The Chainlink (LINK) price has been declining since reaching a high of $8.9 on July 15.

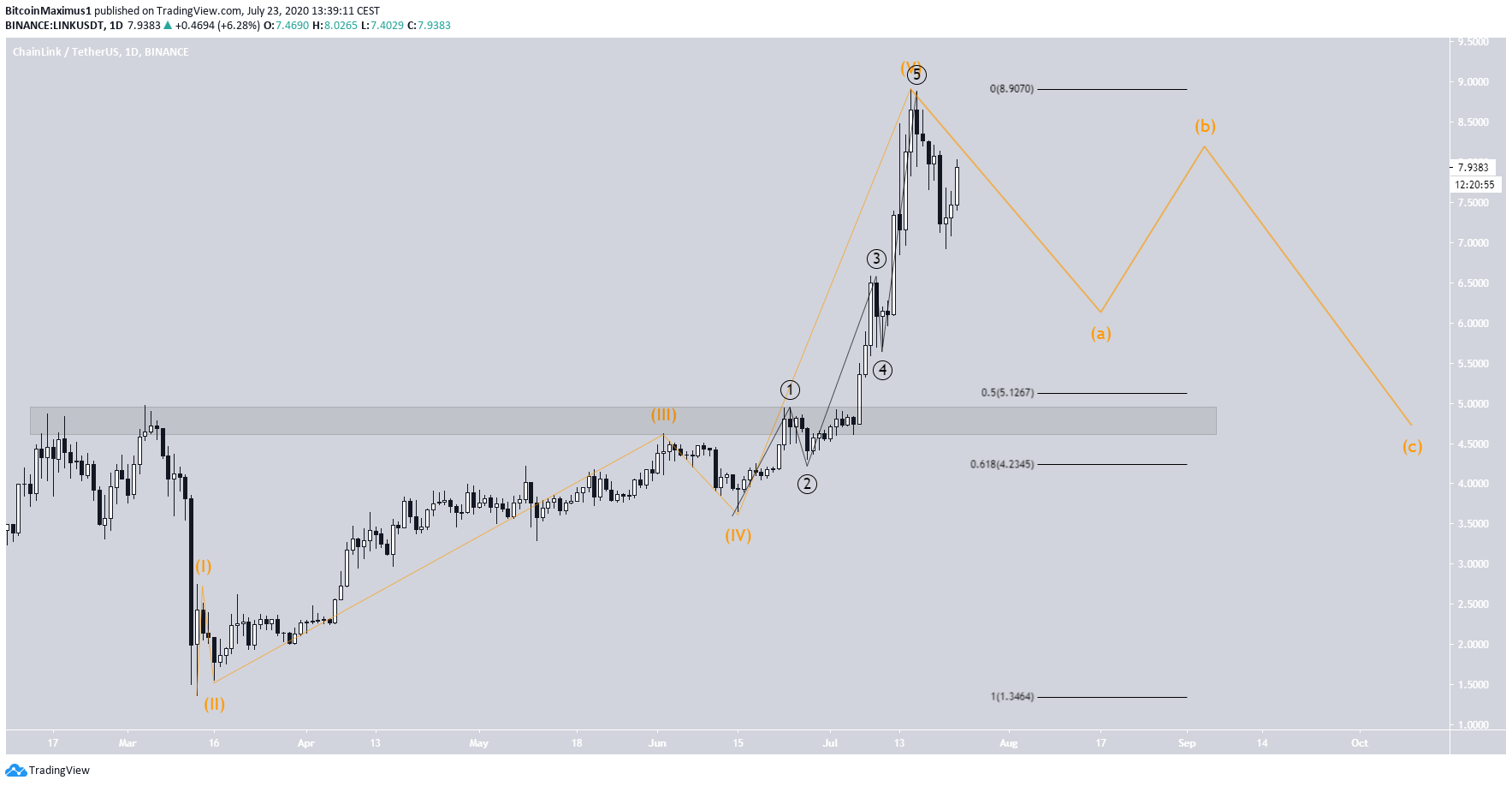

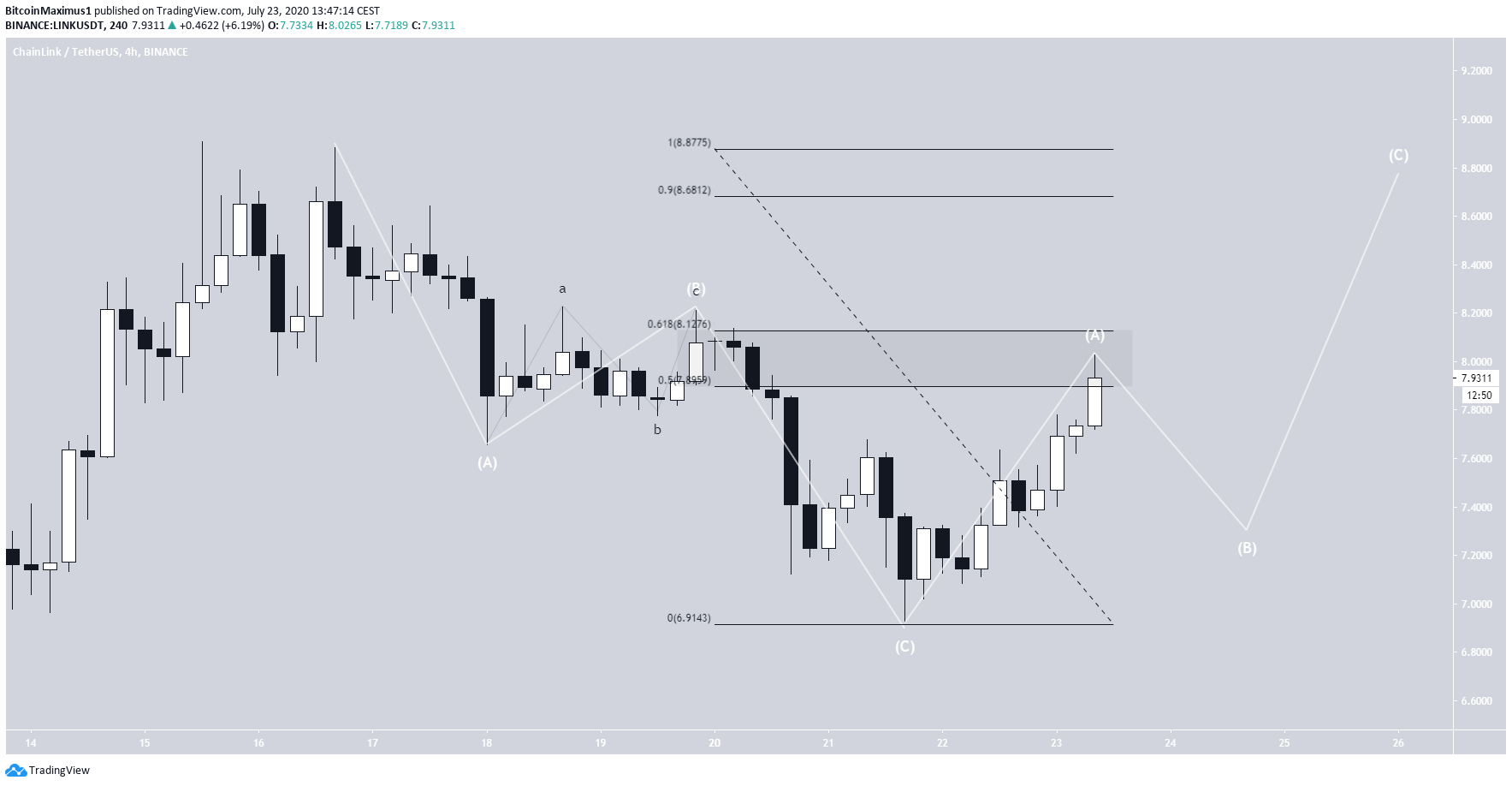

Due to the length of the movements, it’s possible that the price has completed an impulsive upward move that began in March, and has now begun a correction. However, the start of the corrective period has not yet been confirmed.

Has LINK Reached a Top?

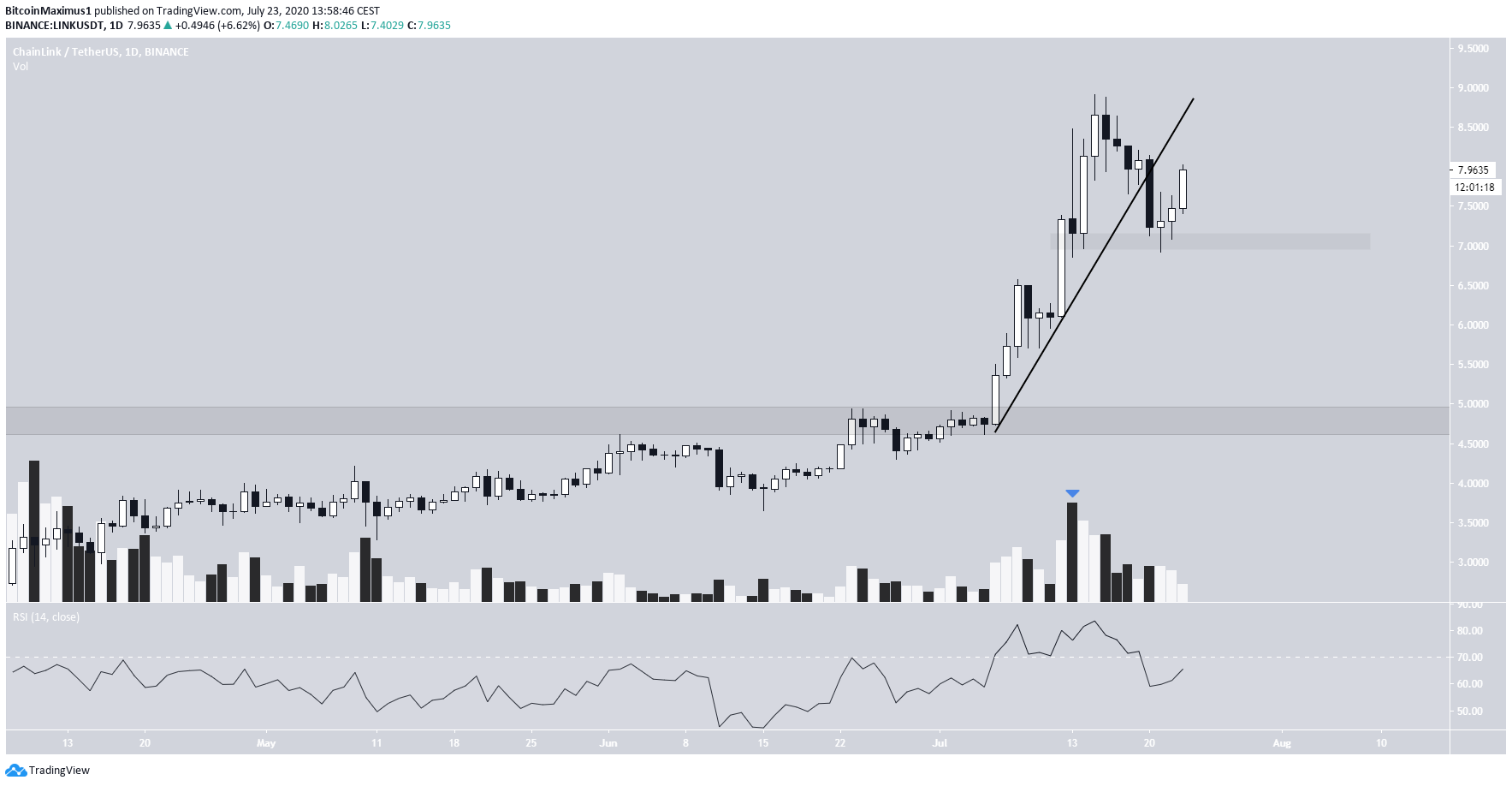

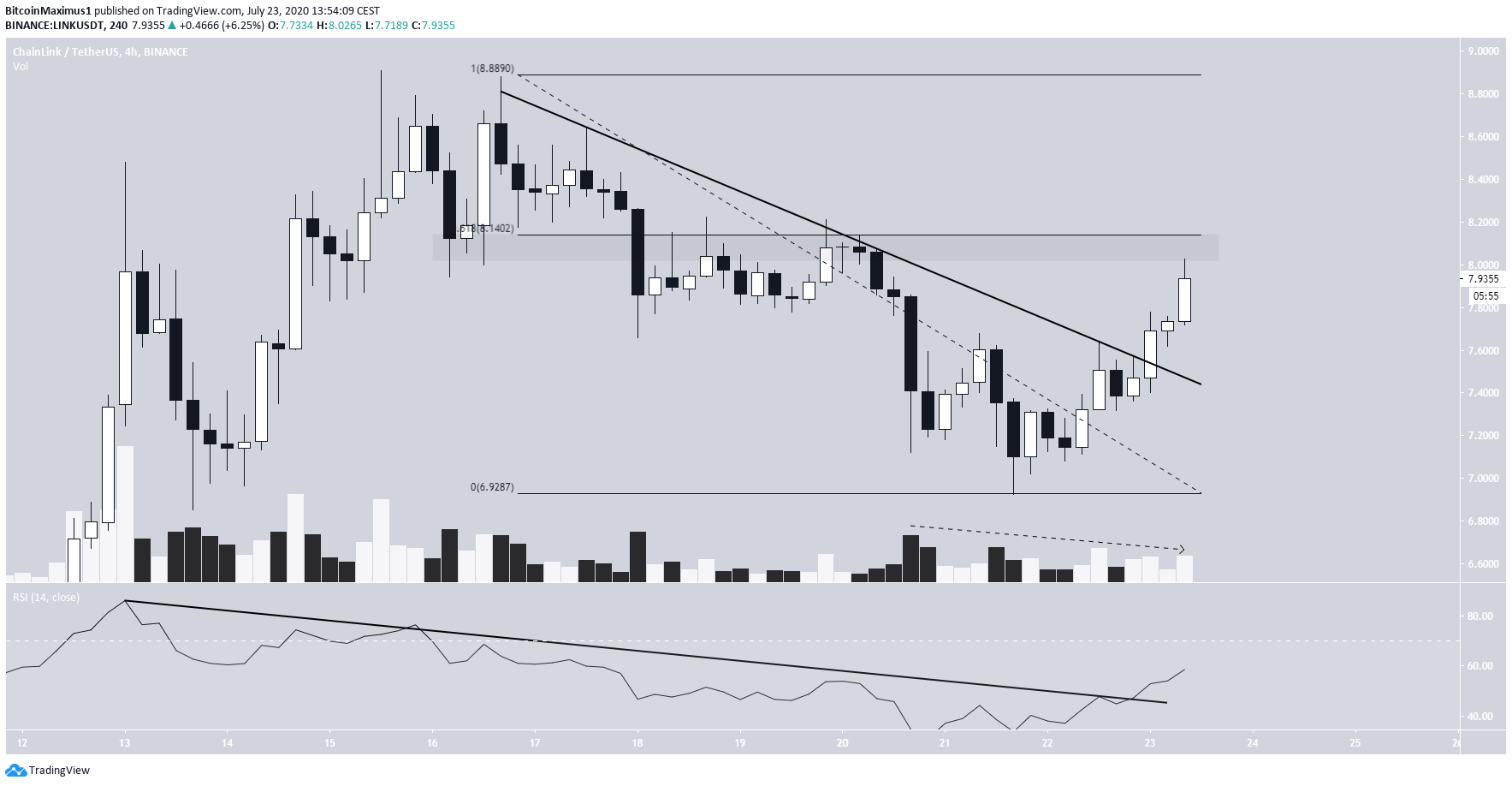

The LINK price has been rising at an accelerated rate since it first broke out from the $4.7 resistance area on July 6. During this rise, the price followed a very steep rising support line, below which it broke down on July 20. The price found support above the minor $7.1 support area and has been rallying over the past couple of days. The readings from technical indicators are mixed, currently leaning bearish. The daily RSI has been declining from its overbought levels but has not formed any type of bearish divergence. However, volume was the highest during the shooting star candlestick on July 13 and has been gradually decreasing since. It was particularly low during the current upward move.

Wave Count

In our previous LINK analysis, we explained that LINK has likely reached a top:“since the current wave 5 has extended to the 1.618 Fib level of waves 1 – 3, which is a common level for 5th wave extensions.”So, we are going to operate on the assumption that the price has already reached a top.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Valdrin Tahiri

Valdrin discovered cryptocurrencies while he was getting his MSc in Financial Markets from the Barcelona School of Economics. Shortly after graduating, he began writing for several different cryptocurrency related websites as a freelancer before eventually taking on the role of BeInCrypto's Senior Analyst.

(I do not have a discord and will not contact you first there. Beware of scammers)

Valdrin discovered cryptocurrencies while he was getting his MSc in Financial Markets from the Barcelona School of Economics. Shortly after graduating, he began writing for several different cryptocurrency related websites as a freelancer before eventually taking on the role of BeInCrypto's Senior Analyst.

(I do not have a discord and will not contact you first there. Beware of scammers)

READ FULL BIO

Sponsored

Sponsored