As the $40 million Arbitrum grant program comes to an end, the perpetual trading platform GMX secured the largest payout. However, liquid staking platform Lido walked away empty-handed.

The grants are awarded to projects to push them toward better development, and to improve users’ or developers’ onboarding efforts.

Perpetual Trading Platform Wins Big

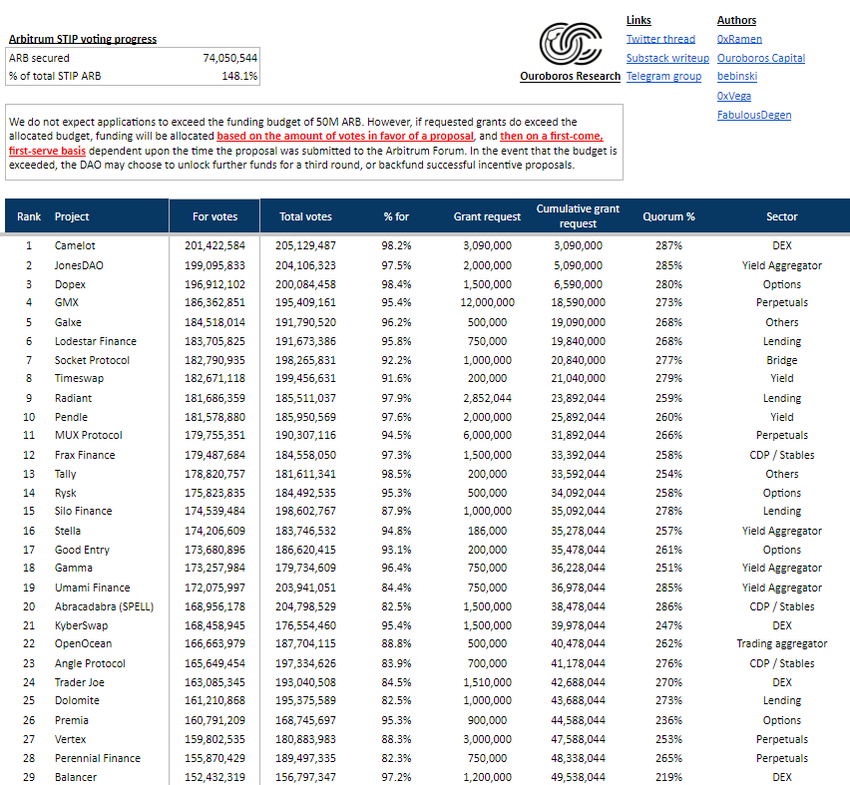

Over 29 projects collectively won the 49.6 million Arbitrum grant (worth nearly $40 million). Among these projects, GMX secured the highest funding of 12 million ARB tokens (around $10 million).

While the price of the GMX token is in a downtrend in the daily time frame, it increased by 2.63% after the announcement.

Read more: A Guide to GMX: The Decentralized Perpetual Exchange and Crypto

The screenshot below shows that the leveraged trading platform MUX protocol will get the second-highest grant of 6 million ARB (about $5 million). Whereas the decentralized exchange (DEX) Camelot will get 3.09 million (around $2.5 million) ARB tokens.

The projects that won the Arbitrum grant are supposed to use the funds to bring more users to the Layer 2 blockchain.

Read more: Optimism vs. Arbitrum: Ethereum Layer-2 Rollups Compared

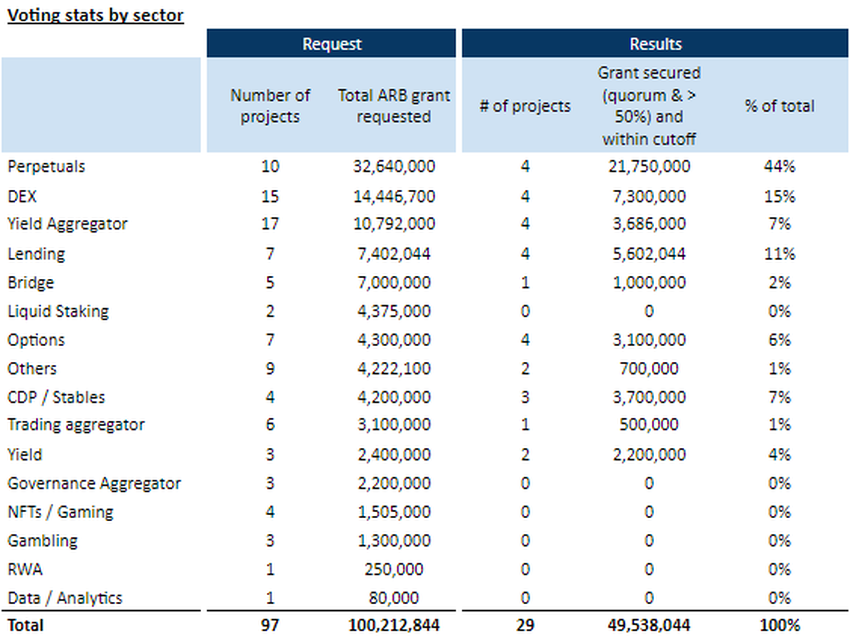

Sector-wise, the perpetual trading platforms will receive over 44% of the total grant, while DEXes will receive 15. And the yield aggregator platforms will only share 7% of the total stash.

Most notably, Lido failed to secure any funding as the Arbitrum community voted against it, as it is a non-native platform. A community member wrote:

“Apologies, but 5m ARB is way too much for a non-native protocol.

I respect the size of Lido and its contribution to Ethereum, but I struggle to see how such a huge amount will specifically drive value for Arbitrum.

How does this 5m bring in new users or new builders? I would support a proposal that is significantly reduced in size with additional details on what native protocols this will support.”

Read more: The Ultimate Guide to Lido Staked ETH (stETH)

Do you have anything to say about the Arbitrum grant, GMX, or anything else? Write to us or join the discussion on our Telegram channel. You can also catch us on TikTok, Facebook, or X (Twitter).

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here.