BeInCrypto breaks down the five biggest altcoin movers and shakers from the previous week. Will their momentum continue?

The five altcoins that increased the most last week are:

- Revain (REV) : 95.72%

- The Sandbox (SAND) : 60.40%

- Tezos (XTZ) : 46.22%

- Solana (SOL) : 30.40 %

- Arweave (AR) : 29.88%

REV

REV has been increasing since July 20, when it was trading at a low of $0.005. So far, it has reached a high of $0.023 on Aug. 30.

Technical indicators are bullish as both the RSI and MACD are increasing, although the former is in overbought territory.

The closest resistance levels are foundat $0.027 and $0.033. The former is the 0.382 Fib retracement resistance level and the latter is both the 0.5 Fib retracement level and a horizontal resistance area.

SAND

SAND has been moving upwards since breaking out from a descending wedge and validating it as support on Aug 25.

On Aug 29, it reclaimed the $0.80 horizontal resistance area and proceeded to reach a new all-time high price of $1.20 the next day. However, it’s in the process of creating a long upper wick and potentially a shooting star candlestick.

Technical indicators in the daily timeframe are still bullish. This is especially evident by the RSI movement above 70 (green icon).

The closest resistance area is found at $1.375. This is the 1.61 external Fib retracement resistance level.

XTZ

XTZ has been moving upwards since July 20. In a span of 39 days, it increased by a full 195%. This led to a high of $6.18 on Aug 29.

However, XTZ was rejected by the 0.618 Fib retracement resistance level and has decreased slightly.

Despite the drop, both the RSI and MACD are still bullish. Nevertheless, reclaiming this level is required in order for the trend to be considered bullish.

SOL

SOL has been moving upwards since July 20. It managed to reach a new all-time high price of $82 on Aug 21. The high was made right at the 1.61 external Fib retracement resistance level.

After a slight decrease, it resumed its upward movement on Aug 25 and proceeded to reach a new all-time high price of $101.96 on Aug 30.

While there is a potential bearish divergence developing in the RSI, the indicator is still increasing alongside the MACD. The next resistance area is found at $118.50.

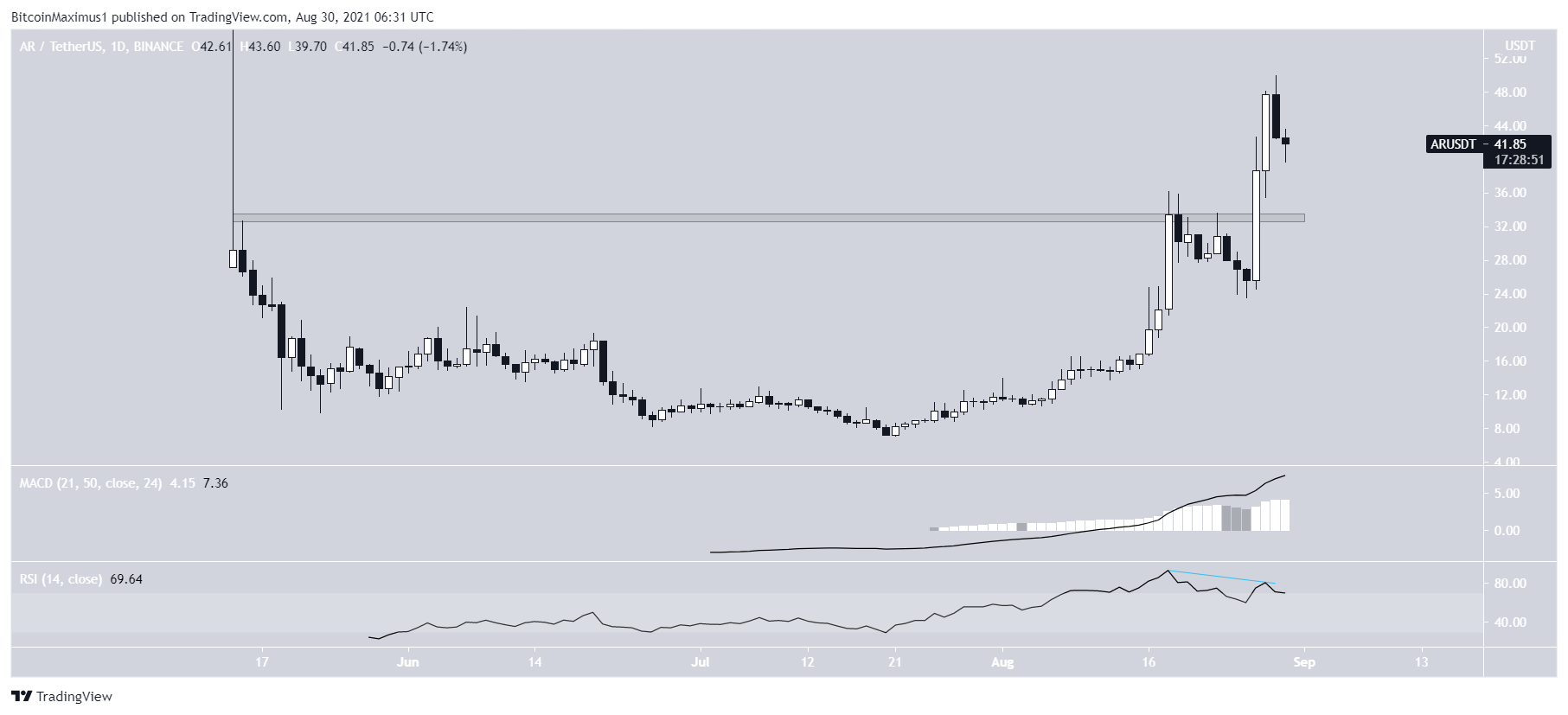

AR

AR had been moving upwards since July 20. It managed to break out on Aug 15 and proceeded to reach a high of $36.16 on Aug 18. After a decrease that continued for six days, AR bounced considerably and reached a new all-time high price of $50 on Aug 29.

Similar to SOL, there is a bearish divergence developing in the RSI.

If a drop occurs, the $33 area is likely to act as support. This same area previously acted as resistance on Aug 29.

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.