Bankrupt crypto exchange FTX has agreed to sell its remaining stake in AI startup Anthropic for $452.2 million, according to a court filing on May 31.

FTX disclosed that G Squared, a global venture capital fund, bought about one-third of the 4.5 million shares for $135 million. Over 20 other venture capital funds, including Gemini Ventures, Fund FG-BLU, and Fund SCVC-PV-LXVI, also participated in the purchase.

FTX to Net $800 Million From Anthropic Share Sales

FTX’s Anthropic shares sales, still pending Judge John Dorsey’s approval, could total about $1.3 billion, netting the company around $800 million. Initially, FTX invested $500 million in Anthropic in 2021, holding a 7.8% stake.

Anthropic, an AI company known for its chatbot Claude, aims to release AI models with stricter guardrails than ChatGPT and other rivals. Founded by former OpenAI employees, Anthropic has attracted significant investments from tech giants like Google.

The sale could be the most profitable for FTX as it seeks to repay creditors following its November 2022 bankruptcy. However, some creditors argue that the shares should have been allocated to FTX customers, whose deposits funded the purchase.

Read more: FTX Collapse Explained: How Sam Bankman-Fried’s Empire Fell

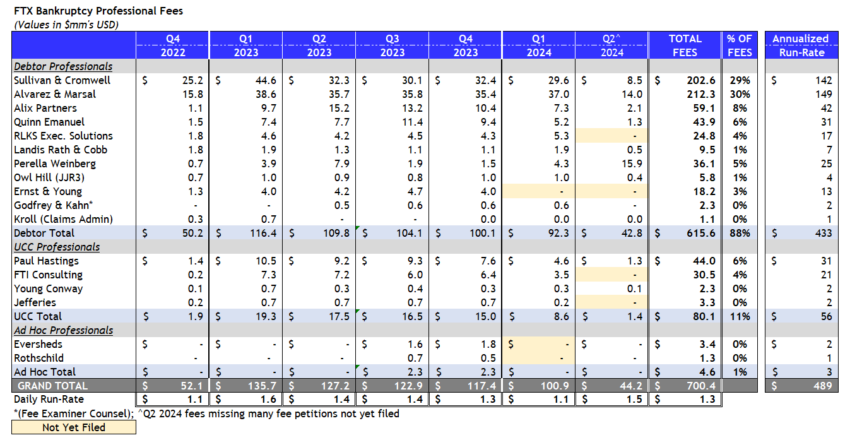

Moreover, the rising costs of FTX legal fees have drawn sharp criticism from FTX creditors, who accuse the advisors of destroying over $10 billion of creditor value. Recent bankruptcy filings reveal that FTX has incurred $700 million in legal and administrative fees, as tracked by X user Mr. Purple. Consulting firm Alvarez & Marsal billed $212 million, while legal counsel Sullivan & Cromwell invoiced $202 million. Additionally, FTX CEO John Ray III billed $5.6 million at an hourly rate of $1,300.

“FTX advisors billed $700 million while destroying over $10 billion of creditor value. John Ray charged $5.6 million for making all business decisions, such as not restarting FTX despite multiple bids and selling assets at a 90% discount. Plan administrators need to change,” wrote FTX creditor Sunil Kavuri.

FTX’s efforts to sell Anthropic stake and manage rising legal costs remain under scrutiny as it navigates its complex bankruptcy proceedings. The results of these sales and Judge John Dorsey’s decisions will be crucial in shaping FTX’s future and its creditors’ recovery prospects.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.