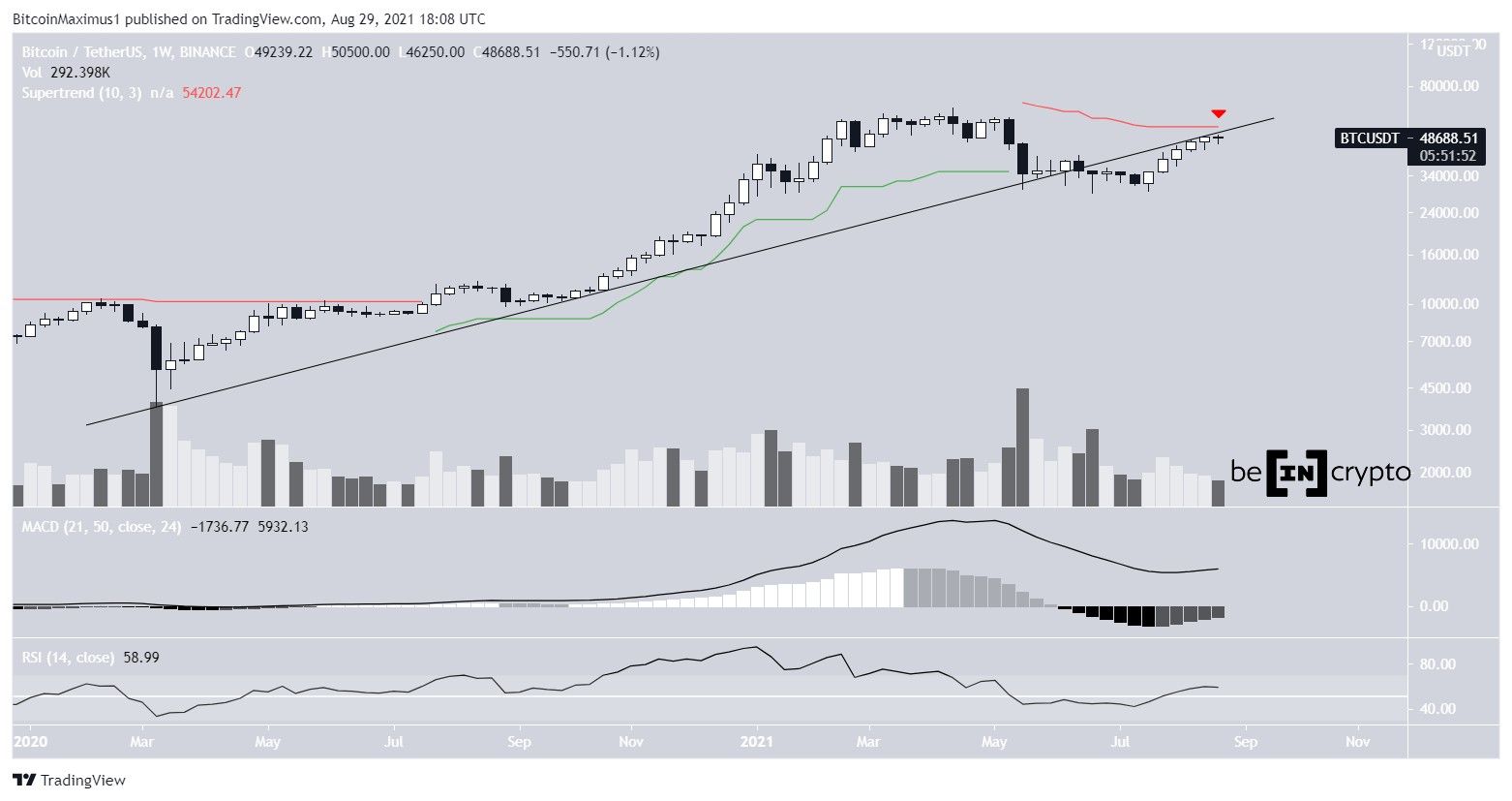

The bitcoin (BTC) price decreased only slightly last week, opening at $49,239 and closing at $48,808.

It has broken down from an ascending support line in the short term and could likely continue moving downwards towards the closest support area at $42,400.

Bitcoin faces weekly resistance

BTC had a rather uneventful week on Aug 23-29, moving from a low of $46,250 to a high of $50,500. The weekly chart continues to show mixed signs as well.

On the bearish side, the price has broken down from a long-term ascending support line and could be in the process of validating it as resistance (red icon). In addition to this, the line coincides with the supertrend resistance (red icon). Furthermore, volume on the upward movement has been weak relative to that during the May crash.

On the bullish side, the MACD has given a bullish reversal signal and is increasing. Moreover, the RSI is above 50.

Therefore, a look at lower time frames is required to determine the direction of the next movement.

Crucial level

Similar to the weekly time frame, the daily chart doesn’t provide a clear picture that would help determine the trend’s direction.

BTC is trading just below the main resistance area at $51,200. This is both a horizontal resistance area and the 0.618 Fib retracement resistance level.

Secondly, considerable bearish divergences have developed in both the RSI and MACD (blue). This has only led to an incremental decrease, which is not proportional to the level of divergence. However, there is also a potential hidden bullish divergence (yellow), which is developing in the RSI.

Volume has also been consistently decreasing during the rally, a sign of weakness in the upward movement.

While the direction of the trend is not clear, it cannot be considered bullish unless BTC manages to reclaim the $51,200 area. This would also cause it to reclaim the long-term ascending support line as outlined in the previous section.

The closest support area is at $42,400. This is the 0.382 Fib retracement support level and a horizontal support area that coincides with the supertrend support line.

Future movement

The six-hour chart leans toward the possibility that BTC will move downwards since it shows a breakdown from an ascending support line.

While it initially seemed that BTC had reclaimed the line (red circle), it has fallen below it since.

Similar to the daily time frame, the RSI and MACD are neutral. However, a continued decrease toward the $42,400 support area would cause them to turn bearish.

The exact long-term wave count remains unclear since both a bullish (orange) and bearish (black) count remain possible.

However, both counts point to a short-term decrease. BTC is in wave four of a bullish impulse and a sharp fall would be expected due to the concept of alternation. However, an upward move would likely follow.

On the other hand, if an A-B-C corrective structure is complete, BTC could continue toward new lows. In either case, a short-term downward movement is likely.

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here.