The global COVID-19 crisis has created a currency vacuum that will drive the price of gold up, according to analysts at SkyBridge Capital.

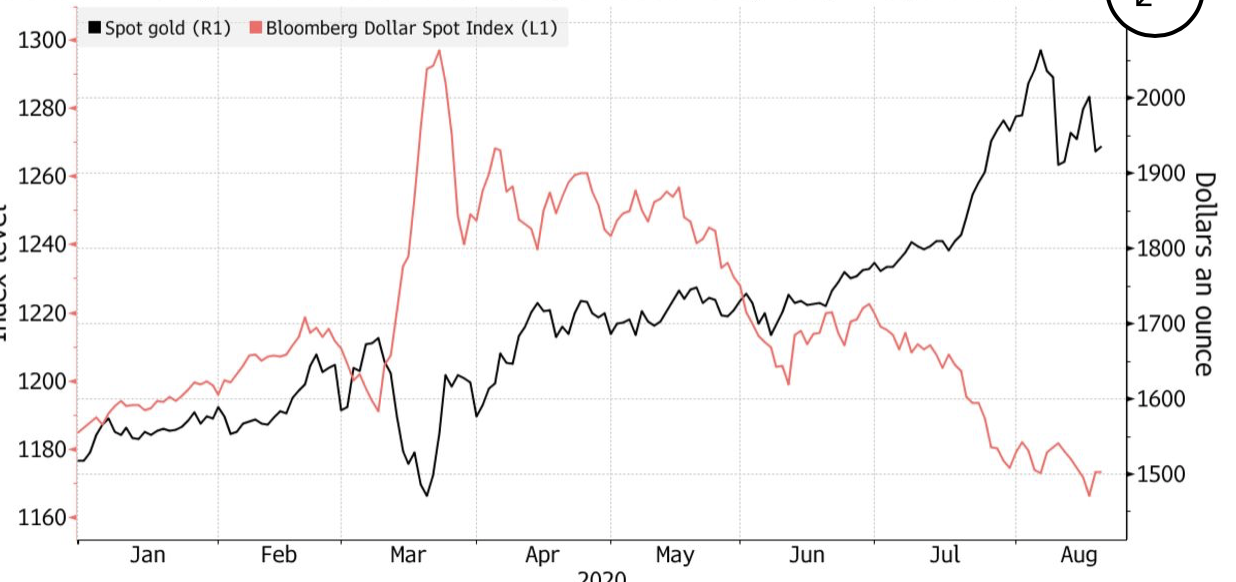

The team believes the global currency market will implode, and gold will fill the gap left behind. The argument is mainly driven by current concerns over the U.S. dollar. The coronavirus has resulted in unprecedented stimulus payments and a significant loss in dollar strength in 2020.

The difficulty, per SkyBridge, is that no other currency has the fortitude to fill the reserve gap the dollar has long held. According to Troy Gayeski, co-chief investment officer and senior portfolio manager:

When you think of currency debasement the question is, what is the dollar going to weaken against, and when you look around the globe, it’s hard to be excited about alternative currencies. So, gold is obviously a natural alternative currency.

Buying the Gold Bug

The report was coupled with news that the company would be buying the precious metal for the first time since 2011. Warren Buffett, a long time gold naysayer, also bought heavily into the gold market this week.

Will Bitcoin Follow Suit?

The new gold rush may also provide some insight into the rise of Bitcoin. The ‘digital gold’ has witnessed dramatic gains to over $12,000 a coin in recent days. To date, it’s still holding above $11,800. Some would argue that the run-up is being spurred by a rush into assets that can act as an alternative currency, but is divested from dollars. Bitcoin may be perceived as offering this dual functionality. However, while gold is remarkably difficult to spend, bitcoin has the added advantage of liquidity. The difference between scanning a QR code, and carrying a bar of gold should be obvious. Either way, investors continue to flee the ailing dollar.

Top crypto platforms in the US

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Jon Buck

With a background in science and writing, Jon's cryptophile days started in 2011 when he first heard about Bitcoin. Since then he's been learning, investing, and writing about cryptocurrencies and blockchain technology for some of the biggest publications and ICOs in the industry. After a brief stint in India, he and his family live in southern CA.

With a background in science and writing, Jon's cryptophile days started in 2011 when he first heard about Bitcoin. Since then he's been learning, investing, and writing about cryptocurrencies and blockchain technology for some of the biggest publications and ICOs in the industry. After a brief stint in India, he and his family live in southern CA.

READ FULL BIO

Sponsored

Sponsored