Gemini has announced it is hiring 100 new staff to support expansion into the Asia-Pacific region as the US cracks down on crypto.

The recruitment spree will staff the Winklevoss-led exchange’s Singapore hub as it explores new growth opportunities outside the US.

Gemini to Bolster APAC and Indian Hubs

Gemini’s billionaire founders Cameron and Tyler Winklevoss also plan to staff an engineering hub in Gurgaon, India, to support existing operations in Singapore, Ireland, and the United Kingdom.

The exchange added Singapore dollar pairs less than three years ago to boost local trading volumes. About 40% of all Singaporean investors own crypto to diversify their portfolios.

The Singapore Monetary Authority has discouraged retail crypto trading but has so far not issued a ban. The central bank favors tokenized traditional assets protected by established financial markets laws.

Last month, Cameron and Tyler Winklevoss met with the UK’s Financial Conduct Authority to discuss a potential second headquarters in London.

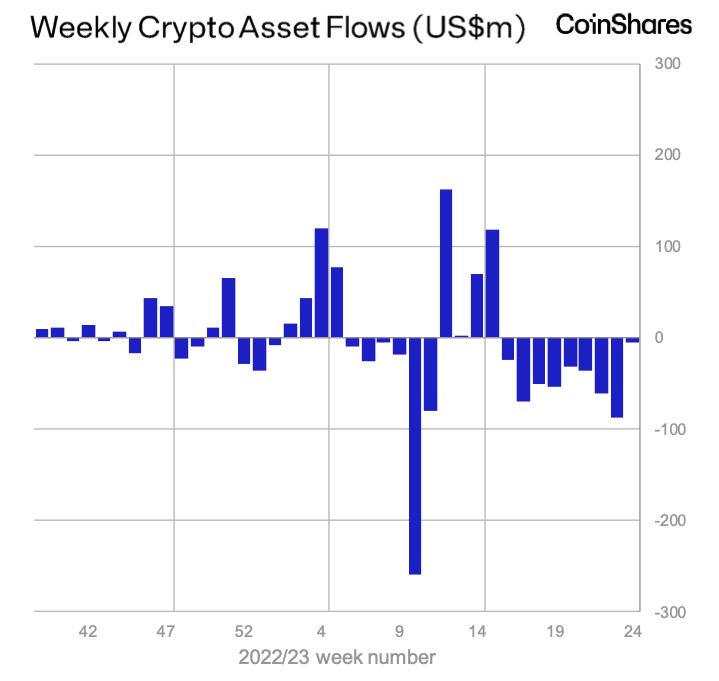

US Exodus Accompanies Massive Outflows

Crackdowns by US regulators have seen large crypto companies target overseas jurisdictions for growth.

Gemini rival Coinbase recently partnered with Standard Chartered in Singapore to enable local crypto trading. Meanwhile, Bittrex, another notable crypto business, recently confirmed its exit from the US before filing for bankruptcy.

The US Securities and Exchange Commission (SEC) fined crypto exchange Kraken $30 million for offering its staking product as an unregistered security. Later, Kraken withdrew its staking product for US customers.

Industry players argue the SEC has failed to table clear registration paths for issuers of digital assets, whose technical details render existing securities rules inappropriate. The resulting ambiguity has seen notable outflows from exchanges.

Read our guide to the best no KYC exchanges here.

Crypto pundits await the outcome of an application by asset management firm BlackRock to launch a Bitcoin spot exchange-traded fund (ETF) later this year. Less than a week later, WisdomTree, another big traditional finance firm, filed a similar application.

The SEC said no to previous applications, arguing the Bitcoin market was prone to manipulation. Subsequent approvals of powerful firms’ applications would confirm rumors the SEC is allowing Wall Street to usurp the crypto industry.

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here.

Trusted

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.