The Federal Reserve’s potential decision to cut interest rates by 50 basis points at its upcoming meeting could have unintended consequences for Bitcoin.

While lower interest rates typically boost risk assets, such as cryptocurrencies, the scale of this cut could signal deeper economic concerns that might make investors more cautious.

How Fed Rate Cuts Could Impact Bitcoin

Historically, the Fed has favored smaller moves, typically opting for 25 bps adjustments. However, the possibility of a 50 bps cut has gained traction. This could indicate that the central bank is behind the curve in addressing economic weakness, particularly after disappointing job reports.

Markus Thielen, founder of 10X Research, warned that such a large cut could be seen as a sign of urgency. It could lead to a retreat from risk assets like Bitcoin.

“While a 50 basis point cut by the Fed might signal deeper concerns to the markets, the Fed’s primary focus will be mitigating economic risks rather than managing market reactions,” Thielen said in a note to clients.

Concerns about a slowing economy suggest that a large rate cut could be imminent. If the Fed cuts rates by 50 bps, it could suggest that economic conditions are worse than anticipated. Therefore, it will prompt a flight to safer assets. This would likely hurt Bitcoin, as investors seek stability in times of uncertainty.

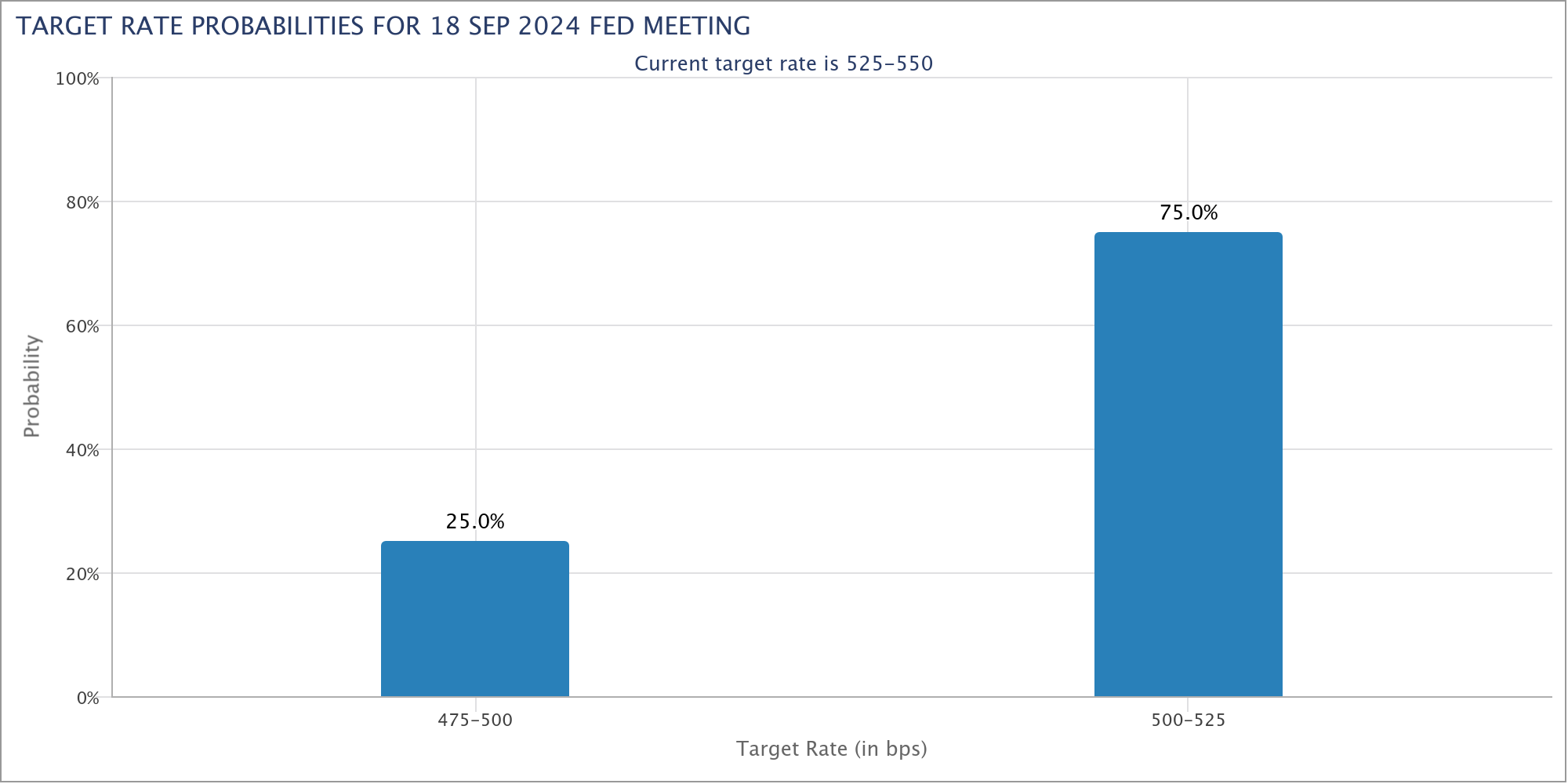

The Chicago Mercantile Exchange’s FedWatch tool shows a 25% chance of a 50 bps rate cut, adding to market speculation.

Read more: How to Protect Yourself From Inflation Using Cryptocurrency

Likewise, Mati Greenspan, CEO of Quantum Economics, told BeInCrypto that while a 25 bps cut might support Bitcoin’s price, a 50 bps cut could have the opposite effect. He noted that such a drastic move could be seen as an “act of desperation,” causing a negative reaction in the market. According to Greenspan, this is “precisely why such a move is fairly unlikely.”

This view aligns with the notion that Bitcoin’s recent price rise has been partly driven by expectations of modest rate cuts.

“The current expectation is for the Fed to cut interest rates by 0.25%, which would be bullish for financial assets like stocks and crypto, as it reduces the cost to borrow money,” Greenspan said.

Read more: Bitcoin (BTC) Price Prediction 2024/2025/2030

Ultimately, while Bitcoin investors would normally view a rate cut positively, a larger-than-expected cut could signal economic trouble ahead, putting downward pressure on the cryptocurrency.