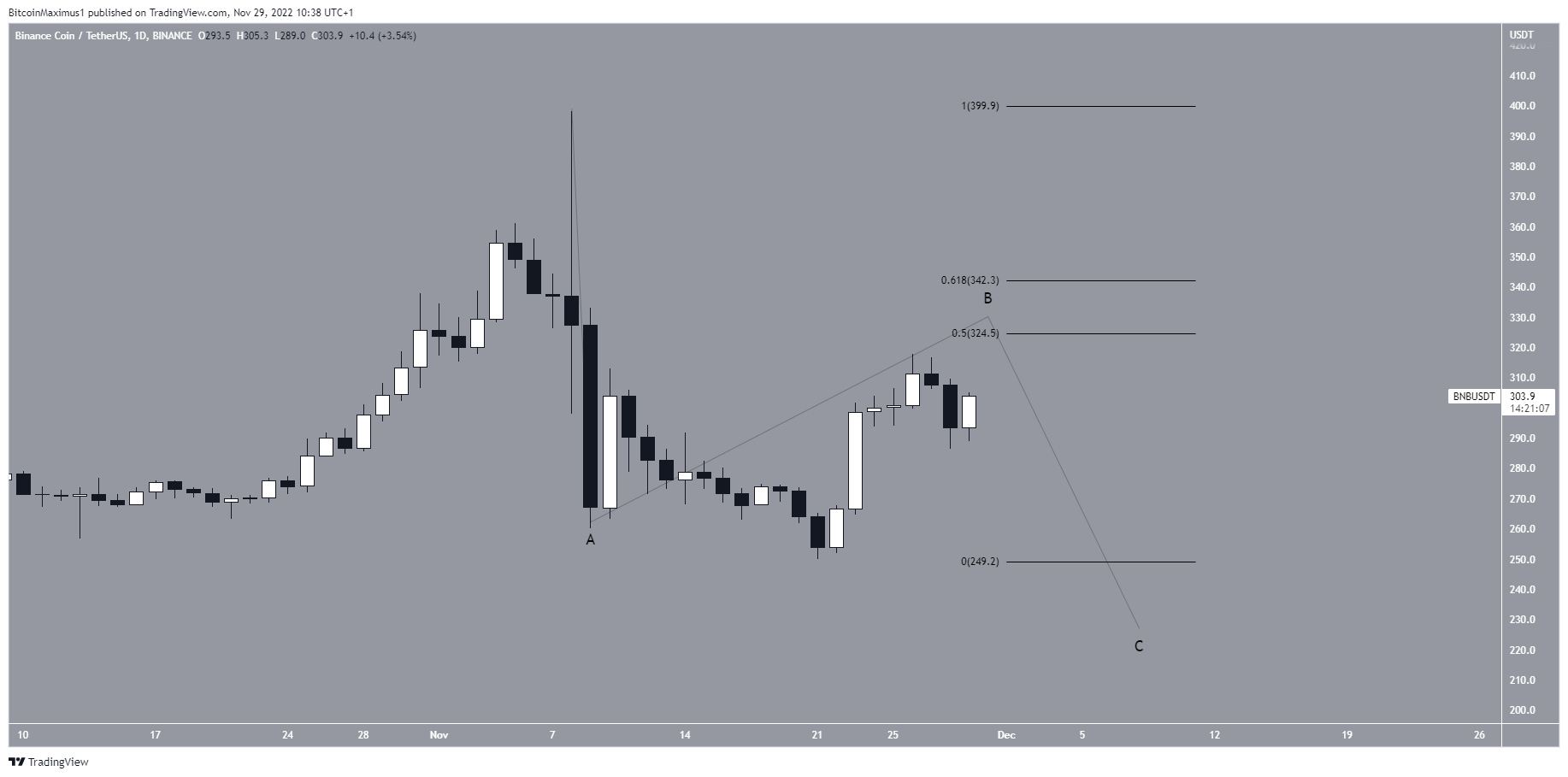

On the other hand, the bearish count indicates that the BNB price is mired in an A-B-C correction. In this case, it is currently in the B wave, after which another drop will follow. The B wave is likely to end between $325-$342.

The invalidation level for this count is less clear-cut than in the bullish one. While a sharp price movement will not invalidate it, a decisive close above the 0.618 Fib retracement resistance at $342 will.

Therefore, the reaction once the Binance Coin price gets to the $325-$342 resistance area will be crucial in determining the future trend.

For BeInCrypto’s latest crypto market analysis, click here.

Disclaimer: BeInCrypto strives to provide accurate and up-to-date news and information, but it will not be responsible for any missing facts or inaccurate information. You comply and understand that you should use any of this information at your own risk. Cryptocurrencies are highly volatile financial assets, so research and make your own financial decisions.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.