BlockFi customers are on the brink of a significant financial recovery. Following intense negotiations, BlockFi has managed to secure an agreement with FTX and Alameda Research that could see up to $874 million returned to its coffers, pending judicial consent.

This settlement marks another chapter in the firm’s bankruptcy process. It could result in repaying customers impacted by the collapse of these crypto giants in 2022.

A Step Toward Restitution for BlockFi Creditors

Under the settlement terms, FTX has committed to prioritizing a $250 million payment to BlockFi. This initial amount is part of a larger $874 million settlement designed to compensate BlockFi for assets held on the FTX exchange and loans extended to Alameda Research.

The agreement specifies that the remaining settlement amount is contingent upon FTX’s ability to repay its own customers and other creditors, underscoring the interconnected challenges within the crypto industry’s recovery efforts.

Read more: Best BlockFi Credit Card Alternatives

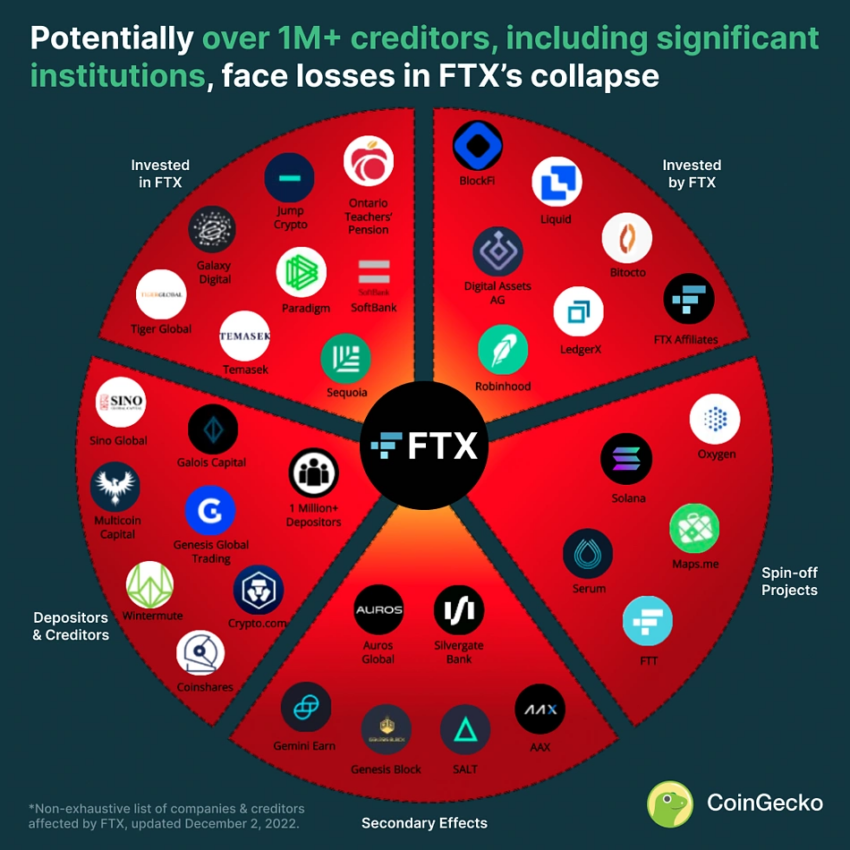

The genesis of this settlement can be traced back to a close relationship between BlockFi and FTX, which soured during the 2022 crypto market crash. This crash unveiled the widespread misuse of customer funds by FTX. This ultimately led to a series of legal and financial challenges for both entities.

Despite these adversities, the two companies have worked toward a resolution that could see BlockFi reclaiming a substantial portion of its assets. This raises the chances for full customer restitution.

FTX Works on Clawing Back Funds

In parallel, FTX’s efforts to claw back funds have seen significant progress. It recently approved the sale of its stake in AI firm Anthropic.

This strategic divestiture is expected to inject approximately $1 billion into FTX’s estate. This would be significant in enhancing its capacity to meet creditor obligations. Barstool Sports’ Dave Portnoy recently lamented his losses in FTX, claiming that the bankrupt exchange owes him $1 million.

“That fat [expletive] with the curly hair, SBF (Sam Bankman-Fried), that scumbag, [expletive] me. So FTX owes me like a million bucks,” Portnoy articulated.

Read more: FTX Collapse Explained: How Sam Bankman-Fried’s Empire Fell

Such moves are instrumental in FTX’s broader strategy to navigate its bankruptcy proceedings and fulfill its commitments to creditors, including BlockFi.

With judicial approval, BlockFi customers could soon witness a significant step toward making them whole.

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content.

This article was initially compiled by an advanced AI, engineered to extract, analyze, and organize information from a broad array of sources. It operates devoid of personal beliefs, emotions, or biases, providing data-centric content. To ensure its relevance, accuracy, and adherence to BeInCrypto’s editorial standards, a human editor meticulously reviewed, edited, and approved the article for publication.