Users of the defunct Gemini Earn platform have been waiting for their funds to be returned, but they could be in for a big disappointment. A restructuring plan has detailed what customers might be entitled to and could be a lot less than they put in.

Gemini Earn users could be getting potentially just 61% of the value of their crypto from January 19, 2023. This is the date that Gemini filed for bankruptcy.

Reorganization Plan Draws Ire

On December 14, ETF analyst James Seyffart said, “This could be brutal,” adding that it was a worst-case scenario.

Even at 100%, which was still possible, it still stings based on current prices, he added. He pointed out that Bitcoin was $20,940 and Ethereum was $1,545 at the time.

On December 13, Gemini filed a plan of reorganization in bankruptcy court that outlines a proposal for initial distributions to Earn users.

The disclosure statement estimates Earn users could recover 61-100% of their account balance from Genesis through the complex plan, plus additional potential funds from litigation by Gemini.

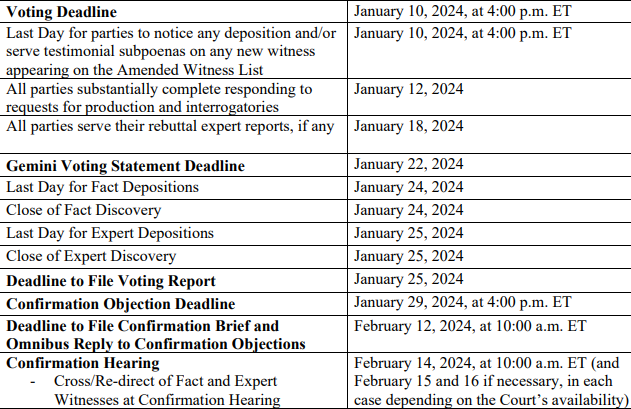

Additionally, users received instructions on reviewing the statement and voting to accept or reject the plan by January 10, 2024.

If confirmed and made effective, there would be an initial distribution to Earn users, followed by possible subsequent distributions.

Gemini stated that if they rejected it, they would have to develop an alternative, causing distribution delays of at least several months.

Responses to the proposed Gemini recovery plan were colorful, to say the least. There were calls to vote no to the plan and reimburse all assets.

“Where the hell is the other 41%? What a fraud, a year to offset, others will poke holes into this,” one responded raged.

Read more: How To Open a Bitcoin Account in 3 Easy Steps

“How can any of your customers believe a single word you say when you have deceived and lied to us for WELL over a year,” lamented another who continued:

“Maybe 61%? Maybe 100%? I’m supposed to vote on this? How is this far? You stole our money. Give it ALL back, every single dollar.”

“BTC and ETH have doubled since petition date, so 60-100% recovery is actually 30-50% recovery,” said another. He continued,

“What a joke. Good riddance. Winkelvi are finished.”

Gemini Looking Back

The US Securities and Exchange Commission charged Gemini for the unregistered offering and sale of securities through its Earn program in January.

In February 2021, Earn launched to allow retail investors to earn interest on their crypto assets.

Moreover, Gemini customers claimed at the time that the exchange misled them regarding the FDIC status of their GUSD stablecoin deposits.

Gemini and lending company Genesis reached a $100 million agreement over the Earn program in February.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.