Unlike the rest of the market, Fetch.ai’s (FET) price prevented major losses over the last 24 hours as the altcoin kept its decline limited to 2%.

The credit for this goes to the whales who offset the bearish cues. Nevertheless, there is still a threat to the altcoin.

Fetch.ai Saved – Whales for the Win

The crypto market correction is weighing heavily on all the digital assets, but Fetch.ai’s price somehow did not fall as much. FET only noted a 2% correction throughout the day. However, that does not cover up for the fact that the altcoin could have dropped by over 15%. All thanks to the whales for not letting this happen.

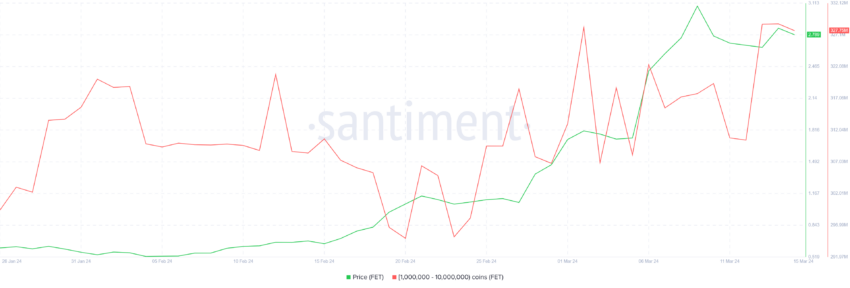

The intra-day lows of $2.37 were nearly locked in as trading price before the whales stepped in. The large wallet holders accumulated FET heavily, resulting in the price bouncing back.

Addresses holding between 1 million and 10 million FET managed to amass over 18 million FET in two days. This is worth over $50 million, bringing their holdings to 327.81 million FET.

Consequently, Fetch.ai price can be seen trading at $2.80 at the time of writing.

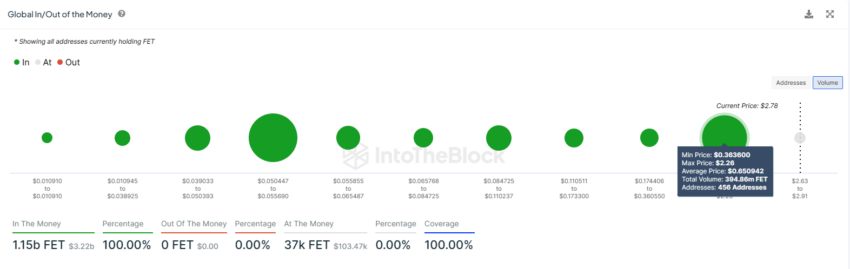

Beyond the whales, the altcoin also has solid support at the $2.26 price point. This level is the upper limit of the range in which about 394 million FET tokens worth over $1.1 billion were purchased by investors.

Thus, Fetch.ai’s price will bounce back from this level should it come across it, as investors will likely keep from booking profits out of fear of losses.

FET Price Prediction: Bearish Momentum Is yet to Build

Fetch.ai’s price nearly slipped to $2.37 but bounced back to the trading price of $2.80. This establishes the precedent that the bullish steam has not been completely exhausted. The altcoin is still above the 50-day Exponential Moving Average, which is also a positive signal, making FET safe from falling below the $2.46 support floor.

Nevertheless, Parabolic SAR, a trend-following indicator that helps traders identify potential reversals in price direction, indicates a downtrend. While the black dots are present above the candlestick, it is not intensive yet.

Additionally, the Average Directional Index (ADX) is also above the 25.0 threshold. ADX is used to assess the strength of the momentum, and the downtrend is losing strength presently as the indicator is noting a downtick.

But, this does not rule out the potential of this trend gaining strength down the line, which could pull Fetch.aiI price down to $2.46. Losing this support line would invalidate the bullish thesis, sending FET to $2.26 or beyond.

Trusted

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.