The US Securities and Exchange Commission (SEC) must answer ARK Invest’s Bitcoin spot exchange-traded fund (ETF) application by Aug. 13.

The agency must rule on the first of several applications through which Wall Street incumbents seek exposure to Bitcoin (BTC).

ARK Invest Approval Process Unlikely to Break SEC Tradition

ARK Invest, whose CEO Cathie Wood is bullish on crypto, applied to launch a spot fund on May 15. According to the Federal Register, the SEC will approve, reject, or commence rejection proceedings by that date. The SEC can legally extend the deadline to Jan. 10, 2024.

Approving ARK’s fund would set the tone for at least seven other applications filed by Bitwise, BlackRock, VanEck, WisdomTree, Valkyrie, First Trust Galaxy, and Fidelity. The entrance of the Wall Street heavyweights recently prompted Bloomberg analysts to revise their prediction of an approval upwardly.

Read here how the recent banking crisis exposed the growing links between traditional and crypto finance.

However, Matt Hougan at Bitwise said the SEC had dragged its feet with spot ETF applications since 2016. He expects the agency to adopt the same approach with the ARK application.

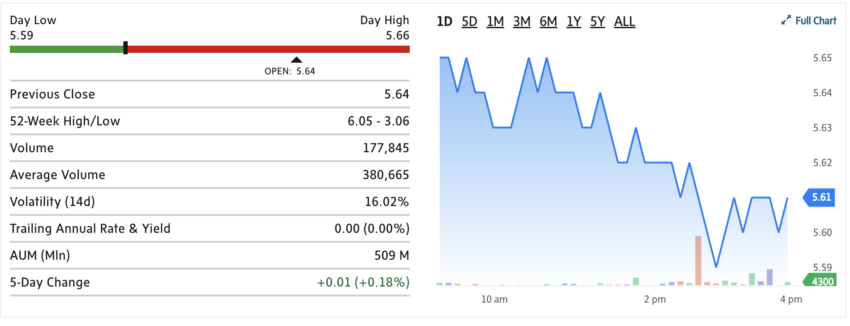

On the other hand, the CIO of Purpose Investments, Som Seif, said Americans are investing heavily in its spot Bitcoin ETF in Canada. The fund manages about $500 million.

This is despite the country’s securities agency ejecting several notable crypto exchanges that didn’t meet its compliance requirements.

Grayscale Case to Convert Bitcoin Trust Could Bring Approvals Forward

A ninth firm, Grayscale Investments, believes it will win a court case to convert its Bitcoin trust into an ETF. Grayscale’s chief legal officer Craig Salm predicted a win would see the SEC approve its first ETF in October.

Last year, the SEC rejected Grayscale’s application, citing the vulnerability of investors to market manipulation. The company sued the agency, arguing the SEC approved futures ETFs with the same price reference. The agency has greenlighted several exchange-traded funds tracking Bitcoin futures contracts.

A panel of judges at the Court of Appeals in Washington, D.C., criticized the SEC in March for not explaining its rejection of Grayscale’s application despite being provided with requested disclosures.

Got something to say about whether the SEC could approve ARK’s spot Bitcoin ETF or anything else? Write to us or join the discussion on our Telegram channel. You can also catch us on TikTok, Facebook, or Twitter.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.