On May 7, FTX Trading Ltd. and its associated debtors filed an updated Plan of Reorganization. They filed it with the United States Bankruptcy Court in Delaware.

The plan outlines a structured approach to repay creditors by liquidating nearly all assets held by FTX at the time of its downfall. This move marks a crucial step in resolving the financial turmoil following its November 2022 bankruptcy.

Unpacking FTX’s Financial Recovery and Repayment Proposals

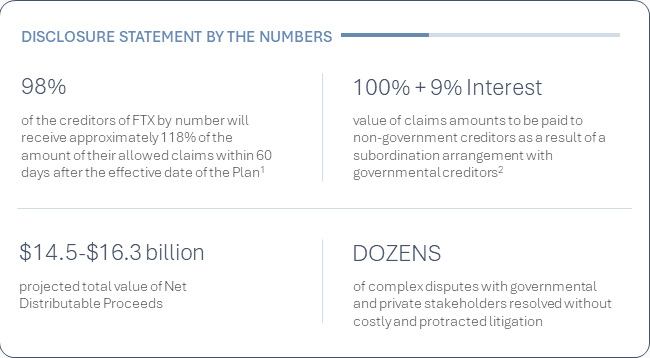

The reorganization strategy indicates that FTX has secured between $14.5 and $16.3 billion for repayment. The amount has been achieved through liquidating diverse assets, including those controlled by various global entities involved in the proceedings.

Despite the massive asset shortfall identified at the beginning of the bankruptcy, the plan ensures that non-governmental creditors will receive full payment. They will receive up to 9% interest from the start of the bankruptcy cases.

The strategy introduces a ‘convenience class’ for creditors with $50,000 or less claims. If the court approves, this arrangement is expected to enable 98% of such creditors to receive about 118% of their claim value. This will occur within 60 days of the plan’s activation.

However, it subordinates governmental creditors’ claims, permitting interest payments of up to 9% to primary customers and creditors classes from the start of the Chapter 11 cases until distribution. Additionally, certain creditors might receive extra payments from the Supplemental Remission Fund.

Read more: FTX Collapse Explained: How Sam Bankman-Fried’s Empire Fell

A core component of the bankruptcy exit strategy involves a series of settlements with key stakeholders. This strategy aims to consolidate FTX’s position and simplify the repayment process.

These pending court-approved agreements include resolving a $24 billion IRS claim from before the Chapter 11 cases with a $200 million payment and a $685 million subordinated claim. Furthermore, the Plan proposes subordinating post-Chapter 11 Internal Revenue Service (IRS) tax claims and similar claims from the Commodity Futures Trading Commission (CFTC).

These subordinated claims will fund supplemental payments to certain creditors and customers through a special fund, pending further details.

The Plan also outlines a potential arrangement with the Department of Justice (DOJ). This arrangement will distribute over $1.2 billion in forfeiture proceeds to creditors without extra costs or delays. It confirms settlements with the Ad Hoc Committee of Non-US Customers, Class Action Claimants, and the Official Committee of Unsecured Creditors, giving customers special priority.

Another settlement allows FTX.com customers to resolve their claims either in Chapter 11 or in the liquidation of FTX Digital Markets, Ltd. This arrangement offers similar financial outcomes. Lastly, a previously approved settlement with BlockFi, FTX’s largest creditor, is included.

In its official statement, John J. Ray III, Chief Executive Officer and Chief Restructuring Officer of FTX, expressed his gratitude regarding this plan.

“We are pleased to be in a position to propose a Chapter 11 plan that contemplates the return of 100% of bankruptcy claim amounts plus interest for non-governmental creditors. On behalf of FTX’s independent Board of Directors, I want to extend our deepest appreciation to the numerous governmental agencies. […] Finally, I want to thank all the customers and creditors of FTX for their patience throughout this process,” Ray stated.

Read more: Who Is John J. Ray III, FTX’s New CEO?

As FTX moves forward with its proposed plan, the role of the US Bankruptcy Court becomes crucial. A late June hearing will let Judge John Dorsey review and potentially approve the voting procedures and disclosure statement. Moreover, this decision will gauge the repayment plan’s effectiveness and fairness.

This development follows the tokens sell-offs from the FTX estate, like Solana. BeInCrypto reported the estate began its second tranche of token sales, pricing each between $85 to $110. Despite the discount to the current market prices, demand remains high, with firms like Galaxy and Pantera Capital participating.