FTX has received approval to sell its 7.84% stake in OpenAI competitor Anthropic. The move takes the FTX bankruptcy estate one step closer to repaying customers as former CEO Sam Bankman-Fried awaits sentencing.

FTX has received approval to sell its $500 million stake in San Francisco-based artificial intelligence (AI) startup Anthropic.

How FTX Sale Brings Repayments Closer

The FTX bankruptcy estate under new CEO John Ray III received approval to sell the share in the safety-focused AI firm following a filing in early January. The sale would recover roughly $1 billion after Anthropic’s valuation soared during the AI boom.

Judge John Dorsey gave the green light to the sale in a Delaware bankruptcy court on Thursday. The sale would offload one of FTX’s most valuable assets and take the estate closer to repaying creditors. It would add $1 billion to the $6.4 billion FTX has earned from other sales, increasing the chance that the estate will repay creditors fully, per a February court filing.

“Based on our results to date and current projections we anticipate filing a disclosure statement in February describing how customers and general unsecured creditors, customers and general unsecured creditors with allowed claims, will eventually be paid in full, ” the filing said.

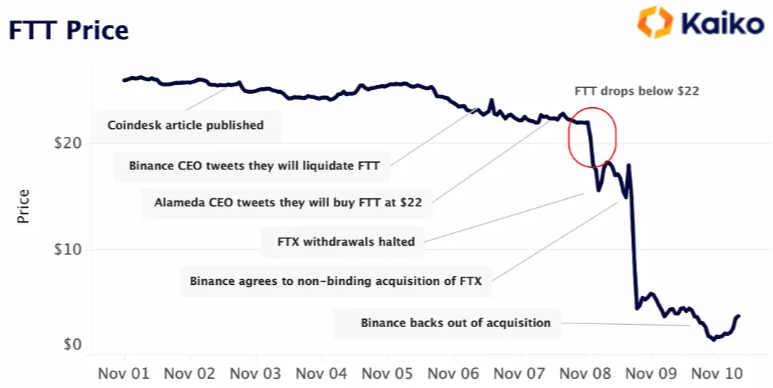

FTX filed for bankruptcy in November 2022 following a liquidity crisis that exposed its dependence on FTT, one of many centralized exchange tokens popular at the time. Later investigations revealed that the exchange had a roughly $8 billion hole in its balance sheet.

Read more: FTX Collapse Explained: How Sam Bankman-Fried’s Empire Fell

The company recently sold its Digital Custody Inc. subsidiary to CoinList for $500,000. Last month, FTX tapped crypto financial services firm Galaxy Digital to offload its crypto holdings.

Judgment Day Looms Large for SBF

In the meantime, FTX’s former CEO, Sam Bankman-Fried, is awaiting a sentencing hearing. The hearing comes after a jury convicted him of financial crimes while running the crypto exchange. A nine-member panel found the crypto mogul guilty of all counts of money laundering and fraud in late 2023.

Recent reports have revealed that Bankman-Fried has become accustomed to life at the Brooklyn Metropolitan Detention Center. Former ex-blood gang member G Lock told crypto reporter Tiffany Fong that Bankman-Fried had not been subject to serious violence or intimidation while in jail. He also appears to have built a rapport with fellow inmates, who have roasted him about his relationship with former Alameda Research CEO Caroline Ellison.

Bankman-Fried will face a sentencing trial in March. Though his maximum prison time is 110 years, judges could be lenient if the recent crypto price increases restitution to some FTX creditors. However, this would only be a mitigating factor if these customers joined FTX before Bankman-Fried committed a crime.

Read more: Who Is Sam Bankman-Fried (SBF), the Infamous FTX Co-Founder?

Bankman-Fried asked attorney Marc Mukasey to represent him at the March 28, 2024, hearing. BeInCrypto reached out to Mukasey on LinkedIn but did not hear back at press time.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.