Despite the anticipation of a crypto market ‘Uptober,’ Bitcoin was still stuck under the $20,000 level as social volumes continued to dwindle.

A new month is often accompanied by positive social sentiment and fresh gains for assets. For Bitcoin and the larger cryptocurrency market, bearish blues are still playing despite entering October.

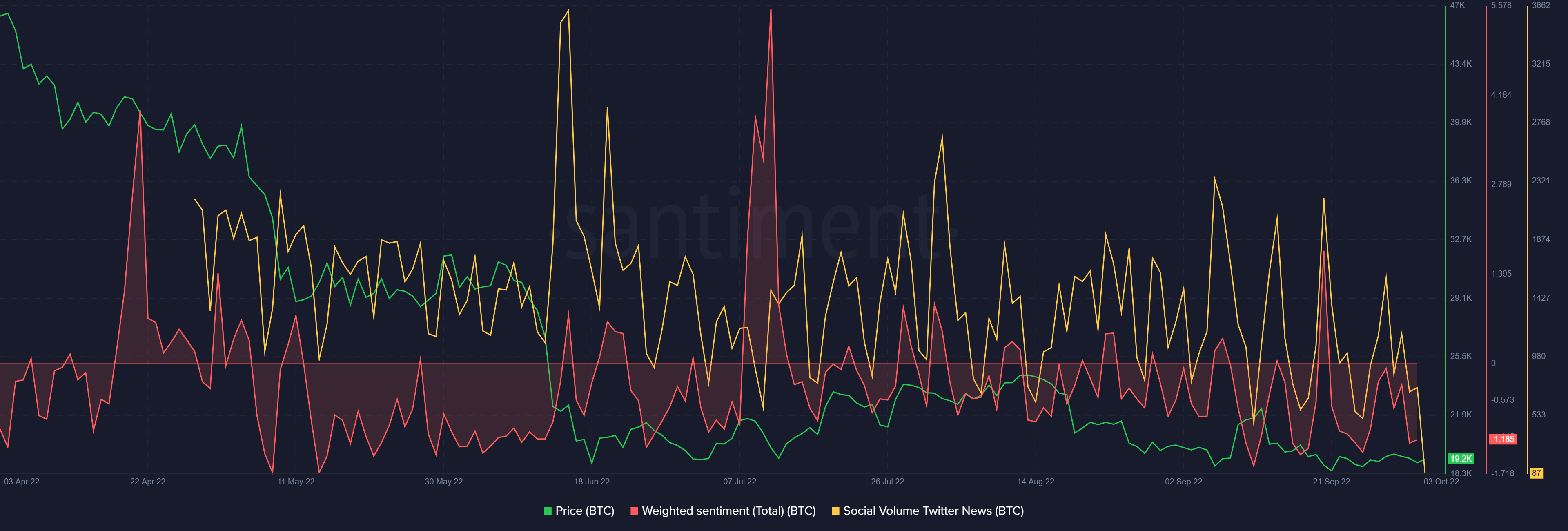

Social data from Santiment showed a weighted BTC sentiment score of -1.185, while the social volume Twitter news metric fell back to its lowest levels since April 2022. Low social volumes and a drop in weighted sentiment highlighted that talk of BTC on social media has taken a hit, indicating that interest in the top cryptocurrency by market cap has waned.

Maximum pain for BTC HODLers?

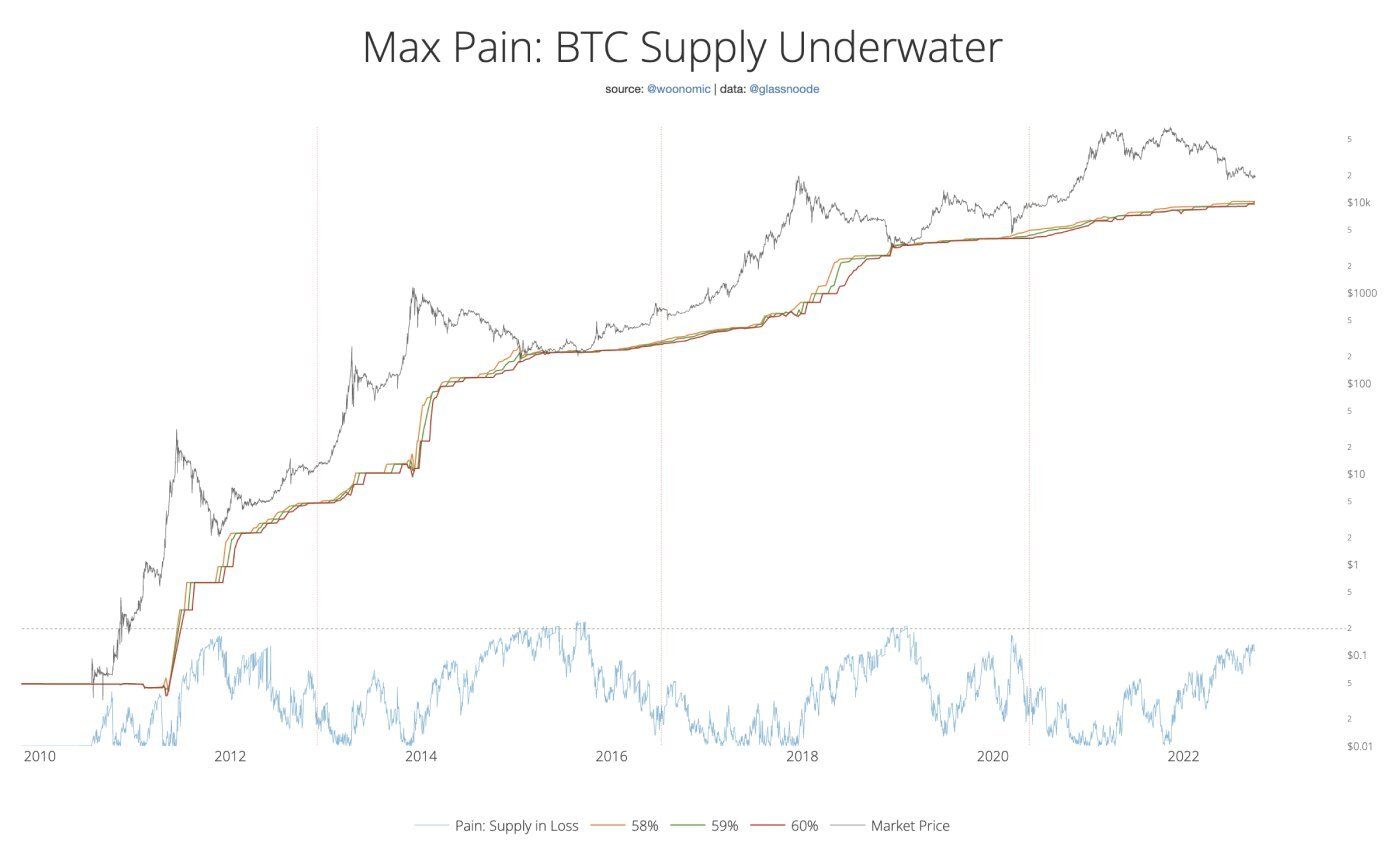

Bitcoin analyst Willy Woo pointed out that maximum pain levels had not yet been reached, which could mean BTC HODLers are yet to reach a bottom. Looking at the chart below showing BTC supply at a loss, it is evident that during past cycles the BTC price bottomed when around 60% of Bitcoins traded below their purchase price.

This time around, a similar situation has yet to be seen. According to supply in loss, the current BTC bottom could be reached around $10,000. However, since the ‘structure of this current market is very different,’ it’s tough to say whether $10,000 could really be the bottom.

Crypto volumes holding up

On the weekly chart Bitcoin’s price has been moving in a tight range between $23,700 and $18,800 since June 2022. The weekly RSI is showing no sign of a breakout, as sellers continue dominating buyers.

One positive sign is the constantly rising volumes since April, which suggests retail traders are still in the game even though OGs have remained neutral.

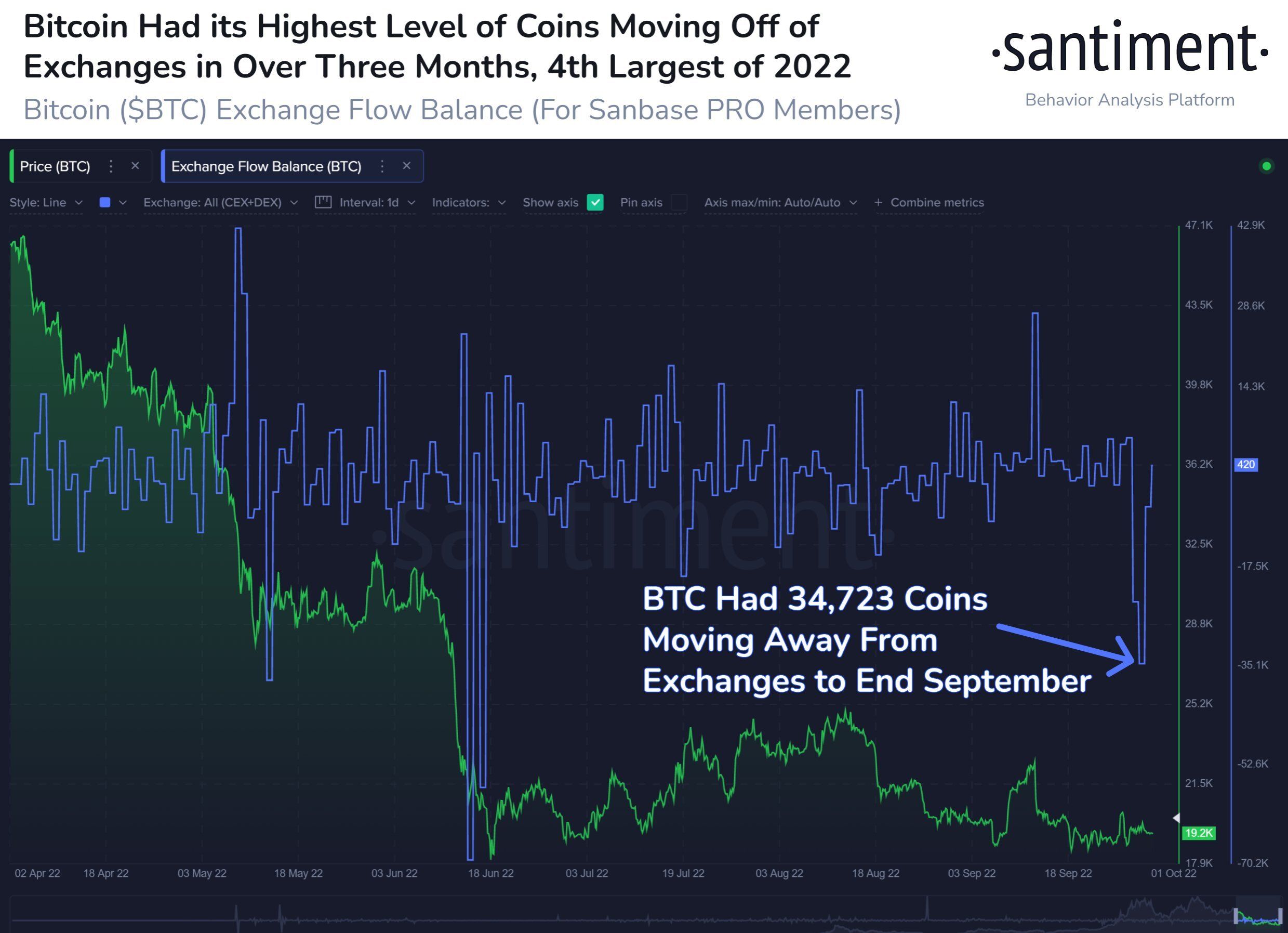

Bitcoin recently saw the highest number of coins move off exchanges during this past quarter acting as a bullish signal. However, it hasn’t been enough to push the price above key resistance levels.

Data from Santiment showed that Bitcoin saw 34,723 BTC move off exchanges on Sept. 30, indicating what may be a hint of trader confidence heading into Q4. The last time this many BTC left exchanges was June 17, and prices jumped +22% over the month that followed.

While the high outflows could present some short-term bullishness, October likely won’t turn to ‘Uptober’ for crypto HODLers this time around. Notably, while October has been a bullish month during bull markets, in bear markets BTC has never performed well in October.

That said, the correlation between BTC and equity prices, especially tech stocks, has noted steady growth. Macroeconomic concerns around inflation, geopolitical climate, and monetary policies have left BTC prices down thus affecting the broader market as well.