As FTX unwinds its vast Solana (SOL) holdings, reports suggest the bankrupt exchange still has over $1 billion worth of tokens to offload.

This significant number of tokens could pressure Solana’s market valuation, as on-chain data points to declining interest.

Solana Selling Pressure Could Spike as FTX Moves Tokens

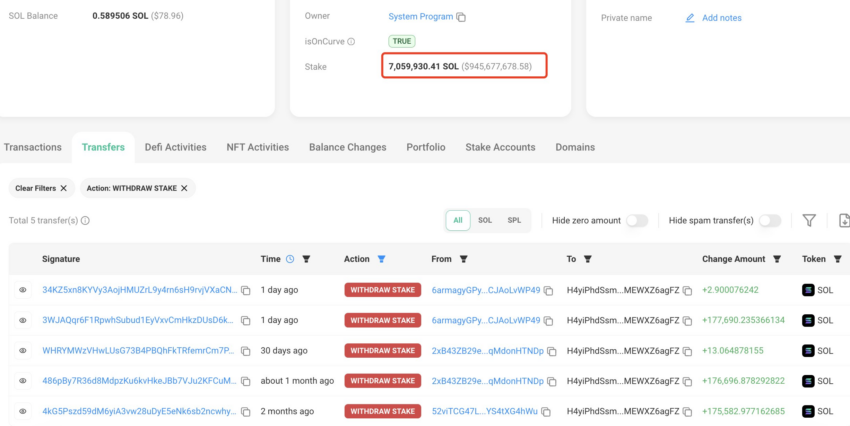

According to blockchain analytics firm LookOnChain, FTX and its sister company, Alameda Research, have already unstaked significant portions of their Solana tokens. In the past three months, they unstaked 530,000 SOL, worth approximately $71,000, with monthly averages reaching 176,700 SOL, or $23.5 million.

Despite these transactions, 7.06 million SOL, valued at $945.7 million, remains staked.

FTX’s relationship with Solana was notably strong before the exchange’s collapse in November 2022. Following its downfall, SOL prices plummeted to as low as $8, exacerbating the volatility in the broader crypto market.

FTX has been slowly selling its Solana assets since then, and some of these sales may have taken place over-the-counter (OTC) to minimize price impact.

FTX’s ongoing liquidation of its crypto assets comes amid heightened scrutiny from federal authorities. Caroline Ellison, former CEO of Alameda and former partner of Sam Bankman-Fried, will face sentencing on September 24 for her involvement in the exchange’s collapse. Ellison previously accepted all charges against her as part of a plea deal.

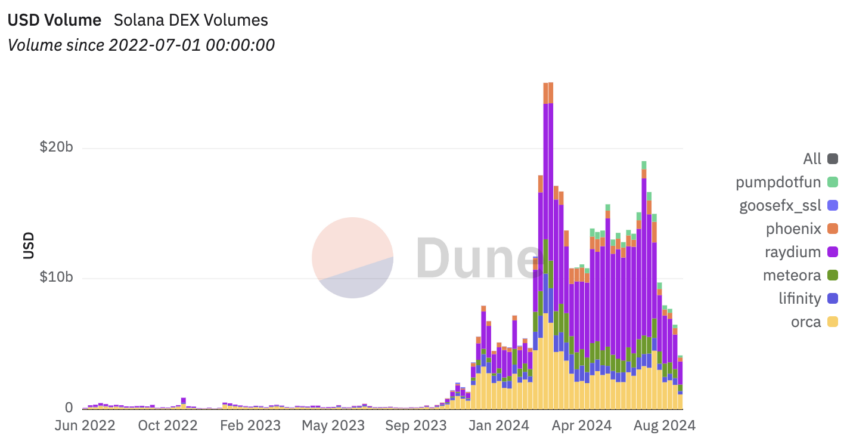

While Solana remains tied to FTX’s liquidation process, the blockchain has seen a decline in on-chain activity. Last week, the ecosystem recorded a six-month low in weekly decentralized exchange (DEX) volumes at $7.7 billion, according to Dune.

This is a sharp contrast to the network’s March volumes, which were 50% higher than Ethereum’s at the time.

From a technical perspective, Solana’s price is facing a pivotal moment. After losing its 200-day exponential moving average (EMA) support, the price hovers near $127.

Analysts warn that a drop below $126 could lead to further losses, potentially pushing the price toward the $92 to $110 range.

Read more: Solana (SOL) Price Prediction 2024/2025/2030

As FTX continues to offload its Solana tokens, market participants remain cautious, awaiting the next move in this unfolding chapter of the exchange’s liquidation process.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.